Successfully running a small business is all about efficiency.

Think about it. As a small business owner, you don’t have too many resources at your disposal. Compared to the big players, your money and manpower is limited. You have less time—to do more things.

But that’s also your small business’s big advantage. You can move fast. Make decisions and act on them right away, Be bold.

And when it comes to finding the financing you need to efficiently grow your small business, there’s one important way to use a business loan that you should know about:

Debt refinancing.

We’ll walk you through what it is, why you might need it, how it works, and how refinancing can make a massive difference to your small business.

Let’s get started.

Debt Refinancing: The Basic Idea

If you’re unfamiliar with the idea of refinancing, not to worry. We’ll cover what it is—and why you might look for a refinancing loan.

What is Refinancing?

Simply put, refinancing is using the proceeds of one loan to pay off another one.

It’s actually not that complicated of an idea, as it turns out…

Although it might sound a bit intimidating (or confusing) to use one loan to pay for another, there’s one important thing to understand:

When you refinance your first loan with a second one, that newer loan is better in some way—saving you money, expanding your cash flow, giving you extra capital, and so on.

Whether you’re refinancing in a big way or just taking a small step up, this is a smart and efficient strategy for small business owners to get capital and grow their companies.

Why Refinance?

There are plenty of reasons to refinance your existing debt, but let’s take a look at the 3 biggest ones.

1. Lower Rates

Taking out a second loan to pay off your first one might make sense if, say, that second loan comes with a lower interest rate.

All of a sudden, refinancing can make your business debt more affordable.

We’ll talk more about this later on, but depending on when you’re able to refinance that loan, you could be paying substantially less interest on the principal—which is the amount you borrowed from a lender.

In other words, refinancing can lower the cost of your capital. You’re borrowing for less.

And there are especially expensive loan products—like merchant cash advances—that are great choices to refinance into more affordable kinds of debt. The option to refinance gives you the chance to limit the damage that pricey short-term borrowing can do to your bank account or cash flow.

2. Longer Terms

Another reason to refinance your business loan is if that second loan comes with a longer term.

In other words, you’ll have more time to pay off the money you borrowed (plus interest).

You might look for a longer term because your current loan’s payments are cutting into your cash flow, you want to lower each payment amount, or you prefer more sporadic expenses—like weekly instead of daily payments.

Regardless of the exact benefit you’d want, a longer loan term is one reason why plenty of business owners search for refinancing.

3. More Money

This one is pretty straightforward:

That second loan comes with a bigger pile of cash you can use to grow your business.

By refinancing with a larger loan amount, you can invest more capital into your business without taking out multiple loans at once or waiting to finish paying off your first round of funding.

Of course, a portion of that second loan will go towards paying off your first loan, but so long as what’s left over is more money than you would’ve had otherwise, refinancing for this reason makes perfect sense.

***

More often than not, you would refinance because of some combination of these reasons—maybe even all three.

Now that you understand why you might want to refinance your debt, let’s take a look at the different kinds of business loan refinancing…

And how each can make a big impact on the success of your business.

3 Different Kinds of Refinancing

Do any of the above reasons to refinance sound like they could be useful for your small business?

If so, now is a good time to figure out which kind of refinancing you should start looking into.

Here are the 3 main types of refinancing out there.

1. Taking small steps to improve your business

This is a common—but useful and important—way to use refinancing.

Let’s say your business’s details and financials haven’t changed too much since you took out your last loan.

Maybe it’s been a few months and you’ve put that extra capital to good use, growing your inventory a little or launching a new marketing campaign.

In other words, it’s been business as usual…

But you were still able to snag a better deal on a business loan when you applied for refinancing.

Whether in terms of more favorable rates, longer terms, or more capital, the refinancing loan you can qualify for is somehow a step up from your current debt.

This might not be a groundbreaking change—maybe you’re moving from $40,000 to $60,000 in financing, for example, or from a loan term of 18 to 24 months—but you’re still expanding your possibilities for growth, building credit, and keeping the financing cycle going.

This kind of refinancing isn’t for everyone, and if you don’t need a second loan then you shouldn’t take one out.

But if you’re looking to continue your business growth, refinancing into a better loan will help.

Refinancing Short-Term Loans with Short-Term Loans

There is a potential danger with this sort of refinancing that you should be aware of, though.

When it comes to refinancing expensive short-term debt with other expensive short-term debt—even if it’s a bit more affordable—then you risk getting “stuck” in a cycle that can be hard to climb out of.

When you refinance one short-term loan with another, you’re paying a good deal of interest on interest. Sometimes that’s a necessary evil if you’re getting much better financing, but it’s not necessarily the most cost-effective option.

In short, when it comes to refinancing a loan with a similar loan, make sure the benefits are truly worth the costs.

2. “Graduating” into bigger and better loans

(Buckle up—this is the big one.)

On the other hand, maybe your business hit a certain milestone since your last business loan.

If that’s the case, you might very well qualify for a whole new set of better loan options.

These larger and more affordable loans, with longer terms and less frequent repayments, can change the way your business operates—in a big way.

You can save money, breathe easier with a flexible cash flow, worry less about more manageable payments, and use that extra cash to substantially develop your business.

Here are just a few standard milestones that could indicate your business might qualify for better financing:

- Reaching the 2 years in business mark. 50% of small businesses fail after their first year, so making it to 2 years proves to lenders that your business model is pretty sustainable. The more confident lenders are in your business, the better their loan offers will be.

- Making 6 figures in annual revenue. Cash is king—that’s not just an empty saying. The more money your business takes in, the more lenders will expect it to continue taking in. From a lender’s point of view, a proven successful business is a better investment.

- Hitting a 700 personal credit score. Your personal credit score is very closely tied to both what loans you qualify for and how much they cost, and getting a 700 credit score or above could make a huge difference in the financing available to your business.

Been in business for long enough? Medium-term lenders might all of a sudden seem more interested in your loan application. Or you finally got that higher credit score? Now you might qualify for a long-term, low-cost loan from the Small Business Administration.

You should note that these aren’t hard-and-fast rules—hitting one of these benchmarks won’t necessarily qualify you for a better loan…

But they are common guidelines that a lot of lenders tend to follow.

So if you’re able to, graduating from one loan into a substantially better product can make a big difference to your business.

Just imagine refinancing your relatively small and expensive short-term loan with a bigger, more affordable medium-term loan… And then refinancing that into a long-term, single-digit interest rate SBA loan.

By making some smart choices and thinking seriously about your business financing, you’ve potentially moved from an 18-month loan of $40,000 with daily payments and 20% APR to a 10-year loan of $120,000 with monthly payments and 6% APR.

Of course, that’s just an example—but we’ve seen it happen plenty of times.

Refinancing is an incredibly powerful tool that all small business owners have at their disposal. It requires some planning ahead and thoughtful financial management, but that extra work is worth the potential benefits to your small business’s growth.

3. Consolidating multiple loans

Debt refinancing and debt consolidation are often used interchangeably, but that’s not quite correct.

Instead, debt consolidation is a kind of debt refinancing.

Debt consolidation is when you take out one loan to pay off multiple smaller loans (as opposed to one smaller loan, as with the above examples).

For example, say you’ve taken out several small loans over the course of a year to pay for an expense here, to cover an accident there… But those payments add up.

With debt consolidation, you can roll up all those different daily payments into a larger weekly payment.

In terms of how it can help your business, debt consolidation brings all the same advantages of normal debt financing: you’ll save money, get more capital, have longer to pay off your debt, and can spend more flexibly with a looser cash flow.

Plus, you get to establish a more regular payment schedule and bring together your various sources of business credit. You can worry less about forgetting to make a payment and hurting your credit score, too.

Before You Refinance: Prepayment Penalties

When you’re refinancing a loan, you’re essentially paying it all off early—with the proceeds of another loan.

That’s all well and good, but some lenders actually attach prepayment penalties to their loans—and these should be a factor in your decision whether or not to refinance.

What Is a Prepayment Penalty?

As you might be able to guess, a prepayment penalty is when you’re penalized for paying a loan off before its term ends.

This might sound counterintuitive—why would a lender want to wait if you have their money now?

Well, what actually happens when you pay off early is that your lender loses out on some interest they expected to receive. They’re not making as much money as they thought, in other words.

Some lenders will charge extra for prepayment in order to make up some of that lost capital. Others offer prepayment “incentives” where they’ll forgive a portion of your interest when you pay early—but only a portion.

Either way, refinancing a loan will trigger that prepayment penalty, so watch out. Make sure you’re aware of whether your loan has a prepayment penalty—and how much it is—before you refinance.

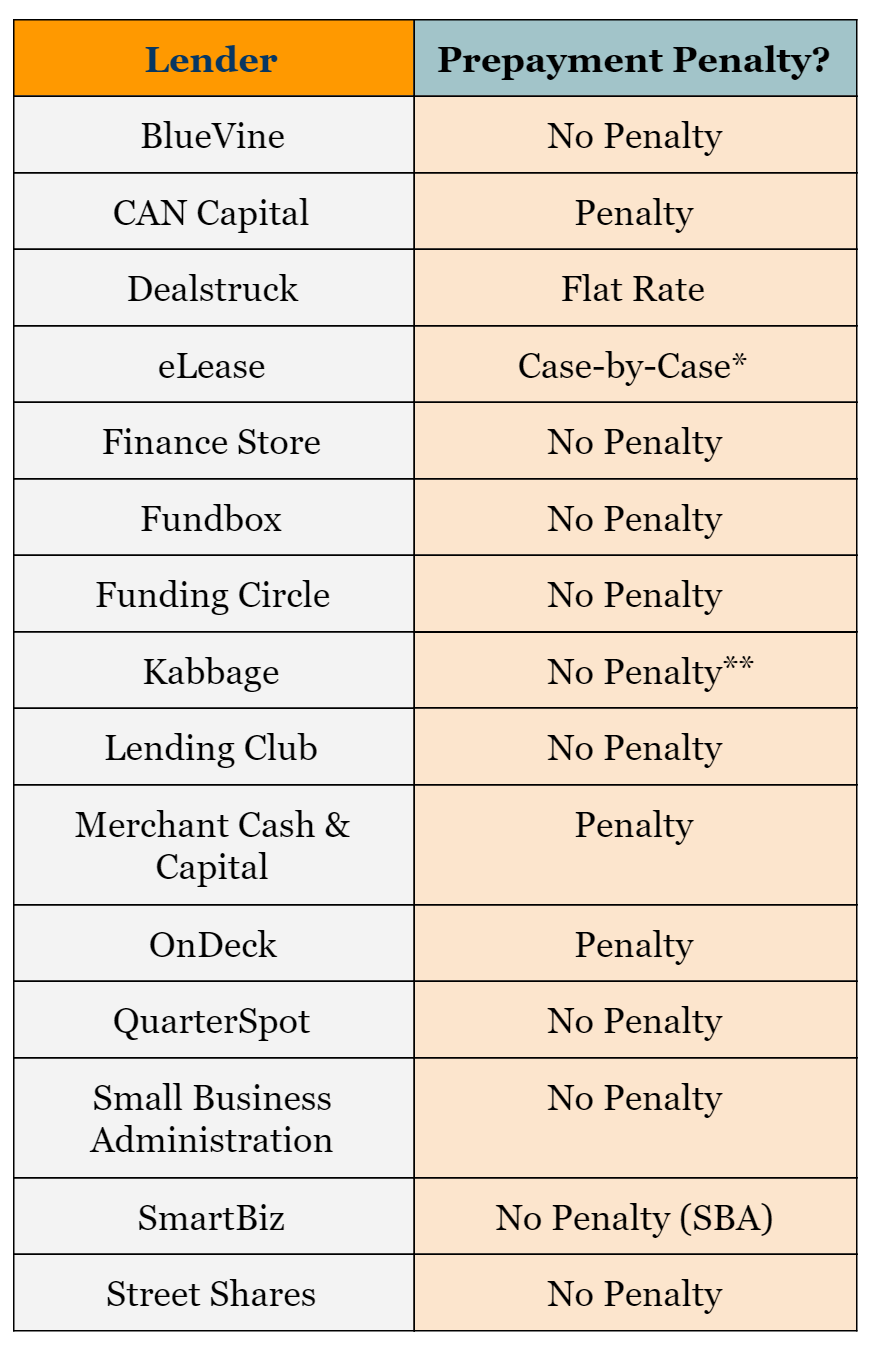

Prepayment Penalties on Our Marketplace

This isn’t a comprehensive list of all online lenders, but here are the lenders on Fundera’s business loan platform—and a note on whether they impose prepayment penalties on their borrowers.

Dealstruck’s “Flat Rate” means that they charge a lump sum based on your loan’s terms, like 6 months’ interest.

“Penalty” means that the lender will charge a percentage of your remaining interest—and that percentage might be higher the earlier you pay.

*In some cases, eLease doesn’t enforce a prepayment penalty. In others, they include a prepayment penalty only if you prepay within the first year of the loan. Make sure to clarify your terms if you borrow from them.

**Kabbage technically doesn’t have a prepayment penalty—but they frontload their interest, which is non-traditional for a line of credit, and compensate by forgiving all interest from prepayment.

Accounting for Your Prepayment Penalty Before Refinancing

Since your current loan’s prepayment penalty will come into effect when you refinance, you’ll have to carefully consider the costs of refinancing.

It’s not necessarily a tough calculation:

Is what you’ll save by refinancing into a better loan greater than what you’ll spend by paying that prepayment penalty?

If so, refinancing might be worth your while.

If not, you might be better off sticking to your loan’s agreed-upon term and taking out a second loan afterwards.

Make sure to consider the differences in loan terms and amounts as well, though. Refinancing might cost more, but having extra capital for longer could be an important factor in your decision.

Some Debt Refinancing Success Stories

Here at Fundera, we’ve seen a number of wild success stories with debt refinancing—especially when it comes to graduating small business owners from expensive short-term financing to bigger and better loans.

Let’s take a look at a few examples of entrepreneurs who saved thousands or dug themselves out of dangerous short-term debt with refinancing.

This Veteran Saved $3,000 a Month

Brian Williams is the owner of Under Control Technologies, a business that helps install audio/visual equipment like television, internet, heating, and air conditioning in homes.

Looking to grow, Brian took out a loan with a short-term lender—but was soon stuck in a cycle of expensive debt. High daily payments were slowing down his cash flow, but even though he had a stellar credit score and a strong revenue, banks wouldn’t give him a cent.

“I was paying $200-and-something a day, 5 days a week. It totaled over $5,000 a month. My cash flow was sucked dry,” Brian said.

Refinancing would prove to be his answer.

Brian qualified for financing from a medium-term online lender offering 2- to 5-year loans. Suddenly, he was spending less on financing in a month than he had been paying weekly.

And soon after, Brian qualified for an even larger and more affordable SBA loan—getting even more money at the same rate.

This was Brian’s path of debt refinancing:

- Short-term loan: $5,000 per month for $55,000

- Medium-term loan: $1,700 per month for $57,000 over 4 years

- SBA loan: $1,700 per month for $150,000 over 10 years

He saved over $3,000 per month—while tripling his loan amount and stretching the length of his loan by more than 5 times.

Saving $15,000 a Month With Refinancing

Brian’s story is great—but not the only one of its kind.

Emilie Christenson, owner of umbrella company Carlie Devon, is another example of a business owner who escaped short-term debt and climbed the ladder all the way up to an SBA loan, saving money and opening up her business to tons of new opportunities.

In order to escape a cycle of short-term debt, Emilie also looked to refinancing.

Since her business had strong revenues and good credit, she qualified for an SBA loan right away.

However, that would take a long time to apply for and receive funds from. SBA loans are slower, more effort-intensive applications. And Emilie had an upcoming inventory purchase to make.

Instead, she opted for a medium-term loan first, then refinanced that funding with an SBA loan soon after. By taking advantage of her strong financials, Emilie was able to save money and get financing when she needed it.

All told, Emilie wound up saving $15,000 a month for her small business through refinancing.

Refinancing… and Escaping a Shady Broker

Serial entrepreneur Kevin Krabill was stuck in a bad bind.

Because of the recession, he was forced to take back some of his franchised restaurants from its current owners… While also pursuing his next business idea. In order to deal with this burden, Kevin took out a short-term loan to tide his businesses over.

He looked to refinance that debt out—but even though his financials were strong, he was rejected by a medium-term lender.

What happened?

Kevin suspected that his broker had actually sabotaged the refinancing deal, because a more affordable business loan would cut into the broker’s own profits.

And he was right.

In fact, his broker forged Kevin’s signature on a false loan application. But when Kevin found out, he worked around the broker and proved that his business would benefit from refinancing.

In the end, Kevin refinanced his debt—and saved his cash flow.

The moral of the story?

Even when you’re looking for refinancing, be careful who you work with. Loan sharks and shady brokers rarely care about your needs—and refinancing debt isn’t usually in their best interest, even though it might be in yours.

***

Taking out a loan to refinance the debt you have can be a serious game-changer for your small business.

Whether you’re making incremental improvements or reaching for the stars, graduating into a significantly better kind of loan, refinancing can give you more time to access more capital at a more affordable rate.

That’s a lot more—for a lot less.

Here’s the bottom line:

Refinancing doesn’t always make sense for every business…

But it’s a powerful option for small businesses looking to grow in a big way.

So think carefully about your debt situation, your business’s needs, and how your financials have changed since your last loan. Debt refinancing might be just what you need.

The post Is Refinancing the Right Move? This Guide Will Tell You appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/06/08/debt-refinancing-graduating-into-better-loans/

No comments:

Post a Comment