If you’ve ever had a mortgage or loan, you’ve probably heard the terms “amortization schedule” and “payment schedule” tossed around. But did you know they actually tell you very different things? Learning the important difference between the two may help you make wiser financial choices when it comes to choosing payment frequencies and other terms for your loans. It can also help you understand the impact of prepayments at different times during the course of the loan, saving you money in the long run.

What is an Amortization Schedule?

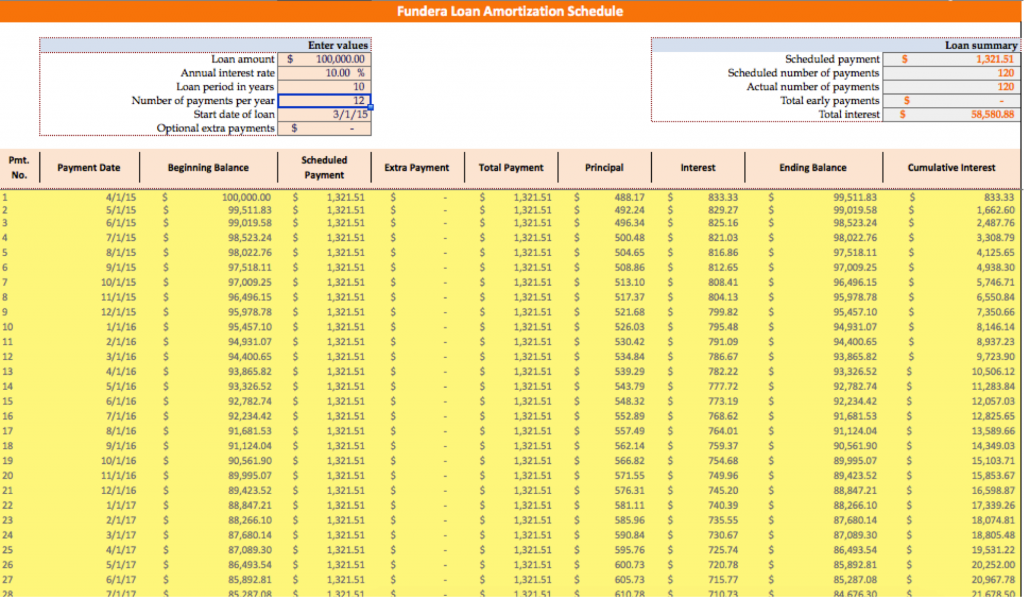

An amortization loan amortization schedule shows what you’re paying in interest and principal for each and every payment until the loan is paid off. As a reminder, the “principal” of the loan is what you borrowed, while the “interest” is, as you probably know, the cost of borrowing that money. But you might not know that every payment you make isn’t equally split between principal and interest.

In fact, borrowers usually pay more of the interest upfront, leaving the principal for the end of a loan’s term. In other words, while you might be paying the same amount for that loan every week or month, what you’re paying towards will probably change. And understanding that balance impacts your prepayment options—but we’ll go over that in a bit.

Understanding an Amortization Schedule, Column by Column

Note: For a more detailed deep-dive into amortization schedules, check out this post.

Not sure how to tackle these documents? No problem. Let’s break down a loan amortization schedule column by column.

In the far left column you’ll see the payment number, starting at 1, and ending with the last payment of your loan. So, if you have a two-year loan with monthly payment periods, you’ll see the numbers 1 through 24. This just shows how many payments you’ll make over the course of your financing.

The second column displays the date of that payment. Remember, paying on time and in full helps you build your business credit as well as avoid late charges!

Beginning balance, in the third column, is pretty self-explanatory: that’s how much of the loan you have left to repay.

The fourth column shows what you’ll be paying, and the next two columns indicate any extra payments and the full total, too. This generally remains the same.

The seventh and eighth columns are where things get interesting. As you can see, that scheduled payment gets broken down into principal and interest… And, as you go down the length of your payment, you can watch the principal portion increase while the interest amount decreases. That’s because your beginning balance drops with each payment, so naturally the interest on that amount is lower. But also notice how, as we mentioned earlier, you’re paying more interest in the beginning and more principal towards the end of your loan cycle.

Finally, the ninth column shows your balance after that row’s payment, while the tenth column tracks all the interest you’ve paid to-date.

What is a Payment Schedule?

A payment schedule, on the other hand, simply shows when you’ll need to make those payments. It shows the dates of each of your payments and the payment amount—the first four to six columns from the amortization schedule above, basically—but it doesn’t break down how much of your payment goes towards interest or how much gets applied to your principal. It’s straightforward, but much less informative.

The Key Differences Between Amortization Schedules and Payment Schedules

While amortization schedules actually give borrowers some useful and transparent information in terms of how much they are actually paying in interest, payment schedules are really just a calendar of payment dates. Yes, a payment schedule will show you the payment due and on what date, but it won’t reveal much more. They’re both useful, but for the savvy small business owner, an amortization schedule can give a lot more.

Making Prepayments

Once you get your hands on your amortization schedule, look at the figure at the bottom of the interest column. In the example from earlier, the very last payment—#120—has only $10.92 in interest, while the first had $833.

Why is this important? Well, you might occasionally have the option to pay a loan off early with a full prepayment, or at least make partial prepayments when your cash flow allows. But you’ll need to make sure you review your loan documents carefully to see how prepayments are applied. If they go directly towards the loan principal, they can reduce the amount of interest you’ll pay in the long run, especially if you make the prepayments early on in the loan. Prepayments made later on in a loan won’t save you as much money, because as you can see, most of your interest has already been paid to the lender.

Also, watch out for prepayment penalties, fees charged by the lender for the privilege of paying the loan down early. In some cases, these penalties completely wipe out the benefit of paying your loan off early.

Where’s My Amortization Schedule?

Some lenders only provide a payment schedule, so borrowers don’t know how much of their payment goes to principal and how much goes to interest. The solution? Just ask them for one. And be sure to read the fine print of your loan agreement carefully, because if you want to pay the loan off early, you may only get a “discount” on the interest you would have paid instead of avoiding paying the remaining interest altogether.

Also, some lenders who provide payment schedules can’t provide amortization schedules. If these lenders allow prepayments, they’ll usually give you a discount on your remaining total, both principal and interest. We see this primarily with short-term lenders.

Create Your Own

If you can’t get an amortization schedule from your lender, try calculating your own amortization schedule using one of the handy loan amortization scheduling tools on our Know Before You Owe page. You’ll need to know your loan balance, total amortization time (the total time you’ll be making payments on the loan), the amount of each payment, and your APR. If you don’t know your APR, use one of our APR calculators to get that figure first.

The more you know about amortization schedules and payment schedules, the better armed you’ll be to make the best financial decisions regarding your business borrowing.

The post The Difference Between an Amortization Schedule and a Payment Schedule appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/01/20/the-difference-between-an-amortization-schedule-and-a-payment-schedule/

No comments:

Post a Comment