Three little digits. A simple, seemingly arbitrary number on a page. It’s hard to imagine that a single number—any number—could have such a big impact on your life choices or opportunities.

But when those three digits represent your personal credit score, they can indeed have a dramatic impact on your future choices. Can you buy a house or a car? Can you rent an apartment? Can you take out a personal loan? To a large extent, the answer depends on those three digits of your credit score, so you should probably know what credit scores mean.

Simply put, your personal credit score—also often called your FICO score—is a number between 300 and 850 that indicates to lenders your level of creditworthiness, or whether you are a good candidate for future credit. The number is based on complex calculations that take into account various factors of your borrowing history.

What exactly goes into those calculations, and how are they impacted by your day-to-day spending habits? We’ll break down all the details below.

But first, you’ll want to understand a bit about FICO and its credit algorithm.

Credit Score Meaning: What Is FICO?

FICO is the largest and best-known company for calculating an individual’s personal credit score. Though FICO isn’t an abbreviation anymore, the name does come from the longer, original company name Fair Isaac Corporation.

Here’s where people often get confused:

FICO isn’t actually a credit reporting agency.

Instead, they’re a predictive analytics company that created the algorithm most widely used by lenders to understand how likely you are to pay back a bill on time. Using the information found in credit reports from the three main U.S. Credit Bureaus, often called the main credit reporting agencies—Equifax, Experian, and TransUnion—FICO’s algorithm assigns each individual a number between 300 and 850 that labels the individual’s risk to a lender based on their past credit habits.

And one more important part of your credit score meaning:

As you probably already know, your FICO credit score is a dynamic, “living” number. It changes as your habits and life circumstances do. Each time you check your credit score, you could have a different (hopefully higher) number than before.

The FICO Algorithm and Your Credit Score Meaning

Technically, a FICO score is made up of 12 different scorecards.

Consumers are segmented into different categories, because a slightly different equation is used for each segment.

For example, there’s a particular scorecard for individuals with late payment histories and a separate card for individuals whose credit history is less than a year.

But while every individual’s profile is different, the goal of the FICO algorithm (and your credit score meaning) is always the same: the algorithm’s intention is to predict your relative likelihood of defaulting on a debt within the next 18 months.

The breakdown of how a FICO credit score is calculated for the average person is also more or less the same—or similar enough that FICO has shared a percentage breakdown for the average borrower.

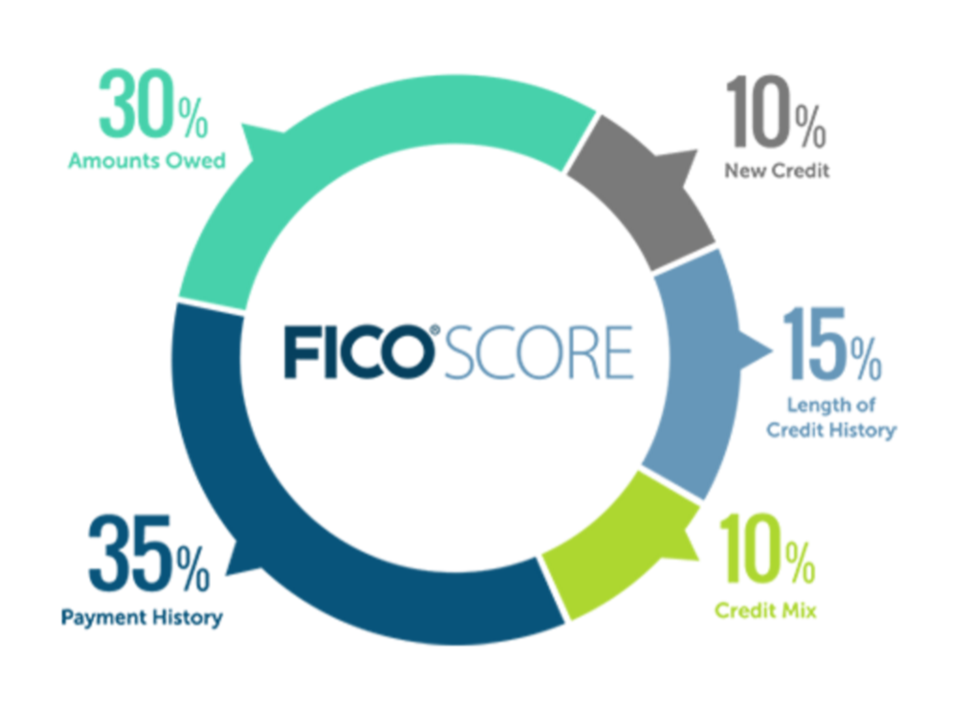

Your score is decided based on your payment history, amounts owed, length of credit history, new credit, and the mix of credit you use.

But what exactly do each of these categories mean—and how do they reflect your ongoing habits as a borrower? How can understanding these factors help you understand your credit score meaning?

Let’s dive a little further into each one now, starting with the largest category.

Payment History (35%)

Not surprisingly, your payment history is the biggest factor used to calculate your credit score by FICO.

After all, your recurring habits for paying off debt in the past is the most telling sign of how you’ll pay back future lenders. (The proof is in the pudding, as they say!)

Naturally, an on-time payment history is good—and the more credit lines you have with a consistently on-time payment history, the better your score will be.

But what if your payment schedule has been less than perfect? Will one bad season of spending haunt you forever?

The algorithm factors in more than simply whether or not you pay your bills, thankfully. Both severity—how far delinquent you are—and frequency—how many times you were late—impact the payment history section of your credit score. In addition, when the delinquency occurred matters.

Late payment histories are bad, but the later they are, the worse it will reflect on your score. The first level of delinquency to impact your credit is at 30 days late. It’s not good, but 60 days is worse, and 90 days is even worse… And so on and so forth.

In addition, being currently delinquent is worse than being delinquent in the past—so, for example, being 30 days delinquent as we speak will have a more negative impact on your current score than being 60 days late on a payment four years ago.

This is a small silver lining for late payers:

Even if you showcased bad habits in the past, the more you make an effort to pay your debt on time going forward, the more you’ll slowly start to boost your score again. And eventually, negative payment history ages off your file. It will no longer appear on your credit report 7 years after the first date of delinquency.

Amount Owed (30%)

You probably guessed that this category reflects total amount of credit you currently owe—or have outstanding. But in addition, and more importantly, the amount owed also reflects the ratio of your current outstanding debt relative to your credit limit. In terms of your credit score meaning, this is a big factor.

To better explain amount owed, we’ll need to review the two types of credit contracts: installment and revolving.

An installment credit account is a closed-end loan with specific payment terms—like a car loan, student loan, traditional term business loan, or mortgage.

For example, let’s imagine that you take out a five-year car loan with 60 payments.

When you first open the loan and are making your first few payments, your utilization ratio (or your ratio of amount owed) will be very high. Closer to the end of the five years, on the other hand, your utilization rate will be much lower, because you’ll have made the majority of payments back to the lender. Essentially, your utilization ratio on an installment credit contract decreases incrementally over the life of the loan.

For the purposes of your FICO score, your utilization rate on installment credit is generally less significant than your revolving utilization ratio. Revolving credit accounts are any in which you have a set borrowing limit, but can repeatedly borrow and repay funds within that limit. (Like a line of credit, for example.)

For example, imagine you have a credit card with a $10,000 limit. If you spend $5,000 and that’s what is reported to the bureaus, you have a 50% utilization ratio. Maybe you pay back $1,000 of that amount and now your utilization ratio is 40%. It’s easy to see how—if your spending continues to outpace your payments—your utilization ratio could skyrocket quickly.

Individuals with high levels of revolving credit utilization are the targets of the FICO algorithm, because they’re statistically most likely to default on a payment.

Borrowers with high levels of revolving utilization are basically financing their lifestyles with very expensive debt, since carrying a balance month to month means paying very high interest rates. These are typically individuals living paycheck to paycheck, so they have little if any wiggle room in their personal finances.

Sadly, what inevitably happens in many of these scenarios is that the borrower encounters either an unexpected expense or a loss of income, and next thing they know, they’re behind on a payment. With so little cushion, one mistake or surprise can cost a lot.

In terms of credit score meaning, amounts owed is important because it identifies those people without enough flexibility who are just one little slip—a car repair, a medical expense, a temporary disability—away from becoming a delinquent borrower.

When you have revolving credit, it’s best to keep your credit utilization ratio below 30% at any given time—if you can afford it.

This means that, if you have a $10,000 credit limit, keeping your utilization below $3,000 on your account will help you avoid hits to your credit score on the amounts owed front.

If you’re having a hard time keeping your accounts at a reasonable utilization ratio, consider contacting your revolving credit issuer to request an increase in your credit limit. This will give you more breathing room with your total available credit, helping you manage your credit utilization ratio.

But it’s also important to note that you want to keep your utilization above 0%. If it looks as though you’re not using the accounts you’ve opened, your lack of credit utilization could end up hurting your credit score in the end.

It might seem like a delicate game of balance when it comes to amounts owed, but it doesn’t have to be that complicated: try to stay below the 30% threshold.

Length of Credit History (15%)

Would you lend money to someone you just met? Probably not.

And that’s the same logic that FICO, the credit bureaus, and ultimately lenders use in considering length of credit history as a factor in your overall credit score meaning.

When you take out your first credit card, car loan, or student loan, FICO and the credit bureaus are on the edge of their seats, waiting to see what kind of borrower you will be:

Will you make your payments on time, every time? Will you budget and plan ahead for upcoming payments? Will you be a transactor—paying your credit card bill in full every time? Or a revolver—getting closer and closer to your credit limit while making only minimum payments?

In the beginning, FICO doesn’t have those answers, so their algorithm just doesn’t have much to go on. Your credit score meaning is based on only a sliver of data.

From a statistical perspective, the more data points FICO has—think types of credit, months and years of payments made or not made on time—the more confident their algorithm can be about its overall prediction of your future behavior. So if you only have 6 months of credit history, there’s just not a lot for the algorithm to work with.

Because of this category, new borrowers will often have a lower credit score for a year or two after opening their first account, at least until they gather a longer payment history.

The good news? In this category at least, your credit score will keep going up the longer you’re listed as a borrower.

That said, your length of credit history is ultimately an average—so, in some cases, it can be brought back down by FICO’s next category.

New Credit (10%)

Of course, we all know that our credit scores—and our lives in general—are not as simple as a single account opened or a single line of credit.

As life goes on, you’ll have multiple lines of credit opening and closing. You buy a new car or house. Open a new credit card. Take out a new student loan on behalf of your college-aged child. Chances are good that, every couple of years, you’ll be taking on some form of new credit.

On the other hand, if someone just recently took out five new borrowing accounts, that would drive their average length of history down.

Because FICO hasn’t seen a lengthy borrowing history on those accounts, it’s hard for them to predict their trajectories into the future. The equation just isn’t sure that the person has established that they can handle all of this new borrowing.

You might be thinking that these two categories—length of borrowing history and new credit—sound pretty similar.

It’s true that they’re intertwined in many ways, but the main difference between the two is that new credit factors in credit inquiries.

Let’s explain:

Every time you submit an application for a new credit account—whether it’s to open a new credit card, rent an apartment, buy a car, or take out a personal or business loan—the lender you’ve applied to is going to pull your credit report with at least one, if not multiple, credit bureaus.

And when they do, only the first inquiry will be logged—which is why it’s often recommended that, if you’re shopping around for the best deal, you do so within a short span of time so it only impacts your credit rating once.

A new account is always preceded by an inquiry, and it tells FICO’s algorithm that you’ll probably be borrowing more money soon. FICO’s algorithm can’t yet track a payment history for that new account, but it’ll eventually impact your credit score. If you check your credit score very regularly, you’d probably see it go down just slightly after an inquiry, and even more so right after you open that new account. But eventually, after one month, three months, six months, and a year of positive payment history on that account, the negative impact on your score go away.

The bottom line:

Both on individual accounts and with your credit life in general, the longer you’ve shown a positive payment history, the more confident the equation will be. This is a fundamental rule of what credit scores mean.

Mix of Types of Credit Used (10%)

Imagine that a friend from work asked to borrow money from you. The colleague seems like a pretty nice person day-to-day, but you only know them in the context of work. You’ve never met their family. You don’t know anything about their personal life. Maybe you’re not even sure why they need the cash.

Do you really feel comfortable lending them money?

By contrast, imagine if that friend from work also lived in your neighborhood and attended the same volunteer group as you, so you knew their family well and interacted with them all the time outside of work. Wouldn’t that make you a bit more comfortable with the idea?

This is exactly the same concept that leads FICO and the credit bureaus to include what’s called your “credit mix” or “account mix” as a factor in their scoring algorithm: diversity of context matters for your credit score meaning. The equation wants to see how you handle different types of credit accounts.

To better understand this, let’s track back to the two types of accounts we discussed earlier: revolving accounts (like credit cards and lines of credit) and installment accounts (like car loans, student loans, and mortgages).

Remember, the FICO algorithm’s goal is to predict your future behavior with any type of credit, not just one.

In general, borrowers are much more likely to be late on a credit card payment than they are on a mortgage or car payment. After all, if you miss a few car payments, the lender can take your car away. If you’re severely delinquent on mortgage payments, the bank can repossess your home. If you’re late or fail to pay your credit card bill, there are fewer direct or immediate consequences.

Because of this, your positive payment history on your car loan or mortgage can’t totally reassure lenders that you’d behave the same way with a credit card or revolving line of credit. That’s why the FICO algorithm looks for a mix of credit types, so that it can more accurately predict your future behavior with different types of credit.

Multiple Factors Working Together

At this point, we’ve walked through each of the five factors that make up each individual’s FICO credit score.

That said, it’s important to keep in mind that the exact calculations and considerations for each person will look a little bit different: these guidelines aren’t totally scientific.

And remember, there are actually 12 different algorithms that FICO uses depending on population sector, so exactly how each of these categories work together will depend on things like your age, income level, past credit behaviors, and more.

Plus, the FICO algorithm isn’t the only piece of the greater credit score puzzle… We also have to look at the role of the credit bureaus.

Credit Score Meaning: What Do Credit Score Ranges Mean?

Your credit score is often measured as part of a range, but do you know what it means when you’re in a specific range? The credit score ranges vary from bureau to bureau but there are common traits amongst all of them that can help guide you. Here is a general breakdown of the ranges and what you can expect if you fall in one of them:

300 to Mid-600s: Poor

A score of 300 through about 650 will definitely be a hurdle when it comes to applying for credit. You may have to settle for a secured credit card or loan and you probably won’t qualify for the best terms. That doesn’t mean there aren’t business loan options for bad credit, they just may be harder to find.

Mid-600s to Mid-700s: Fair-Good

If your score lands somewhere in the mid-600s to mid-700s, you’ll likely have more options for financial products. Though you may not get the very best rates, you can expect to have a good deal of options whether you’re applying for a loan or a business credit card.

Above Mid-700s: Very Good-Excellent

If you’ve worked hard to pay your bills on time and have maintained a healthy credit utilization, you’re probably lucky enough to have a credit score above the mid-700s. This very good to excellent range will land you the best credit terms and allow you to pick from many different financial options.

Credit Score Meaning: Different Bureaus, Different Ratings… but Why?

If you’ve ever pulled your own credit report before, you might remember that you didn’t do so directly from the FICO corporation. Remember, FICO isn’t a credit reporting agency. They’re just the creator and owner of the statistical model that credit bureaus use to calculate credit scores.

This distinction might seem trivial, but it actually has a significant impact on your final credit score meaning.

While all reputable credit reporting agencies—including the three most widely known: Experian, Equifax, and TransUnion—use the FICO algorithm to calculate your credit score, the exact information that goes into that algorithm can vary widely between agencies.

Each agency has its own proprietary method of collecting information about borrowers, meaning they can gather slightly different information at different times.

Remember when we broke down the various types of credit accounts you might have earlier?

Well, not all of those lenders report to every agency or on the same timeline. To complicate matters even further, the Federal Trade Commission suggests that—because of issues like name changes or similarities, changes of address, and clerical errors—at least one out of every 20 consumers is likely to have errors on their credit report.

This is why, despite both using the same algorithm built by the same statisticians, a lender can pull your credit report from two different agencies at the same time and see different scores.

Maximizing Your Score

Of course, now that you know what goes into your credit score, every borrower’s immediate question is the same:

What can I do to maximize my credit score?

Unfortunately, a lot of the recommendations online that involve “reverse engineering” the FICO algorithm to somehow trick your credit score can often do more harm than good.

That said, there are common sense measure you can take to boost your FICO score. Here are just a few:

1. Get Up-to-Date on Payments

If you’re not current on all your credit accounts, take steps to address that immediately.

Being currently behind on payments is the single biggest factor that will weigh down your credit score, so this one is non-negotiable. Set a budget for yourself and figure out how to take control of your current finances before you consider any new debt.

Your credit score meaning translates into “How reliable of a borrower are you?” If you’re not paying your lenders back, you’re giving a pretty straightforward answer: “I’m not.”

2. Thoroughly Check Your Credit Reports

Are you among the one in five Americans with errors on your consumer credit report?

Without reviewing your report from all three major credit bureaus, you can never really know.

Pull your personal credit report from Experian, Equifax, and TransUnion, and check it thoroughly for any accounts you don’t recognize—or that you might’ve forgotten about.

If you find a delinquent account that’s accurate, take immediate steps to get it paid off. Collections agencies will can sometimes help to ease the burden of added fees if you reach out to them to make a payment.

If, on the other hand, you do find an error on your report, contact the credit bureau in writing to dispute it.

A word of warning: the process of correcting errors on your credit report can be long and arduous—but depending on the charge and your future financial needs, it’s usually worthwhile to get your credit report straightened out.

3. Pay Attention to Your Revolving Utilization Ratio

Even if you’re fully up to date on all accounts, it’s worth paying attention to your utilization ratios—particularly for any credit cards or other revolving credit accounts.

An ideal utilization ratio is below 30%, but the lower the better. Any steps you can take to pay down credit card debts and lower your utilization ratio will be in the best interest of both your credit score and, ultimately, your bank account.

***

Most of all, it’s important to remember that your FICO credit score is a tool that meant to work for you. Lenders avoid opening accounts with borrowers who have low credit scores because it’s unlikely that those individuals will be able to pay back the funds borrowed.

Understanding credit scores and what they mean is a way for you to decide whether it’s smart to take on that loan or credit card.

While there might be alternative “quick fixes” that can help you to make small improvements in your credit score, you’re better off focusing on common sense personal finance principles and trusting that, as you get a better handle on your finances, your credit score will increase to reflect those choices. Plus, there are also financing opportunities for individuals with bad credit: use these to build your credit up over time.

The post What Does Your Credit Score Mean? Here’s a Step-by-Step Explanation appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/credit-score-meaning/

No comments:

Post a Comment