What Is a Sole Proprietorship?

A sole proprietorship is an unincorporated business with one person or a married couple as the owner. Sole proprietors report business income and losses on their personal tax return and are personally responsible for the business’s debts and legal obligations.

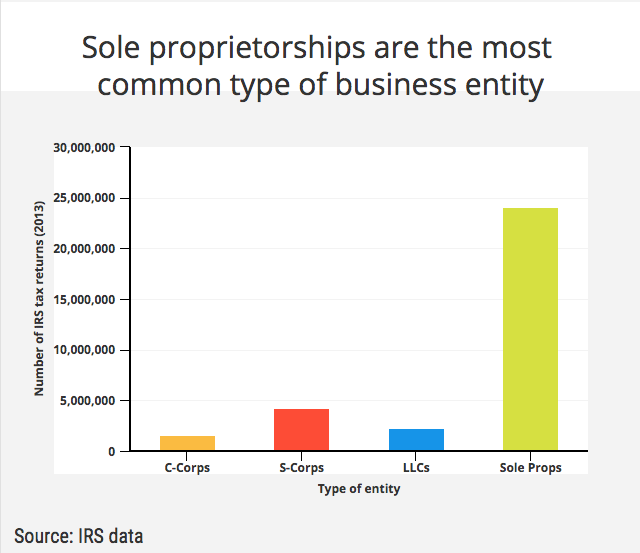

There are more than 23 million sole proprietorships in the U.S., making this by far the most common type of business entity. Sole proprietorships are common because setup is very easy. If you’re operating an unincorporated business and are the only owner, you are automatically a sole proprietor.

Although sole proprietorships are easy to start and to manage, they come with a host of legal, financial, and business risks. If someone sues your business, you have the most to lose as a sole proprietor. Sole proprietors sometimes find it harder to get business loans and land big clients. Not to mention, corporations and limited liability companies (LLCs) have certain tax advantages over sole proprietorships.

Learn everything you need to know to decide if a sole proprietorship is right for you, including tips on how to best run your business should you decide to join the ranks of the many sole proprietors.

Sole Proprietorship Definition

The best way to define sole proprietorship is an unincorporated business entity with one owner. Spouses can also jointly own and operate a sole proprietorship. More than 70% of small businesses are organized as sole proprietorships, making this by far the most common type of business entity.

Unlike corporations and limited liability companies (LLC), which are state-registered business entities, a sole proprietorship doesn’t require you to file formation papers with the state. So if you’re running a business on your own and haven’t registered the business, you already have a sole proprietorship. That said, you might still have to obtain business licenses and permits to comply with local laws.

The main selling points of a sole proprietorship business are easy formation and the fact that the owner is entitled to all profits. But on the flip side, sole proprietors are also personally responsible for all of the business’s losses, debts, and legal obligations. This can give rise to a whole host of concerns. Next, we’ll look through all of the pros and cons of a sole proprietorship to help you decide if this business structure is right for you.

Sole Proprietorship Examples

Given how common they are, sole proprietorship examples are everywhere you look.

Here are some sole proprietorship examples:

- Freelancers

- Consultants

- Bookkeepers

- Virtual assistants

- Home-based business owners

Any time you open a business without any business partners, you have a sole proprietorship. The business starts the moment you begin offering goods or services for sale. You can elect to incorporate your business or register as an LLC, but in the absence of filing papers with the state, you have a sole proprietorship on your hands.

Top 5 Advantages of Sole Proprietorships

A sole proprietorship is the simplest way to start and run a business, and there’s a lot to be said for that. Small business owners are very busy people, with the majority devoting more than 50 hours per week to their business. If that describes you, then a sole proprietorship can be very appealing.

Here are the biggest advantages of sole proprietorships:

1. Initial setup is fast.

Wondering how to become a sole proprietor? Well, starting up a sole proprietorship is very easy. As we’ve mentioned, there’s no need to register or incorporate your business with the state. All you have to do is obtain business permits and licenses (e.g. zoning permits, sales tax permits, liquor permits, etc.) that your state or local government require. You’ll also have to file a fictitious business name (DBA) form with the state or locality if you’ll be operating the company under a trade name. After that, you’re legally authorized to do business—that was easy!

Once you’re legally up and running, all you really need is a business checking account, a website, and some customers to get going.

2. There are few ongoing legal requirements.

After you’ve set up shop, things remain pretty easy for a sole proprietorship from a paperwork standpoint. That’s why you’ll find freelancers, consultants, and other busy professionals often decide to organize their businesses as sole proprietorships—at least in the beginning. Sole proprietors don’t have to keep a bunch of documentation to maintain their business’s legal status. In contrast, owners of corporations and LLCs have to keep meeting minutes, bylaws, resolutions, and other documents.

3. Management is easy.

As a sole proprietor, you have complete control over business decisions and priorities. Conflicts among partners is one of the leading causes of business failure, but fortunately, sole proprietors don’t have to worry about this. You can change priorities, shift goals, and adjust your schedule however you please (of course, you have to keep employees in mind if you have staff).

Another benefit of a sole proprietorship is that your personal financial and legal situation and your business financial and legal situation are exactly the same. This can remove some of the headache associated with keeping track of your personal and business interests.

4. Sole proprietorship taxes are simple.

Filing taxes as a sole proprietor is also relatively straightforward. Sole proprietorships are considered pass-through entities for tax purposes. This means that the owner reports business income and losses on the personal tax return. You simply need to attach a Schedule C to your 1040 tax return. Since you’re the sole owner, there’s no need to figure out different ownership percentages and shares. You take home all of the after-tax profits.

Many sole proprietors operate out of their homes. If that’s the case with your sole proprietorship, don’t forget to deduct home business expenses and car expenses (if you drive your personally owned car for business purposes).

5. Many sole props can take advantage of a 20% income tax deduction.

The recent tax reform law—the Tax Cuts and Jobs Act of 2017 (TCJA), aka the Trump tax plan—went into effect earlier this year. The law will have some impact on virtually every small business’s tax burden. One of the main provisions in the law is the Section 199A 20% tax deduction. This provision allows owners of pass-through entities such as sole proprietorships to deduct 20% of the business’s net income from their taxes. The 20% deduction can result in a big tax cut for many sole proprietors, though there are limits we describe below.

Top 5 Disadvantages of Sole Proprietorships

With just one person at the helm, a sole proprietorship is easy to set up and manage. However, that also makes the business and your personal assets more vulnerable. Knowing the risks in advance can help you plan and take steps to protect yourself.

Here are the main disadvantages of sole proprietorships:

1. You face unlimited personal liability for business debts and lawsuits.

There’s no clear distinction between a sole proprietor and their business. Imagine two overlapping circles, one representing you (the owner) and the other representing the business. There are steps you can take to separate yourself from the business, but financially and legally, there will always be some degree of overlap.

Sole proprietors are fully, personally liable for the business’s debts and obligations. That means creditors and legal claimants can go after your personal assets (e.g. your car, your personal bank accounts, your home in some cases) to get their money.

This can be very risky, particularly in industries where injuries are more common. For example, say you have a landscaping company and mow customers’ lawns. If someone trips on your lawn mower and injures themselves, they could very well sue your business for their medical costs. Since you’re a sole proprietor, the court could allow a successful claimant to go after your personal assets to get their money. Had you started an LLC or corporation, only your business assets would be on the line.

Kelli Daniel, founder of Dart Frogg Communications, decided to incorporate her business to shield herself from personal liability:

“I am a freelancer, but established an LLC as soon as I started accepting work. I did so to protect myself should (in the admittedly very rare case) someone wish to press charges. If I was a sole proprietor, someone could press charges and take my personal assets. The LLC protects me from business-related legal matters that could otherwise compromise my financial security. Although I don’t ever expect to be sued for anything, I am someone who believes in insurance and in taking precautions.”

2. Sole proprietorship taxes are higher.

As we mentioned above, recent tax reforms let pass-through entities like sole proprietorships take a 20% tax deduction. This is a great way to lower your tax bill, but sole proprietors still usually end up paying more taxes than corporations and LLCs.

One reason is not all sole proprietors can utilize the 20% tax deduction. Tony Deutsch, CPA and head of Concannon Miller’s tax department, says there are three main limitations:

- Amount of income: If you’re a sole proprietor and make over $315,000 (married joint filers) or $157,500 (single filers) in annual business income, you can’t take the full deduction. The deduction phases down as your income increases.

- Business’s employees/assets: After reaching those income thresholds, you can only take a phased-down version of the deduction if you have employees or depreciable business property. If you don’t have employees or depreciable business property, you’re out of luck.

- Industry: Sole proprietors who provide certain types of services, including actors, artists, athletes, lawyers, and accountants, also can’t take the full deduction after reaching a certain income threshold.

On top of these limitations to the 20% tax deduction, sole proprietors often end up paying more self-employment taxes (Medicare and Social Security tax). All sole proprietorships must pay income taxes and self-employment taxes on the total income of the business. If your business is making a lot of money, that can be a big bill to pay. All business owners have to pay self employment taxes, says Deutsch, but owners of corporations can reduce their tax burden by taking some money out of the business as dividends. Those dividends aren’t subject to self-employment taxes.

The tax code is very complicated, so we recommend consulting a tax professional to learn more about how different business structures will affect your tax bill.

3. Burnout is more likely.

Sole proprietors wear many different hats when running a business. Of course, you can hire employees or independent contractors to help, but the reality is that many sole proprietorships don’t have extra hands to help out.

Sole proprietors have to take care of marketing, advertising, finances, strategy, and leadership—and everything else that comes with running a business. Doing too much on your own can lead to serious burnout and cause the business to fail.

4. Succession plans might be unclear.

Another problem with sole proprietorships is that the business might not survive the owner. Sole props often build up a ton of intangible value and customer loyalty from the owner. That is great for a time, but can hurt the business’s prospects if the owner passes away, experiences a disability, or retire. So, if you want your business to outlast you, consider incorporating or starting an LLC.

5. Landing clients is harder.

Customers and vendors are more likely to take you seriously when you structure your business as a corporation or LLC. You might find the choice of business entity is important when trying to land a big client or buy raw materials from a major supplier.

Here’s what happened to Michael Simonson, founder of viral marketing agency ClickBoost:

“I actually lost a potential client two months ago because they were not comfortable working with an agency that wasn’t incorporated. I would have been the agency of record for this client, and it would have been a nice-sized gig. But they eventually rescinded the job offer, explaining that they had a policy against hiring unincorporated companies.”

Raising Money for a Sole Proprietorship

Now that you know some of the pros and cons of sole proprietorships, there’s a broader point worth discussing. No matter what type of business structure you decide on, at some point you will need business financing to grow.

Having a sole proprietorship works well if you plan to invest your personal finances—or family finances—into the business and grow the company from the ground up. However, a sole prop is more challenging if you want to raise money from investors or take out a business loan.

To raise money from venture capitalists or angel investors, you must have a corporation or LLC. Investors seek ownership (equity) in your business in exchange for funding, and you can’t carve up equity when you own 100% of the business.

Sole proprietorships also face potential roadblocks when applying for business loans. Although sole proprietors technically have almost all of the same funding options open to them, some lenders, particularly banks, prefer working with incorporated businesses because they statistically have a higher likelihood of success than sole proprietorships. Registered businesses tend to survive for a longer time, so the owners are more likely to be able to repay the loan.

In addition, some lenders are wary of sole proprietorships because of the legal risks. If someone successfully sues a sole proprietorship, the business and the owner are much more likely to go bankrupt, since your assets are inextricable. A corporation or LLC can weather more storms, leaving the business standing to pay back debt.

We pulled some of our own data to determine if getting loans is actually more challenging for sole proprietors. The table below shows the percentage of different types of businesses that applied for funding through Fundera during a six-month period and who ultimately received medium-term loans. Even though sole proprietors made up 21% of total applications, only 4% of those business owners went on to receive funding.

| Business type | Percent of loan applications | Percent of approved loans |

|---|---|---|

|

Sole proprietorships

|

21%

|

4%

|

|

LLCs

|

36%

|

15%

|

|

S-corps

|

32%

|

18%

|

|

C-corps

|

9%

|

14%

|

This data doesn’t necessarily prove that being a sole proprietor makes it harder to qualify for all types of business loans. But, the data indicate that there may be something inherent about sole proprietorships that made them less likely to get a medium-term loan during this specific time period. For instance, maybe the sole proprietors who applied were so busy running the business on their own that they couldn’t devote as much time to their loan application. As a result, lenders turned them down more frequently.

Increasing Your Odds of Business Loan Approval as a Sole Proprietor

Ultimately, lenders care more about a business owner’s credit and finances than about the business’s legal structure. If you have a good credit score and positive cash flow, those factors work in your favor, and lenders are likely to approve your application, sole proprietorship or not. Your business entity status is likely to make a difference only in borderline cases.

Nate Causey, a senior loan specialist at Fundera, says:

“When funding any type of entity, lenders care first and foremost about a business’s revenue, profit, and cash flow, and the owner’s credit score. The real challenge with getting loans for sole props lies in the reality that the proprietor wears many hats and has more limited resources than larger corporations. Not only is the owner, the president, and CEO, but also the head of marketing, bookkeeper, and IT support. Often, this is a simple and straightforward business for lenders to approve, but there are risks inherent in having one person in charge of every aspect of the business.”

Work on getting your credit score as high as possible and improving your business’s finances. In the meantime, if you have difficulty qualifying for a business loan, there are a few alternatives that are great for sole proprietors:

- Personal loan for business: Sole proprietors can obtain a personal loan based on their personal credit history and income. You can use a personal loan for eligible business purposes, but the loan amounts usually aren’t very high.

- Crowdfunding: Try an online crowdfunding platform to raise money from early supporters of your product or service.

- Business grants: Federal, state, and local government agencies and nonprofits provide grants to small businesses.

- Business credit cards: Sole proprietors and freelancers can qualify for business credit cards to use for business expenses.

If you organize your company as a corporation or LLC, then traditional business loan options, such as bank loans, SBA loans, and online term loans, might become easier to obtain.

Personal Guarantees Are Required for All Types of Businesses

No matter what type of business you have, keep in mind that almost all lenders will ask you to sign a personal guarantee on a business loan. A personal guarantee is a promise to pay back the loan, backed by your personal assets.

If you default on a loan, lenders will first look to your business assets to collect on the debt. But if the business assets aren’t enough to cover the debt, then the lender can seize your personal assets. These might include your car, personal bank accounts, and even your home, in some cases.

So, even if you aren’t a sole proprietor, you do have to personally guarantee a business loan, making your personal assets fair game for creditors.

5 Ways to Lower Liability Risks of a Sole Proprietorship

After weighing the pros and cons, you might be drawn to the simplicity of sole proprietorships and decide that this business form is the right choice for you. Here are a few ways to take advantage of everything that a sole proprietorship has to offer and minimize the disadvantages.

1. Open a business bank account.

Sole proprietors can establish some separation between themselves and the business by opening a business bank account. The key to remember: Only use this account for business deposits and withdrawals. Maintaining a separate business bank account will enable you to easily identify streams of business income and losses for tax returns and bookkeeping.

There are plenty of business bank accounts that require low minimum balances and allow you to make dozens of deposits and withdrawals for free each month.

2. Get a business credit card.

A business credit card is another great tool for separating business expenses. Again, the key here is to use the card only for business expenses, nothing personal. Business credit cards are a great alternative to loans because specific cards offer different credit limits, rewards points on purchases, and introductory 0% interest rates. And you can choose the one that’s most advantageous to your business as a sole prop. While the introductory rate is in effect, you can basically borrow money interest-free.

3. Apply for an Employer Identification Number (EIN).

An employer identification number (EIN) is a unique, nine-digit number for your business. Similar to a social security number for individuals, this number “follows” your business around on tax returns, credit reports, and loan applications.

Does a sole proprietor need an EIN?

As a sole proprietor, you aren’t legally required to have an EIN, unless you have employees. Instead of an EIN, you can use your personal social security number on business paperwork. That said, getting an EIN can help you build business credit. Having credit in your business’s name, as opposed to relying on your personal credit alone, can strengthen your business loan applications.

Depending on which state you’re located in, you might also need to get a state tax identification number. Applying for a federal EIN is free and takes just minutes on the IRS’s website.

4. Purchase business insurance.

Sole proprietors face more legal risks compared to corporations and LLCs, but buying business insurance can significantly lower your risk. There are several types of business insurance that you can purchase. General liability insurance covers the cost of damage to your business’s premises, equipment, or products. Product insurance covers damage ensuing from defective products. And home-based business insurance is available for sole proprietors who work out of their homes.

5. Draft clear contracts with your clients.

Contractual disputes between businesses or between employees and employers are common. Lawsuits can be very debilitating for any company but especially for sole proprietors because your personal assets are completely on the line. One of the best ways to guard yourself is by drafting clear contracts whenever you do do business with a supplier, vendor, or other third party.

Same goes when you hire employees or independent contractors. You can hire an attorney to create these contracts or write up simple contracts yourself.

Consider Starting as a Sole Proprietorship and Switching Later

One thing to keep in mind when deciding your business’s structure is that your initial choice of entity isn’t set in stone. Many freelancers and other business owners start out as sole proprietors and then later “graduate” to an LLC or corporation when they reach one of these milestones:

- Going from a side gig to a full-time professional business

- Hiring employees or multiple contractors (You can have employees as a sole proprietorship, but if you are adding employees to your business, it might be better to restructure as an LLC)

- Significantly increasing revenue

- Working with major clients who prefer a registered business

Feeling a strong commitment to your business, as opposed to the business being a side gig or an experiment, is a good signal that you might benefit from registering your business. Mazdak Mohammadi, owner of web design studio BlueberryCloud, says:

“I decided to upgrade from being a sole proprietor to being a corporation when my desire became to run my business for the rest of my life. I wanted to protect myself in the process, and transferring personal liability to my corporation was my main priority. After deciding to be a lifelong business owner, becoming a corporation was a must.”

Switching to a different business structure is relatively straightforward and involves filing a few forms with the state. When you do so, you’ll need to check to see if the name you’d like to incorporate your business with is a available. If so, you’ll need to file your articles of incorporation with the state office where you operate your business.

After that’s filed, you’ll need to create an LLC operating agreement outlining your business’s structure. And finally, you’ll have to obtain your employment identification number (EIN) from the IRS. You can ask a business attorney for help with this process or use a legal do-it-yourself site, like LegalZoom or IncFile.

Sole Proprietorship vs. LLC

LLC is another popular business structure among small business owners.

There are several differences between sole proprietorships and LLCs:

- Formation – In order to form an LLC, you have to file formation papers, called articles of organization, with the state. A sole proprietorship, on the other hand, is the default form of ownership for a single-owner company.

- Taxes – LLC owners can choose whether to be taxed as a disregarded entity or as a corporation. A sole proprietor must report business income and losses on a Schedule C attached to their personal tax return.

- Liability – Members of an LLC are shielded from personal liability for business debts and obligations. Sole proprietors face personal liability for any lawsuits or debts of the business.

Other than these core differences, it’s costlier and more time consuming to maintain an LLC compared to a sole proprietorship. For instance, most states require LLCs to file an annual report and pay an annual tax. That said, many business owners opt for an LLC to get limited liability protection.

Sole Proprietorship vs. Corporation

There are also several differences between sole proprietorships and corporations:

- Formation – To form a corporation, you must file articles of incorporation with the state. Sole proprietorships don’t require a business filing for initial setup.

- Taxes – C-corporations and S-corporations have different tax rules. C-corps are subject to a flat 21% corporate income tax. In an S-corp, business income and losses pass through to shareholders’ personal tax returns.

- Liability – Shareholders in a corporation are shielded from personal liability for business debts and obligations. Sole proprietors, as mentioned above, can be sued personally by business creditors.

A corporation is the most complex type of business entity, with three layers of ownership and management: shareholders, officers, and directors. There are several corporate formalities that you need to follow, such as holding shareholder meetings, to keep your corporation in good standing. For this reason, many small businesses opt for an LLC, partnership, or sole proprietorship.

Sole Proprietorships Are Simple, but Face More Risk

Ultimately, a sole proprietorship offers the value of simplicity, but there are many potential downsides. Among them, higher taxes, more legal exposure, and more difficulty landing new business.

Here are some considerations for sole proprietorships:

- Sole proprietorships blur the distinction between business and owner.

- Sole proprietors are personally liable for the debts and liabilities of the business, which can be risky and in some cases cause your business to fail.

- Thanks to recent tax reforms, sole proprietors take a 20% tax deduction on their business income, but this is subject to some limitations.

- Sole proprietors often pay more self-employment taxes.

- There’s some data to indicate that sole proprietors have a tougher time landing a business loan, but ultimately, lenders care most about your credit, cash flow, and finances.

- If you decide to be a sole proprietor, take steps to limit your legal exposure by separating business from personal finances as much as possible.

The main thing to keep in mind is that as your business evolves, so can your business structure. Be open to changing your business entity to an LLC or corporation as you make more money, earn more clients, and generate more revenue.

The post Sole Proprietorships: What You Need to Know to Get Started appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/sole-proprietors/

“As a CPA, I've referred clients to Mr Benjamin lee for many years with great results. I recently had the opportunity to use him for my home loan, and now I know why my clients have always been thrilled!he's thorough, timely, personable and most importantly knowledgeable. I'll certainly be referring him for a long time to come to anyone looking for loan please to contact Mr Benjamin lee, Mr Benjamin lee is a loan officer working with a reputable investors who are ready to fund any kind of project as long as you are willing to make refund as promised.Here is Mr Benjamin lee contact information” 247officedept@gmail.com WhatsApp +1-989-394-3740.

ReplyDelete