When you hear the term “business expense report,” it could seem a tad misleading. You might think such records are meant to track every purchase your enterprise makes or every financial obligation incurred by your business. Actually, these reports are intended to document the costs that a proprietor or employee covers out of their own pocket that require reimbursement from the business.

Such expenditures can include personal outlay for company travel, office supplies, corporate training, or coursework, etc. Essentially, if the owner or an employer spends money on something that the business would normally cover, they should file an expense report to receive repayment and to ensure that the company properly records all expenses.

Why File Business Expense Reports

As mentioned above, business expense reports help employees and businesses document their total expenditures. Even if you’re a sole proprietor, we suggest that you create business expense reports. You’ll find such records useful for budgeting and for calculating your yearly tax liability.

Some personal expenses are deductible from your small business taxes: items like a) a percentage of your rent or mortgage and your utilities if your office is located in your home, and b) a portion of the mileage traveled in your own car for work purposes, due to the additional wear and tear on the vehicle. We’ll discuss the latter in further detail below. If you’ve kept accurate expense reports, it will make tabulating your tax deductions that much easier when the time comes.

If you’re a larger company with one or more employees, expense reports provide a paper trail that protects your workers and your enterprise should any disputes arise as to who paid for what. Expense reports also establish ownership in the event of a criminal or civil claim. For example, if you use your personal mobile device to conduct business, your employer may be entitled to access the records and data on your device, or even seize it entirely. If your company reimburses you for part of your data plan or pays the bill in its entirety, their right of ownership may increase.

What a Business Expense Report Contains

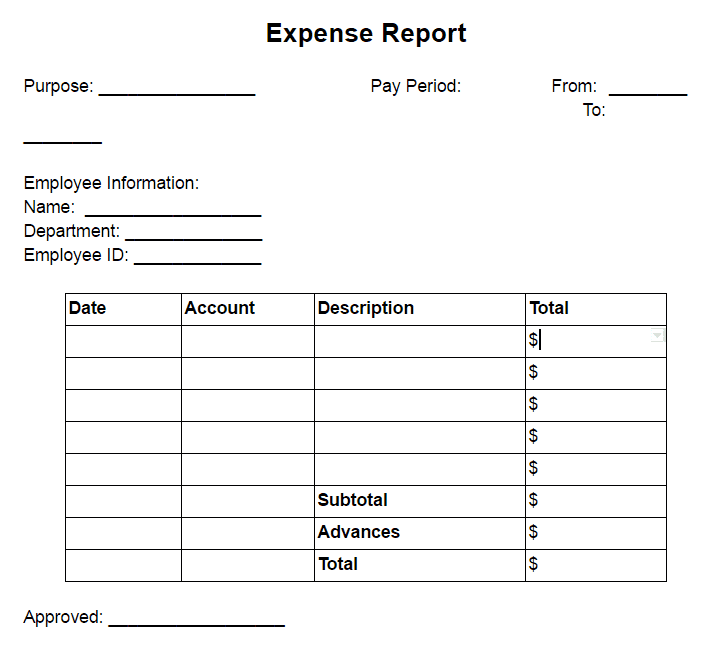

Business expense reports are not standardized, and should be tailored to fit the needs of your business. However, there is some information that’s customary to include, no matter the industry:

- Name and contact information of the individual who seeks reimbursement

- Description of the expense or an itemized list, if the report includes more than one expenditure

- Date of the purchase

- Total amount of money spent

- Purpose of the expense and/or the client account for which it was bought

- Subtraction of any monetary advances received that should be applied toward the overall cost

- Final sum of the repayment sought

- A place for the receiving individual to sign and approve the request

A basic expense report looks something like the example below. You’ll notice that this report includes all the information we listed.

Photo credit: Examples.com

Photo credit: Examples.com

Don’t forget to attach the documentation to your report that supports your claim—items like invoices, receipts, or credit card statements with the appropriate purchases highlighted. And remember that these records should be filed at regular intervals (weekly, monthly, or quarterly) with the accounting department, your bookkeeper, or the business owner—depending on the size of your company.

Specialized Business Expense Reports

As noted above, many businesses modify their expense reports to reflect the nature of their enterprise. If you’re in sales, for instance, you might spend a lot of money wining and dining potential customers. You’ll want the template for your reports to reflect that reality, perhaps with a place to indicate what you discussed at every meal you expense. This information will be helpful if your business is ever audited by the IRS.

There are a couple specialized expense reports that are useful across a variety of industries. We’ll review those now.

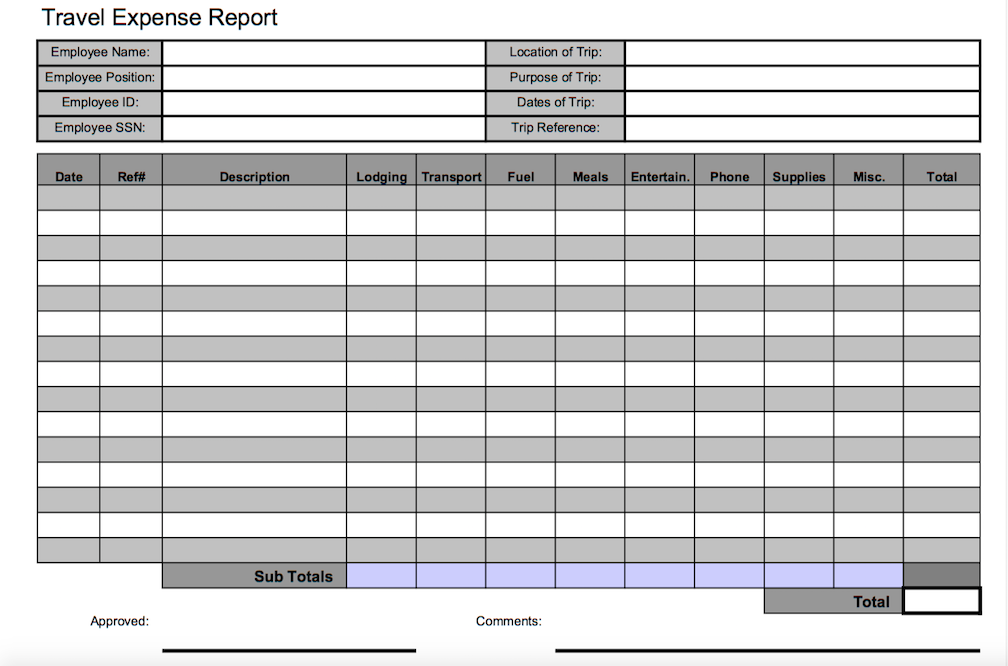

A Travel Expense Report

Many businesses require travel—whether to visit remote clients, attend conferences, meet with vendors, or hawk your wares at a commercial event. Unless you or your employees have a separate business credit card, you’ll likely charge meals, rental cars or rideshares, lodging, and other incidentals to a personal credit card, and seek reimbursement from the company later. That’s where a travel expense report comes in. Here’s a sample:

Photo credit: Samplewords.com

Photo credit: Samplewords.com

Notice how this modified report provides space to list per day the cost of individual travel expenses and fields to record some details about the nature of the trip. Again, in the event of an audit, this information would prove useful, as such facts will confirm that the purpose of your travel was indeed business.

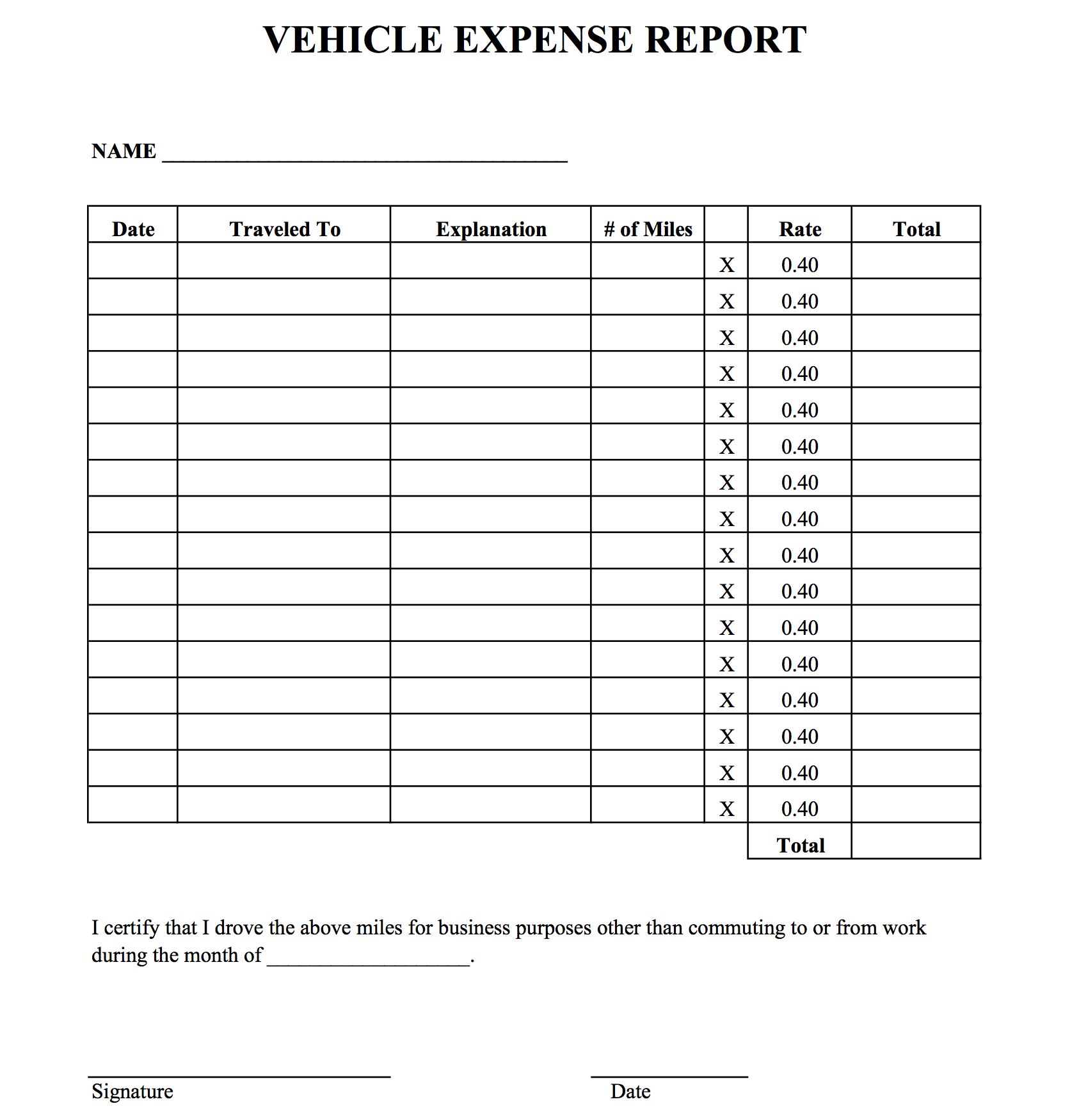

A Mileage Expense Report

Many business owners and employees commute to work in their personal vehicle or use their own cars for company deliveries, appointments, etc. If that’s the case for your enterprise, you may choose to reimburse your employees or yourself as the proprietor a certain amount of money per mile driven, as each mile theoretically adds wear and tear on the vehicle.

Whether your business has a mileage reimbursement plan or not, the IRS allows for a small tax deduction per mile. In 2019, you can deduct 58 cents from your personal taxes for each mile driven in your own car for business purposes. That’s a 3.5-cents-per-mile increase over the deduction allowed for 2018.

Thus, it’s smart to keep track of the miles driven for work in your personal vehicle, no matter the company policy. Use a mileage expense report like the one below.

Photo credit: Examples.com

Photo credit: Examples.com

As you can see, the business in this example decided to reimburse its employees 40 cents per mile, but that rate will vary company to company. It’s not mandatory for a business to reimburse its employees for commuting in their personal vehicle, but companies should provide some sort of repayment if you use your own car to conduct business. This bring us to another topic that’s crucial for small business owners.

Create an Expense Reimbursement Policy

No matter the size of your enterprise, it’s wise to create an expense reimbursement policy. That way, you’ll have guidelines and procedures in place as your business grows. Here are some topics to address in your policy:

- Detailed explanations of the items you will reimburse, and what you will not repay

- The time frame in which employees must file reports (ex: not more than 30 days after the initial purchase)

- Whether big ticket items, like conferences or plane tickets, require pre-approval from the appropriate individual(s) in order to receive reimbursement

- What type of supporting documents you require for repayment (i.e., does a photocopy or printout of a receipt suffice, or do you need to submit the original?)

How to Generate a Business Expense Report With Ease

Now that we’ve explained why business owners ought to file business expense reports, what goes into such a report, and best practices regarding these reports, let’s examine some simple ways to generate the reports themselves. Microsoft Excel offers a basic template for an expense report that completes all calculations for you, as does Google Spreadsheets.

Excel also supplies a template for travel expenses that will automatically tabulate your requested repayment based on the categories and the parameters you provide, such as the amount your company reimburses per mile traveled in your personal vehicle and the maximum allocation the company provides per day in transit (if such a cap exists).

If you’re ready to go further down the tech rabbit hole, Wave is a good place to start. Wave is a mobile application that uses the camera on your smartphone to scan your expense receipts directly into the app. You can also import statements from your bank account or credit card into Wave, and select which purchases are relevant. Organize your business expenditures in any way you choose, and export them to your accounting software.

Wave is straightforward, easy to use, and free for individuals and small businesses. You’ll only pay for Wave if you try their invoice payment or payroll tax services.

Expensify is another solid option. It’s a paid app with a lot more bell and whistles, but you may find it’s worth the price. With Expensify, you also scan your receipts or import them from your bank accounts, but you can instantly create and send a business expense report within the app itself. The app also automatically categorizes your expenditures for you, and exports them to the accounting program of your choice.

Another neat feature is that Expensify can log the miles you’ve traveled through your phone’s GPS, and generate a mileage report from that data. And this app won’t break the bank. Expensify offers low-cost plans for individuals and small businesses, starting at $4.99 per month or per user—depending on the level of service you select.

Remember, though, that applications like Wave and Expensify store your records in the cloud, which invites a potential cybersecurity risk. If you’re concerned about digital security, click through the following link to learn how to protect yourself and your business online with our comprehensive introductory guide on the topic.

The Bottom Line on Expense Reports for Small Businesses

To create and file expense reports may seem tedious, especially if your enterprise is still in the early stages. Remember, though, that such records will make it easier to budget, and to calculate your tax liabilities.

Benjamin Franklin put it best: “Beware of little expenses. A small leak will sink a great ship.” A business that tracks all its spending—no matter how small the company or the cost—can use that knowledge to allocate its resources wisely, and is better prepared to weather any storms it may encounter.

The post How to Write a Business Expense Report appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/business-expense-report/

No comments:

Post a Comment