How Does Credit Work?

Whenever you open a credit card or apply for a loan, credit bureaus collect information about your usage. That information appears on your credit report and is used to calculate a numeric credit score. Your payment history, credit utilization, mix of credit accounts, length of your credit history, applications for new credit all affect your credit and your ability to qualify for financing in the future.

Credit affects many parts of your life, both as a consumer and as a small business owner. Whether you apply for a business loan, make a major purchase, open a cell phone plan, or turn on utilities like water and electricity for your home, your personal credit comes into play. And using credit wisely is essential to having continued access to it in the future.

Unfortunately, since personal finance isn’t taught at most high schools or colleges, the majority of consumers learn the answer to “How does credit work?” from their parents or through trial and error—often only after facing the tough experience of being held back from their dreams and goals because of credit challenges.

Read on to learn all about how credit works, so you can be a smarter consumer and business owner. It’s not just about achieving the perfect credit score. Sure, that’s nice. But it’s more important to understand how different actions affect your credit, so you can better prepare for your business’s financial future.

How Does Credit Work? Personal Credit Basics

How does credit work? If you’re brand new to the idea of credit, let’s start with the very basics. Consumer credit comes into play whenever you borrow money as an individual. The person borrowing is responsible for making payments—and the information about amounts borrowed, as well as the schedule and size of repayments is recorded on that person’s individual credit file.

Consumer debts like car loans, mortgages, and credit cards are the most common types of credit accounts, and creditors in these categories report both positive and negative payment histories to credit bureaus. But those aren’t the only forms of credit that exist.

If you rent an apartment, have a cell phone, or use utilities for your home, those can all be considered credit accounts as well under the latest credit scoring models—the company or creditor in question (think your property management or utilities company) offers you a service and expects you to remit payment after the fact.

You might be wondering where business loans fit in to all this. Even when you borrow money for your business, your personal credit score is very relevant. The reason is that small businesses have high failure rates, so lenders use personal credit score as a proxy to evaluate whether you’re likely to pay back a business loan on time.

Types of Credit

In addition to the different ways that creditors report a borrower’s payment history, there are also two main types of credit accounts, which work a little bit differently in terms of how they process payments and how they’re reported. These are installment credit accounts and revolving credit accounts. Let’s take a closer look at each.

Installment Credit

Imagine that you take out a five-year car loan with 60 monthly payments. When you first open the loan and make your first few payments, your utilization ratio (or your ratio of amount owed to amount paid) will be very high. Closer to the end of the five years, on the other hand, your utilization rate will be much lower because you’ll have made the majority of payments.

A traditional term business loan is a prime example of an installment credit account. It’s closed-ended with specific payment terms, a clearly outlined repayment schedule, and an explicit end date. The utilization ratio on an installment credit contract always decreases incrementally over the life of the loan.

Other examples of installment credit account include car loans, student loans, mortgages, and personal loans.

Revolving Credit

Accounts labeled as revolving credit are probably the ones that you already associate most closely with credit reporting or borrowing funds. A common example of a revolving credit account is a credit card, which offers a set credit limit, minimum monthly payments, and charges interest on any balances carried from month to month.

Another example is a business line of credit. As with a credit card, a line of credit has a fixed credit limit. The lender sets a specific repayment schedule, and when you’ve paid back what you borrowed in full, your available credit goes back up.

Revolving credit offers borrowers a lot of flexibility to spend money now but pay for the purchase when they have the cash available. Of course, that convenience tends to come with a hefty monthly fee in the form of high interest rates.

Types of Borrowers

Not everyone who opens a revolving credit account actually revolves the balance on that account. Creditors typically classify borrowers as either transactors or revolvers, depending on how they go about using their revolving credit lines. This classification has important consequences for your credit.

Transactors

In an ideal scenario, you’d approach every credit relationship with the goal of being a transactor. You have a credit limit on your credit card or line of credit, you spend a certain portion of that limit, and you pay the balance in full each and every month.

The greatest benefit to being a transactor is that, when it comes to credit cards or lines of credit, you never have to worry about hefty interest payments. Because you aren’t carrying a balance month to month, interest charges will never kick in. And equally importantly, operating as a transactor in your credit relationships almost guarantees a positive credit history over time.

Revolvers

Let’s say you have a credit card with a $10,000 limit. If you spend $5,000 toward that limit in one month but only pay back $1,000 of that amount, you’ll be revolving or carrying a balance of $4,000 on that card.

Borrowers who operate as revolvers typically have little, if any, margin in their personal finances. It’s easy to see how—if your spending continues to outpace your payments as in the example above—your levels of debt could skyrocket quickly.

In these scenarios, it only takes one unexpected expense or loss of income to turn a revolving borrower into a delinquent payer.

Experian

How Does Credit Work? Your Credit Report Tells Your Financial Story

Now that you can answer “How does credit work?” and understand the ins and outs of different types of accounts and borrowers, you might be asking yourself, “Why does all of this even matter? Does anyone really care what type of borrower I am?”

Absolutely. There’s a whole group of people—namely other creditors—who pay attention to how you borrow and repay funds. In particular, future lenders will look to your credit report in order to make decisions about whether to give you that new credit card, car loan, mortgage, or anything else that you’ll want to purchase with credit now or in the future.

Your credit report tells the story of your financial life and gives these creditors all the information they need to decide whether to approve you for credit. Over time, your credit report records the ups and downs of your financial life story—and every money-related decision you make.

The Role of Credit Bureaus

But who exactly is telling the story of your financial life? Unfortunately for borrowers, your credit score isn’t a memoir. We don’t have full control over exactly how our narrative gets portrayed.

Instead, each borrower’s financial story is controlled by credit bureaus—the agencies that collect information about individual credit reports and summarize it on behalf of lenders.

The main three credit reporting agencies—Experian, Equifax, and TransUnion—each have their own proprietary method of collecting information about borrowers, meaning they can collect slightly different information at different times. The information they have depends on which bureaus a creditor reports too. For instance, a credit card company might report only to Experian and not the other two bureaus.

Despite these small differences, your credit reports from each bureau will look very much alike. The government entitles you to one free copy of your credit report from each bureau once per year. Looking at your own credit report and finding out where all your credit accounts stand is the first step to taking control of your financial story.

One time where all of these bureaus come together is through the use of the FICO credit score.

How Does Credit Work? Figuring out Your Credit Score

If your credit report is the story of your financial life, your credit score is basically the SparkNotes version. If you’re answering “How does credit work?” then you should understand how they’re related… and how they’re different.

Your credit score boils down all of the information that’s in your credit report to a three-digit number between 350 and 800. The number is meant to provide lenders with a snapshot view of your creditworthiness as a borrower—telling them whether your length of credit history, your payment record, and the types of accounts you hold indicate that you’re likely (or not) to consistently make payments on time in the future.

To calculate your credit score in a standardized way, credit bureaus use a complex formula known as the FICO algorithm to evaluate various parts of your credit history.

The FICO Algorithm

Simply put, the goal of the FICO algorithm is to predict the likelihood that a borrower will default on debt payment within the next 18 months.

The lower the credit score, the more statistically likely the borrower is to default. By contrast, higher credit scores indicate that the borrower is less likely to default within the same time period. Although achieving a perfect 850 credit score is pretty rare, a score of 670 or higher is generally considered a good credit score.

With that goal in mind, let’s take a deeper look at the five components weighed by the FICO algorithm:

1. Payment History (35%)

When it comes to credit, your history can either help or hurt you. Your past payment history is the single most influential factor determining your personal credit score. As you might have guessed, on-time payment history is good:

The more credit lines you have with an on-time payment history, the better your score will be. But the algorithm factors in more than simply whether or not you pay your bills. Things like severity (how far delinquent you are) and frequency (how many times you were late) help to determine exactly how your credit score will be impacted.

This means all late payment histories are bad, but the later they are, the worse it will reflect on your score. The first level of delinquency to impact your credit is at 30 days late. It’s not good, but 60 days is worse, and 90 days is even worse… And so on.

Timing is also a big factor in the impact of overdue payments. Being currently delinquent is worse than being delinquent in the past. If you have a history of late payments but are working to turn things around, the good news is that the negative impact of your payment history won’t last forever. All late payments age off your credit report within seven years after the first date of delinquency.

2. Amounts Owed (30%)

As the name suggests, this category reflects total amount of credit you currently owe—or have outstanding. More importantly, though, amount owed also reflects the ratio of your current outstanding debt relative to your credit limit. The term credit bureaus use for this is credit utilization ratio.

To better understand this, let’s look back to the different types of credit that we reviewed above. Since your utilization ratio on installment credit accounts is fixed and always relative to the amount of time you’ve had the loan open, that ratio is less critical for the purposes of FICO’s algorithm.

The real importance of this ratio applies to revolving credit—again, those are things like credit cards and lines of credit in which you have a set borrowing limit, but can repeatedly borrow and repay funds within that limit.

Borrowers with high levels of revolving utilization are ultimately financing their lifestyles with very expensive debt, since carrying a balance month to month means paying very high interest rates. This high cost—along with the fact that these individuals are borrowing more than they can pay back—makes them precisely the targets of the FICO algorithm. Statistically speaking, these individuals are much more likely to default on a payment.

Sadly, what inevitably happens in many of these scenarios is that the borrower encounters some unexpected expense or an unexpected loss of income—a car repair, a medical expense, a temporary disability—and they can’t afford to pay their credit balance. They next thing they know, they’ve become a delinquent borrower.

To stay within safe borrowing limits and keep your credit score on the up and up, aim to stay within FICO’s recommendation of a 30% utilization rate or lower. This means that if your credit card limit is $10,000, you should never charge more than $3,000 at a time before paying down the balance.

3. Length of Credit History (15%)

When you take out your first credit card, car loan, or student loan, FICO and the credit bureaus are waiting to see what kind of borrower you will be. Will you make your payments on time? Will you budget and plan ahead for upcoming payments?

In the beginning, FICO doesn’t have those answers, so their algorithm doesn’t have much to go on.

From a statistical perspective, the more data points that FICO has (months and years of payments made or not made on time), the more confident the algorithm can be about its overall prediction of your future behavior. So if you only have six months of credit history, there’s not a lot for the algorithm to work with in terms of data.

This category can severely impact new borrowers, who will often have a lower credit score for a year or two after opening their first account. The good news is that in this category at least, your credit score will keep going up the longer you are listed as a borrower.

4. New Credit/Credit Inquiries (10%)

Each time you submit an application for a new credit account—whether that be to open a new credit card, rent an apartment, buy a car, or take out a personal loan—the lender will most likely pull your credit report with at least one, if not multiple credit bureaus.

New accounts are always preceded by hard credit inquiries, and they tell FICO’s algorithm that you’ll probably be borrowing more money soon. These credit inquiries will negatively (though temporarily) impact your credit score, dinging it by a few points. There are special rate shopping rules for mortgages, auto loans, and student loans, however, to reduce the impact of credit inquiries.

And in any case, time lessens the impact of credit inquiries. After one month, three months, six months, and a year of positive payment history on that account, the negative impact on your score from that new account will continue to dwindle. They completely disappear from your credit report within two years.

It’s important to know that checking your own credit score will not negatively impact your score. You can check your score and your credit report as many times as you want, without any impact to your credit standing. In addition to that, many lenders now conduct a soft credit pull, which gives a summary of your score without impacting it.

5. Credit Mix (10%)

You might be surprised to learn that a borrower’s statistical likelihood of making on-time payments can vary widely depending on the type of account.

In general, borrowers are much more likely to be late on a credit card payment than they are on a mortgage or car payment. After all, if you miss a few car payments, the lender can take your car away! And the same can be said for your home. But if you’re late or fail to pay your credit card bill, there’s fewer direct or immediate consequences to be had, so these unsecured accounts are more likely to face delinquent payers.

Remember, the FICO algorithm’s goal is to predict your future borrowing and repayment behavior not just for a certain type of credit accounts, but for all possible types of credit. To make this prediction as accurately as possible, the algorithm needs to see how you’ve handled borrowing under any number of circumstances.

For this reason, the credit mix portion of the algorithm measures whether you have a varied mix of credit account types represented. The more variety that’s shown, the better you’ll do in this category.

Now that we’ve reviewed the five factors that the FICO algorithm, the credit bureaus, and ultimately potential lenders are paying attention to in your credit story, what can you do to make sure the best possible version of your story is told?

Let’s take a look at a few ways you can take back control of your own financial narrative.

Take Ownership of Your Credit by Fixing Errors in Your Credit History

Few consumers realize that they may be one of the one in five individuals with false information on their credit reports—and even fewer take steps to do anything about it.

These could be fairly innocuous errors, such as a mistake in your address or in the spelling of your name. Or, they could be serious errors, like a mistake in the amount you owe or an account erroneously listed as delinquent.

As the consumer, if one or more of the credit bureaus have gotten your story wrong, the burden of responsibility is on you to notice the error and get it fixed. This means first and foremost, you should be pulling and reviewing your credit report regularly—at least once a year, if not more frequently—from all three major reporting bureaus: Experian, Equifax, and TransUnion.

If you find errors on any one of your credit reports, it’s important that you take steps to fix it by contacting the reporting agency in writing. The process of correcting your credit report is pretty straightforward. You can start by either contacting the original creditor or using the agency’s dispute process. The creditor or agency is then legally obligated to address your concerns. The entire dispute process takes about 30 to 45 days.

TransUnion

How to Improve and Build Your Credit

Beyond knowing what your credit report says and resolving any mistakes, what can you do to take the fear out of the credit process and make your credit work for you?

Let’s review six big steps you can take at every stage of the game:

1. Start Early

We realize that for many of our readers, it might be a bit too late to make use of this first recommendation—but it’s still worth passing on to your children or other young people you know!

You now know that 15% of your consumer credit score is based on length of credit history, so there’s value in starting early to develop a positive payment history. Anyone over the age of 18 can apply for a credit card, although options may be more limited at first. It’s worthwhile for a young person to get a starting credit card as soon as they are of age, even if it is co-signed by their parents.

Of course, it’s important for young adults to be well-educated in financial literacy before they start using credit. Encourage the young adults in your life not only to use credit, but to follow sound practices for usage and repayment.

2. Aim to Be a Transactor

When it comes to revolving accounts like credit cards and lines of credit—for as long as possible, you should always aim to be a transactor.

As you learned, transactors are borrowers who use things like credit cards for the convenience or perks (like credit card rewards), but who pay their balance in full every month. While this goal might not always be possible as your personal needs grow, starting this habit as your norm from the beginning of your credit life will help you to avoid getting in over your head in the future.

3. Don’t Overdo It

There’s no denying that when used responsibly, credit is a valuable tool. The problem that too frequently arises, though, is that consumers fall down the slippery slope of using credit to live beyond their means.

While it’s smart to maintain a mix of credit accounts early in your life in order to establish a strong credit history, don’t confuse the ability to access credit with the ability to afford a certain lifestyle. If you’re living paycheck to paycheck, only making minimum payments, and continually opening more and more lines of revolving credit, it’s too easy for one seemingly harmless decision at a time to turn into a personal credit crisis.

Avoid overextending yourself financially by building a budget and sticking to it—starting with exactly how much of your credit you will actually use. As a rule of thumb, stick with the often-cited recommendation of 30% utilization: that means never charging more than 30% of your total credit limit without paying down the balance.

Create some margin in your finances by maintaining a cushion of cash—ideally 3 to 6 months of living expenses if you can. If you’re currently in debt but turning things around, start by paying off the most expensive debt (i.e. credit cards or lines of credit with the highest interest rates) to pull yourself out of that revolving credit hole.

4. Look for Variety

If you’re going above and beyond in your pursuit for a top notch credit score, you can take proactive steps by making sure that you have a variety of credit accounts. Remember, your credit mix accounts for 10% of your total credit score, so this is an area where—if you act wisely—you might be able to score a few bonus points.

In addition to a credit card or two that you pay off regularly, make sure that you have a few installment credit accounts as well. For example, consider taking out a small personal loan with a low interest rate to show the bureaus you’re capable of paying back the loan on time.

The same is true for rental and leasing properties, provided that the company you lease from is actually reporting your positive payment history to the credit bureaus. Many property managers, utility companies, and other companies in this credit category only report negative information to the bureaus, so it’s worth checking with any new creditor to learn about their policies.

5. Always, Always Pay On Time

It should be obvious by now that there’s nothing more crucial to maintaining a solid credit score than paying your bills on time, every time.

At the end of the day, this is the entirety of what FICO, the credit bureaus, and lenders are monitoring—whether or not you’ve made payments on time in the past and whether you’re likely to continue doing so in the future.

If you’ve struggled with making on-time payments in the past, it’s time to re-evaluate your cash flow and lifestyle to determine if you’re spending beyond your means. Whatever must be done for you to get a handle on your monthly payments is ultimately an investment in your long-term financial future.

6. Get Organized

For some people, late payments or even occasional delinquent accounts are a product, not of overspending, but of failing to organize and keep track of their outstanding accounts.

But there’s truly nothing more unfortunate (or easier to solve) than letting unpaid bills negatively impact your credit score when the money to pay them is readily available in the bank…

You just have to get organized! If you’re prone to letting stacks of mail sit unopened on the countertop, forgetting about newly opened credit accounts, or failing to change your address with the post office when you move, you might be delinquent on payments without even realizing it.

To solve this, create a simple and repeatable system for paying your bills. When will you open your mail? When will you sit down to write checks or make payments online? Would it help you to create a simple table tracking when payments are due, or sign up for auto billpay functions where available? Have you added due dates for all your bills to your family calendar?

These steps might sound overly simple, but you’d be surprised how many individuals find their credit scores taking a hit because of small oversights.

Approach Credit Repair Companies With Caution

All it takes is a quick online search to find hundreds of articles, tutorials, and even companies claiming they’ll teach you to hack your credit score or promising a quick fix for repairing personal credit.

These experts might have good intentions—but the unfortunate reality is that there’s no such thing as a quick fix for personal credit. You can’t snap your fingers and unwrite your credit story.

And besides, if you think about it, a quick and temporary fix to your credit history can only hurt you in the end. Lenders created the credit reporting and scoring system not only to protect their own interests, but in a way to save borrowers from making poor financial decisions. By finding a way to reverse engineer the system only to gain even more credit, borrowers almost guarantee digging themselves into an even deeper credit hole.

Be wary of credit card companies that claim to help you increase your credit within just a few days, in exchange for a fee. These companies legally cannot dispute negative but truthful information on your credit report. And mistakes are something that you can dispute on your own for free.

That said, credit counselors can be of help to business owners who are deep in debt. Look for a certified credit counselor through your state’s attorney general or consumer protection agency. Credit counselors can work with you on a debt management plan to help you pay back your loans.

What Is Business Credit?

Your personal credit score is the biggest determinant of your ability to qualify for financing and the rates that creditors extend to you. However, it’s not the whole story. Once you launch your business, your company starts building up a credit history as well.

Everytime you apply for business financing in the name of your business, the information about that account and your business’s repayment history will show up on your company’s commercial credit report. Your business credit report will also include information about your suppliers and trade credit.

Experian, Equifax, and Dun & Bradstreet are the three main business credit bureaus. Unlike the FICO personal credit score, there isn’t one universal business credit score. Each agency uses a slightly different scoring model. But the best way to improve your business credit score is to make sure that your company handles its financial responsibilities in a timely manner.

Understanding How Credit Works is the Key to Improving It

Next time someone asks you, “How does credit work?,” we hope that this guide will serve as a valuable resource to help you explain the impact of your credit in a way that makes sense.

But even more importantly, we hope that it will help you to make wise choices about your credit moving forward and be more mindful about the way your financial story is told.

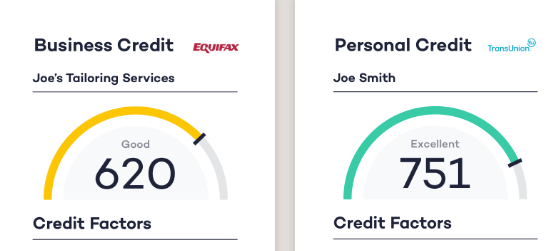

Before you can work on improving your credit, however, you need to know where you stand right now. Fundera’s free credit monitoring tool lets you check your personal and business credit scores in one place. That way, you get the full picture on your financial story and can work on getting your credit to the best possible place.

The post How Does Credit Work? The Internet’s Best Guide appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/how-does-credit-work/

No comments:

Post a Comment