What Is the Schedule K-1 Tax Form?

Owners of pass-through entities must file the Schedule K-1 tax form along with their personal tax return to report their share of business profits, losses, deductions, and credits. Beneficiaries of trusts and estates must also submit a Schedule K-1. March 15 is the deadline for receiving a Schedule K-1.

If you are an owner of an S-corp or partnership or a member in an LLC, then you’ve probably received a Schedule K-1 in the mail. The IRS won’t accept your personal tax return if your Schedule K-1 isn’t included along with it. And if you fail to file your Schedule K-1, you might face some stiff penalties for an overdue return, as well as back taxes.

Fortunately, the rules around Schedule K-1 aren’t too complicated. Your best bet is to have a dedicated accountant or tax professional to help you with this, but we’ll walk you through the form and how and when to submit it, so you’ll be ready come tax season.

Who Has to File Schedule K-1?

Similar to a W2 or 1099 form, a Schedule K-1 lists taxable income, but it’s only for particular types of business entities. The form shows the income that you’ve received from the business and breaks it into different categories.

There are two sets of taxpayers that need to file a Schedule K-1 with their taxes:

- Owners of pass-through business entities (S-corps, partnerships, and LLCs taxed as an S-corp or partnership)

- Beneficiaries of trusts or estates

The information on the form and the rules for submission vary slightly depending on which type of taxpayer you are.

Schedule K-1 for Pass-Through Entities

A pass-through entity is a business entity for which income, losses, credits, and deductions are reported on the owners’ personal tax returns. That income is then taxed at the owners’ individual income tax rates. S-corporations, partnerships, and LLCs that are taxed as an S-corp or partnership are the main types of pass-through entities.

Depending on a variety of factors, pass-through taxation can be more beneficial than having the business itself pay corporate taxes on income earned by the business (as is the case for C-corporations).

Schedule K-1 shows each partner’s or shareholder’s share of business income and losses. For instance, if a partner owns 60% of a business, their Schedule K-1 would reflect 60% of the business’s earnings and losses.

Here is a more detailed look at what goes on Schedule K-1:

- Dividends, deductions, gains, and losses are reported on each partner’s or shareholder’s K-1. These are calculated based on each partner’s or shareholder’s basis—or percentage of ownership or investment—in the business.

- In the case of a partnership where one or more partners receive guaranteed payments, the guaranteed payments are also reported on the partners’ K-1s.

- A capital account analysis for each partner, or percentage of stock ownership for each shareholder, is included on the K-1.

Each partner attaches the Schedule K-1 form to their personal income tax return.

Schedule K-1 for Trusts and Estates

Beneficiaries of a trust or estate also need to file a Schedule K-1. The trustee of a trust or fiduciary of the estate needs to issue a Schedule K-1 to allow beneficiaries to correctly report income on their personal tax return.

The only difference is that the beneficiary should not include the Schedule K-1 with their tax return. They should keep it with their records and only use it to report trust or estate income, losses, credits, and deductions.

When to File Schedule K-1

The deadline for companies to issue Schedule K-1s to all the owners of the business is March 15 of the calendar year. This is the same day that your business tax return is due, so by March 15, you should have calculated the income and loss distribution for each owner.

Form K-1 will show each owner’s share of the business’s income and losses and any credits or distributions that the owner has received from the business. The March 15 deadline gives business owners enough time to report and file this information with their personal income tax return, due in mid-April.

How to Complete the Schedule K-1 Form

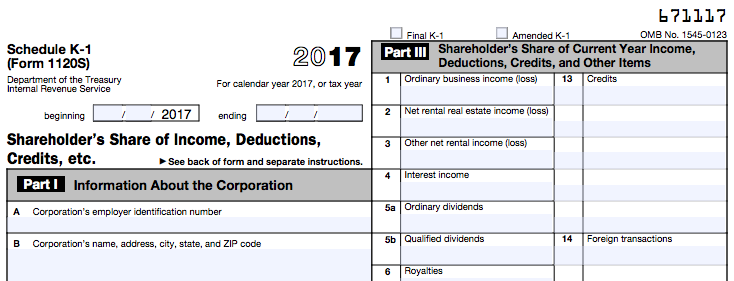

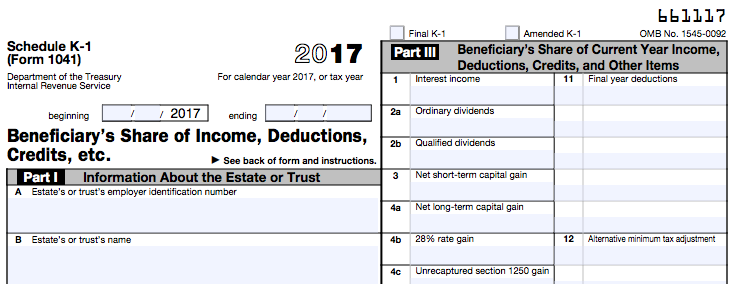

Schedule K-1 filing instructions depend on the identity of the tax filer. There are three different Schedule K-1 forms:

- Form 1041 Schedule K-1 for the beneficiaries of a trust or estate

- Form 1065 Schedule K-1 for partnerships

- Form 1120S Schedule K-1 for S-corps

You’ll want to choose the appropriate form based on your type of business. LLC members should choose the form corresponding to how they’re taxed.

Although each form K-1 contains slightly different information, these are the common elements in each Schedule K-1:

- Information about the company, trust, or estate (Part I)

- Information about the business owner or beneficiary (Part II)

- Information about the partner’s or beneficiary’s share of the current year income, losses, deductions, and credits (Part III)

The reason that income, losses, and other items are broken down by category is because different types of taxable income are subject to different tax rates. For example, the individual income tax rate is different from the capital gains tax rate. The information for parts I to III should all be available from your business tax return or your business’s financial statements. The partnership agreement, LLC operating agreement, and corporate bylaws should also contain information about each owner’s share of the business.

Double Check Your Schedule K-1 Tax Form For Accuracy

The Schedule K-1 tax form contains information not only about your income and losses in the business, but also about your ownership basis in the business.

At the most basic level, you or your tax professional should check your Schedule K-1 and make sure that the correct amount of income is reported on it. This document will be used to prepare your tax return, and you want to make sure you are reporting the correct amount of income and deductions.

If you received guaranteed payments from a partnership, double check the amount reported on your Schedule K-1 and compare it with your personal records. If the amounts are off, ask for an explanation or a corrected K-1 from the business (or hold an owners’ meeting to figure out the error).

Schedule K-1 also contains information about your ownership basis in the business. Ownership basis refers to the owner’s initial investment of assets and capital in the business. Basis goes up when the owner receives profits from the business and goes down when the owner takes a loss. Basis is important for determining an owner’s gain or loss when they sell their business interest and exit the company. If the ownership percentages don’t look correct, ask the person who completed the K-1 form to explain their calculations.

Finally, make sure you use the right Schedule K-1 for your situation. As mentioned above, there are different versions of the Schedule K-1 tax form for partners in a partnership, shareholders in an S-corp, and beneficiaries of an estate or trust. If you are a partner in a partnership, your Schedule K-1 should reference Form 1065. For S-corps, Form 1120S will be referenced. If you received money from an estate or trust, look to Form 1041.

Some states also have a K-1 or similar equivalent that must be provided to affected taxpayers in that state. Your tax professional can tell you if this applies to your situation.

Schedule K-1 Reminders

The Schedule K-1 tax form is an important business tax form that business owners receive each year. Take the time to review your Schedule K-1 tax form with your tax professional or accountant, if you have one. If you are doing things yourself, here are some pointers to keep in mind about Schedule K-1:

- It might not have all the blanks filled in: Don’t be surprised if you receive a Schedule K-1 with only a few of the fields completed. This doesn’t mean there is a problem with your Schedule K-1. The form is meant to encompass a variety of situations, and not all situations apply to all businesses or partners or shareholders within that business.

- You’ll receive one even if your business had losses: You should expect a Schedule K-1 every year you are a partner or shareholder in a business organized as a pass-through entity. This applies even if the business has operated at a loss for the year. A Schedule K-1 that shows a loss may actually lower your tax bill, so don’t disregard a K-1 that shows negative numbers!

- Wait to receive Schedule K-1 before filing taxes: Schedule K-1s must be prepared and made available by March 15 each year. If you are eager to file your personal tax return early, it can be tempting to file before you receive your K-1. Doing this, though, will likely result in you needing to amend your tax return, which typically means you will pay additional tax preparation fees. It’s best to wait to file your income tax return until you are sure you have received all the Schedule K-1s you are expecting.

Verifying the information on your Schedule K-1 is correct will ensure that your personal tax return is completed accurately and that you are reporting all the income—and claiming all the deductions—you should report. This will make tax season less stressful for both you and your tax preparer, a win-win for both of you!

The post Schedule K-1 Tax Form: What It Is and What You Need to Know appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/schedule-k-1-tax-form-what-it-is-and-what-you-need-to-know/

No comments:

Post a Comment