What Are Articles of Incorporation?

Articles of incorporation, also known as certificate of incorporation or corporate charter, are a legal document that you file with your state’s business filing agency to establish a C-corporation or S-corporation. The document contains basic business information, such as company address and number of shares. Once approved by the state, the articles of incorporation legally establish your corporation.

As an aspiring entrepreneur, you might have a lot of plans about starting a business. But officially launching your business requires more than just a great idea. To create a new corporation, you’ll need to file a legal document called the articles of incorporation with your local secretary of state. Once the state approves your filing, your business officially exists.

The articles contain basic information about your business, and in most cases, you can file them yourself with your secretary of state or use a legal help website. Hiring an attorney is a good idea, though. A lawyer can counsel you on whether a corporation is the right choice of business entity and what else you need to do to keep your corporation in good standing.

Learn about what information goes in your articles of incorporation, how to file, and fees. We’ll also give you some tips on post-filing steps to complete the launch of your new company.

Before Filing Your Articles of Incorporation

Before filing your articles of incorporation, there are a few things that you’ll want to take care of. First is making sure that a corporation is how you want to structure your business. If it is, you’ll also need to choose a corporate name and a registered agent.

Make Sure You Want to Structure Your Business as a Corporation

Articles of incorporation are required to establish a C-corporation or S-corporation. But many small businesses opt for a different company structure.

Based on tax data from 1980 to 2013, sole proprietorship is the most popular type of business structure. Sole proprietorships are easier and faster to start than corporations, and have significantly fewer legal and financial requirements.

Limited liability company is another popular choice. LLCs are easier to maintain than corporations, while offering many of the same advantages. Your attorney can help you choose the best business entity for your company.

Choose Your Corporation’s Name

You can’t file articles of incorporation without choosing a unique name for your business. Under the laws that regulate corporations, the name of your company can’t be the same as or too similar to another company’s name. The company name also has to end with some kind of corporate identifier, such as Inc. or Corp.

John O’Brien, an attorney and owner of John R. O’Brien, P.C. gives an example:

“If you were to try and open a hardware store and call it ‘Ase Hardware, Inc.’ it would probably be rejected because it sounds the same as Ace, the established national hardware store chain. And neither the state nor Ace would want someone to sue Ace if they were hurt at your store.”

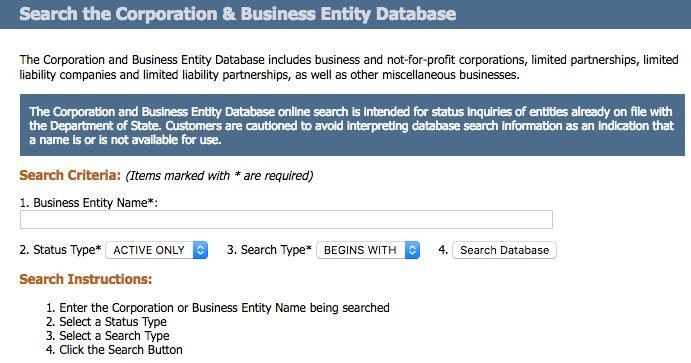

To help businesses, most states have an online name database that lets you check if a name is available and reserve that name until you file your articles of incorporation. New York, for instance (whose name database is pictured above), allows you to reserve a corporate name for 60 days if you mail in a name reservation request. California lets you mail in a name reservation request or reserve by phone. You do not need to reserve your business name if you plan to file the articles of incorporation right away.

Appoint a Registered Agent

When filing your articles of incorporation, you’ll be asked to choose a registered agent for your business. A registered agent is an individual or company that receives legal and financial documents, such as the annual reporting notice from the state, on your behalf. The purpose of a registered agent is to ensure businesses don’t misplace important documents in the daily course of business. It also prevents businesses from evading lawsuits.

Registered agents must have a physical address in the state of filing (no P.O. boxes) and be available to accept mail during regular business hours. If you have a business lawyer with a local office, they can act as your registered agent. Online legal services, such as LegalZoom and Rocket Lawyer, also provide registered agent services. Most states even allow you to appoint yourself as the registered agent, but there are good reasons not to do so.

According to O’Brien, it’s best to:

“Have your attorney serve as the registered agent for your company. Don’t make yourself the agent, because if you overlook the annual report message from the state, your corporation could get dissolved without your realizing it. Also, if your company gets sued, the attorney will be served with the complaint, which will hopefully ensure that the matter is handled appropriately.”

What’s Included in Your Articles of Incorporation

Articles of incorporation vary slightly from state to state, but most states have similar requirements. You can access your form by visiting your state’s business filing agency online. In most states, this means the secretary of state’s or attorney general’s website.

Most articles of incorporation include the following information:

- Corporation’s name: This is the company’s legal name, usually ending in a corporate identifier like Corp. or Inc.

- Corporation’s address: This is your business’s principal operating address in the state where you’re filing the articles of incorporation.

- Registered agent: This is the individual or company that will receive official documents on your business’s behalf.

- Business purpose: Some states have a general statement authorizing the business to engage in any lawful purpose, but other states require a more specific description of your business’s products or services.

- Directors and officers: Some states require you to provide the names and addresses of directors and officers. Directors are responsible for overall strategy and corporate planning. They are elected by shareholders and appoint the officers. Officers—like chief executive officer, treasurer, and chief financial officer—are responsible for running the business on a day-to-day basis.

- Number of shares: C-corps can issue an unlimited number of shares, whereas S-corps are limited to 100 shares. Your articles should specify the number of shares, but you don’t have to issue all of them. Businesses often leave some shares unissued to expand and bring on more shareholders.

- Class of shares: C-corps can issue different classes of stock (common and preferred), whereas S-corps are limited to one class of stock. In a C-corp, preferred stock usually is designated for investors who get first access to dividends and distributions of assets.

- Incorporator: The individual or legal service company that fills out and files the form is the incorporator.

Having all of this information ready to go before filing your articles of incorporation will make the incorporation process go quickly.

How to File Articles of Incorporation

There are three main ways to file your articles of incorporation, each with their own pros and cons:

- File yourself through the secretary of state’s office.

- File through a legal help site.

- File with a lawyer’s assistance.

Filing the articles of incorporation yourself through the secretary of state’s office is the fastest and most affordable option. Most states now allow online filing. You just have to pay the filing fee, ranging between $100 and $300 depending on the state, and you’re done.

Legal service sites—such as LegalZoom, Rocket Lawyer, and IncFile—offer a little extra help in filing. These services will walk you through a step-by-step questionnaire about your business that includes all the information in the articles of incorporation. The company will then fill out and submit the form on your behalf. In this case, you’ll have to pay the state filing fee plus the site’s fees. Legal services sites usually charge around $150 for filing articles of incorporation.

The last option is to hire a lawyer to help you file the articles of incorporation. Most businesses can handle filing on their own or through a legal help site. But if you already have a business lawyer on retainer or have a more complicated situation (e.g. thousands of shares or subsidiaries within your business), hiring a lawyer can be helpful. Actually filing the articles doesn’t take long and won’t cost you much. But a consultation with a lawyer could help you avoid problems down the line.

Once you file your articles of incorporation, assuming everything was filled out correctly and completely, the state will file the paperwork and officially register the business name. You’ll receive a formal certificate of incorporation in the mail. You should save a copy of this certificate as well as a copy of the articles of incorporation with your corporate records.

Where to File Articles of Incorporation

Most small businesses incorporate their company in the state where their office or shop is located.

This is probably the easiest option, but you can choose to incorporate your business in any state, regardless of where your business is physically located. For example, Delaware and Nevada are popular “incorporation havens” because of their favorable tax laws and corporation-friendly legal systems. In fact, many investors won’t invest in a company unless it is incorporated in Delaware.

These are some variables to keep in mind when deciding where to incorporate your business:

- Formation fees

- Annual fees and filings

- Corporate taxes and franchise taxes

- Legal system

- Investor preferences

If you choose to incorporate in one state but do business in another, you’ll have to qualify as a foreign corporation in the state where you operate. This requires some additional paperwork, and it could also increase your tax bill. For instance, if your company is incorporated in Delaware but does business in New York, you’ll have to pay New York state income taxes on business income plus a “franchise tax” for being incorporated in Delaware.

What to Do After Filing Your Articles of Incorporation

After filing your articles of incorporation, you might think your job is done, but not so fast! There’s additional work that you need to do to legally operate your corporation and ongoing filing requirements to maintain your status as a corporation.

The next to-do steps include:

- Initial report: Several states require you to file an initial report within a month or two of your incorporation. Initial reports contain up-to-date information about your business’s directors and officers, location, and registered agent. In a lot of ways, it might seem like a repetition of the articles of incorporation.

- Publishing requirement: Most states require you to publish a notice in a local newspaper that contains your business’s name, address, number of shares, and other information from your articles.

- Annual report: Annual reports usually contain detailed financial data for prospective shareholders and the public. States vary in the specifics, but you typically have to submit them by March or April after the year of incorporation.

- Corporate bylaws: Corporate bylaws contain the blueprint for running the corporation and are far more detailed than the articles. They set out the rights and responsibilities of shareholders, directors, and officers.

- Hold board of directors meeting: After incorporating, hold your first board of directors meeting and document the minutes and any resolutions the board takes.

- Hold shareholder meeting: You’ll also have to hold and document your first shareholder meeting. At this meeting, you’ll issue shares of stock and record the transfer.

- Elect S-corp status (optional): To organize your company as an S-corporation, you’ll need to file Form 2553 with the IRS.

- Handle administrative matters: As part of company setup, you’ll also need to obtain any local business licenses, apply for an employer identification number (required for corporations), and open a business bank account. You also should determine your state’s deadlines for filing corporate taxes and franchise taxes.

This seems like a long list, but it’s important to complete all of the initial and ongoing requirements for corporations. Failing to complete these tasks can land your company in hot water legally or open you up to an IRS audit. The best way to protect yourself is to hire a lawyer who can help guide you in your journey of business ownership and answer questions specific to your business.

The post Articles of Incorporation: Everything You Need to Know to File Them appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/articles-of-incorporation/

No comments:

Post a Comment