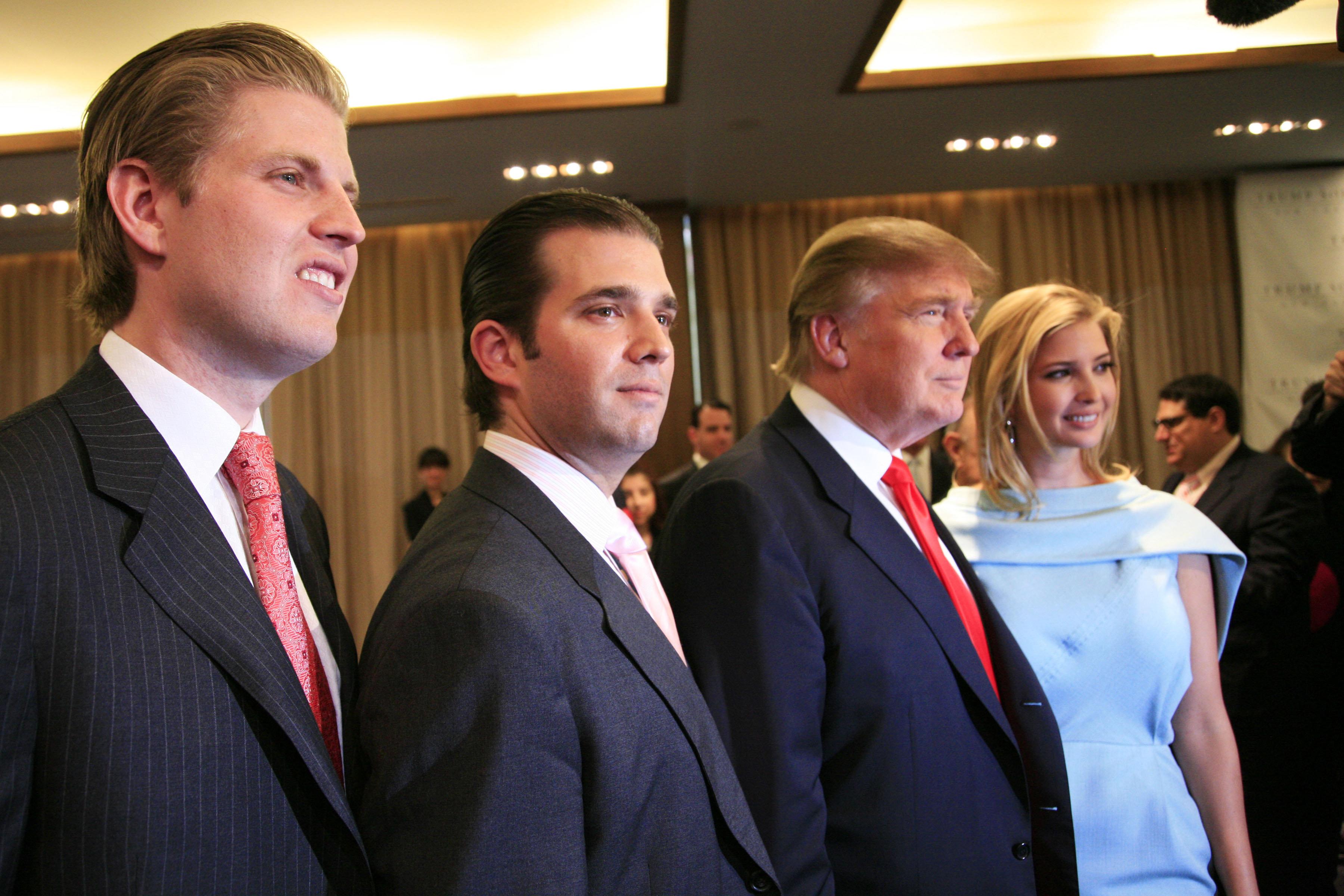

When Donald Trump won the 2016 presidential election, a big question mark was who would continue operating the Trump Organization. Shortly before taking office, Trump and his daughter Ivanka stepped back from the business, leaving the president’s two sons in charge. The Trump Organization is a multibillion dollar company with domestic and international properties, but it’s also run very much like a mom-and-pop shop in some ways—without a clear hierarchy or delineation of responsibilities.

Small business owners often focus so much on the day-to-day responsibilities of running a company that they don’t give much thought as to what will happen after they step down. This can leave heirs of the business in an uncertain situation. President Trump’s three eldest children have been closely involved in the business for years, preparing them to lead the company well into the future.

But most people are not in this position. A whopping 90% of American businesses are family-owned, but most of those businesses don’t have transition or succession plans. If you’ve inherited a company, there might be a lot of questions on your mind. You might not want to be an entrepreneur, or even if you do, you might prefer to work in a different industry. Even if you’re ready to take on the business, you might be unsure about how to deal with current employees and suppliers.

Needless to say, there’s a complicated web of financial, tax, and legal issues for business heirs to navigate. As always, it’s a good idea to get the assistance of an attorney with this type of situation. But, here are some basics of business inheritance that can help you figure out what to do next.

Eric Trump and Donald Trump Jr. have taken over the Trump Organization from their father, President Trump.

Learn as Much About the Business as You Can

Inheriting the family business might be something that you’ve been preparing for for years, or it might come as a complete surprise to you. In either case, your first step will be the same. You should gather as much information as possible about the business in its current state.

Peter Christman, CEO of the Christman Group and an expert in exit planning, advises business inheritors to “complete an assessment of the business’s value factors and drivers, operations, financials, personnel, facilities, legal status, and industry. From that analysis, an action plan should be developed. This step should take place no matter what happens to the company in the future.”

This should be a comprehensive 360-degree due diligence review of all facets of the business. If the business currently has an accountant, attorney, banker, or financial advisor, all of those individuals should be included in the conversations. That said, those people might have blind spots about the business, especially if they were very close to the former owner or worked with the business for a number of years. For that reason, it’s also helpful to bring an independent attorney and financial professional to the table.

Once you’ve gathered all the pertinent people, you’ll want to review all of the following:

- Current incorporation paperwork, business licenses, and permits (contact your local secretary of state)

- Last three years’ business tax returns

- Accounts payable aging reports and accounts receivable aging reports

- Business plan

- Succession plan (if one is available)

- Most recent balance sheet, profit and loss statement, and cash flow statement

- Existing debt schedule

- Last six months’ business bank account statements

- Documentation of business insurance

- Customer lists

This is just a starter list. Doing due diligence on a business is an exhaustive, document-heavy process, but you don’t want to overlook anything. You’ll need to understand the company from a financial, legal, and tax standpoint to figure out your “action plan” as Christman calls it.

For example, if due diligence reveals that the company is deep in debt or doing very poorly financially, you might want to find an exit path. In contrast, if the former owner ran the business very efficiently, that makes for an easier transition. Next, we’ll go over your options after doing due diligence on the business.

→TL;DR (Too long; didn’t read): When you inherit a business, the first step is to learn as much about the business as you can. You’ll want to review the business’s legal, financial, and tax documents with the help of an independent attorney and financial professional.

Option 1: Take over the business.

One option when inheriting a business is to simply take the reins and run with it. The transition might be relatively easy if you’ve received training over the years to take over the business. In that case, you’ve probably been around the business a lot and been in close discussions with the former owners. But if you weren’t close to the business, then taking over will be more difficult.

Here are some guidelines to follow for taking over the business:

Review the previous owner’s succession plan and business plan.

As the inheritor of a business, there are two documents that will inform your future plans. These are the succession plan and the business plan. The former owner might not have created either of these documents, but if you have them at your disposal, they can give you an “insider look” at the company.

A succession plan prepares the groundwork for a new owner to take over the business. If the former owner has left you with a succession plan, then you’ll use that to gain an insider’s perspective on the company. Succession plans often contain information about training that the new owner should receive, access to confidential information, and intel on competitors.

A business plan can also be very helpful when you’re learning the ropes. Although people tend to think of a business plan as a forward-looking document, it can actually say a lot about a business’s past. Especially if the former owner periodically updated the business plan, you can see what changes occurred over the years. Business plans contain information about the company’s market positioning, advertising strategy, and financial goals.

Eventually, you’ll want to update the business plan and succession plan for your own purposes. But these documents can give you a clue into what the former owner saw as the company’s opportunities and challenges.

Communicate changes with current customers and vendors.

Business inheritance means big changes for you but will also affect the lives of the company’s current staff, suppliers, and lenders. Each of these parties is used to working with the former owner, and change is hard!

Even if you plan to shed staff or change vendors, you’ll want to maintain transparency and good connections with these people because they are a repository of knowledge about the business. For example, employees might have been closely involved in implementing prior marketing plans or developing new products and services. Their experiences can teach you a lot about the business and what to do going forward.

Given their value to the business, these stakeholders deserve to be notified of changes to the way the company is run. “Any changes,” says Christman, “should be part of the newly developed action plan. Distinct communication must take place with management and personnel as to the merit and reasons for any business changes.” Maybe the previous owners didn’t capitalize on social media marketing or missed out on a great new product idea. Before implementing something new, explain the change to current employees and vendors. You’ll gain their trust in doing so, which will be helpful to you down the line.

Consider the financial needs of the business.

There’s a saying about family-owned businesses that goes like this: “The first generation builds the business and the second makes it a success.” Every generation defines success differently. When you take over a family business, you might want to tap into new customer acquisition channels, expand the business, or even pivot to a new product or service. New business owners typically have big ambitions.

However, it’s important to be practical about future plans, particularly in terms of finances. For instance, more than 80% of businesses have unpaid invoices. That’s money lying on the table, but difficult to collect. When figuring out where to take the business next, you’ll have to consider the time involved in chasing down those invoices. Or maybe you should spend your time on other projects and write off those invoices as bad debt. Consider how these types of financial trade-offs will help you accomplish your goals.

If you want to overhaul the current business, you’ll need enough funding to make that happen. You can get some money by selling off unused assets, but if that doesn’t get you far enough, you might need to take out a business loan. Fortunately, there are a variety of options for securing business financing, and the longer a business has been operating, the easier it is to get funding for the business.

→TL;DR: Running a business that you inherited can be challenging. You should use the former owner’s succession plan (if there was one) and business plan as a roadmap to inform your next steps. You should also communicate with the business’s stakeholders and consider your budget before making changes.

Option 2: Bring a business partner on board.

Upon inheriting a business, many people take to the idea of becoming an entrepreneur, but they do not want the responsibility of sole ownership. For such individuals, bringing a business partner on board can defray some of the responsibilities of business ownership and make it easier to deal with the transition to ownership.

There are many ways to find a business partner. For a family-owned business, you might recruit one or more siblings or cousins to help out. There are also apps and websites like Ideas Voice that are designed to help entrepreneurs find a business partner.

Once you do find a partner, the best practice is to draft a partnership agreement where each partner’s rights and responsibilities are well defined. Even if your business partner is a friend or relative, having a comprehensive partnership agreement is important. You can draft a simple partnership agreement yourself, but hiring a lawyer or using an online legal service like LegalZoom is a good idea.

A partnership agreement helps you avoid conflict down the line by delineating clear areas of focus for both partners. For example, one partner might focus on customer acquisition and the other on strategy and management. The best business partnerships bring complementary skill sets together, but the owners follow a unified business strategy.

→TL;DR: Finding a business partner can lighten the load of business ownership. Just be sure to document each owner’s rights and responsibilities in a partnership agreement.

Option 3: Sell the business.

If for any reason you don’t want to own the business that you inherited, selling is an option. NYC restauranteur Helah Kehati inherited several restaurants when her father passed away in February 2015. Ultimately, she decided to sell portions of the business:

“I inherited multiple restaurants, cafes, bars. Initially, I took over all of the businesses before making the hard decision to sell them over time. The motivation behind keeping them was both financial and sentimental. Also, I don’t believe that one should make decisions under duress (such as having lost a parent). Over the years, my family and I have decided to sell some of the businesses, both to keep us from spreading ourselves thin while involved in other careers, and also due to existing partnerships and business relationships that were inherited along with the establishments.”

The possible buyers for a business depend on the type of business entity. If the business is structured as a corporation with multiple shareholders or as a multi-member LLC, you might be able to sell your share of the business to another owner. This is called a buyout and can be structured in multiple ways. For example, business bylaws sometimes require all owners to approve a buyout. Look to your company’s bylaws to see if there are any rules or restrictions on buyouts.

Selling your small business to an external third party requires more due diligence and time than selling to someone who is already involved in the business. A business broker can help you advertise the business and secure a ready buyer. They will also help you through the due diligence process, during which you’ll be required to share a lot of business documentation with prospective buyers. You’ll also need to get a professional business valuation before both parties sign the final buy-sell agreement.

Hiring a broker is important because there are many points of negotiation during the sale process. The broker can help ensure that you get a fair sale price. If possible, be willing to keep your business on the market for at least six to nine months, the customary length of time to find a buyer.

→TL;DR: Selling a business that you inherit is an option. You can sell to existing owners if the business is an LLC or corporation. Alternatively, you can seek out a third-party buyer with the help of a business broker.

Restauranteur Helah Kehati inherited several businesses from her father, and eventually sold some of them.

Follow These Dos and Don’ts After Business Inheritance

Business inheritance can trigger a bunch of questions and unknowns. Especially if the inheritance comes in the wake of losing someone you love, it’s tough to deal with the emotional impact of that plus the legalities and financial implications of business ownership.

In those tough few weeks and months, here are some dos and don’ts to guide you:

Do:

- Review all the business’s financial, legal, and tax paperwork as soon as you inherit the business.

- Hire an independent attorney who can help you assess the business’s current position and future challenges.

- Use the former’s owner succession plan and business plan to inform your future plans for the business.

- Consider bringing a partner on board if you want to hold onto the business, but don’t want to do things completely on your own.

Don’t:

- Conceal pending changes from current employees, suppliers, or other stakeholders of the business. Be as open and transparent as possible.

- Be hesitant to explore selling options. Entrepreneurship isn’t a good choice for everyone, and you might have the option to sell your share of the business to co-owners or to a third-party buyer.

- Let the business’s current finances limit you from reaching your goals or overhauling parts of the company. There are plenty of financing options for businesses.

At the end of the day, the former owner trusted you to do what’s best for the company. Depending on your situation, that might mean retaining the business, bringing on a partner, or selling.

The post You’ve Inherited a Business… Now What? Next Steps, Dos, and Don’ts appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/inherited-a-business-now-what/

No comments:

Post a Comment