What Is a Business Tax ID Number?

A business tax ID number, also called an employer identification number (EIN) or federal tax ID, is a unique nine-digit number that identifies your business with the IRS. Owners of most types of business entities need a business tax ID number to file taxes, open a business bank account, obtain a business license, or apply for a business loan.

Most people know their social security number by heart, but not all business owners know their business tax ID number, otherwise known as your EIN. Your EIN isn’t something that you use on a day-to-day basis, so keeping this number top of mind isn’t as easy as remembering your company’s phone number or address.

But your EIN is essential for some very important business transactions, like filing tax returns and obtaining business financing. In these kinds of situations, accuracy and speed matter. Not having your business tax ID can prevent you from getting crucial funding for your business or meeting a tax deadline.

Ideally, you should memorize your business tax ID or have this number in an easily retrievable place. But with everything competing for your attention as a small business owner, you might not realize that you don’t know your EIN until you’re midway through your tax return. Not to worry! Locating a forgotten, lost, or misplaced business tax ID is actually pretty easy and shouldn’t cost you anything. Here is a guide to stress-free federal tax ID lookup. We also cover how to find another business’s EIN.

Why You Need to Know Your Business Tax ID Number

The IRS requires most types of businesses to apply for an EIN. The exceptions are some sole proprietors and owners of single-member limited liability companies, who can use their social security number instead of an EIN. But even small business owners who don’t have to get an EIN often opt to get one, so that they’re easily able to track their business’s finances separately from their personal finances.

If the IRS requires you to get an EIN or if you choose to get one, these are some of the situations where you’ll need to provide your business tax ID number:

- When filing business tax returns or making business tax payments

- When applying for a business loan

- When opening a business bank account

- When applying for a business credit card

- When issuing Form 1099s to independent contractors

Although each of these transactions doesn’t happen regularly, when you consider all of them together, you’ll need to provide your EIN at least a few times per year. So, this is a number worth committing to memory and storing safely. Ideally, you should retrieve your business tax ID before you complete any of the transactions above.

→TL;DR (Too Long; Didn’t Read): Your business tax ID number, or employer identification number (EIN), is a nine digit number that identifies your business with the IRS and on other company paperwork. You’ll need to know your business tax ID number when filing taxes, applying for credit, paying contractors, and opening a bank account.

Business Tax ID Number Lookup: Your 3 Best Options

Many times, small business owners get stuck midway through a loan application, tax return, or bank account application because they don’t know their business tax ID number. Fortunately, locating your EIN is pretty simple.

Here are the three best ways to look up your business tax ID number:

Option 1: Check Your EIN Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

- If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by postal mail.

- If you applied by fax, you would have received your confirmation letter by a return fax.

- If you applied by mail, you would have received your confirmation letter by a return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

Option 2: Check Other Places Your EIN Could Be Recorded

If you’ve misplaced your EIN confirmation letter, then you’ll need to get a little more creative to find your business tax ID number. Fortunately, once you get an EIN, your tax ID typically won’t change for the entire lifespan of your business. That makes locating the EIN easier.

These are places where you can locate your EIN:

- EIN confirmation letter

- Old federal tax returns—your EIN should be at the top of the very first page of the return

- Official tax notices from the IRS

- Business licenses and permits

- Business bank account statements or online account profile—you can also call the bank for help

- Old business loan applications

- Your business credit report, which shows your business’s credit history with lenders and suppliers

- Payroll paperwork, such as 1099 forms that you’ve issued to independent contractors

Note that your EIN generally will not appear on business formation paperwork, such as Articles of Incorporation, Articles of Organization, or a fictitious business name (DBA) document. These documents establish your business’s legal setup but don’t contain your business’s tax ID number.

Option 3: Call The IRS to Locate Your EIN

You should be able to track down your EIN by accessing one or more of the documents listed above. But if you’re still not having any luck, the IRS can help you with federal tax ID lookup. You can call the IRS’s Business and Specialty Tax Line, and a representative will provide your EIN to you right over the phone. The Business and Specialty Tax Line is open Monday through Friday from 7 a.m. to 7 p.m. Eastern time. This should be your last resort option because the call wait times can sometimes be very long.

Before you call, keep in mind the IRS needs to prove you’re actually authorized to retrieve the business tax ID number. For example, you’ll need to prove you are a corporate officer, a sole proprietor, or a partner in a partnership. The IRS representative will ask you questions to confirm your identity.

Don’t get frustrated: This is simply a precaution to help protect your business’s sensitive data. After all, you wouldn’t want the IRS to give out your Social Security number to anyone who called, would you? Once you’ve found your business tax ID number, we suggest putting the number in a safe place—like a locked file cabinet or even better, in secure Cloud storage—so you won’t have to go through these steps again!

→TL;DR: The easiest way to locate your EIN is with the confirmation letter that the IRS issues when you first apply for your business tax ID number. If you can’t find that letter, you can also find your EIN on old business tax returns, business bank account paperwork, business credit reports, and payroll documents. The IRS also has a phone number to retrieve a lost EIN.

How to Find Another Company’s EIN

Usually, small business owners need to locate their own company’s tax ID. But businesses sometimes need to look up another company’s EIN. For example, you can use an EIN to verify a new supplier or client’s information. Also, in industries like insurance, you might need other companies’ EINs during your daily course of business.

Use one of the following options to find another business’s federal tax ID number:

- Ask the company. Usually, someone in the payroll or accounting department should know the company’s tax ID.

- Search SEC filings. If the company is publicly traded, look at the Securities and Exchange Commission’s website and enter in the company’s name. The SEC filings should contain the business tax ID number (listed as “IRS No.”).

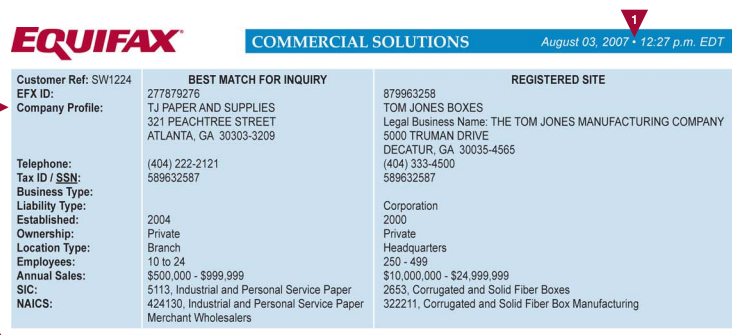

- Get the company’s business credit report. Credit bureaus, such as Experian and Equifax, as well as other sites like Nav allow you to purchase your own business credit report or view another company’s business credit report for a fee. The credit report will show the business’s EIN.

- Use a paid EIN database. Commercial EIN databases charge a fee for access to company EINs. Some databases even link EINs to other information, such as company size and industry. This can help you find new prospects.

- Use Melissa Database for nonprofits. Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Share the number only with a limited subset of people—lenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number.

→TL;DR: The easiest way to find the EIN of another company is by asking their payroll or accounting department. However, you can also search SEC filings, obtain the company’s commercial credit report, or get access to an EIN database.

How to Change or Cancel an EIN

Once you obtain an EIN for your business, that tax ID remains with your business for the entire lifespan of the company. However, there are some situations where you might need a new business tax ID number.

Here’s when you need to apply for a new EIN:

- You incorporate for the first time or change your business entity

- You buy an existing business or inherit a business

- Your business becomes a subsidiary of another company

- You are a sole proprietor and are subject to a bankruptcy proceeding

- You are a sole proprietor and establish a retirement, profit sharing, or pension plan

- You receive a new charter from your state’s Secretary of State

- There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.

Once your business get an EIN, the IRS technically can’t “cancel” the tax ID. Even if you close down your business and never file a tax return, no other business will ever get the same number. If you ever decide to reopen your business, you can use the old number. If you determine that you don’t need an EIN that you applied for—maybe because you never actually started the business or because you dissolved the business—then you close your business account with the IRS by writing a letter. If you close your account and launch another business in the future, you’ll need a new EIN at that point.

→TL;DR: Your EIN usually lasts a lifetime, but changes to your business’s ownership or structure sometimes requires a new EIN. If you change your business’s name or location, that usually doesn’t require a new tax ID.

Bottom Line: EIN Lookup Is Typically a Painless Process

Knowing your business tax ID number is important, but with all of the competing attentions for a small business owner, you might forget or misplace your tax ID.

Here’s what you should know if you need to locate an EIN:

- Try to locate your EIN before you need to file taxes, apply for a business loan, or open a business bank account. Knowing your EIN will speed up the process.

- You can locate your EIN on your confirmation letter from the IRS, old tax returns, old business loan applications, your business credit report, or payroll paperwork.

- You can also call the IRS to look up your federal tax ID number.

- If you need to locate another company’s EIN, you can start by asking the company. There are also free and paid databases that can help you find a business’s tax ID number.

- Once you apply for your company’s EIN, you won’t need a new one for business name changes or location changes. However, if your business’s ownership or structure changes, then you’ll likely need a new EIN from the IRS.

Your business tax ID number is important for lots of business milestones. Make sure you keep this number safe so you’ll have it whenever necessary.

The post Business Tax ID Number: IRS EIN Lookup, Plus How to Change an EIN appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/business-tax-id-number

No comments:

Post a Comment