Default vs. Delinquency

Loan defaults and delinquencies both stem from overdue loan payments. A loan becomes delinquent as soon as you’re late on a payment, by even one day. If you miss several payments or can’t make payments for an extended time (usually 90 to 120 days), the lender will place the loan in default and can start collection proceedings against you. Both delinquencies and defaults damage your credit.

The moments after you closed on your business loan are probably filled with memories of relief that the loan application process was over, and happiness that you finally had the money to grow your business. But now, after a few months or years, you might feel like you took on more than you could handle.

Maybe the loan payments have started to feel burdensome. Your business might not be generating enough cash flow to cover the payments. You might even have missed a payment or two and are worried about what will happen to your business and to your personal credit. First, if you’re in this position, you should recognize that you’re not alone. More than one-third of Americans are delinquent on debt, and some of those business loan delinquencies end up in default.

If you fall behind on payments, there are steps you should take right away to get back on track and limit the damage to your finances. And even if your loan has already gone into default, there are things you can do to minimize the damage. Learn everything you need to know about small business loan delinquencies and defaults, and how to protect yourself.

What’s a Delinquent Loan?

Any time that you’re late on a loan payment, your loan becomes delinquent. Whether you’re late for the first time or have been late in the past doesn’t matter. If your payment is due on January 1 and the lender doesn’t receive your payment that day, the loan becomes delinquent on January 2.

Impact of a Delinquent Loan

The impact of a late payment depends on your lender’s policies and the specifics of the loan agreement that you signed when you took out the loan. In most cases, however, a delinquent loan can have three consequences:

- The lender assesses a late fee or hikes up your interest rate.

- The lender reports your late payment to credit bureaus.

- The lender contacts you with increasing frequency to collect the payment.

Late Fees and Penalty Rates

Loan agreements often allow the lender to assess a late fee after a grace period of a few days. Though less common, some loan agreements also allow the lender to increase the interest rate on overdue amounts. This is called a “penalty rate” or “default rate” and is more prevalent with credit cards.

Late fee structures vary significantly by lender, says Greg Hockenbrocht, Director of Lender Partnerships at Fundera. “Most lenders charge late fees,” says Hockenbrocht, “but the exact structure of the fee varies a lot by lender. Some will charge a fee right away if you’re even a day late. Others are more lenient and will only charge a fee if payment isn’t received within a week or two.” Online alternative lenders often deduct payments automatically from your bank account. If you have insufficient funds, your loan is delinquent and can trigger late fees.

Here’s a look at the late fees that some popular online lenders charge for delinquent loans:

| LENDER | LATE FEE | WHEN FEE IS ASSESSED |

|---|---|---|

|

Lending Club

|

5% of the amount due or $15, whichever is higher

|

After 15 days late

|

|

Funding Circle

|

15% of the amount due

|

After 7 days late

|

|

Kabbage

|

$10 to $100 depending on how much you owe

|

After 4 days late

|

|

Fundation

|

$35 or 5% of the amount due, whichever is higher

|

Immediately

|

|

BlueVine

|

3% of the amount due

|

After 2 weeks late

|

For more information about individual lenders on the Fundera platform, see our Lender Review Pages.

Your Credit Score Will Take a Hit

After you are 30 days late, lenders can report the late payment to the credit bureaus. Under credit score regulations, lenders can’t report a late payment any sooner, even if they’ve charged you a late fee.

Once you’re past the 30-day window, a late payment on your credit report can ding your score by as much as 100 points. And a lower credit score makes qualifying for future business loans more difficult. The level of lateness matters—being 60 days late will impact your score more than being 30 days late. Late payments can stay on your credit report for up to seven years. If you pay the lender after the overdue item shows up on your report, that will lessen the impact to your score but won’t delete the item from your credit report.

Note that this 30-day rule doesn’t apply to business credit reports. A lender can report late payments to the commercial credit bureaus even if you’re just one day late.

Frequent Calls and Emails from the Lender

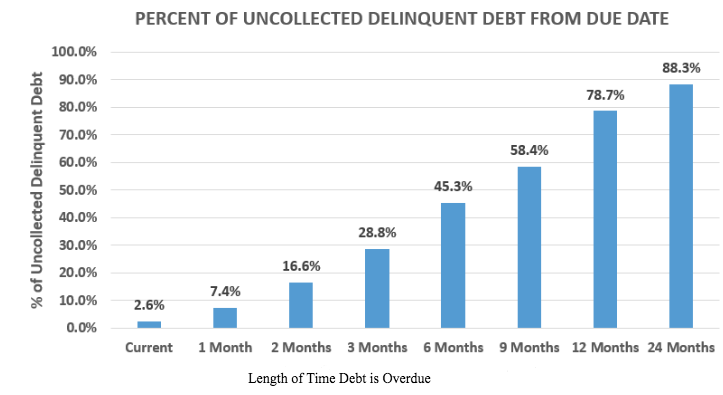

When you miss a payment, you can expect to get frequent calls and emails from your lender, pushing you to make payment. Lenders try to collect on late payments as soon as possible when the deadline is still fresh in the borrower’s mind. As a borrower becomes more and more late, the lender has a much tougher time collecting on the debt.

If your loan becomes delinquent, no matter how late you are, try to send in your payment before the loan goes into default. Defaulted loans have worse, longer-lasting consequences.

→TL;DR (Too Long; Didn’t Read): A loan is delinquent when you miss a payment, by even one day. Your loan agreement might allow the creditor to assess a late fee on a delinquent loan. Creditors can also report delinquent loans to credit bureaus after 30 days.

What’s a Defaulted Loan?

Your loan goes from delinquent status into default when you have an outstanding balance for a long period of time. Your loan agreement will specify exactly how long that is. Usually, lenders wait 90 to 120 days before they consider a loan to be in default.

Impact of a Small Business Loan Default

When your loan goes into default, the lender will send you a written notice explaining that you’ve breached your loan agreement and have to pay the entire balance of your loan right away. The lender might even sell or transfer the debt to a collection agency, which will then make increasingly frequent calls to recover the loan balance.

If the lender believes they won’t get their money back, they can charge off the loan—that is, remove the loan from their books. A charge-off removes the loan from the lender’s balance sheet, but you’re still responsible for paying the debt.

From there, the lender’s next steps depend on whether the loan is secured or unsecured. A secured loan is backed by a personal guarantee, a lien on your assets, or collateral, such as a piece of equipment or a building. An unsecured loan is not backed by any asset.

If you have an unsecured loan, then you’re not on the hook if it goes into default. In reality, completely unsecured business loans are hard to come by. Like your own business, lending companies are profit-seeking enterprises and want to ensure that they’ll get their money back, plus interest. If a secured loan goes into default, the lender can seize the collateral or get a court order to liquidate your assets. The exact procedures for enforcing a personal guarantee or lien vary by state.

Remember how a delinquent account can hurt your credit score? Well, credit reports are very specific, and the report will show the loan’s exact status. For instance, a credit report will indicate if a loan is in collections or if the lender has charged off the loan. These statutes can ding your score and credit history even more than an ordinary late payment. A collection or charged-off debt can be on your report for up to seven years. Paying off the overdue debt won’t remove the item from your credit report but can lessen the impact to your credit score.

→TL;DR: If your loan payments are overdue for a long time—how long depends on the loan agreement—the lender will place the loan in default. This means your entire balance is due. If the loan is secured, the lender can repossess collateral or liquidate your assets to satisfy the unpaid debt. A defaulted loan can have a very negative impact on your credit.

What to Do If You’re Having Trouble Affording Loan Payments

As you can see, the consequences of missing a payment or two on your loan can be pretty far reaching. The best way to stay in the clear is simply by making sure that your loan is affordable and that you can comfortably cover the payments without stretching your business’s finances too thin.

But sometimes things don’t go as planned. Here’s what to do if you’re struggling to make business loan payments on time:

1. Contact your lender and start a conversation.

The most important thing to remember when you have a business loan is to think of your lender as your ally. Your lender wants your business to succeed so that they can get their money back, with interest. So, if you’re struggling with loan payments, that’s the time to start a conversation with your lender.

The lender might offer a number of solutions to your problem. They might extend the term of your loan to give you lower installment payments. They might put you on a payment plan with lower payments. When things are really down to the wire, lenders might even agree to settle a debt for less than the amount that you owe. Lenders want to avoid going through the time consuming and expensive process of repossessing collateral or liquidating assets, so they might forgive some of the debt.

You’ll never know if you don’t try—so reach out now.

2. Understand your rights as a borrower.

When you are delinquent on a business loan, lenders will contact you (a lot!) to request payment. Debt collectors will contact you if the lender sells or transfers the debt. Although lenders and debt collectors are legally allowed to reach out to you to collect on unpaid debt, there are laws regulating what they can and can’t do.

A lender or debt collector cannot do any of the following:

- Arrest or threaten to arrest you if you don’t pay debt

- Pose as law enforcement

- Lie about the amount of money you owe

- Report false credit or financial information about you

There are fewer debt collection protections for business owners compared to consumers, but if the debt collector is doing any of the above, you should contact the attorney general in your state for help.

3. Call a debt counselor for assistance.

Debt counselors are individuals or agencies that help people better manage their debt. While most only work with consumers, there are a select few that also help small business owners. Debt counselors can assist you with budgeting, developing a payment plan, consolidating and refinancing debt, and interfacing with lenders.

4. Don’t borrow more than you can afford down the line.

Sure, hindsight is 20/20. But this is important.

During underwriting, lenders check your business revenues, existing debt burden, and credit history to make sure you can afford a loan, but you also have to take responsibility in checking whether you can handle the loan payments. After all, you know your business most intimately and realistically.

When applying for a business loan, look at your financial projections for the next few months (or years, if applying for a multi-year loan) and see if you’ll make enough profits to cover the loan payments, with a sufficient cushion for unexpected expenses.

In addition, Fundera’s Hockenbrocht says, “finding ways to cut business expenses can be a short-term solution” to get you back on track. For example, can you operate with a leaner staff or try more cost-efficient marketing strategies? Cutting back, even if just temporarily, might be worthwhile to prevent the financial damage that can ensue from late payments.

5. Set up automatic loan payments.

Sometimes, late loan payments are a result of forgetfulness rather than an inability to pay. As a small business owner, you have a thousand and one things to do every day, and a loan payment might slip your mind.

If this is the case for you, try setting up autopay. Most lenders can set up automatic payment deductions from your business bank account. And if the lender can’t, most banks offer the functionality on their end.

→TL;DR: If you’re struggling with loan payments, start an open conversation with your lender. They might be able to help make your payments more affordable. In the future, make sure you carefully assess your business’s finances to see how much you can afford. And if remembering your payments is the source of the problem, set up autopay.

Delinquencies and Defaults Damage Your Finances, but You Can Minimize the Fallout

Every once in awhile, even the best small business owners might miss a loan payment. This isn’t the end of the world, but there can be serious consequences to your credit or finances.

Here’s what to keep in mind about credit card delinquencies and defaults:

- A loan becomes delinquent if you’re even one day past the due date. Your loan agreement will allow the lender to charge late fees.

- After 30 days, the lender can report a late payment to the consumer credit bureaus (sooner for business credit bureaus). This can stay on your consumer credit report for seven years.

- A loan goes into default based on the specifics of your loan agreement. If you’ve missed multiple payments or have a long overdue payment (90 to 120+ days), the lender can place the loan in default.

- When the loan is in default, the lender might transfer or sell the debt to a collection agency. Or they might charge off the debt from their books. This can have an even more negative impact on your credit.

The best way to avoid a delinquency or default is by keeping on top of your loan payments. This might mean that you have to cut costs or make some compromises in the way you run your business. But always keep your lender in the loop. This ensures that all the parties involved understand the status of your debt and can take steps to make sure it gets paid.

The post Business Loan Default vs. Delinquency: The Important Difference appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/delinquent-loan

Great article, I am so happy that I came across this article. definitely I picked up some good ideas from your article list. we are also offering small business loans with the easy steps.

ReplyDelete