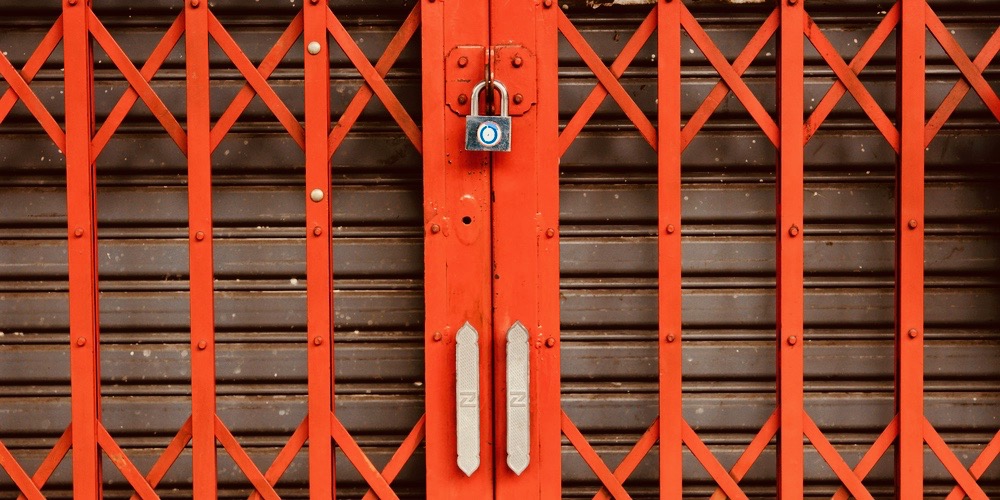

Although everyone aims to succeed when starting a business, the reality is that some entrepreneurs unfortunately don’t. It’s not a fun thing to figure out how to close a business, but turning the page can also provide peace of mind and open opportunities for new ventures.

It’s also, of course, necessary from a legal standpoint. Shuttering a company means doing more than putting up a sign that reads “Closed.” Although many entrepreneurs are familiar with the process of starting a company—including incorporating, filing for trademarks, and drafting business plans—they might not know the appropriate legal method for how to close a business.

Shutting down your company is called “filing a dissolution.” And this allows entrepreneurs to formally close their business with the state. If, for whatever reason, it’s time to close the doors and stop doing business, you’ll need to tie up your loose ends before you can move forward on whatever the future holds.

Here’s what you need to know about how to properly close a business, and make sure you stay within the law, too.

Step 1: Determine if you’ll need to vote on dissolution.

If you need to shut down your company, don’t immediately jump into filing a dissolution. Especially if your legal structure is a corporation or LLC. And that’s because the decision isn’t entirely yours.

What we mean is the board of directors at a corporation or managing members at an LLC must first vote and agree on the dissolution. And, in the case of public corporations, votes from shareholders are also counted with the board of directors.

If you can’t secure your vote, then you’ll need to figure out where the dissonance is among your ownership or directors—you can’t close a business without it. But, if you have enough votes in favor of a dissolution, then you can move on to the next step.

→Too Long; Didn’t Read (TL;DR): If you’re a corporation or an LLC, you’ll have to get approval from your board, shareholders, or managing members before you can go forward with closing your business.

Step 2: Create a dissolution proposal.

The first thing to note is that this step is only required for public corporations figuring out how to close a business. If you’re not public, you can move on to Step 3.

If you’re a public corporation looking into how to close a business, however, you’re among those required by most states to formally announce their intent to dissolve in a dissolution proposal. These proposals are part of public record and name the corporation, along with a statement that confirms a majority vote went into the decision to dissolve. (That’s why that first step is so important.)

When filing articles of dissolutions (more on that in a second!), make sure to also file Form 966, Corporate Dissolution or Liquidation with the IRS. You have to make sure to get this form in within 30 days of filing articles of dissolution.

→TL;DR: If you’re a public company, you’ll have to file articles of dissolution. Skip this step if you’re privately held.

Step 3: File articles of dissolution.

Now that you know you want to close down the business for good, and everyone is on board, it’s time to keep the state you do business in updated by filing articles of dissolution. This is a big step in the process of how to close a business.

What goes into filing articles of dissolution? The corporation or LLC dissolving its business will need to include their name, date the dissolution will go into effect, reason for the dissolution, and, if there is any, information on pending legal actions.

Once you file articles of dissolution with your secretary of state, your business will have its existence formally terminated.

When you’re longer seen as active, this ensures that neither the business nor its owner will be liable to continue filing annual reports, paying state fees, or be charged fees associated with the business.

→TL;DR: File articles of dissolution so the state in which you’re registered to do business no longer sees you as active. That way, you won’t be responsible for any new fees associated with your company.

Step 4: File a withdrawal.

Did you previously register your corporation or LLC to do business in another state?

Even if you filed your articles of dissolution and no longer exist in your home state, you’ll still need to go through the process of how to close the business in any other states. That’s because the business is considered to be active in other states, and can still be held liable for its obligations.

Filing a withdrawal allows you to stop doing business in other states, and fully terminates the company.

→TL;DR: Make sure you file a withdrawal in any other states you’re registered to do business in.

Step 5: Distribute assets.

Now that your corporation or LLC has completely dissolved in every state it does business in, it’s time to distribute any remaining assets. We’re on the last step of how to dissolve a business in its entirety.

First! If the business has creditors, like small business lenders, these must be paid back before anything else. Any assets that are left over are generally distributed to the owners based off of the percentage of the business that they own. LLCs distribute assets to managing members based off their original contributions. Corporations pay shareholders based on the amount of shares they own, and shareholders will return their outstanding shares.

→TL;DR: Pay back debts to creditors before distributing assets, and then distribute any existing assets based on percentage of business ownership.

And that’s it. Remember, although learning how to close a business and shuttering your company might be a painful process, you’ve learned so much as a small business owner that you can take into the next phase—whatever that might be. Just make sure your loose ends are tied up legally before you get there!

The post How to Close a Business—and Make Sure You Stay Within the Law, Too appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/how-to-close-a-business

No comments:

Post a Comment