Understanding, predicting, and managing cash flow are concerns that top small business owners’ lists over and over. When it comes to managing your business cash flow, more options to choose from is always a good thing. Here’s one you might not have heard of yet.

To date, over 70,000 small businesses across many industries have worked with Fundbox to solve cash flow problems. Many small businesses might be familiar with the popular invoice financing product from Fundbox, but there’s another option that you should consider when seeking business capital. It’s called Fundbox Direct Draw.

An extension of the original Fundbox product, Direct Draw offers flat transaction fees and 12-week repayment periods. Neither one requires a personal credit check or personal guarantee to get started, and interested business owners can expect a decision in under 3 minutes (that’s based on the median decision time for Fundbox customers).

Fundbox Invoice Financing requires that the business owner connect to the service using an approved accounting software, including: QuickBooks Online, QuickBooks Desktop, Freshbooks, Harvest, Clio, Kashoo, Jobber, eBillity, Xero, SageOne, InvoiceASAP, PayPal, AND CO, Billy, Bookly, Knowify, Paid, and Zoho.

While many users love the integrations with these popular software products, there are many business owners who simply don’t use them, and therefore haven’t been able to apply for Fundbox Credit.

Why Direct Draw?

First introduced in mid-2017, Direct Draw was the Fundbox answer to demand from business owners who wanted flexible access to funds, but didn’t use one of those Fundbox partner accounting software programs, and didn’t want to leverage their personal credit to apply for a loan from a conventional source, like a bank.

Direct Draw works similar to a credit card: It’s a revolving line of credit for small businesses, with credit limits up to $100,000. Instead of filling out piles of paperwork, you simply connect your business bank account and Fundbox automatically reviews your transactions to make a credit decision. If approved, you can click to draw funds anytime and repay over up to 12 weeks.

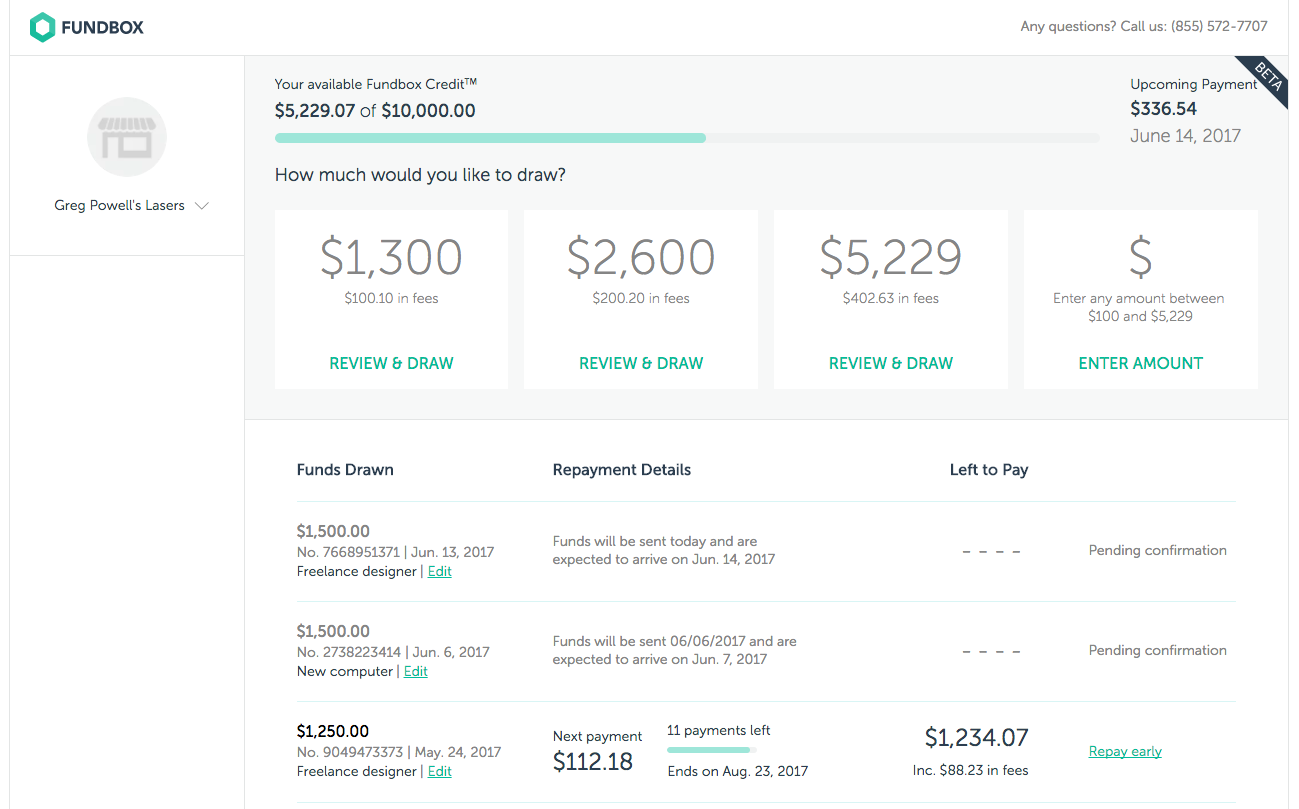

Here’s a Look at the Direct Draw Dashboard

The Direct Draw dashboard works a bit like an ATM. If approved, you can draw a predefined amount (25%, 50%, or 100% of your available credit) or choose your own amount, up to your individual credit limit. You’ll always get a chance to review and confirm the amount, and review the potential fee, before you draw.

Save Money with Flat Fees

One of the key features to note about Fundbox Direct Draw is that, like with Fundbox Invoice Financing, all fees are flat. That means, you pay the same fee each week you use your credit. There’s no fee for repaying early, and you only ever pay a fee on what you draw.

While this may not sound like a huge deal, it can save you a ton of money on fees. When you consider that many lenders heavily front-load their fees, meaning you would be paying the majority of your fees in your first few repayments, you can start to see how this flat fee structure has saved business owners so much money in the long run.

Direct Draw vs Lines of Credit

How does Fundbox Direct Draw compare with typical lines of credit? This is a bit of a trick question. Direct Draw works essentially just like a line of credit. It’s revolving credit financing that you can use however and whenever you see fit for your business expenses. “Revolving credit” means that, as you pay back the funds you borrowed, the amount you repay (minus the fees) becomes available to use again.

Where Fundbox differs is in the simplicity and speed of applying, approval decisions, and customer service if approved. You can apply online with no personal credit check, no paperwork to get started, and no fees for applying.

Why Direct Draw Is Good News for Small Businesses

The ability to apply online, skip the personal FICO check, and get a decision quickly can be a giant relief for small business owners.

Oftentimes, you simply can’t rely on a bank for a traditional loan; even in the currently improving lending climate, only 25% of loan applications are approved. Even when a large institution like a bank does approve a small business loan, they are reluctant to loan amounts less than $200,000, which is more debt than most small businesses want to assume simply to smooth a few cash flow gaps.

With Direct Draw, small businesses get the speed, service, and flexibility they want without assuming the risk of a bigger loan, without entangling their personal and business credit scores and finances, and without the hassle of working with a major bank.

Learn more about Direct Draw here.

Still wondering if it’s the right call for your business? See reviews on Fundera here.

The post What Is Fundbox Direct Draw? appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/fundbox-direct-draw

No comments:

Post a Comment