In July 2017, the U.S. government hit the world’s largest chain of Chinese fast-food restaurants, Panda Express, with a $400,000 fine.

What exactly happened here? Panda Express got slapped with the fine because they failed to keep up with the evolving regulations surrounding the I-9 form, established by the Immigration and Customs Enforcement (ICE).

These regulations, if ignored or otherwise not followed, can easily land your company in similar hot water.

Although a $400,000 fine might be just a drop in the bucket to a company like Panda Express, a similar penalty enforced on a small business could be catastrophic. Imagine how a sum of money even a fraction of that would slice into your business’s bottom line. And a great majority of American businesses owners are in the very same position.

Let’s take a good look at exactly what Panda Express did to earn themselves such a hefty fine—but first, and most importantly, let’s really understand the new Form 1-9 changes. If you don’t take away anything else (but you will!), just know that staying updated on recent and constantly evolving changes to the I-9 can make a world of difference. And save you thousands of dollars along the way.

What the Form I-9 Means for Employers

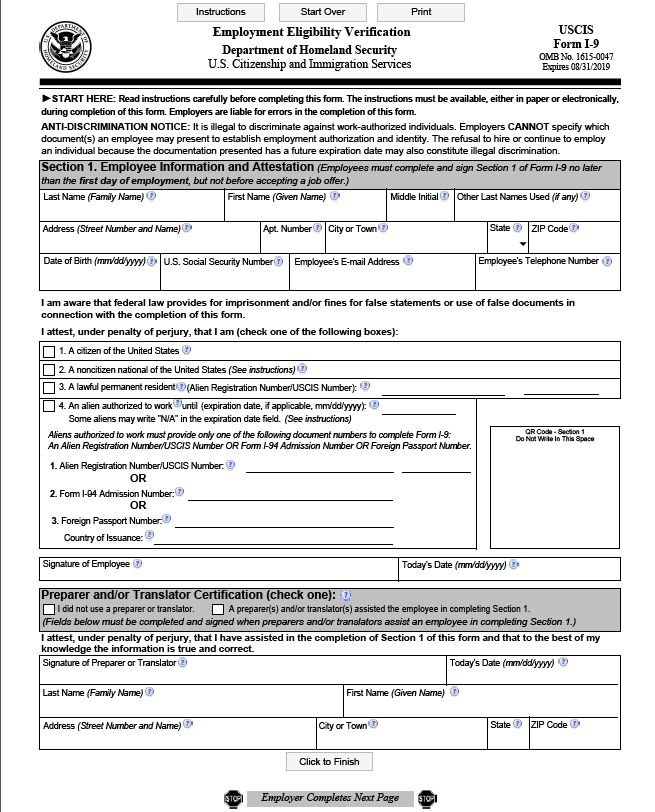

You fill out a million forms in your life as a small business owner, so let’s just review what the Form I-9 is exactly. We’re talking about the Employee Eligibility Verification form. It’s used by the U.S. Department of Labor to identify each employee hired in the U.S. as eligible to work in this country. Each new employee you hire has to fill it out in order to come on board in your operation.

This particular form has been in effect all the way back to the 1986 Immigration Reform and Control Act, which, along with other changes to immigration, put into place sanctions on employers that hired undocumented workers into their ranks if they were aware of their immigration status. While this act is primarily overseen by the United States Immigration and Citizenship Services, the I-9 does not only apply to immigrants—it applies to all employees.

The problem was that Panda Express failed to take note of this inclusory aspect of the form. Each new employee, American or otherwise, was required to fill out an I-9 at the time of hire. So far, so good.

However, once the permanent residence cards of the foreign nationals expired, these workers would have to verify their I-9 eligibility to work again. But they didn’t also require something of their U.S. citizen workers when it came to expired documents. This is because this practice was in direct violation of the anti-discrimination regulations set out in the Immigration and Nationality Act, which prohibits employers from discriminating based on citizenship status when it comes to documentation.

When this discriminatory behavior was discovered by an audit performed by ICE, legal trouble started brewing for the company.

How Attention on the I-9 Is Changing

Since everyone employed in the United States needs an I-9, any new changes made to the form have a far-reaching effect. So, keeping up with new the submission guidelines and staying abreast of the updates can help you avoid business-sinking penalties.

The first thing to know about the changes is that ICE is ramping up audits, the cost of the fines incurred, and the number of agents and officers it has to carry out these tasks.

An audit from ICE can happen unexpectedly and come with as little of a notice as three days. If your business receives an audit notice, you need to be ready. This is because the ICE didn’t just slap a bulk $400,000 fine onto Panda Express. Instead, it was carefully itemized.

The fines for mistakes and missing information are increasing from $110-1,100 depending on the type of error, to $216-2,156. That’s almost doubling the fee costs! You might be thinking that you don’t hire many workers, so the fees aren’t that steep for you.

Well, consider that these fees aren’t based on the number of problematic I-9 forms, they’re on an error-by-error basis. This means that, for every mistake or field left blank, that’s $216-$2,156. If you fail to file forms altogether, then each form can rack up tens of thousands of dollars in fines—even if you’re a tiny operation.

Additionally, there have been changes made to the way that these violations are legally perceived. In the past, there has been a distinction between “technical” violations and “substantive” ones. Technical violations are usually simple errors or procedural problems concerning your I-9, while an example of a substantive violation is failing to produce an I-9 for an employee altogether. This distinction has been effectively eliminated, as a company called Buffalo Transportation found out as they tried to appeal a $109,000 fine on the grounds of technical errors.

Now, if the ICE finds a technical error on an I-9, you will have 10 business days to correct the form before it becomes a substantial error. This is called the notification and correction period.

Form I-9 Errors to Avoid

Here is a quick list of some substantial errors to keep in mind when dealing with I-9 forms. And note that these don’t trigger the notification and correction period:

- Not having the employee’s name printed in Section 1 of the form

- Not having the employee sign the attestation in each section

- Not signing each Section yourself

- Not completing Section 2 of the form within the first three days after the employee’s hire date

- Not making sure that a green card or visa holder has added their A number into section 1

You can see a much more detailed list of the I-9 violation fees on the ICE website.

How Employers Can Protect Themselves

Big companies might be able to take a hundred-thousand-dollar hit without it breaking the bank, but small business owners need to make sure they aren’t caught unaware. And attention on I-9 violations is only expected to increase in the coming years as immigration itself is being more heavily scrutinized.

The best thing to do is to be prepared and to stay on top of your I-9 documentation. As you already know, the I-9 has several sections. The first section, Section 1, needs to be filled out completely between the time that the employee accepts the job offer and the end of the employee’s first day on the job. Section 2 has to be done in the first three days after the employee’s hiring date.

While completing Section 2, the employee needs to present the unexpired original copies of their legal identification documents. Copies of these documents and the I-9s themselves need to be kept secure and filed appropriately for easy access should you be audited.

Additionally, ICE has also implemented a smart electronic version of the I-9 that became mandatory in September 2017th. Failure to use this new form could result in severe penalties.

Ultimately, the best thing to do is to perform your own internal audits to make sure that your case is airtight in case you are audited by a federal agency. Make sure that the person or people performing these audits is well-versed in the regulations set by the federal government as well as immigration law and the I-9 requirements. If you’re prepared to perform the audit yourself, you can use this helpful guide for internal auditing provided by the ICE.

Rather than wait for trouble to come knocking, like Panda Express, Buffalo Transportation, and so many other companies have done, you need to be proactive and up-to-date with your employment documentation, especially if you employ immigrants. You’ve built your business through hard work and dedication, don’t jeopardize it because of an oversight or lax policy.

The post How New I-9 Form Changes Will Affect Employers (and How to Make Sure You Don’t Land in Legal Trouble) appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/new-i-9-form-changes

No comments:

Post a Comment