Navy Federal is the premiere credit union that has been serving the armed forces, veterans, and their families for nearly a century.

Since 1933, the Navy Federal Credit Union has pursued its mission—to “be the most preferred and trusted financial institution serving the military and their families”—with respect and honor for consumers and business owners who have served in the armed forces.

As such, the financial services they offer to military are top-of-the-line for all of their members, whether they’re actively serving, veterans, or family.

But do their business credit cards measure up to their competitors’?

Well, that’s a good question, and it’s the one that we’ll be diving into with this article.

We’ll iron out all the details on what the Navy Federal business credit card (both the Visa and the Mastercard versions) has to offer, and then see how each of the card’s details stack up against those of its competitors.

Here’s all you need to know to decide if the Navy Federal business credit card is right for your small business:

The Rundown on the Navy Federal Business Credit Card

The Navy Federal business credit card comes in two versions—the Visa Business Card and the Mastercard Business Card. These two versions differ slightly, but we’ll get to that later, because for the most part, the two versions of the Navy Federal business card are almost identical.

So, let’s get down to brass tax—what does the Navy Federal business credit card have to offer veteran small business owners?

Where the Navy Federal Business Credit Card Shines

The Navy Federal business card shines the most in its lack of fees and its low rate. To be a cardholder, you won’t have to pay an annual fee or a foreign transaction fee. Additionally, if you get an ATM cash advance at a Navy Federal branch or ATM, you won’t have to pay a fee. Otherwise, it will only be 50 cents per domestic transaction and $1 per overseas transaction.

Depending on your creditworthiness when you apply for the card, your APR on the Navy Federal business credit card could be as low as 10.15% (that’s the current prime rate + 5.90%).

These lower fees and potentially low APRs could end up saving you a huge sum in the long run, especially if you need quick cash from your business credit card.

But what does the Navy Federal business credit card offer in terms of rewards?

The Navy Federal Business Credit Card Rewards Program

Put simply, the Navy Federal business credit card’s rewards program is a bit sparse, especially when measured against the rewards program of its competitors.

When you spend with your Navy Federal business credit card, you’ll earn a flat-rate of 1x rewards points for every dollar you spend. To put this rate into context, most business credit cards offer this 1x rate as a base rate for when you max out higher earning categories, but more on that later.

That being said, when you earn enough points—which, keep in mind, will accumulate gradually—you’ll be able to redeem them for virtually anything you want. From cash back to travel, you’ll still be able to access the same cent per point value regardless of what form you redeem them in. Plus, there’s no cap on how many points you can earn in a year.

Where the Two Versions of the Navy Federal Business Credit Card Differ

So, why do two different version of the Navy Federal business credit card exist if they’re essentially identical?

Well, it’s mostly about preference.

One is a Visa card, and one is a Mastercard, and some business owners are very particular about which card network they spend with.

However, there are a few concrete differences that come with the different card networks’ versions of the Navy Federal business credit card:

For instance, while the Visa Business Card comes with only single or joint account capabilities, the Mastercard Business Card also comes with multiple cardholder capabilities within one set account limit.

Additionally, with the Visa Business Card, you’ll gain access to Visa SavingsEdge to keep track of your business’s finances. On the other hand, the Mastercard Business Card offers access to Mastercard’s Easy Savings and its Business Network.

All in all, the Mastercard version of the Navy Federal business credit card unlocks a few more perks than the Visa version. But since the two are so similar, if you prefer spending with a Visa, these couple of extra perks shouldn’t be game changers.

How Does the Navy Federal Business Credit Card Stack Up?

Now, for the big question—does the Navy Federal business credit card stack up to its competitors?

The answer depends on what your preferences are, but it will almost certainly be…not really.

Because the Navy Federal business credit card’s rewards are so sparse, and the low APRs aren’t unique in the market, there is probably a better business credit card option out there for you.

Let’s take a look at two comparable business credit cards available on the market and how they compare to the Navy Federal business credit card:

The Navy Federal Business Credit Card vs. the Chase Ink Preferred

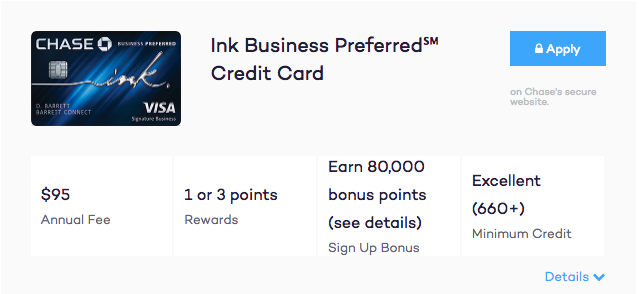

There’s really no two ways about it: in almost every detail, the Chase Ink Preferred outshines the Navy Federal business credit card. Not the least of which is the Chase Ink Preferred’s welcome bonus—when you spend $5,000 within your first 3 months with the card, you’ll earn 80,000 bonus points.

Now, $5,000 may seem like a huge amount as a lump sum, but it really only amounts to an average spend of around $55 a day within your first three months with the card. And when you consider how much 80,000 points can amount to, you’ll warm to the idea of spending that much on your business even more.

Redeemed strategically through the Chase Ultimate Rewards travel portal, your signing bonus could be worth up $1,000 in travel. That’s a lot of free travel for business spending that you’re likely already doing in the first place.

Not to mention, you’ll earn 3x points for every dollar you spend on travel; shipping purchases; social media and search engine purchases; and internet, cable, and phone services. That rate applies on up to $150,000 worth of purchases every year. After that, you’ll still earn 1x rewards points on every dollar you spend, with no cap on how much you can earn at this rate.

That’s right—unless you don’t do a single bit of spending in those top rewards categories and you don’t reach the bonus offer threshold, you always earn more with the Ink Preferred than with the Navy Federal business credit card.

However, there is one notable downside to include in your calculations—the Ink Preferred comes with a $95 annual fee, which may seem like a lot stacked up next to the Navy Federal business credit card’s $0 annual fee. That being said, if you access the Ink Preferred’s welcome bonus, which is one of the most generous on the market, you’ll make up for more than 10 years worth of the Ink Preferred’s annual fee.

The Navy Federal Business Credit Card vs. the Capital One Spark Cash Select

The Ink Preferred is certainly a sweet deal, but if you’re specifically looking for a flat-rate, no fee business credit card like the Navy Federal business credit card, you’ve still got better options to check out.

Namely, the Capital One Spark Cash Select is a no-fee business credit card that offers cash back rewards at a high flat-rate than the Navy Federal business credit card.

Plus, the Spark Cash Select offers a welcome bonus. If you spend $3,000 during your first three months with the card, you’ll earn a solid $200 in cash back. That’s an average of just $1,000 that you’ll need to spend a month in order to access the welcome bonus.

Additionally, though the Spark Cash Select’s APR at 13.99%-21.99% is slightly higher than the Navy Federal business credit card’s, it won’t set in until nine months into your cardmembership. The Spark Cash Select comes with a nine-month 0% intro APR period, so you’ll be able to carry a balance from month to month interest-free as long as you make your minimum monthly payments on time.

Now, the Spark Cash Select feature that is sure to help you earn more is its flat-rate of 1.5% on every dollar you spend with no limit on how much you can earn. And because it’s cash back that you’re earning with the Spark Cash Select, it’s just a versatile (if not more so) than the points you would earn with the Navy Federal business credit card.

If you’re a business owner searching for cash back rewards who also needs to carry a balance, the Spark Cash Select should beat out the Navy Federal business credit card every time.

The Bottom Line for the Navy Federal Business Credit Card

At the end of the day, no matter what you’re looking for, there’s probably a better business credit card out there for you than the Navy Federal business credit card.

Whether you want rewards points, a low APR, or a flat rate, the Ink Preferred or the Spark Cash Select is probably a sweeter deal for your business.

Do the Chase Ink Preferred or the Spark Cash Select sound like the perfect fit for your business? Don’t delay earning for you business spending—apply now.

The post Review: The Navy Federal Business Credit Card and 2 Alternatives appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/navy-federal-business-credit-card

No comments:

Post a Comment