When it comes to getting financing for your small business, you might be surprised to hear that your personal credit score matters—a lot.

The reason is actually pretty simple: business lenders will see your credit score as a reflection of your reliability as a borrower. Your personal credit score measures your repayment history for personal matters, it’s true, but lenders assume that your private financial habits will mirror how you deal with your small business. After all, you’re not running a major corporation where there’s more separation between the business and its owner.

A higher credit score means that you’ve been more responsible with auto loans, student loans, mortgages, and so on—and lenders assume that’ll extend to small business loans, too. Better credit means more trust, and the more they trust you, the more likely it is that they’ll loan you that capital you need.

So, want to finance that expansion, afford new equipment, or refinance your old debt? Look to your credit score to figure out what a lender will think of your business’s ability to repay a loan.

Figuring out your own credit score isn’t too tough—just sign up for AnnualCreditReport.com or CreditKarma—but that three-digit number will help a lot more if you can put it in context. Let’s talk about the average credit score range for small business owners, and why it matters for you.

The Average Credit Score Range for Small Business Owners

The following data comes from Fundera’s customer base—more than 22,000 small business owners—who applied with Fundera from February 2014 to mid-March 2016. It tells the story of the average credit score range for the small business owners that Fundera has helped with business financing.

Check out the full-size image.

It’s important to note that this average credit score range only includes our funded customers: small business owners who came to Fundera looking for financing, found the loan products that made sense for their business, and took out those loans.

So here’s the data deal—the middle-of-the-range small business owner who gets a loan through Fundera has a “Good” credit score between 620 and 660, and about 70% of small business owners we help find funding have credit scores of 620 or higher. There’s also a big jump of small business owners who get loans from below to above a 620 credit score, indicating that this seems to be an important number for small business lenders.

Now, that doesn’t mean a lower credit score will necessarily stop you from getting financing or that a higher one will guarantee you a loan: this is just correlation.

But what it does mean is that, if you’re below the average credit score range here, you’ve definitely got some work to do. Every small business needs financing to help take things to the next level, so don’t leave it up to fate or the generosity of a lender—strengthening your credit score is a proven way to up the probability of getting a loan.

Digging a Little Deeper

A higher credit score is strongly correlated not just with more loan eligibility but also lower APRs.

That’s right: generally speaking, the higher your credit score, the more loan products you can pick from and the lower their APRs will be.

Here’s how your credit score matches up with the kinds of loans you’re likely to qualify for:

Check out the full-size image.

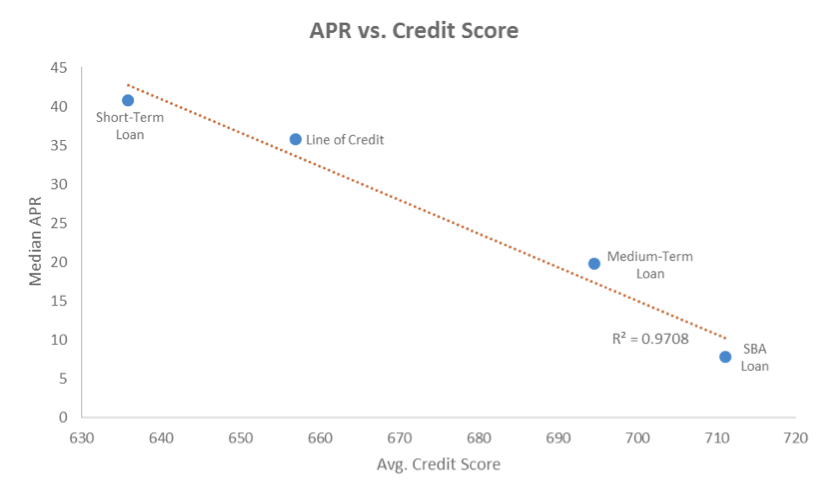

And here’s an illustration of the relationship between your credit score and average loan APR:

Check out the full-size image.

This data shows how higher credit scores match up with less expensive loans—like an SBA loan with a median APR of about 7%—while the lowest credit scores tend to pair with short-term loans with 40+% APRs.

It also shows a distinct trend: as the average credit score increases, the median APR decreases. While you might have thought your personal credit score would be totally irrelevant to getting financing for your business, it turns out that your score actually has a big impact on the availability and cost of that funding.

All things considered, your credit score seems pretty important now, right? It’ll affect what loans you can get from a lender as well as how much those loans will cost: definitely not something to take lightly!

What to do if Your Credit Score Isn’t in the Range You Want it to Be

If your credit score falls into a range where you don’t have many business loan or credit options, don’t worry: your score can improve—it just takes some time and effort.

If you’re looking to boost your credit score to open up options for your business, here a few steps you can take:

Pay On Time, In Full, Every Time

When it comes to building credit, these three things are about as basic as it gets. Your credit score made up a few different factors: namely, your payment history, the amount you owe relative to your available credit, the length of your credit history, your mix of credit types, and the amount of new credit accounts you have. Your payment history, though, is the most important factor. Simply put, if you never pay your balance on time, your credit will suffer because of it. The impact delinquent payments have on your credit score depend on how much you owe, and how late the payments are. To win the credit score game, be sure to consistently pay your balances on time.

Don’t Take on Too Much Debt

This is a smart move just to stay away from a tricky situation where you can’t pay back what you owe. But generally, making sure you don’t take on too much debt relative to the credit available to you will help keep your score in the green. By keeping what’s called your credit utilization low, you’ll come off as a less-risky borrower. As a rule of thumb, try to keep your credit utilization below 30%. This means that if you have a credit line of $10,000, you never have more than $3,000 on your card.

Check Your Credit Reports for Errors

Did you know that 1 in 5 credit reports contain errors in them? If you haven’t checked your credit report in a while, now’s the time to do so. Finding and disputing an error that’s hurting your credit score could play a big role in boosting your score.

Avoid Opening Too Many Accounts at Once

Having a mix of different credit types under your name will help build your credit score, but opening too many accounts at once can hurt it. So if you go and apply to a few different credit cards all at once, credit reporting bureaus will take that as risky behavior.

Keep Your Accounts Open

Once you have different credit accounts to your name, keep them open, and continue using them responsibly! The longer you have credit accounts, the better your credit score will be. So keep your accounts open as long as possible to keep your score strong.

***

Understanding how you measure up to other business owners in terms of credit score will help you predict what kinds of funding you can get for your business—and what it’ll cost you. Take care to improve your credit score in order to get the most flexible and affordable options out there.

The post What’s the Average Credit Score Range for Small Business Owners (And What Does That Mean for You)? appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/average-credit-score-range

No comments:

Post a Comment