It takes many things to start and run a successful small business: passion, determination, discipline, and the right people, but the best-laid plans will go nowhere without one key ingredient—cash. The way you manage your cash flow can make or break your business and affect your ability to grow.

Small business owners need an easy formula to help them analyze how they use cash and project how much cash they’re going to need to grow their business and meet their future obligations.

Two cash flow reports that every business owner should know are the statement of cash flows and the cash flow forecast. Here’s an easy formula for each.

The Statement of Cash Flows

As an accountant, I’ve heard this question over and over again from many small business owners:

“If I have a profit for the year, why don’t I have any money in my bank account?”

Cash flow is simply the movement of money in and out of a business. All business owners are familiar with the profit and loss and balance sheet statements, but fewer understand the statement of cash flows or review it regularly.

The statement of cash flows uses information from both the P&L and balance sheet to show the sources of cash inflows and outflows during the period.

This information can shed some light on the “where is my money going” dilemma.

Here’s how it works:

Transactions are categorized into three buckets of activities:

- Operating activities: Cash generated or used to run the day-to-day operations of your business.

- Investing activities: Cash used for investing in assets like securities, bonds, equipment, or other fixed assets and cash generated from the sale of these types of assets.

- Financing activities: Cash generated from loan or capital contributions by owners and payments made to reduce loan balances or pay distributions or dividends to the shareholders or owners.

Once your transactions have been categorized, the formula for the statement of cash flows looks like this:

Cash from operating activities +(-)

Cash from investing activities +(-)

Cash from financing activities +

Beginning cash balance =

Ending cash balance

The statement of cash flows provides insight into how a business is managing its money. Let’s look at an example.

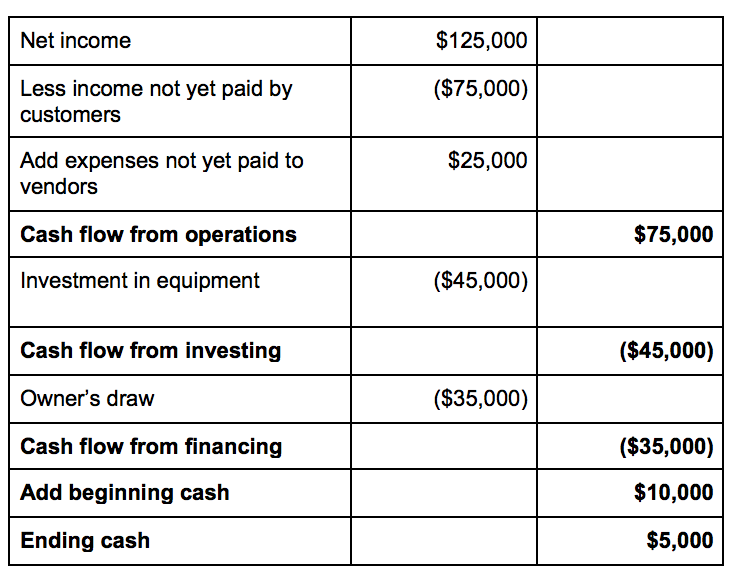

Company A has $125,000 of profit for the year but only $5,000 in the bank at the end of the year.

How can this be? Let’s take a look at a rough outline of their statement of cash flows to see what’s going on.

This example illustrates why it’s so important to review the P&L, balance sheet, and the statement of cash flows in order to get the full picture of a company’s finances. While Company A was profitable, they still had $75,000 uncollected from their customers and owed vendors $25,000 at the end of the year. These non-cash transactions results in a cash basis income of only $75,000 for the period. They also used $45,000 to purchase new equipment, and the owner took out $35,000 as a draw from the company, which left only $5,000 in the bank at the end of the year.

The Cash Flow Forecast

A cash flow forecast helps businesses predict what their cash balance will be in the future.

This report can help a business determine whether they will be able to meet their financial obligations by taking into account the current cash balance and adding or subtracting expected future cash inflows and outflows.

It can also indicate whether it’s a good time to consider making an investment or to seek funding from business loans, sales of property, or investors.

To create a cash flow forecast, you start with your current cash balance and add the amount of cash you expect to receive during the forecast period. This could be cash from customers, loan proceeds, or cash from investors.

Then you deduct your expected cash outflows for the period including unpaid bills to vendors, loan payments, payroll, and other fixed expenses that must be paid during the period. A cash flow forecast is typically reported by period such as week, month, or quarter.

The formula looks like this:

Beginning cash + projected inflows – projected outflows = Ending cash

Let’s look at an example.

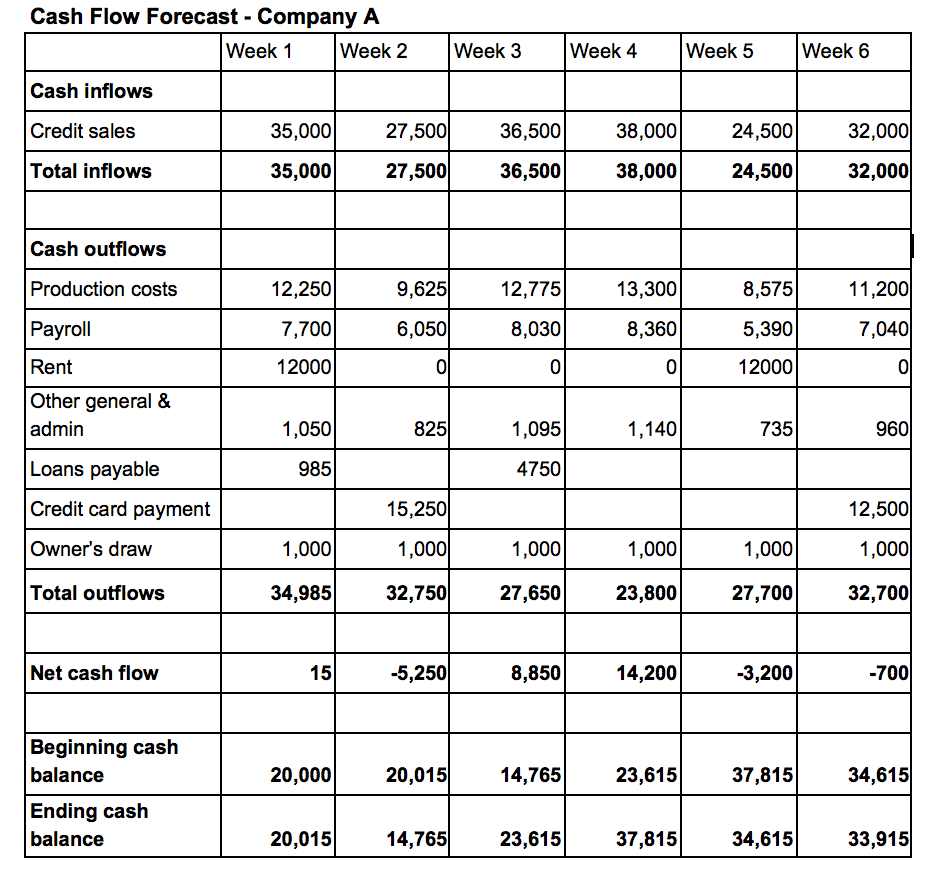

Company A wants to buy a new machine for $25,000 in order to increase production to meet increasing customer demands, and they need to decide whether to finance the purchase or pay with cash. Either way, the bank requires that they maintain a balance of $15,000 in their account at all times. The owner has done an analysis of the expected cash inflows and outflows for the next six weeks:

This forecast indicates a few things:

This forecast indicates a few things:

- In week 2, the cash balance is expected to fall below the $15,000 minimum balance required by the bank, so perhaps the owner can defer his $1,000 draw until week 3 when there is a surplus of cash.

- The ending balance at the end of week 6 is $33,915, which is only $18,915 more than the required minimum balance and doesn’t leave enough cash to purchase the equipment.

By preparing the cash flow forecast, Company A determines that in order to purchase the machine during the next six weeks, they need to seek outside financing for at least part of the purchase so they can maintain their minimum required balance and be able to meet their other financial obligations.

Some Resources That Can Help You Master the Cash Flow Formula

There are lots of resources available to help businesses manage their cash flow.

Many accounting programs, such as QuickBooks, have built in tools to help you create a statement of cash flows or cash flow forecast.

You can find articles, calculators, and templates to help you create a statement of cash flows or a cash flow forecast at the U.S. Small Business Administration website, and you can also visit the SCORE website to read articles and find a mentor to help you with your cash flow analysis.

The post An Easy Cash Flow Formula Any Small Business Can Utilize appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/cash-flow-formula

No comments:

Post a Comment