How to Open a Restaurant and Make It Successful

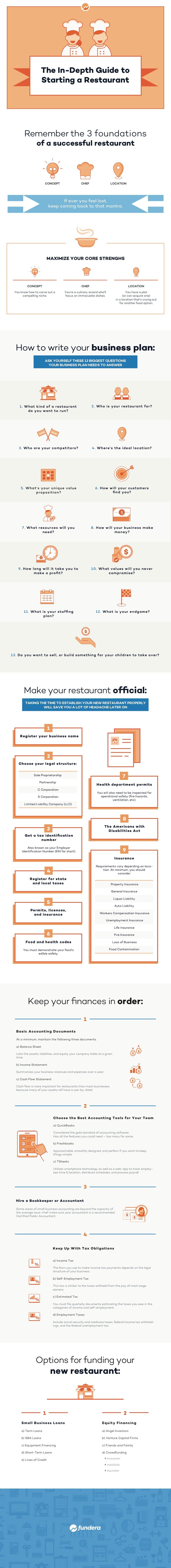

- Make your restaurant business plan. Ask yourself the 13 biggest questions your business plan needs to answer

- Make your restaurant official. Taking the time to establish your new restaurant properly will save you a lot of headache later.

- Keep your finances in order. Be sure to acquire proper accounting software, hire a bookkeeper or accountant, and keep up with tax obligations.

If you’ve done much reading online on how to open a restaurant, you’ve probably mostly come across article upon article citing all the reasons you shouldn’t.

But don’t listen to the pessimists—you have a dream. If you’ve heard the arguments of all the naysayers, yet you still can’t let go of your restauranting dreams—we’ve got the step-by-step instructions you need for starting a restaurant.

First, the Three Pillars of How to Open a Restaurant

Before you get overwhelmed by all the possibilities, focus on the three pillars of starting a restaurant:

Concept. Chef. Location.

Whatever background or level of experience you come from, nothing can totally prepare you for starting your first restaurant. Even more, no matter how much you read or what research you do, there are certain things about being a restaurateur that you can truly only learn from experience. Nonetheless, with this guide on how to open a restaurant, we’ll do our very best to prepare you for most things that starting a restaurant could throw your way.

How to Open a Restaurant in the Perfect Niche

In our experience as diverse eaters, there are a wide variety of eateries out there in the world, and it takes lots of different skills to keep them running smoothly.

As you look around your own little corner of the universe, what cuisine, service, or convenience do you see as missing? What foodie need is still left to be filled?

If this isn’t narrowing down your options well enough, maybe consider some of these popular restaurant concepts or these top trends will help inspire you.

You’ve got plenty on your plate—no need to reinvent the wheel!

Could a Franchise Restaurant Work For Your?

As you dream about your restaurant venture, perhaps you’re thinking, “I’m not looking to reinvent the wheel here, I just realized that our neighborhood is woefully lacking in honey butter chicken biscuits!”

If this is the case, then it sounds like you might be looking for a franchise.

When you open a franchise, a lot of the work is already done for you. You won’t have to agonize over a menu, how to decorate, or building a marketing plan from scratch. Your future customers will already be well aware of the allure of a fresh glazed Krispy Kreme, a cold cherry limeade, or crispy McNuggets.

This kind of brand recognition—as well as a lower failure rate than independent restaurants—is part of the appeal of opening a franchise.

But as with anything, restaurant franchising has its pros and cons.

While a franchise will come with very helpful brand recognition and a tested plan for success, there are definitely some drawbacks.

First, starting a franchise isn’t cheap. Buying franchise rights is usually non-refundable, and often must come from your personal assets as opposed to a loan.

Plus, the business model you’re investing in isn’t flexible, so there’s little to no room for creativity when it comes to running this business. If your national brand decides to do a complete decor overhaul, you’re going to have to shell out the money for it regardless of your personal preferences. If this is the path you’ve chosen, consider all the pros, cons, and options before you dive in to set yourself up for success on this venture.

How to Open a Restaurant: Writing Your Business Plan

Let’s be honest. When you’re ready to get in the kitchen and delight customers with your delicious recipes, nothing sounds less fun than slowing down all that momentum to sit down and write a research paper.

Spreadsheets? Pie charts? Statistical analysis?

No thanks!

But before you decide to skip this step, just stop and ask yourself:

Would you go about making a brand new and unknown dish without even glancing over a recipe?

In the same way that recipes give you a roadmap to create an excellent dish, your business plan is the recipe you’ll follow to make your restaurant a success.

Ultimately, writing a business plan is about thinking through and answering questions about your future restaurant that force you to contemplate the market you serve, the viability of your overall plan, and challenges you might not have otherwise have thought of.

When done right, this process will help you refine define the next steps involved in opening your restaurant, giving you the highest possible shot at success.

Take a look at the 12 biggest questions you should be answering as part of the business planning process for your future restaurant:

1. What kind of a restaurant do you want to run?

Restaurants come in all shapes and sizes, from food trucks to major franchises. The first step for you is narrowing your interests down to one type of eatery.

Go ahead and write out both a long and a short answer to this question—and then commit the short answer to memory.

This is known as your “elevator pitch,” and it’s something you’ll repeat over and over and over to friends, family, customers, lenders, investors, and just about everyone else.

2. Who is your restaurant for?

This is called your target market—the group of people whom your restaurant is meant to serve.

The more specifically you can answer this question, the better you’ll be able to create a menu, design your environment and overall experience, and build marketing campaigns that meet the needs of your demographic.

Consider creating customer profiles to build a mental picture for yourself and your team members of the individuals you hope to do business with.

When you’re building your profiles, you want to know how many households are in your price point in the area you plan to serve.

Finding a location that has a population that will support your price points—and that isn’t already saturated with similar eateries, will be crucial to your long-term success.

3. Who are your restaurant’s competitors?

Many of the world’s most successful, experienced business owners will tell you not to worry about your competition.

It’s what you do that matters.

This is great advice for when you’re in the thick of running your business. After all, you can’t live your life reacting to everything your competitors do.

But when you’re first starting out, it’s worth at least knowing who your main competitors are and how their restaurants are similar to and different from yours.

Do your research to identify your restaurant’s primary competition. This will save you from creating a business model that too similarly mirrors an already established alternative.

4. Location, location, location

It’s been said a million times, but this is going to be incredibly important in shaping the kind of place you run.

Defining your target market and competitors should already start narrowing down smart and profitable potential locations.

After all, having a high dollar steakhouse in the middle of low-income neighborhood probably won’t stay afloat too long.

At the same time, a taco truck might not fare well in a gated neighborhood full of multi-million dollar mansions. (Wait, who are we kidding? Everyone loves tacos—that business would be brilliant!)

5. What’s your restaurant’s unique value proposition?

Don’t let the fancy terminology scare you. Your “unique value proposition” is essentially just what makes your restaurant different from the competition.

What is it about your menu, service, atmosphere, pricing that will cause your customers to choose you over your competitors?

Potential unique value propositions might include your restaurant location, a unique experience or environment for your patrons, a commitment to sustainable or local food sources, or even offering a new ethnic option to a neighborhood.

An essential part of your unique value is your menu. After you define the items on your menu, and their price points, next you test it. Throw tasting parties, cater a few events, and be open to feedback.

Although your menu will of course change over time, you want to build your business plan around an initial menu that you’re confident in.

6. How will your customers find your restaurant?

Your answer to this question will form the foundation of your restaurant’s marketing strategy:

Will you primarily generate business by word of mouth? Will you pursue paid advertising, and if so through what means? How will your website, social media, or other online presence play into connecting with your customers?

These and other questions will help you define how you’ll turn your target market into a loyal, repeat customer base.

Fortunately, there are lots of great ways to connect with customers that are restaurant-specific. You could invite reviewers and bloggers to write up your menu, hold a big grand opening event, or use popular apps like Yelp or OpenTable to allow customers to find and review your restaurant or even book a reservation online.

In addition, before you open, you’ll want to have a press kit at the ready for any local news sources that show interest, as well as nice photographs of your place to use for online profiles and directories.

7. What resources will your restaurant need?

As the saying goes, it takes money to make money.

What will you need in order to open and run your restaurant? Will you be the head chef, or will you hire someone? What kind of technology will you use for your restaurant’s point of sale transactions? What are the restaurant zoning rules in your area for commercial real estate? Will you hire a branding agency or build the brand yourself? How many employees will you need?

Take the time now to list out all the one-time and recurring expenses you’re likely to incur as part of your cost of doing business—leaving no stone unturned.

Don’t forget research things like the cost of utilities, pest control, and laundry services to get a realistic picture of your full budget.

If you’ll need other non-monetary expenses (like equipment you already own, or a friend or family member’s business contacts), outline those as well.

8. How will your restaurant make money?

You might have a great idea to offer a cuisine or service that customers will love, but that doesn’t necessarily mean your business idea will actually be profitable.

Your business model determines how your restaurant will generate revenue, cover expenses, and eventually make more money than it spends. Many popular restaurants ultimately fail because of a flaw in their business model, so learn from your predecessors here by taking the time to really flesh out the specifics of how your restaurant will make money.

In addition to the pricing of your menu, you’ll want to think about how you will staff, your insurance and license costs, and tax obligations.

9. How long will it take your restaurant to make a profit?

It’s typical for new restaurants to operate at a loss at the beginning—especially for the first year—as they invest in needed resources, work to acquire customers, and work out the kinks in the business model.

But in the long run, we assume you’ve gone into business to make money off of your tasty menu!

Use a revenue forecast to determine how long it will take to recuperate your initial investment, break even, and run a profitable business.

10. What values will you never compromise in running your restaurant?

When the going gets tough, knowing what you stand for is critical to making the best decision at every turn.

What values are most important to you, both personally and as a business? What are your non-negotiables?

Putting your business’s core values on paper from the outset will help you with everything from making the right vendor choices to how your hours or menu might change when faced with a critical fork in the road.

11. What is your staffing plan for your restaurant?

Little-known fact—great service makes food taste better.

Having a skilled and hardworking staff starts with finding great candidates. Of course, there are the usual means of posting in local papers, job websites, and the classic sign in the window. But finding really quality staff is best achieved through personal connections.

Your head chef, friends, and family will be the place to start looking for stand-up, smart, reliable people. There’s a very good chance that your chef will want to bring people they have worked with in the past that fit into your company’s culture.

Once you find them, you’ll next have to train them.

Good foundational training on the rigid rules of food service and customer service sets an important precedent for their time as part of the face of your company.

Having an engaged management team to support your staff is a recipe for consistently great customer service—and being consistent in service as well as food quality, encourages repeat customers!

12. What’s your endgame for your restaurant?

Are you building a restaurant that you hope to eventually sell, or are you working towards a long-term, sustainable business? Do you dream of starting a small diner you could pass down to your children or grandchildren, a medium-sized local chain, or the future McDonald’s of Thai food?

Knowing where you want to end up, and when, will help to inform many of your business decisions along the way. Take the time now to outline your long-term endgame, as well as the steps you foresee taking to get there.

Starting a Restaurant? Make It Official

Now that you’ve done the big picture planning, it’s time to get down to the meat and potatoes.

When you’re first starting out, you’ll face more paperwork and legal hoops to jump through than at any other point in your business.

We know this part is not the most exciting, but persevere! Taking the time to appropriately establish your new restaurant from the beginning will save you a lot of headache (and potentially even greater consequences) down the line.

Here are the main steps you’ll need to take to get your business legally established with the proper federal, state, and local authorities.

1. Register Your Restaurant’s Official Business Name

If you plan to use a unique name for your business, go ahead and file your “doing business as” name with your state’s agency.

Even if you decide to change your legal structure down the line, filing your DBA early will keep you from losing your clever name idea to a fellow restaurateur.

2. Choose Your Restaurant’s Legal Structure

When you’re ready, the next “official” task on your on your new business to do list is to decide on a business entity for your restaurant.

The structure you choose will impact how you file state and federal business taxes, the roles of different team members, and how you can be held liable in the event that someone files a legal claim against your business.

Because of the long-term and potentially weighty impact of your chosen business structure, it’s a good idea to consult a business attorney to help you make this choice.

Even so, we’ll give you a quick primer here into the various business structures you can choose from.

Sole Proprietorship

This is the most basic form of business structure, in which you alone own the company and are responsible for any liabilities associated with it.

If you plan to have a food truck, pop up, or any very small operation and won’t be taking on fixed assets or hiring any employees, a sole proprietorship might be the perfect structure for you.

And the best news?

You don’t have to take any formal action to form a sole proprietorship!

If you’ll be operating under your own name, you can just jump right into business. And if you have a clever idea for a business name, your “doing business as” filing (from above) will be all you need.

Partnership

This structure defines a single business in which two or more individuals are owners.

There are a few different partnership structures you can choose from, including a general partnership, limited partnership, or a joint venture.

Most experienced entrepreneurs don’t recommend partnerships as a business structure because they don’t offer much protection from liability.

It’s also important to keep in mind that a partnership is much like a marriage, in that you will work closely with and be both financially and legally tied to your business partner for a long time.

Make sure you choose a business partner that you can work well with for the long haul, and put clear terms and expectations in writing from the beginning detailing the roles and responsibilities of each party.

Corporation

A corporation is a more complex business structure usually reserved for larger companies, or those in particularly high-liability industries looking for a little extra insulation.

Most attorneys tend to put restaurants in this high-liability category, so that along with the number of employees you’ll need to hire suggests that a corporation structure is most likely to be recommended.

That said, keep in mind that establishing a corporation requires having a board of directors as well as officers, and has more complicated tax filing requirements.

So consult your attorney, but also be prepared that the process might be a bit complex.

S-Corporation

Structured very similarly to a regular C-corporation, S-Corporations stand out because they’re taxed at the individual business owner level, rather than being taxed corporately.

If you think you may need the structure of a corporation but don’t want to mess with complicated dividend filings, an S-Corp might be a great middle ground for you.

Limited Liability Company (LLC)

Offering the liability protections of a corporation along with the flexibility and tax simplicity of a sole proprietorship or partnership, the limited liability company (LLC) is a “best of both worlds” business structure that has grown significantly in popularity over recent years.

Entrepreneurs who opt for an LLC structure can choose between a single-officer LLC, a partnership LLC, or a limited-liability corporation.

Again, choosing a structure for your business is one area where your smartest bet is to consult an attorney for individual advice. It’s an important decision that will have long-term impacts on how you do business, so do your research and make sure that you fully understand the implications of whatever structure you choose.

3. Get a Tax Identification Number for Your Restaurant

Also known as your employer identification number (EIN for short), this number helps the IRS keep track of your business for tax purposes.

Think of it like a social security number for your business.

If you plan to retain employees (think wait staff, hosts and hostesses, cooking staff and even dishwashers)—and especially if your business is established as a corporation or partnership—you’ll need this number to keep things on the up and up.

To obtain an employer identification number, apply online at the IRS website.

4. Register Your Restaurant for State and Local Taxes

In addition to federal business taxes, most U.S. states and territories will require you to pay income and employment taxes for your business. Certain states have additional fiscal requirements, like state-mandated workers’ compensation and unemployment insurance.

Registration, requirements, and filing procedures vary widely from state to state, so check out the business tax information specific to where you live.

5. Secure Permits, Licences, and Insurance for Your Restaurant

The FDA updates the Food Code every four years, but the details of what is required, strongly encouraged, and just optional will vary from state to state, and even between counties.

You could read the 600+ pages published by the FDA, but we would recommend starting by finding your state’s food service code regulation department. No matter where you plan to set up shop, here are some of the highlights you should expect to encounter to get up to code in your area.

This section is very useful, but not comprehensive, so be sure to check in with your local health department to make sure all of your bases are covered.

It’s a good idea to keep a master calendar with reminders for all of your renewal and payment due dates. You don’t want to walk into work one day to find anything has expired!

6. Your Restaurant Will Need Food and Health Codes Licenses

Every operation, big or small, requires some kind of official approval stating you are safely handling the food and beverage you serve, even if it’s free.

The names of these will vary by establishment, but they all certify that you are safely handling, storing, and serving food. And don’t think that having a food cart or even a booth at a festival gets you out of this: they thought of those, too.

Included in this, but with its own special set of permits and rules will be serving alcohol. This covers not only safely serving alcohol but also includes training for dealing with customers that have perhaps overindulged.

7. Health Department Permits

Wait, didn’t we just talk about this?

Not exactly…

The health department has a lot to say about what is safe for the places you want to store, prepare, and serve your food. Your establishment will need to be inspected for operational safety, as well as edible safety.

Think maximum occupancy, fire hazards, ventilation, food surface types, sink placement, restroom regulations, and so on.

8. Make Your Restaurant Compliant With the Americans With Disabilities Act

In 1992, the Department of Justice passed the Americans with Disabilities Act so that consumers and employees with disabilities could avoid discrimination from places of public accommodation.

The complete details of the ADA are pretty detailed, but luckily for us, the Small Business Administration has created this short guide for small businesses to understand what is expected of them.

When you get past all the angles, measurements, and legalese, it boils down to having accommodations in place so that people with disabilities can safely park, travel into your restaurant, order food, and eat at a table.

9. Find Insurance for Your Restaurant

Even though you’ve jumped through every hoop the health department presents with poise and agility, you still need to have some extra safety nets in place.

When it comes to this, small business insurance is like phone apps, there’s one for everything, and some are way more useful than others.

Requirements vary depending on where you live and how you’re funded, but at the very least, you’ll want to consider these greatest hits:

- Property Insurance

- General Insurance

- Liquor Liability

- Auto Liability

- Workers Compensation Insurance

- Unemployment Insurance

- Life Insurance

- Fire Insurance

- Loss of Business

- Food Contamination

How to Open a Restaurant… and Keep Track of Its Finances

You decided to open a restaurant because you love great food and have a passion for the experience of friends and family gathering around the table together. But little did you know, this new adventure will suddenly force you to become not just an expert chef, but a financial pro as well.

If the idea of managing business finances for your new restaurant is about as appealing as undercooked liver and onions, don’t worry!

It’s not as hard as it sounds—we promise.

Here’s a beginner’s guide to what you need to know about managing finances for your new business venture:

Set up Basic Accounting Documents for Your Restaurant

Running a restaurant involves a lot of paperwork. You’ll need accounting documents to file your taxes, apply for business financing, and for internal tracking of your revenue, expenses, and profitability.

And those are just the financial documents!

At a minimum, every restaurant owner should regularly maintain these three basic accounting documents:

Balance Sheet

The balance sheet is essentially a snapshot of your restaurant’s financial standing at a given moment.

It lists the assets, liabilities, and equity your company holds at a given time and is used to calculate the net worth of your business.

Maintaining a “balanced” balance sheet—one in which total assets equals liabilities plus equity—is the foundational tenet of basic bookkeeping.

If you’re not sure how to get started creating a balance sheet for your restaurant, take a look at our free downloadable balance sheet template.

Income Statement

Sometimes called a profit and loss statement, your income statement summarizes your business revenues and expenses over the course of a year, letting you calculate your net profit or loss for that year.

Maintaining an accurate income statement is critical to measuring profitability over time.

Check out our free downloadable income statement template to begin tracking revenue and expenses for your new restaurant from day one.

Cash Flow Statement

Having enough cash on hand to cover expenses can make or break a restaurant’s financial health. In fact, this issue is so important, there is an accounting document dedicated to the tracking of cash flow.

Your cash flow statement reflects the inflow of revenue and outflow of expenses resulting from all your restaurant activities during a specific time period—usually a month or a financial quarter. Inflow will come from serving food and drink to your paying customers, while outflow represents things like purchasing ingredients, payroll, and paying rent and other overhead expenses.

Need help tracking your company’s cash flow? Get started with our free downloadable cash flow template.

Choose the Best (Digital) Tools for Your Restaurant’s Team

Especially with all the moving parts involved in a working restaurant, managing the accounting documents above by hand can get overwhelming fast.

Not to mention employee schedules and timesheets, payroll processing, and all the other logistics that go into keeping your restaurant afloat!

Thankfully, there are several great accounting software options and other useful tools available that will take the guesswork out of your bookkeeping and generate these accounting documents automatically.

Check out our favorite cloud-based accounting and other complementary tools for restaurant owners to find the program that fits your needs.

QuickBooks

Considered the gold standard of accounting software by most professional small business accountants, QuickBooks has all the bells and whistles any small business—from restaurants, to retail, consultants, and more—could ever need.

If you plan to eventually grow a medium to large business with multiple income sources, QuickBooks is your best bet for maximum functionality.

But if you’re keeping it small and are mildly tech-phobic, you might want to consider a simpler option.

Freshbooks

Does just the idea of accounting software make you hyperventilate? If so, Freshbooks might be the best option for your needs.

It has an approachable look and feel, with all the features most small businesses need without additional confusing add-ons.

And the top-notch support team at Freshbooks is highly responsive in helping you work through their easy-to-setup accounting system, making this service ideal for brand new entrepreneurs.

TSheets

When it comes to tracking your employees’ hours and shifts, TSheets is a welcome game-changer.

Tsheets utilizes smartphone technology as well as an easy to use a web interface to track employees’ time and location, distribute schedules, and process payroll.

You can log in to see who’s working when you’re away from your restaurant, and it seamlessly integrates with other great apps like QuickBooks, Square, and Gusto.

WhenIWork

If you’re looking for a simple way to tackle the arduous task of organizing a shift schedule, WhenIWork is going to end your search.

Through its smartphone app, WhenIWork puts scheduling and accountability right into your employees’ pockets. Not only can you instantly distribute schedules to your entire team, but they can also clock in, request time off, and even manage shift trades.

Hire a Bookkeeper or Accountant for Your Restaurant

While the right software can do wonders to help you manage your new restaurant’s finances, there are some areas of small business accounting that are beyond the capacity of the average sous-chef.

Ask around for a recommended certified public accountant and start building a relationship with your new CPA right away.

It’s important to choose someone whose personality fits with yours, who will be available to answer questions as needed, and who can handle financial areas where you have less experience.

Having a CPA experienced in the restaurant industry will help you understand your local laws to avoid problems when it comes servers minimum wage, tips as income, and over time for your staff.

Keep up With Your Restaurant’s Business Tax Obligations

Along with getting your books in order, understanding and fulfilling tax requirements should be a first priority in the financial management of your restaurant.

The consequences for failing to file your state and federal business taxes are severe—as in you could lose your business and even face criminal charges.

So even though dealing with the IRS can be intimidating, this isn’t something you can ignore.

Let’s break down the main business tax obligations you’ll need to keep track of:

Income Tax

All businesses must file annual income tax returns and make payments based on revenue received.

The exact tax form you use to make income tax payments depends on the structure of your business: sole proprietorship, partnership, corporation, S-corporation, or limited liability company (LLC).

Self-Employment Tax

Individuals who work for themselves (including small business owners) must pay social security and Medicare taxes via a self-employment tax. This tax is similar to the taxes withheld from the pay of most wage earners.

Estimated Tax

Income and self-employment taxes both qualify as “pay as you go” taxes. You’ll need to file quarterly documents estimating the taxes you owe in these categories and make payments accordingly.

Click here for forms and more information about how to make quarterly estimated tax payments.

Employment Taxes

Since you’ll probably have employees working in your restaurant, you’ll face additional tax obligations related to those employees, including social security and Medicare taxes, federal income tax withholdings, and the federal unemployment tax.

Learn about the specific IRS information about filing employment taxes for your business.

Are you worried about filing quarterly taxes and otherwise keeping up with your tax obligations as a business?

Here’s a more extensive breakdown of the steps involved and what you’ll need to know.

Funding Your Newly Opened Restaurant

Let’s be honest—financially speaking, figuring out how to open up a restaurant isn’t easy.

Even if your ambition is for a modest sidewalk cafe, the costs of construction, permits, staffing, marketing, equipment, and of course the food add up to a little more than you probably have stored in your piggy bank.

So unless you happen to be independently wealthy, you’ll likely need some funding from somewhere for starting a restaurant.

Entrepreneurs choose to finance their businesses in any variety of ways. Maybe you’ll reach out to friends and family, pursue debt financing in the form of a business loan, or even work with an investor!

Below, we’ll review the basics of various financing options you may want to consider.

Small Business Loans for Starting a Restaurant

One of the most common ways small business owners access financing is by borrowing funds through a bank or alternative lender.

The growth of the alternative lending industry has brought about a wide variety of loan products to meet the needs of entrepreneurs, each with different costs, payment structures, and application processes.

If you think you may eventually need a business loan to fund your restaurant goals, take a moment to review this quick breakdown of the most common loan types sought by small business owners:

Term Loans

Probably the first thing you think of when you imagine business lending, term loans offer a set repayment time, set number of payments, and have a fixed or variable interest rate.

Depending on your business needs, credit rating, and other factors, there are a wide variety of term loans available to many small business owners—both from traditional banks and from non-bank alternative lenders—and with terms ranging from one year with daily payments up to five-year terms with monthly payments, and everything in between.

SBA Loans

Because of the risky nature of small business lending, many commercial lenders have in the past been hesitant to lend money to small business owners, especially new restaurant ventures.

As a solution, the Small Business Administration began guaranteeing as much as 80% of the loan principal for term loans through participating lending institutions. This could be a viable option if you are already experienced in the food industry. (Otherwise, you probably won’t be considered.)

The SBA offers a variety of loan programs, including for restaurateurs. If you plan to use an SBA loan as your main source of funding to start your restaurant, you will need to go into this process with your ducks in a row. Write a stellar business plan that highlights the uniqueness of your idea, and be prepared to have 20%-30% of your loan amount in cash—or to take out a mortgage on your home.

Keep in mind, though, that while the SBA’s stamp of approval may make some lenders more willing to consider applicants who don’t fall within their strict loan criteria, applying for an SBA loan still involves lengthy paperwork, and the process can take several months.

Equipment Financing

If you specifically need cash to make a big equipment purchase (like point of sale technology, commercial kitchen appliances, flatware, or furniture) for your new establishment, equipment financing might be the right choice for you.

This financing product works very similarly to a car loan, with the amount you can borrow depending on the price and type of equipment you’re buying.

And because the equipment itself serves as collateral, you likely won’t be asked to put up additional collateral for the loan.

Equipment financing terms typically work at a fixed interest rate—usually between 8% and 30%—with a fixed term length so your payments will be the same from month to month.

Short-Term Loans

For businesses with smaller and immediate financing needs, short-term loans can be a lifesaver. These loans work similarly to traditional term loans but cover amounts in the $2,500 to $250,000 range with terms of between three and 18 months.

With interest rates as low as 14%, short-term loan providers can often get you cash in hand in as few as two days, letting you make rent, cover payroll, pay food vendors, or meet other immediate overhead expenses—even when cash is tight.

Line of Credit

Perhaps the most flexible form of business financing available, a business line of credit gives you capital to draw upon to meet a variety of business needs.

Once established, you can draw on your line of credit as you would a personal credit card, to get more working capital, buy inventory, handle seasonal cash flows, pay off other debts, or address almost any other business need.

If you do plan to apply for a small business loan at any point in the future, make sure that you are regularly reviewing your personal and business credit reports, as well as doing what you can improve your credit score.

Along with your annual revenue, time in business, and average bank balance, your personal and business credit scores are the single most important factor that will determine your ability to qualify for a small business loan.

Business Funding Alternatives for Starting a Restaurant

Small business loans aren’t the only way to finance your restaurant.

Here are just a few of the alternatives you might consider to cover the initial costs of your new restaurant venture:

Angel Investors

Every day, thousands of investors are contributing both finances and expertise to what they see as the “next big thing.” If your restaurant idea has a high chance of profitability, you may be able to spark the interest of a capital investor.

Angel investors are individuals of means—often successful entrepreneurs themselves— who choose to personally invest in a wide variety of startup ventures as a means of furthering their own incomes and giving back to other entrepreneurs with their resources and expertise.

In exchange for their funds and expertise, not only will you be giving this individual equity shares in your business, but in many cases they’ll also obtain a certain amount of decision making power.

So before you hand over the proverbial keys to your restaurant to an angel investor, be sure you’ve agreed to drive in the same direction.

Venture Capital Firms

Similar to angel investors, venture capital firms are more organized, established organizations that fund larger-scale business ventures by purchasing a percentage of the business in a startup’s “round” of funding.

Funding your business through a venture capital firm can be highly competitive and has a certain barrier to entry that most restaurant owners aren’t able to meet. Most venture capital firms make minimum investments in the million dollar range, so consider this option only if you’re goals are to build a larger scale chain of restaurants, as opposed to just one or a few locations.

Friends and Family

If your family and friends seem supportive of your restaurant venture, they might be willing to invest funds to help you succeed.

Of course, accepting funds from friends or family comes with its own set of strings attached. Even when everyone has the best of intentions, loss of income from a failed restaurant deal can ruin relationships.

Should you choose to go this route, do everything you can to keep it professional. Offer a well-thought-out, professional-quality investment proposal as you would to any other investor, and set the exact terms of the investment in writing.

The more negotiated up front, the less risk you’ll have of dealing with miscommunications or relational challenges with those closest to you down the line.

Restaurants sometimes offer dining perks these investors, like a permanent reservation or discount, to sweeten the deal.

Crowdfunding

Platforms like Kickstarter or IndieGoGo are great for smaller ventures looking to offer products or other goodies in exchange for a contribution.

FoodStart is specifically designed for independent restaurants & food trucks to receive community funding through their Amazon accounts. This could be a great option for eateries with a dedicated customer base to expand their operation. Having the support of your community greatly increases the chances for success.

Larger scale ventures might consider equity crowdfunding platforms like EquityNet, which sells company equity to capital investors in a crowdfunding format.

Don’t underestimate the value of a few hundred $50, $20, or even $10 pledges toward your overall fundraising goal. That money adds up fast.

And if your campaign goes viral—catching the attention of folks outside of your immediate network—the possibilities grow even further.

How to Open a Restaurant: Ready, Set, Go!

There you have it, friends! The ultimate guide to how to open a restaurant.

Will following these instructions guarantee that you never make a mistake or hit unexpected bumps in the road?

Absolutely not.

Being a restaurateur is truly not for the faint of heart, as owning your own restaurant is a never-ending, 24/7 adventure. The challenges and questions that come up for each restaurant owner will vary as widely as the different eateries and states they operate in.

Even so, we hope that this guide answered some important questions and gave you a preview of things to come. Best of luck—and we hope you’ll invite us for dinner!

The post How to Open a Restaurant: 3 Steps to Making It Successful appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/starting-a-restaurant/

No comments:

Post a Comment