At first glance, a general ledger might not seem like the most interesting or riveting topic to dive deep into, but the fact is that knowing the ins and outs of how general ledgers work is absolutely essential for small business owners.

Staying on top of your financials when running a business is paramount, and a general ledger can help you do just that. Let’s take a quick look at what a general ledger is and what it means for your business.

What Is a General Ledger?

A general ledger is a master of all the accounts your company has—it’s the complete record of financial transactions over the life of the company.

How Does a General Ledger Work?

Now that you know the general ledger definition, let’s discuss an example so you have a better understanding of what it looks like.

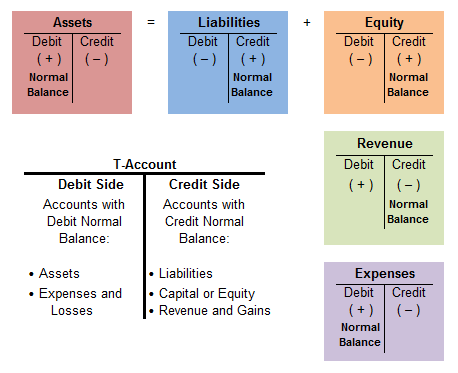

You should be making entries in your accounting system every day: checks, invoices, deposits. All of these hit your general ledger and are considered posting transactions. For instance, if you write a check to pay rent, that transaction will hit two accounts in your general ledger. First, it will credit (lower the balance of) your business bank account and debit (increase the balance of) your rent expense account. If it’s not obvious, general ledgers use the double-entry accounting method. This is the method most businesses should be using, unless you’re a solopreneur. If you’re a solopreneur, the single-entry accounting method works just fine.

Each account on the general ledger has what’s considered a “normal balance.” Here’s a great tool to show you what these normal balances should be:

We got this here.

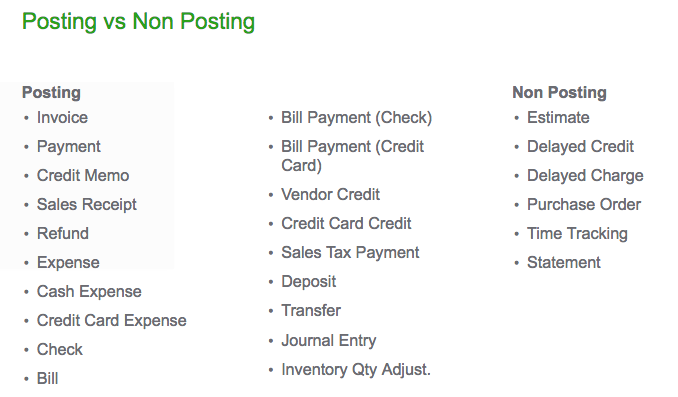

Not every transaction will hit your general ledger, though. There are a few transactions in software like QuickBooks Online that are considered “non-posting” that never touch your general ledger. Here’s a list of posting versus non-posting in Quickbooks Online as an example:

For the record, it is odd that “statement” is listed here. Technically, a statement is not a transaction. But let’s not get off topic here. You’re probably wondering why some transactions are posting and others are non-posting. Let’s look at the non-posting transactions one by one to decipher. We’ll define each and explain why they don’t show up on general ledger reports:

- Estimates. This is when you tell your customer what you plan on selling them and what the price will be. No sale has been made yet.

- Delayed Credit/Charge. These transactions are ways for you to keep a tally of services or items for which you want to invoice a customer at a later date. Again, no sale has been made… yet.

- Purchase Order. The flipside of an estimate, this is a transaction that you give a vendor to let them know what you plan on buying from them and at what cost. No purchase has been made.

- Time Tracking. Time transactions can be used to track time that will eventually show up on an employee paycheck or time for which a client will be invoiced at a later date.

- Statement. This isn’t a transaction. It’s actually a list of transactions that have already posted to your general ledger.

Why Every Small Business Owner Needs a General Ledger

The general ledger can be the most useful tool in your business—it’s a simple way to view spending in order to keep you business on track. Specifically:

- To make sure your books are accurate. A quick glance through the general ledger can show where you might have made a mistake on data entry or where numbers aren’t adding up. You can review a general ledger report to make sure that everything posting to telephone is correct. If you see all AT&T and then one for Consumers Energy—you’ll know that one was misposted.

- To track financial expenditures. We all know that you can’t spend more than you earn without consequences. Reviewing the general ledger will help you stay on top of spending and guarantee that vehicle payments aren’t allocated to an Auto Expense account. These should be split between a Loan/Liability account and an expense account to track interest.

- To track the company’s transactions. Have you deposited personal funds into your business bank account to cover costs? Ever paid for business expenses with personal funds? A general ledger report will help make sure that those deposits aren’t recorded as income and those expenses are on the books. We all know how difficult it is to separate business and personal expenses. A general ledger makes it that much easier.

General Ledger Templates

If you aren’t a user of a major accounting software, you obviously won’t be able to access your general ledger automatically. It’s a good time to note that it’s pretty important you invest in an accounting software, as it will make managing your finances much more streamlined and organized. If you’re not quite there yet, though, and you want a general ledger, here is a round-up of a few great general ledger templates:

- PDF General Ledger Template from Double Entry Bookkeeping

- Excel General Ledger Template from At Your Business

- Word General Ledger Template from Office Templates Online

- Excel General Ledger Template from Excel Templates

While all of the above general ledger template options can work for your business, we recommend using an Excel file. One day, when you’re ready to upgrade to an accounting software, this will allow for an easier transition.

General Ledger Examples

If you do have an accounting software and are unsure how to access your general ledger, below are a few “how-to” find your general ledger examples:

- General Ledger Example #1: How to find the general ledger in QuickBooks Online.

- General Ledger Example #2: How to run a general ledger report in QuickBooks Desktop.

- General Ledger Example #3: How to run a general ledger report in Xero.

- General Ledger Example #4: How to access your general ledger report in FreshBooks.

For QuickBooks Online users, you can also reference the video below to find your QuickBooks general ledger:

If your accounting software is not listed above, you’re most likely to find the general ledger under the reports section of your software. If you still cannot locate it, reach out to your bookkeeper or the support team for your accounting software.

Reading Your General Ledger

In case you’re not convinced yet, we’ll say it one more time: whether you do your own bookkeeping or outsource to someone, you need to be familiar with your general ledger. Every financial transaction that impacts your business is in your general ledger in the form of a posting transaction. We repeat: Every financial transaction that impacts your business in in the general ledger. Given how important it is for you to know the ins and outs of your business’s financial activity, the general ledger will provide the insight you absolutely need.

When you’re able to access your general ledger (or do your general ledger accounting with a template from above), it’s important you know how to read it. Here’s how:

The 7 General Ledger Classifications

As a guide, you’ll want to know that your general ledger is usually made up of seven different categories:

- Assets. These are things such as cash, accounts receivable, equipment, and more.

- Liabilities. This includes accounts payable, loans payable, etc.

- Stockholders’ equity. For example, common stock or retained earnings.

- Operating revenue. This is pretty obvious: think sales.

- Operating expenses. What does it cost to keep your business running? Salaries, rent, etc.

- Non-operating revenue and gains. For example, investment income.

- Non-operating expenses and losses. This includes interest expense, etc.

Many of these terms probably look familiar, right?

For starters, the first three on the list are what you’ll find on your balance sheet. Your balance sheet is home to your permanent accounts, or the ones that will not be closed out at the end of the year. They’ll carry on to the next.

The other four on the list are—you guessed it—what you’ll find on your profit and loss or income statement. (Reminder: income statement and profit and loss are the same thing). These are “temporary” accounts as they will be closed at the end of the year. You’ll begin the next year with no balance in each of these. Any balances you end the year with, as you probably know, are combined and usually entered into “stockholders’ equity” on the balance sheet.

When you’re doing your general ledger accounting, if you don’t see one of the accounts mentioned above, it is usually because there wasn’t any activity in it for that period. You’ll want to check on this regardless if it occurs, but don’t be alarmed if you see it!

General Ledger vs. Other Financial Reports

So how does your general ledger compare to other financial reports?

For starters, people often confuse the chart of accounts with the general ledger. They are not, however, the same thing. A chart of accounts is the listing of the accounts that you’ve made available for recording transactions in your general ledger.

You might also might think the general ledger and general journal are the same thing. Again, don’t be fooled. A general journal is simply a chronological record of transactions.

The best way to think about your general ledger is as the most comprehensive summary of the different parts of your accounting. It is the source from which all financial reports are generated, such as your profit and loss and balance sheet. It’s why you recognize so many of the terms above. But odds are good that you won’t be reviewing a general ledger report very often. And that’s okay, as long as you are reviewing other financial statements.

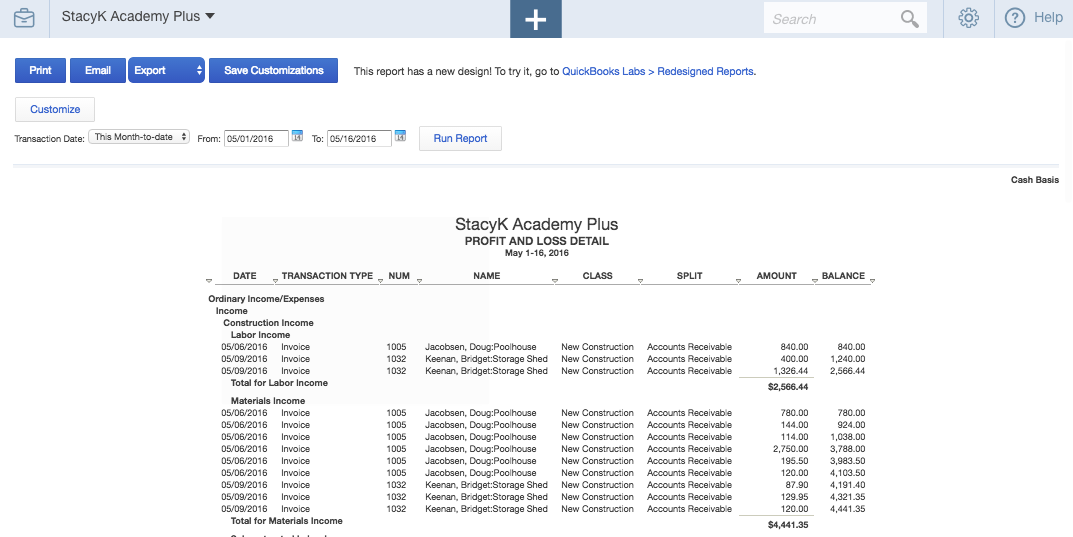

Most small business owners review their profit and loss and balance sheet reports monthly, if not weekly—or even more often. They’re familiar with drilling down into specific accounts to make sure that everything has been allocated correctly. Here is an an example profit and loss detail that lists all income and expense transactions for the specified period:

This profit and loss detail provides a lot of great information. And, for example, in QuickBooks Online, users can customize reports and have them emailed to themselves or others on a recurring schedule:

Whether you’re referencing your general ledger, your profit and loss, or your balance sheet, what’s most important is that you’re doing it often. Our recommendation is weekly. If you are using a software like QuickBooks Online where you can automatically generate reports, there really is no excuse not to.

You’ll get the information you need if you’re consistently checking in on these reports. And, if you are in fact reviewing your financial statement detail reports on a weekly basis, your books will also be in near-perfect shape by the time your tax preparer asks for the general ledger at the end of the year.

You really have no excuse. If staying on top of your general ledger and other financial statements will not only ensure you know what you need to know about your finances, but will make the ever difficult task of filing your business taxes a lot easier for all parties involved, why wouldn’t?

Now, go pull your general ledger report and set up your accounting system to send weekly reports automatically. You won’t regret it.

The post What Is a General Ledger? (And Why Your Business Needs One) appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/general-ledger/

No comments:

Post a Comment