Managing payroll and HR can be tough for a busy small business owner. Every time you hire someone, there are forms to fill, checks to sign, taxes to pay, regulations to comply with, paid time off to track, and so much more. And if you make a mistake, you could wind up having to pay fines and fees. In fact, 1 in 3 business owners have been in this situation.

Thankfully, there are plenty of payroll companies for small businesses that will take payroll management off your hands. From intuitive apps to accounting firms, you’ve got a huge selection of payroll solutions to pick from.

To help you decide, we’ve compiled a comprehensive guide to the best payroll solutions for small business owners. Here’s our list of the 53 best payroll services for small businesses. We’ll also give you some tips of what to look out for when shopping for a payroll solution.

The Best Payroll Services for Small Business: What Should You Look For?

There are thousands of payroll services, and choosing the right one for your company can be difficult. But one thing is clear: Even if you have just a handful of employees, it’s better to use a payroll solution than to try to do things yourself. The price for messing up is often much higher than the price of your payroll provider, so this is one situation where a small upfront investment can save you money and time down the line.

While every business is different, and you need to pick the right solution for your particular needs, there are a few factors to keep an eye out for when shopping around for the best payroll service for your business.

Pricing

The price for payroll services for small business typically ranges from a $20 to $50 monthly base rate, plus an additional per-employee fee.

For example, you might purchase a payroll service for $39 a month, plus $6 per employee per month. Some companies offer free trials, which we recommend using to get a feel for the software or service. And companies often have multiple plans or tiers depending on what services you need.

Many companies that offer payroll services for small business also offer other HR solutions, such as onboarding help and accounting services. As you might expect, you’ll pay more for all-in-one solutions, so purchase these services as a bundle only if you plan on using everything.

Tax Guarantee

For some entrepreneurs, the whole point of purchasing payroll services for small business is so you don’t have to pay any payroll tax fines or penalties.

Accordingly, there are certain payroll services that come with a guarantee. They promise you won’t face any fines—and if you do, the service will reimburse you.

Don’t see a lack of a guarantee as a deal-breaker, though: it usually depends on how automated or manual the actual service is. If payroll uploading and submitting is all on you, then your taxes probably aren’t guaranteed.

Industry Specifics

If you’re in an industry with specific payroll demands, you’ll want to double-check that your favorite service can handle those extra steps.

For example, restaurants need special payroll filings for tips. And if you hire independent contractors, there are special forms you have to file. If the payroll service you selected can’t handle those specific requirements, you should reconsider your choice.

Necessary Features

What do you actually need from a payroll service? If you’ve just got one or two employees, you might want to only pay for the basics: paying your employees, paying your payroll taxes, and filing your tax forms.

If you have dozens of employees or a fast-growing business, then some extra human resources-focused add-ons, such as recruitment and onboarding support, could be worth paying extra. Just know that the more you get, the more you pay—so when looking for your best payroll service, think about what you need now and in the immediate future.

Ease of Use

Whether you end up choosing a mobile application, a desktop application, or a full-service firm, your payroll service should be easy to figure out. You don’t want to spend as much time learning how to use your payroll service as you would’ve spent doing payroll yourself, after all!

So read reviews online, check out screenshots, and try a free trial if you can to make sure the payroll solution that you’re considering make sense to you.

Customer Service

Can you reach this service by phone? Over email? With live chat support? Are their hours convenient for your business? Have you tried their customer service line a few times to test out whether they’re helpful?

Even with the best payroll services for small business, payroll is complicated. It’s always important to make sure that you have the right customer service options in case something goes wrong.

The Best Payroll Services for Small Business: The Most Popular

Since there are literally hundreds of payroll services for small businesses, name recognition and reputation are particularly important. If a fellow small business owner has used a service with good results, then it’s worth looking into for your own company.

That’s why we began our list of payroll companies by speaking to small business owners to find out which payroll services they use and like. If you don’t want to spend too much time researching and comparing products, purchase one of these payroll solutions:

1. Gusto

A popular all-in-one payroll/HR/benefits system, Gusto (previously known as ZenPayroll) is a user-friendly, intuitive package that automates many of the boring, repetitive, and error-prone tasks that HR and payroll management often come with. From basic payroll to 401(k) and workers’ compensation, Gusto gives you everything in one—plus, they probably integrate with the software you already use for accounting, time tracking, and benefits administration.

You can try a free demo of Gusto for one month, and afterwards it’s a flat rate of $39, plus $6 per employee per month. Pretty good for a comprehensive payroll service for small business!

What Small Business Owners Like About Gusto

We have well over 150 clients using Gusto, and highly recommend it. Our firm, Kruze Consulting, runs HR and accounting for over 175 venture-backed startups, and we recommend Gusto for a number of reasons. Federal and state payroll taxes are a BIG deal – Gusto automatically takes care of payroll taxes, so you don’t have to worry. Gusto also has an autopilot feature, so it runs payroll automatically. You want to be busy running your business, not your payroll! Finally, the cost is pretty reasonable; you can get going for $45 per month ($39 base fee plus $6 per employee).

2. ADP

ADP, or Automatic Data Processing, is the one of the oldest and best-known names in payroll. Over 600,000 businesses across the country rely on ADP to pay their workers. They offer payroll software to businesses of all sizes, whether you’ve got just a handful of employees or are a multinational corporation.

With ADP’s small business packages (designed for 1 to 49 employees), you receive payroll and tax filing software, time and attendance tracking, benefits planning, insurance services, and more. While you might find the price tag a little large, especially compared to some competitors on here, ADP is a powerful tool for any entrepreneur looking for a bit more organization in their lives. Small businesses can get two months free upon sign up.

What Small Business Owners Like About ADP

We have been with ADP since day one. The real benefit comes from their ability to grow with our small business, a true turnkey solution. They offer payroll, retirement services (401K, IRA, and more), company benefit plans (medical, dental, and vision), and company insurance plans (workers comp, liability and others). ADP has a user-friendly dashboard and interface. On top of all of this, their customer support is five star. Over the last ten years, they’ve always gone the extra yard to make sure we’re happy.

-Greg Cruikshank, Founder and CEO, LabRoots

3. Paychex

Although Paychex includes payroll services for any business, their small business product—Paychex Flex—is definitely worth considering. If you have 1 to 49 employees, it’s a great solution for payroll and taxes, business insurance, 401(k)s, and HR management. Paychex is a cloud-based, mobile-friendly service that comes with a high-quality support team, available 24/7, to help you out with any complex questions or issues.

What Small Business Owners Like About Paychex

I started a marketing and branding firm 17 years ago and have used Paychex from the start. The main benefits are convenience and cost. Like many small business owners I run payroll sporadically (not every other Friday or last Monday of a month). There have been times I needed to do it every few weeks and other periods when I am chasing down checks and need a few more days. They have been flexible and easy to work with over the years.

It is definitely cheaper to pay their fee than hire someone to run my payroll. Also I have dozens of people all over the place and Paychex gets the tax paperwork out right away in January. Everyone always tells me my tax info is the first one to arrive (thanks to Paychex). Knowing I can depend on them and do not need to manage the situation is great. One less thing on my to do list.

-Paige Arnof-Fenn, Founder and CEO, Mavens & Moguls

4. Square Payroll

If you’re looking for a fast, easy, intuitive, and tech-friendly solution to payroll processing, it’s hard to beat Square Payroll. This is especially effective for retail businesses that already use Square point of sale and hire contractors or hourly employees. Your hourly employees can clock in and out from the Square app, wherever they are, and taxes are taken care of for you. All in, Square Payroll will run you $29 per month, plus $5 per employee—less expensive than many competitors.

At the moment, Square Payroll is available in 38 states, but they are quickly expanding nationwide.

What Small Business Owners Like About Square Payroll

I researched several options before choosing Square, and they were the most transparent about their pricing and services. Square published all the information we needed on their website. They offer all the services we needed and at a much more affordable cost to us than their competitors. Square won our business by not being painful to get necessary information and have kept it by making it easy to automate payroll and taxes.

My only complaint about their service is that I can’t schedule my employees to receive their paychecks on the 1st and 15th of each month. Payroll runs on those dates, but the money doesn’t get put into their accounts until a few days later. My employees rent apartments, and their rent is due on the 1st of each month. It would be slightly more convenient for them to know that they’re receiving the money they need for rent precisely as they need it each month.

-Adam Moore, CEO, Training Studio LLC

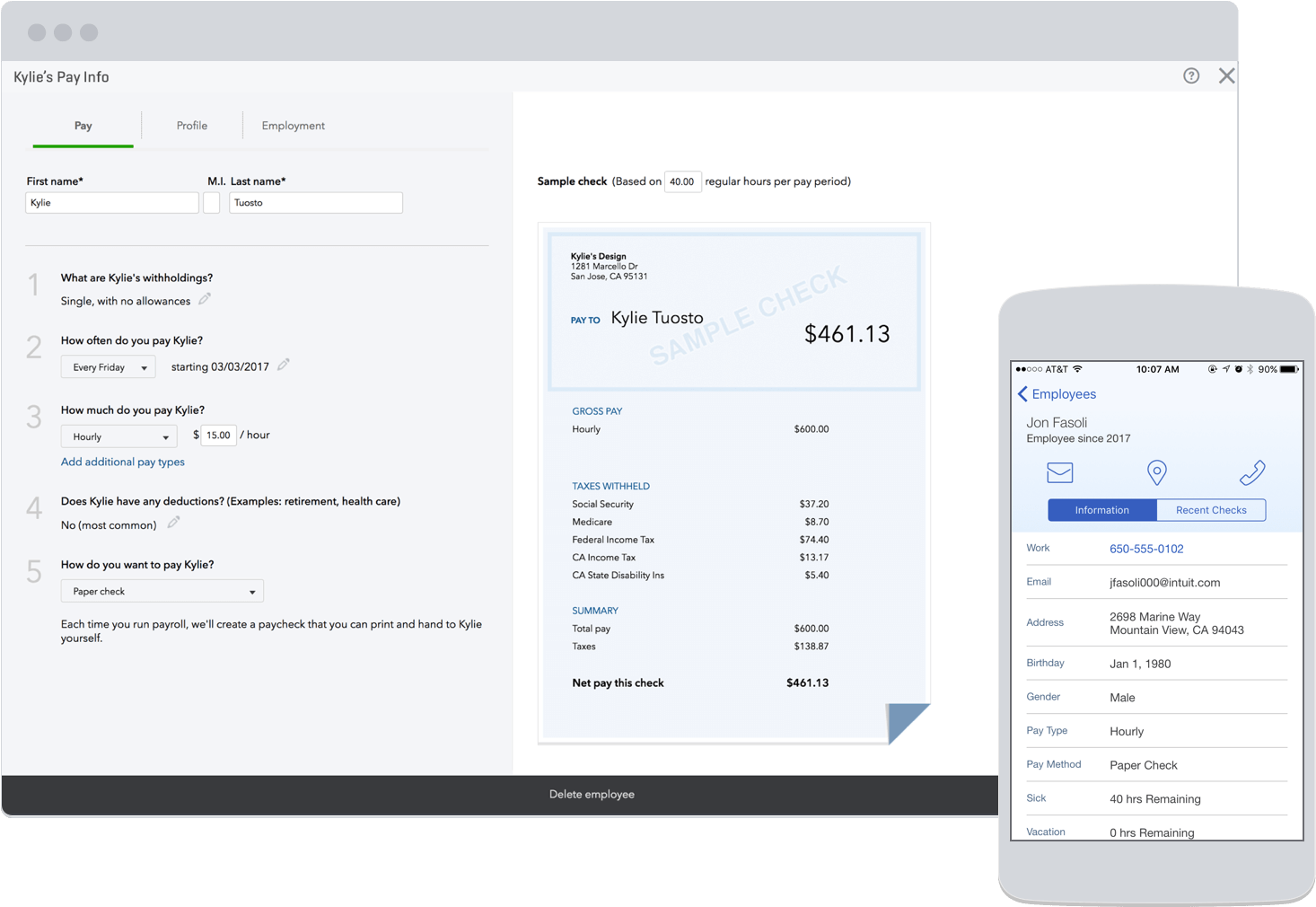

5. Intuit QuickBooks Payroll

Most people know Intuit as a provider of accounting software, but they also have payroll solutions for small businesses. They offer 3 different small business payroll plans—ranging from the payroll basics to white glove automated payroll and tax management—and a host of combination packages with their popular accounting software, QuickBooks Online.

Depending on the plan you choose, you can pay a flat rate of anywhere from $24 to $87 per month, plus $4 per employee per month—but try the free 30 day trial out first to make sure it’s what you need. There’s also a payroll option that links up with QuickBooks Desktop, for businesses that already use that as their accounting software.

What Small Business Owners Like About Intuit Payroll

“I use Intuit Payroll to process payroll weekly. I operate a growing salon with 17 employees and chose Intuit based on ease of use and cost. Ease of use was one of the top decision factors. I really like that I can access and run payroll from anywhere in the world in less than 15 minutes for 17 employees.

QuickBooks Online comes [with the payroll product] at an attractive price, which was my second determining factor when selecting a platform. One downside of the QuickBooks Online version I have is that I need to submit tax forms manually via e-file. There are sometimes issues with this, and I have to manually print and mail documents. But overall, I am very happy with Intuit Payroll / QuickBooks Online and have been using it for over two years now.”

– Lucas Renfroe, Partner, Roots Southern Salon

The Best Payroll Services for Small Business: The Basics

While payroll services for small business often come with other additional features, like HR management tools or regulation compliance, these can be pricier options with steeper learning curves.

Fortunately, all of the popular payroll companies we mentioned above have a basic tier, which handles just payroll and not much else. In addition, there are other good bare-bones payroll services for small business. With the companies below, you’ll get just the basics, without sacrificing quality.

6. PrimePay

PrimePay offers an online payroll system for the computer-savvy or a completely hands-off payroll system run by a dedicated Client Success Representative. They offer 30 day trials of each. Beyond helping with federal, state, and local taxes, they’ll also file your W-2s and make sure you’re 100% compliant. Cost starts at $40 per pay period, plus $2.40 per check.

7. Wagepoint

Want no-stress payroll services for small business? Try out Wagepoint. Their focus on easy setup and simple tools lets you focus your time or energy back on your business. This has all the basics down—direct deposit, payroll taxes, year-end reporting, filing for W-2s and 1099s, and online paystubs. They’ll even calculate commissions, bonuses, or other pay structures automatically. The cost starts at $20 per month, plus $2 per employee.

8. Paylocity

Paylocity is all about efficiency and data. They will take care of payroll and compliance for you, and they offer an array of reports to help you understand your company’s payroll better. If you need a little extra power from them, Paylocity also has online integrations with retirement providers, wellness plans, and point-of-sale systems.

9. Big Fish Payroll Services

From direct deposit to tax services, Big Fish Payroll Services can handle all of your small business’s needs. In addition to time tracking, human resources programs, and payroll reports, Big Fish Payroll Services also allows your employees to view, edit, manage, and verify their own personal information. That saves you the time of having to input employee information yourself.

10. IOIPay

For just the basics, IOIPay handles payroll processing and taxes for businesses of any size. Although they also offer packages for hiring, HR, and employee self-service, their comprehensive payroll plan is straightforward and easy to manage. If you’re looking for no-frills payroll services for small business, IOIPay might fit the bill.

11. CBIZ Flex-Pay Payroll Services

Which do you prefer for payroll: calling, faxing, emailing, or online submissions? No matter what your answer is, CBIZ’s Flex-Pay Payroll Services can help. Customer service is a particular value of CBIZ. If you have any questions, issues, or need to make changes to your payroll partway through the year, CBIZ has a dedicated representative to help.

12. Client Solutions Group

Client Solutions Group’s payroll processing system is an online solution to all your payroll problems, from the basics (previewing and processing payroll) to the advanced (earning and deductions codes, local check printing, and industry-specific customization). Also, CSG encrypts their data and backs it up with dedicated disaster recovery plans.

13. OnPay

OnPay is a straightforward payroll planning, reviewing, and submission tool (plus tax filings and payments). With unlimited payroll processing, an intuitive and mobile program, and a transparent monthly pricing scale, OnPay is a great option for your basic payroll needs. They guarantee all payroll and tax filings. Pricing starts at $36 per month, plus $4 per worker.

14. Optimum Employer Solutions

Optimum’s focus is on handling your payroll quickly and accurately. The company includes tax filing and direct deposits, PTO tracking, form preparation and mailing, and a dedicated site for employee and manager review. They also offer job costing services, so you can estimate how much a project is going to cost your company from a labor stand point.

15. PaySmart

With PaySmart, you can process payroll on a recurring schedule—from weekly to annually, depending on your needs. Whether you’re looking for direct deposit, tax filings, employee benefits, or workers’ compensation, this is one of those no-nonsense payroll services for small business. When you first sign up with PaySmart, a representative will ask a series of questions about your business that will help them put together a customized package for you.

16. Premier Payroll Services

Premier Payroll Services will help with direct deposit, printing and delivering payroll checks, quarterly tax returns, W-2 filing, new-hire reporting, and more. Their software is made by Pay Choice, one of the fastest growing private companies in the United States. Plus, their sister company, MW Group, handles accounting and tax services for small businesses, so they can basically handle all of your financial needs.

17. Integrated Payroll Services

If you’re looking for a small business that helps small businesses, then Integrates Payroll Services is for you. As an independent, family-owned company, IPS can offer customized payroll reports and relationship-oriented service. You can preview payroll records in real time and view historical payroll records. Get the basics with a touch of familiarity here.

18. Diamond Payroll

If you need something specific from a payroll services, chances are good that Diamond Payroll does it. They’ll help with payroll checks, state and federal taxes, year-end tax forms, Affordable Care Act compliance, and other HR operations. In fact, Diamond Payroll guarantees that small business owners won’t have to pay any payroll tax penalties ever again if they use the service—so if you’ve got a bad habit of paying late, check them out. Their website doesn’t look the best, but they offer nearly every basic service you could want.

19. Checkmate Payroll

If you’re the type of entrepreneur who likes to manage on the go, Checkmate Payroll is a secure, trusted provider of payroll and HR services that caters to you. Whether you’re consolidating reports, setting up alerts, or calculating payroll, Checkmate Payroll makes it easy to deal with your small business’s employees. They primarily work with companies in the manufacturing, high tech, hospitality, health care, government, retail, nonprofit, and financial services industries.

20. DM Payroll Services

DM Payroll Services has been helping businesses with payroll since 1962, and their services have evolved and expanded over time. They’ll assist with payroll management, taxes, reports, and compliance, but they also go the extra mile to help clients overcome specific payroll- or human resources-related issues by offering custom packages and top-notch customer service. If you like the idea of accounting professionals helping you with small business payroll, look into this payroll service for small business.

21. PayUSA

PayUSA’s payroll services can help you out whether you have 1 employee, or whether you have 1,000. It’s a flexible, adjustable partner that will help you process payroll, file payroll taxes, manage new hires, deal with workers’ compensation, and more. The cost is similar to competitors, at around $45 per payroll for a company of 25 employees. But if you want add-ons, like time tracking or onboarding, expect to pay extra.

22. MyPayrollHR

Want a simple, online service that syncs with your accounting software? MyPayrollHR could be your solution, especially if you’re currently outgrowing your old, small-scale payroll system. You can set up your payroll system with custom schedules, deductions, and payment types, too. Plus, there’s a guarantee that you won’t pay any late payroll fees. This is an especially good option for businesses that employ hourly workers because you can allocate payroll among different divisions and shifts.

23. Heartland Payroll

Want to make sure your payroll information is absolutely secure? Heartland Payroll offers industry-leading security protocols to keep your data safe, and caters to all types and sizes of businesses. Plus, they actually have an official Anti-Breach Warranty, so you can be sure you’re in protected hands. Whether you’re looking to make mobile payments or simply manage company payroll, Heartland Payroll is an option to pursue.

The Best Payroll Services for Small Business: All-in-One Packages

Payroll is just one part of managing your employees. If you’re into the idea of an all-in-one HR package, combining payroll services for small business with benefits, time tracking, compliance, and more, then this list can help you find the right one.

Some (but not all) of these all-in-one solutions are certified Professional Employer Organizations (PEO). Small businesses can outsource the bulk of employee management tasks to the PEO. The PEO and business both share in employer responsibilities, but the PEO handles most administrative tasks.

Here are the best payroll services for small business that offer all-in-one packages:

24. TriNet

TriNet is a big name among PEOs. They combine extensive payroll processing with benefits, compliance, and more, so you’ve got an all-in-one package that fulfills all of your employee needs—securely in the cloud. They offer different recommended solutions based on your industry, as well as your size and location. If you want help with everything HR-related, TriNet is a great reliable choice for your business. Like most PEOs, prices don’t appear on the website. You have to call and answer a series of questions about your business to get a customized quote.

25. Justworks

Justworks is another big contender in the PEO space, recently raising $40 million to help companies streamline HR management. They are very transparent about how they stack up against competitors, and with Justworks, the details matter. For example, they offer benefits, just like plenty of other all-in-one HR solutions do. However, they go the extra mile and team up with teledoc medical partners, biking companies, and gyms, so your business can offer a full suite of benefits to employees.

26. Namely

Calling themselves “HR for humans,” Namely promises high-tech, forward-thinking HR solutions to classic problems. In addition to payroll, tax, compliance, and the usual set of tools, Namely also features a social news feed, organization charting, an employee database, workflow maps, calendars, and more—including a handy mobile app. If you need a bit of everything with a modern touch, check out Namely.

27. Sage

With the highest customer retention rate in the industry, Sage offers a number of packages specially tailored to businesses of different sizes. For businesses with fewer than 10 employees, there’s the Essentials product with just the basic payroll features. But businesses with more than 10 employees can sign up for Sage Payroll Full Service for a complete, custom package.

28. Fuse Workforce Management

Fuse Workforce Management rolls all the payroll, time tracking, and HR management features you need into one simple product. This helps your employees access all their relevant statistics in a single place, and it makes things easy for you, too. Fuse Workforce Management is cloud-based and offers customizable payroll reports. They offer little details that are really helpful, such as red flag alerts if two or more employees scheduled paid time off on the same day.

29. Jumpstart: HR

Jumpstart: HR has one focus: making sure small businesses get all the human resources help they need to stay on their game. From payroll management to compliance, background checks, HR strategies, and everything in between, you can rely on Jumpstart: HR to take the pressure off your small business. Pricing depends on your business’s size. There are options where you can hire Jumpstart for a fixed number of hours each month, so they fit your budget.

30. Precision Payroll of America

Precision Payroll of America makes payroll processing and taxes easy—while also giving you some help in the HR department. Use their online tool to quickly search for employee withholding forms, insurance, and more state-by-state, as well as to check on your Affordable Care Act compliance.

31. Pro iPay

Pro iPay, from ProData, is a web-based payroll service for small business that helps you process payroll, integrate HR data, and cleans up your to-do list. They work with small businesses and large corporations alike, so no matter your size, Pro iPay could be the right solution for you.

32. TelePayroll

One of the 5,000 fastest growing privately-owned companies in the U.S., TelePayroll combines tech-forward solutions with an experienced customer success team to meet all of your business’s payroll needs—no matter whether you’re 5, 50, or 500 employees strong. With a 97% client retention rate, customers have been relying on TelePayroll for a long time.

33. Advantage Payroll Services

Advantage Payroll Services is geared more towards medium-sized businesses, but if you’re aiming to grow soon, this payroll service might be ideal. While they offer a whole set of products—from tax filing and workers’ compensation to new hire reporting—you’ll want to pay special attention to Instant Payroll. This feature lets you deal with payroll completely online, on your browser, instantly and securely.

34. Alliance Payroll Services

Alliance Payroll Services focuses on a seamless, paperless payroll experience with AllPay. AllPay consolidates all of your employee management data and tasks into one integrated database, so you won’t have to enter in redundant information or deal with messy paperwork. It also can connect with other third-party apps. Whether you’re looking for timekeeping, new hire onboarding, human resource programs, benefits, or payroll processing, this is among the best payroll services for small business.

35. Kelly Payroll

Kelly & Associates Financial Services offers KELLY Payroll, an online service that combines payroll and benefits. This single point of entry makes accessing your payroll and benefit information extremely simple and convenient. If you are in hiring mode or growing very rapidly, KELLY even offers HR audits and training to make sure you’re in compliance with all laws.

36. Coastal Human Resource Group

The online payroll system offered by Coastal Human Resource Group makes payroll simple: they’ll handle direct deposit, but if you prefer checks, they’ll actually print and deliver them on time for your employee payment schedule. They also offer a wide range of HR-related programs, from employee benefits to compliance assistance and workers’ compensation insurance. Employees can trade shifts or volunteer for shifts, making this a collaborative software.

37. PayLumina

PayNorthwest customers can access PayLumina, which fits right in with the ranks of web-based payroll services for small business. It houses all of your payroll and HR information in a single database—and lets you set up different levels of permissions for employees to view sensitive information (or not). Their system is also optimized for businesses with seasonal employees because you only have to pay for an employee once they begin working.

38. AmCheck

AmCheck is another 100% cloud-based payroll solution for filing and reporting, with 24/7 live support and a whole suite of additional products to help you manage your employees. You can set up custom reports, sync AmCheck with your accounting software, and keep track of time and attendance. Plus, AmCheck is rated highly for brand loyalty—which means its customers are generally very satisfied with their choice!

39. APS

APS, or Automatic Payroll Systems, is regularly rated as a top performing payroll solution. APS offers a cloud-based suite of payroll and HR services that you can access from anywhere with an internet connection. They have special services for businesses in certain industries, such as healthcare, hospitality, and education.

40. Newtek

Newtek offers small businesses the standard selection of payroll and HR tools, including nice-to-haves like 401(k) plans, online pay stubs, workers’ compensation, and more. They go above and beyond with payroll account review, though: their tax specialists review each one and deal with taxes at every level. And compared to ADP and Paychex, two big players in the payroll service space, Newtek is less expensive.

41. Harpers Payroll Services

If you’re in need of a proven payroll and HR solution, then Harpers Payroll Services could be worth a look. They operate in all 50 states, offer direct deposit for any ACH-participating financial institution in the US, automatically issue company checks, assist with compliance and new hire reporting, and more. They even offer some unique services that you wouldn’t expect from a payroll solution, such as background checks on new hires.

42. Insperity

If you manage between 10 and 5,000 employees, Insperity could be the one of best payroll services for you. Whether you’re just interested in payroll and a few HR-related tools, or you want the whole suite of management technology, Insperity offers it. These extra features include organization planning, retirement benefits, expense management, and more.

43. JetPay

JetPay is a well-known name in the payments space. The company offers payroll processing tools, as well as options for credit card processing and prepaid cards. Plus, their payroll package comes with a few human resource-oriented features, like job posting, applicant tracking, and review storage.

44. MMC HR

MMC is a true all-in-one payroll/HR package, tailoring products to fit your specific business. Need help with payroll and taxes? Compliance? Vacation and time tracking policies? Benefits? Employee training? Risk management? Get a free quote to see what you’d need to shell out for all of the assistance you need to take HR management off your plate.

45. Oasis Outsourcing

One fee, many tools: that’s what Oasis Outsourcing offers for your business’s human resources. Beyond the typical payroll features, Oasis Outsourcing also brings in specialized experts at workers’ compensation, training, performance reviews, hiring, and more to consult with you and make the best HR plan possible.

46. Emplloy

Emplloy tries to take the mystery out of payroll for small businesses and delivers on all the major services. They have flexibility to run payroll in accordance with your schedule, and can issue special payments for bonuses or tips. Plus, they have an HR One package if you need more HR assistance. With this package, Emplloy will help you create a custom HR plan and offer a live HR help line to answer questions. Pricing starts at $25 per month plus $5 per employee.

47. Highflyer HR

Highflyer HR is a full circle HR solution. You can hire, track time, pay, and manage employees from one cloud-based software. Features include no-fee direct deposit, real-time payroll preview, and automated tax filing. Customers also appreciate the ease of use of the software. They offer a free trial, so you can try out the software before you buy.

The Best Payroll Services for Small Business: Designed for Small Business

As a small business owner, it feels good to use tools made by people who really understand your particular struggles. Running a small business brings different hiring and budgetary challenges compared to a large business.

If you want a payroll company that’s custom-fit for small business, check out this list of the best payroll services for small business:

48. Wave

Wave offers multiple financial products for small business, and their commitment to smaller companies shines through. With a base monthly fee of just $20 and a per-employee fee of $4, depending on how many employees you’re covering—you get a whole host of features. For businesses in large states like California and New York, Wave offers full service payroll. With smaller states, they’ll handle payments for you, but you’ll need to file tax paperwork on your own.

You can expect year-end filing, tax liability tracking, paystubs, and W-2s available on an employee portal, and backups and encryption, all on top of the usual selection of direct deposit and check printing. Plus, this payroll service for small business integrates with the rest of Wave as well, so you can keep your payroll in the same place as your accounting and invoicing.

49. BenefitMall

Whether you want to use direct deposit or print your own checks to pay your employees, BenefitMall has you covered. This payroll service covers businesses of all size, but they offer PayFocus—a payroll-and-HR combination package—to small businesses in particular. They’re a well-established payroll services company with a long track record.

50. Paycor

Whether you’re managing payroll on your desktop computer or mobile phone, Paycor lets you make direct deposits, edit employee information, make quick calculations, and receive notifications. You can see your total payroll costs before the payroll is run, so you always know how much expenses your business has. Beyond the usual checks and direct deposit, pay cards and Paycor checks are also available methods to pay employees.

51. Patriot Software

This small business-oriented payroll service has a completely online experience, transparent monthly pricing, pre-printed checks for customers, free setup and support, and a free 30-day trial. Starting at just $14 per month, they are also one of the more affordable options on our list! Patriot Software’s focus is on simplicity and usability—no need to waste time learning a complicated program just to manage a few employees (although they service businesses with up to 100).

52. SurePayroll

Owned by PayChex, SurePayroll is available for desktop or mobile, letting you adjust your small business’s payroll processing 24/7. They provide a guarantee on federal, state, and local taxes, so you have piece of mind. And you can easily contact their staff by email, live chat, or phone.

SurePayroll is specifically oriented for small businesses by offering flexible payroll schedules, easy online reporting, a payroll tax guarantee, and options for contract hires. You can easily run payroll and manage other functions from their comprehensive mobile app, which is convenient for small business owners on the go. It also has special options for paying childcare providers and home-based workers, if those apply to you!

53. OperationsInc

Whether you need a long-term payroll solution for your day-to-day operations or you’ve bumped into a payroll or tax emergency, OperationsInc essentially wants you to view them as your outsourced HR department. They’ll help out with routine payroll as well as emergency issues, like an unexpected resignation or an employee’s maternity leave. The company also does extensive payroll audits and training.

Finding the Best Payroll Company Takes Trial and Error

With more than 50 payroll companies to choose from for your small business, how do you decide? Rely on the factors we mentioned above, such as budget, features, and industry, to make your pick. Also, many of the best payroll services for small business offer free trials or free quotes, making it easy to compare their features and see which holds the best value for your specific needs.

Try out the packages that sound like the right fit, see what systems you and your employees are most comfortable with, and check the pricing to understand what you can afford!

Using one of the best payroll services for small business will free up your time and energy, so you can focus on what’s more important: growing your business.

The post The 53 Best Payroll Services for Small Business Owners appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/payroll-services-for-small-business/

Thanks for appreciating. Really means and inspires a lot to hear from you guys.I have bookmarked it and I am looking forward to reading new articles. Keep up the good work..Believe me, This is very helpful for me.

ReplyDeleteHRMS Software in Dubai

HR & Payroll Software in Dubai

HRMS Software in UAE

Thanks for sharing a great list of payroll services.

ReplyDeletePaycheck stub online | Real check stubs free | Make check stubs | Check stubs generator

amazing blog sir, i was searched on google for that type of information but whatever information i found i'm not satisfied but recently found your blog that is amazing.

ReplyDeleteAccounting services in barking

i found this article quite interesting and useful

ReplyDeletepayroll online services in london

Exclusive post. Thanks for sharing.

ReplyDeletepayroll services for small business

Good post its nice post.

ReplyDeleteonline accounting services london

I am searching for the best payroll services and I found your blog. I appreciate the way you have given the information. Payroll Services is a best choice for small business to reduce costs, avoid IRS penalties and mistakes. Thanks for sharing.

ReplyDeletePayroll Services for Small Business

Such a wonderful article, This will help people who are all looking for best payroll Services. I would like to appreciate you writing a nice article.

ReplyDeletePayroll Outsourcing Companies

Payroll Management Companies

Nice blog, good information about computers I also refer to some good site where you can get good info

ReplyDeletetax return for self employment in barking,,