If you’re a new user, it’s easy to become overwhelmed by all of the QuickBooks terms that you will encounter throughout the platform. Especially if you’re also new to the world of accounting.

But don’t worry. Below is a list of the most frequently used QuickBooks terms that every user should know.

It’s worth being familiar with these terms when talking to your accountant or QuickBooks tech support, and at parties. Mostly at parties.

Just kidding. I advise you to never bring QuickBooks up at a party. Trust me.

The Top 21 QuickBooks Terms You Need to Know

1. QBO

This is QuickBooks Online. And it is usually pronounced Q-B-O, but I still hear some refer to it as Q-BO, which is hilarious, like that exercise craze in the ’90s. Tae-Bow. Come to think of it, I kind of prefer that to the norm. QBO is the subscription and the actual data file.

2. QBOA

These letters stand for QuickBooks Online Accountant. Also a QBO subscription, and really, QBOA is a QBO Plus file with an accountant skin wrapped around it. SBOs (small business owners) do not use QBOA, as that is really for the accounting firm and staff to manage their work and their QBO clients.

I do hear QBO and QBOA used interchangeably, but that is confusing and wrong. QBOA is the portal the firm uses to access their client QBO files, whereas QBO is the client file.

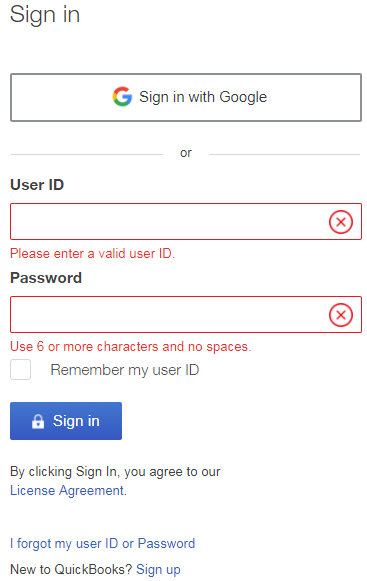

3. Intuit ID

Your Intuit ID is most likely the email address you use to log into your QBO or QBOA company. The user ID (Intuit ID) can be an email address or some abbreviation you choose that is linked to the email address.

For example, qbouser@gmail.com is, in fact, a user id that logs into QBO (with a password) but also is considered an Intuit ID as it is a user that logs into a product.intuit.com. But I also have a user ID of qbouser, just by itself. That gets me into qbo.intuit.com too and is linked to my email address of qbouser@gmail.com.

Best practice is to just use your email address as the user ID that logs you into QBO, a.k.a. your Intuit ID.

4. Gear Icon

Some call it Gear, some Tools, one dude I heard refer to it as Sprocket, which is a little rich for my blood, but works.

One of the icons at top right of QBO, it does, in fact, look like a sprocket. The Gear icon is where all operational features of QBO reside. Manage users, Account & Settings, Attachments, Recurring transactions, Budget (if QBO Plus), User profile, etc.

5. Account & Settings

The access point for the Account & Settings is under the Gear Icon. Here you can turn some features on and off, as well as enter some company info like entity type, tax form type, as well as accounting settings like close date, start of fiscal year, etc.

Account & Settings has a lot of advanced type options too like invoice automation, inventory (if Plus), class/location tracking (Plus), and multi-currency.

I look at it this way—if you can’t find a feature in QBO, don’t give up until you’ve checked the Account & Settings, it might just not be turned on.

6. Advanced Settings Terms

The Advanced tab in Account & Settings holds a lot of the hidden gems of what QBO (mostly Plus) can do. Below is a screenshot of the sub-sections of that tab, and it is always important QBO setup step to click through each Advanced setting to at least know the feature is there for the day you’re ready to activate it.

7. Manage Users

Also accessed from the Gear Icon, this page is critical. This is where you invite your accountant (assuming they did not create the QBO sub from their QBOA) and your colleagues that will have access to the QBO file.

Manage Users is split into two sections—Manage Users, which is the business users that will access the file, and Accounting Firms. Your accountant will give you the email address to invite in that section, and that is how the firm accesses your file.

8. Chart of Accounts

Here’s the spine of any accounting software. This is ye olde ledger, bucket balances, holes where numbers go to die.

Oh, that was a little strong, but without the chart of accounts, there is no ledger existence, there is no fun.

And QBO supports all the typical account types any accountant would want: Assets, Liabilities, Equity, Income, Expense—all the major players are in here.

These accounts allow your Balance Sheet and Profit & Loss to exist. When you sell or purchase things, money is moved from one account to another, and the magic is it all balances. Something is debited, something credited, something gained, another lost. Ask your accountant for more info, but the T-chart starts and stops here.

This is accessed from the Account tab in the Left Nav Bar or from the Gear icon.

9. QuickBooks Labs

Accessed from the Gear Icon, QuickBooks Labs is a Beta playground. It showcases a few features QuickBooks is considering adding to QBO at large but want feedback for first.

10. Invoice/Bill

When you sell to a customer who will pay you later, you create an Invoice. On accrual basis, the income shows on the P&L, even though you might not have received the actual payment yet.

On a cash basis P&L, the income will not show till the payment is received against the invoice. Same on other side of the fence—you purchase a product or service from a vendor, and you will pay them later, you will use a Bill. Same story re: accrual/cash basis on reports.

I know most of you run your business on a cash basis, so it is important to know how Invoice/Bill behaves on a cash basis P&L.

Note: Do not use an invoice or bill if you receive/pay the money right away. Instead, use a Sales Receipt on customer/income side, and a check, expense, or credit card charge on cost side. Accessed from many areas, the + sign at top right is quickest.

For me, when thinking of QuickBooks terms, this differentiation is very important. If you’re working with a ProAdvisor, please keep in mind that when you reference an “invoice,” we are always going to think you’re talking about something you give your customer, and we generally try to clarify, especially when we hear something like, “When I entered the vendor invoice….” Don’t be surprised if you get “I think you mean a bill.”

Bottom line: In regards to specific QuickBooks terms: Invoice = Customer Transaction and Bill = Vendor Transaction.

11. Recurring Transactions

Sometimes you want QBO to create transactions at a certain frequency for you so you don’t have to do them manually each time. Like a recurring check for rent, or a bill for utilities, or a sales receipt for a monthly customer payment.

Nearly all transaction types in QBO can be set to recur, save for a paycheck, a bill payment, and a customer payment against an invoice. All other transactions are fair game to repeat if you choose. The Recurring transactions list is found under the Gear Icon, and some use it to set Reminders too. Got some examples below….

Tip: If you have QB Payments active, you can set up recurring sales receipts to auto-draft customer bank account…Boom!

12. Attachments

Under the Gear Icon is the Attachments list. In QBO Essentials and Plus, you can attach docs to transactions and customers/vendors. You can even take a photo of a receipt on the QBO mobile app, which creates an expense transaction in QBO with the receipt attached. Brilliant.

These days, if there is no attachment it is like it never happened. There is no top cap of attachments, the cap is at the transaction or list level (customer/vendor) and is 25MB per.

13. Reconcile

This should absolutely should be done monthly. This is where you or your accountant will match the bank statement from last month to what is inside of QBO for that same period. And it must match!

It is another backbone of accounting, along with the chart of accounts, products and services, customers and vendors. It just needs to be done. The Reconcile module is accessed either from Gear icon or from Accounting tab in the Left Nav Bar. If you don’t know how to reconcile, definitely leverage a ProAdvisor in your area and one that is adept at QBO.

14. Audit Log

One of my favorite reports in QBO. I can see when a user logged in and out and what they did while they were in QBO. I can also filter for a particular user and specific event. Mostly, the log tracks transaction events. Only All users, Company admins and the Master Admin, of course, can view the Audit Log, so it is a great report for tracking what limited users are doing, not for fraud purposes but for training opportunities.

15. Left Nav Bar

I have referred to it above several times, or as I like to call it, the left-hand panel. Dashboard, Banking, Sales, Expenses, Employees, Reports, Taxes, Accounting, My Accountant, and Apps. It did change several months ago and for some nearly a year ago, but this should be the state of the Left Nav Bar from here on out.

16. Dashboard

This is your QBO homepage. A few charts and graphs, bank feed connections, reminders, and tips. You see it every day first when you log into your QBO file.

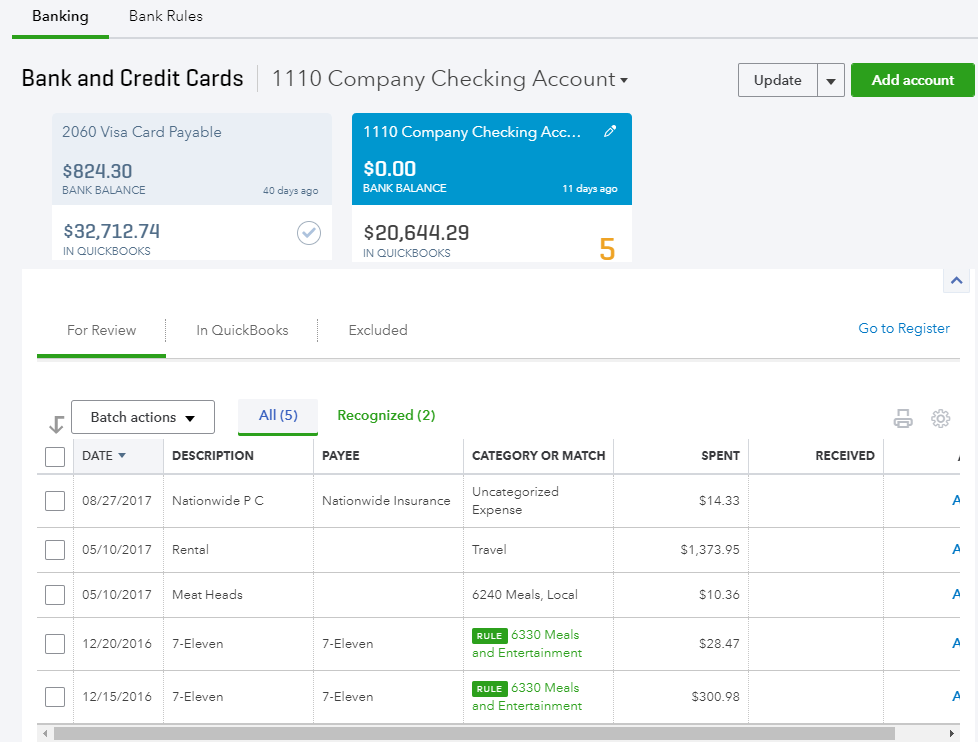

17. Bank Feed/Bank Rules

Here’s another main backbone of QBO, and really any accounting software.

Reports are great, and mostly the end game, but how do you get the data there fastest?

I say connect your checking account and credit card account to QBO, and everything that was cleared the day before will show up in your feed. You can then add to register or set up rules to help auto-categorize and choose proper Payee.

There is even a setting in the rule that will automatically add to register. Automation of data entry is where it’s at, and bank feeds are your way to get there. You can access your feeds from the homepage at the far right or from the Banking tab in the Left Nav Bar.

18. QBOP

This stands for QuickBooks Online Payroll, the payroll module that lives inside of QBO.

19. QBFSP

QuickBooks Online Full Service Payroll is the payroll module that also lives inside of QBO but Intuit handles all the tax payments and form filing. Wow!

20. Quick Create

The “spinny” plus sign at top right of QBO is where all transactions are accessed.

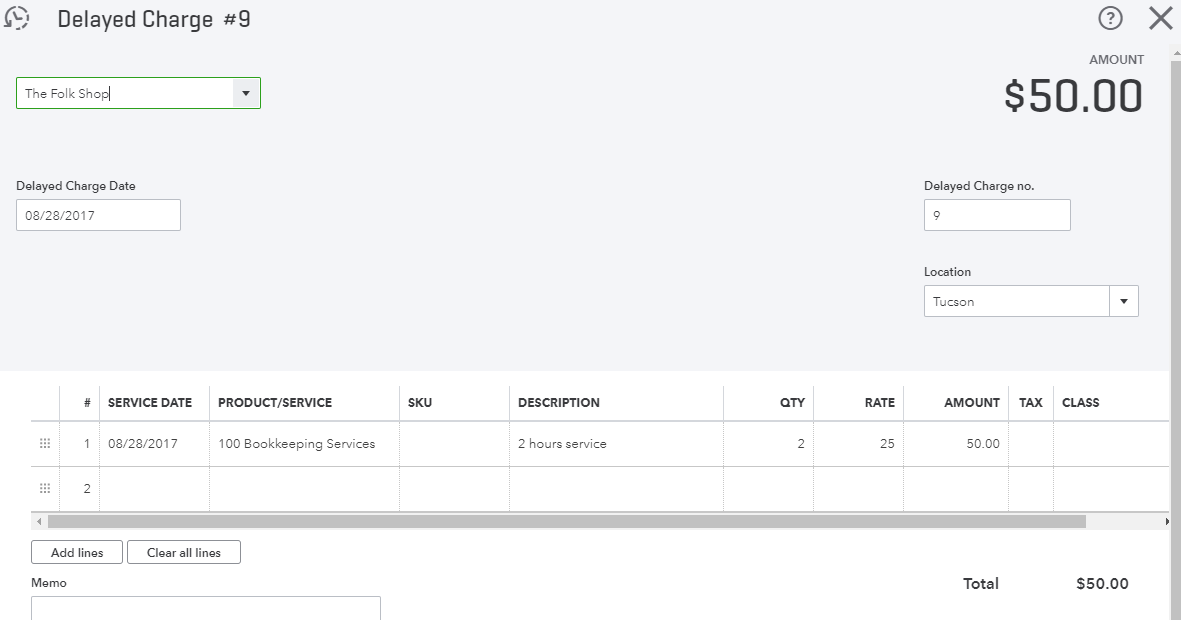

21. Delayed Charge

A non-posting sales transaction that holds the charge for the service until you want to invoice against it. Some might use this in place of a Sales order, though QBO does not track current availability.

Still, I can create Delayed charges for customers that I plan to invoice at a later date so I don’t forget to bill them for services provided. The form is found under the Quick Create.

You can create invoices against them too and there is even a setting that will do that automatically at a certain frequency in Account & Settings.

22. QBDT

Oh, you can skip this one, it will no longer be relevant to you. Just kidding, but really, it stands for QuickBooks Desktop.

There you have it, my list of top QuickBooks terms you need to know. This, of course, is in no way an all encompassing list. I’m sure I left off some important QuickBooks terms. But this list of Quickbooks terms will certainly get you familiar with the platform.

The post The Top 22 QuickBooks Terms You Need to Know appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/quickbooks-accounting-terms

No comments:

Post a Comment