Managing human resources is one of the most challenging aspects of small business ownership, and staffing costs usually comprise the largest percentage of a small business’ expenses. Because of this, many small business owners choose to utilize the services of independent contractors rather than hiring employees outright, but is this always the best choice?

What are the pros and cons of outsourcing to independent contractors vs. hiring employees? What are the potential pitfalls of a 1099 worker as compared to an employee?

These questions—and their answers—have significant financial implications for your small business. This article explores the pros and cons of contractors whose payments are reported on a 1099 vs. W2 employees. We even take a quick look at a couple of solutions that combine the best of both options.

1099 Worker Vs. W2 Employee: What’s the Difference?

Let’s start by taking a look at the differences between a 1099 worker vs. a W2 employee. While both independent contractors and employees provide vital services to the small businesses they work for, there are several important differences between the two. Understanding these differences is vital. A misclassification of those who do work for your business could lead to costly fines and legal fees.

A 1099 worker—or independent contractor—generally provides specific services, defined by a written contract. Though some independent contractors will only work on one project at a time, most serve multiple businesses providing a service or set of services within their expertise. In short, independent contractors are business owners themselves.

As is the case in your own business, this means a true independent contractor define for themselves how and where they work, what tools and methods they use to complete the work they do for your business, and they can choose to hire other people to help them provide their product or service. They also assume the risk for their own profit or loss.

Finally, most of the time a business hires an employee with the intention of working with them for an undetermined length of time. An independent contractor is engaged for a defined period of time, though that engagement may be renewed as many times as both the contractor and the business owner find it to be mutually beneficial.

While a W2 employee doesn’t enjoy many of the benefits of an independent contractor—most employees don’t get to define their own schedules, nor do they have the opportunity to realize a true profit—there are a number of perks to being an employee. Among these are:

- Tools and supplies are provided. Independent contractors must provide their own.

- By law, employees are guaranteed a paycheck for their salary or hours they have worked on a regular and ongoing basis. Independent contractors are paid through a business’ accounts payable process.

- Employees are typically reimbursed for business expenses they incur in the course of their employment. This is typically not the case for independent contractors.

- Benefits such as health insurance, retirement contributions, and flexible spending accounts are available to all qualifying employees in a business. These benefits are not available to independent contractors doing work for a business.

- Probably the most overlooked benefit enjoyed by a W2 employee is the employer’s contribution to Social Security and Medicare. Independent contractors must cover the full amount of these taxes themselves.

1099 vs. W2 Employee: Which Is Better for Your Business?

Now that we know the difference between an independent contractor and a W2 employee, it’s time to answer the question, “Which is better for your business?” As is usually the case, the answer is, “It depends.”

Many small business owners choose to work with independent contractors because of the perceived cost savings. Employment taxes, workers compensation insurance, and overhead costs‚like office space, break room supplies, etc.—can quickly erode a business’ bottom line. However, because of their own overhead costs, the services of an independent contractor can actually cost more than an employee.

As a small business owner, you must weigh the costs of each option, as well as the benefits. Though their services may be more expensive than those of an employee, an independent contractor’s expertise in their field can often yield a higher quality work product in less time than it would take an employee to complete the same work. However, when you work with an independent contractor, you relinquish control over how and when they do their work. For some small business owners, this is unacceptable.

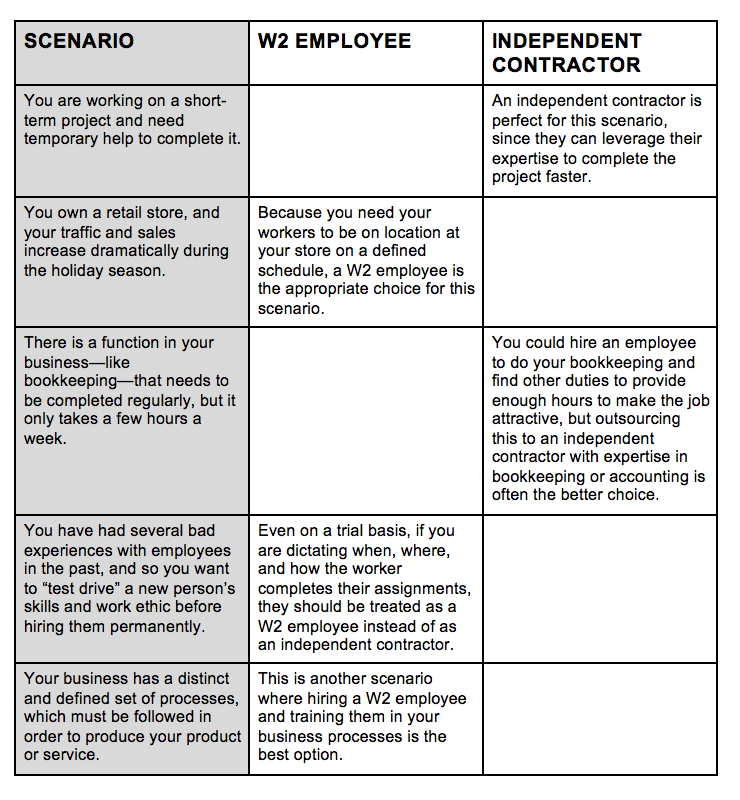

The following table highlights some of the scenarios in which you might choose an independent contractor over an employee, or vice versa:

As you can see, sometimes it makes more sense to engage the services of an independent contractor than it does to hire an employee, and other times you must hire an employee to make sure your business runs as it should.

When engaging a new client, more often than not, my firm has to address the issue of misclassified workers. Often, cost and the intricacies of human resources are the key determining factors a business owner considers before choosing whether to engage a contractor or hire an employee.

While it’s much easier to pay a contractor than it is to administer payroll and handle the other human resources functions required of a business with employees, any cost and time savings quickly disappears if workers are reclassified during a labor audit. For this reason, it is imperative you classify your workers correctly.

However, a couple of options of make it so businesses can enjoy the benefits of having employees without the administrative hassles.

The Best of Both Worlds

Is your business seasonal? Do you want to “test drive” an employee before hiring them on full time? Consider using the services of a temporary agency.

When you contract with a temporary agency, the agency takes care of background checks, pre-employment testing, and timely payroll processing and tax payments. The temp agency also invoices your business for the employee’s wages, taxes, and a service charge for the administrative services the agency provides. This invoice is recorded as a simple business expense in your books, and you don’t have to worry about tax filings, workers compensation insurance, or many human resources issues. This option costs more than administering your own seasonal or temp-to-hire workforce, but the time savings could well offset the additional cost.

Temporary agencies are a temporary solution to short-term employment challenges. There is, however, a longer term solution unknown to many small business owners. A PEO—or professional employer organization—allows businesses to outsource management tasks like payroll, workers compensation, and benefits, while retaining control of the employee’s day-to-day responsibilities.

In addition to relieving small business owners of the administrative burdens associated with having employees, PEOs can also leverage the number of employees they manage to get better benefits options than small businesses alone can negotiate. As is the case with temporary agencies, PEOs charge a fee for these services, but the benefits may outweigh the costs.

Whether you choose to use a temporary agency or engage the services of a PEO, it is imperative you do your due diligence. Ask the temporary agency or PEO for references, and follow up with other business owners who have used these services. As is always the case when you enter into a business contract, you should also engage an attorney to review any agreement with a temporary agency or PEO before you sign it. This ensures you are not inadvertently taking on liabilities that should be covered by the temp agency or PEO.

1099 Vs. W2 Employee: A Complex Consideration

You have numerous things to consider before deciding whether to use the services of independent contractors or to hire employees. The type of work you need done, legal considerations, and cost considerations must all be weighed carefully before you make your decision. If in doubt, consider consulting with your accountant or an employment attorney before making your final decision about how to manage the workforce for your business.

The post 1099 Vs. W2 Employee: Which Is Better for Your Business? appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/1099-vs-w2-employee

No comments:

Post a Comment