Running a small business is no easy feat. Having to deal with the administrative issues, like accounting, adds to the challenge. Thankfully, accounting tools like Xero can help you manage your books a little easier.

Xero is a browser-based accounting app that lets you access and update your books from any place that has internet connectivity.

In this article, we review pricing, main features, and compare Xero with other accounting apps like FreshBooks and QuickBooks.

Xero Full 2017 Review

Pricing

In terms of pricing, Xero’s packages are based on the quantity of tasks you complete each month like creating invoices, reconciling transactions, and administering payroll. For example, the lowest-priced package, Starter, is $9 per month and lets you reconcile 20 transactions, send 5 quotes, and send 5 invoices.

The next package, Standard, has no limit on reconciling or invoicing. The Standard does include payroll but is limited to 5 people. The Premium package lets you do much more like payroll. You can administer payroll for up to 10 people at the base price in this package but for up to 100 people at $180 per month.

Main Features

Main Features

With Xero, you get a number of features to support your accounting activities. A few that stand out include:

- Access to Xero via mobile app for iOS and Android

- Inventory tracking

- Payroll processing

- Timesheets

- Managing time-off requests

- Submitting tax payments and filings electronically

- Employee portal to view pay stubs

- Recurring invoicing

- Expense management

- Integration with over 500+ business apps

- Multi-currency support

Plus, notice that Xero offers what many other online accounting apps offer: bank integration and reconciliation, expense management and real-time reporting for cash flow, profit and loss, balance sheet and a number of other financial reports.

Getting Started

Start by entering your information to receive a confirmation email to activate your account. Xero’s 30-day free trial is a good way to try the app before making a commitment.

Below is the information you are asked for when signing up for a trial. You don’t need to enter any credit card information at the time of starting your trial. In the trial version, you can add unlimited amount of users, too.

Dashboard

Dashboard

Upon logging in, you’ll find some handy widgets on metrics you’ll want to monitor every day like cash flow, income, expenses, and bank balances. For newbies, there’s a 2-minute video you can watch along with a checklist of items to complete in order to help you set up everything.

If you don’t need to see all the widgets they’ve got set up by default or want to move them around, you can edit your dashboard to your liking.

Connecting Your Bank Accounts

It’s recommended that one of the very first things you do is set up your bank account with Xero. This process is straightforward as well since Xero seems to connect with almost any major U.S.-based bank.

Enter your bank name in the search bar in case you don’t see it under “popular US banks.” For those banks not supported by Xero, you can set up a secure Yodlee feed so that your transactions are automatically updated in Xero.

Reports

Accessible from the main navigation menu, from all screens in the app, you’ll see the reports tab. There are plenty of pre-configured reports with options to set date filters on them. Aside from this, there seems to be no other way of customizing the reports. One you change the canned report with filters, you can save them as a custom report.

Creating Invoices

Of course, one of the most critical aspects of accounting is creating and sending invoices. Invoicing that is clunky and difficult to use could cause you to lose money if 1) you dread the process; 2) do something wrong and invoices are incorrect or not sent out properly.

Xero’s interface is rather straightforward to use, but in my opinion, not as intuitive as it could be. It’s simple enough nonetheless. From the dashboard view, in the upper right, you’ll see a big “+” symbol. This menu option lets you create a number of things including quotes, purchase orders, bills, etc. From here, click “Invoice.”

On the invoice screen, you need to enter a number of details like the name of the item, description (optional), quantity, and unit price. If the item you are trying to invoice for doesn’t exist, then you’ll have to create it. Xero will ask for an item code (required) and item name.

The nice thing about Xero’s invoicing is that you can send your invoices directly to the recipient via email. You can also insert a link into your invoicing email template for Online Invoicing, a feature that enables your clients to pay directly on the invoice.

You’ll need to set up a payment service to start receiving payments. Payment services Xero supports include PayPal, Stripe, Authorize.net, Braintree, eWay, and a few others.

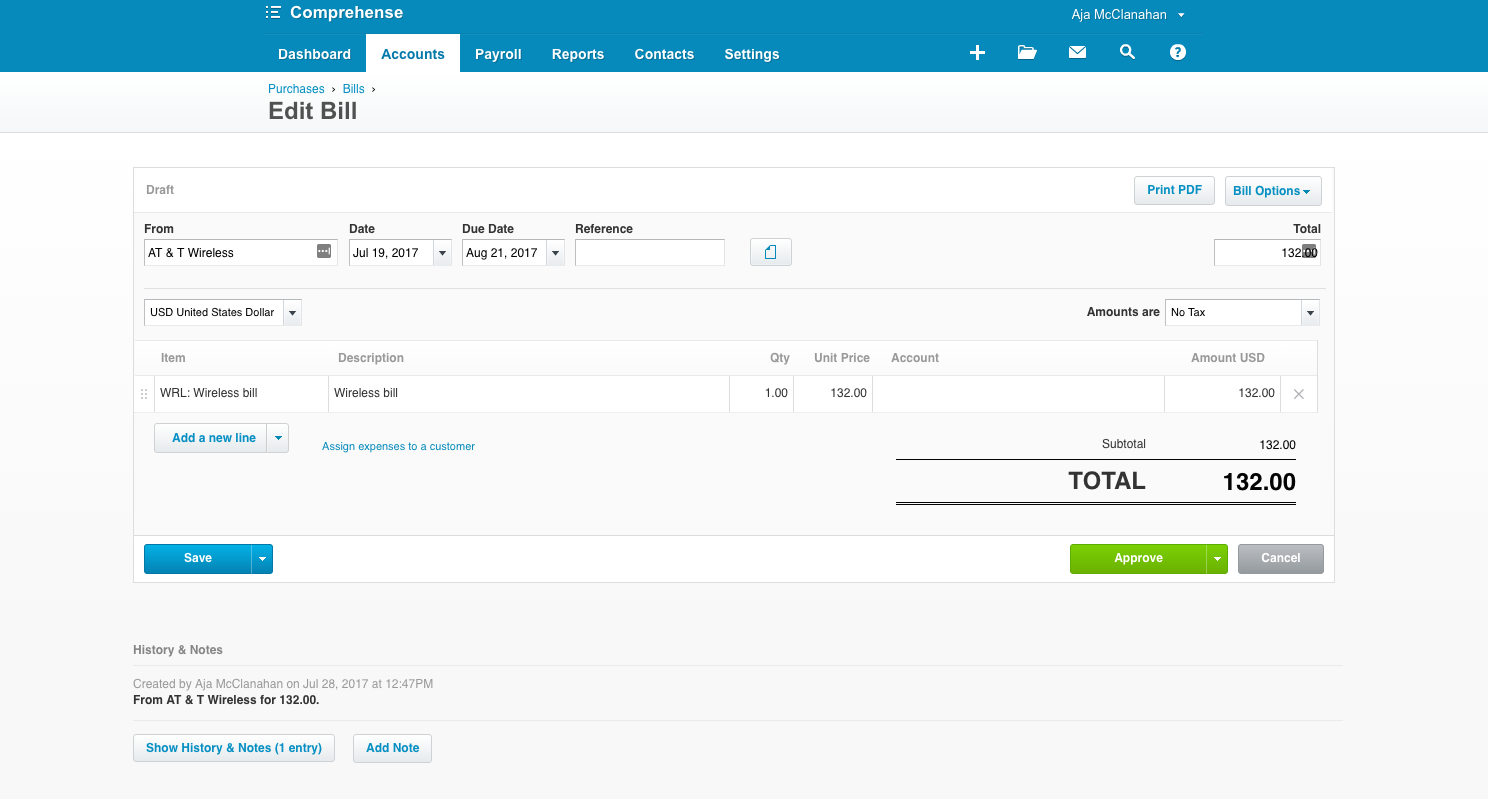

Creating a Bill

This process is not too different from creating an invoice. Again, from the dashboard view, in the upper right, you’ll see a big “+” symbol. Click “Bill.” From here, enter information like due date, vendor name (in the “from” field), along with an account to categorize the expense.

Comparing Xero to FreshBooks, Wave, and QuickBooks

I think Xero is comparable to the rest of the online accounting solutions out there. In terms of price, it comes in lower than FreshBooks, but a newer pricing schema for QuickBooks makes it slightly more expensive than QuickBooks’ lowest package. If you are just starting off in business and want to save money, Xero’s Starter package could work for you.

In terms of offerings, it’s more feature rich than FreshBooks, which doesn’t offer payroll services or inventory management. Regarding ease of use, QuickBooks has made great strides in simplifying the user interface. So, I’d say that Xero doesn’t really surpass them on that level anymore.

Pros:

- 500+ integrations available to add features not native to the core build of Xero

- Simple, intuitive user interface

- Web-based (i.e., no need to download software to a local machine)

- Can store files in your Xero account

- QuickBooks client files are converted to Xero at no charge

Cons:

- No telephone or live chat support

- Email response time is 24-48 hours for each email

- Item code required for all items related to creating bills and invoices

- Limited customization for reports

Recommendation for Use

If you are set on using Xero as your accounting solution, here are a few recommendations to make it work best for you. First, you should attempt the trial version of Xero. Take 30 days to evaluate Xero to make sure you are OK with basic functions like creating invoices, entering expenses, and processing payroll.

Then, you’ll want to work with an accountant who has set up more than a few clients on Xero. This way, they can properly train you on the best practices for everyday use as well as activities like reporting and tax filings.

Bottom Line

Xero is an acceptable choice for small business accounting but not a top choice. In my opinion, you get more for your money than FreshBooks but not as much as you would with QuickBooks. However, you may find Xero’s price is just right and that your small business accounting needs could be served perfectly well with Xero. The best thing to do is to give Xero a try so you can know for sure.

The post Xero Accounting Software Review 2017 appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/xero-accounting-software-review

No comments:

Post a Comment