Do you know the difference between bookkeeping vs. accounting? Many small business owners don’t. Knowing the difference can ensure you hire the right professionals to advise you in your business. It can also help you know what to expect from each relationship.

What’s in a Name?

Many people use the words bookkeeping and accounting interchangeably. There’s a good reason for this. Bookkeepers and accountants generally work together very closely in order to fully serve their clients. Both are tasked with the financial reporting and well-being of the business. And both generally don’t get much time off between the months of January and April.

There are some key differences between bookkeeping vs. accounting, though those differences are becoming increasingly blurred. Advancing technology and shifting mindsets in both professions are causing many bookkeepers to take on roles more traditionally managed by accountants. Similarly, many accountants are branching off into different areas of focus to help their clients manage their entire financial situation more effectively.

Traditional Bookkeeping Vs. Accounting Roles

Traditionally, bookkeepers have managed the day-to-day financial transactions in a business. They have been in charge of recording transactions in the accounting software, reconciling the bank statements at month-end, and producing preliminary financial statements on a monthly basis. Bookkeepers have also often provided full back-office support, including invoicing clients, paying bills, and processing payroll.

Accountants have traditionally taken more of an advisory role with business owners. In addition to preparing the tax return annually, accountants once provided monthly or quarterly insight into the health of businesses. Using the financial statements prepared by the bookkeeper, they worked on strategic planning with their clients, providing valuable insight into strategies that could help business owners grow their companies.

Shifting Roles

As technology has changed the way we all work, we have seen a shift in bookkeeping vs. accounting. Automations within accounting software have dramatically streamlined the bookkeeping function. This has freed bookkeepers from much of the traditional data-entry work, letting them step into more of an advisory role. Since bookkeepers often know their clients’ businesses in intimate detail, this shift makes intuitive sense.

With the options for accounting and other financial software increasing at a rapid rate, bookkeepers are also investing more time in training on a variety of solutions. Their goal is to be able to recommend the best “technology stack” for their clients’ varied needs. Many bookkeepers now refer to themselves as “technology consultants” in addition to calling themselves bookkeepers.

Accountants are also finding innovative ways to serve their clients. As the tax code increases in complexity, tax resolution has become a popular focus with many accountants. Also, since accountants are typically knowledgeable about their clients’ personal financial situation as well as their business situation, some are becoming tax coaches and certified financial planners. These two areas of expertise let accountants provide their clients with advanced tax strategies—making it so the clients can keep more of their hard-earned money in their pockets (or in their retirement funds).

As the line between bookkeeping vs. accounting has become less clearly defined, some states have begun to restrict who can call themselves an accountant. In some states, a person must be a certified public accountant in order to refer to themselves as accountants. For others, a degree in accounting is all that is required. In most states, though, no qualification or certification is necessary to use the term “accountant” or “accounting.” So, it is important to ask your financial services provider what roles they will perform for you.

What does a bookkeeper do, compared to what an accountant does?

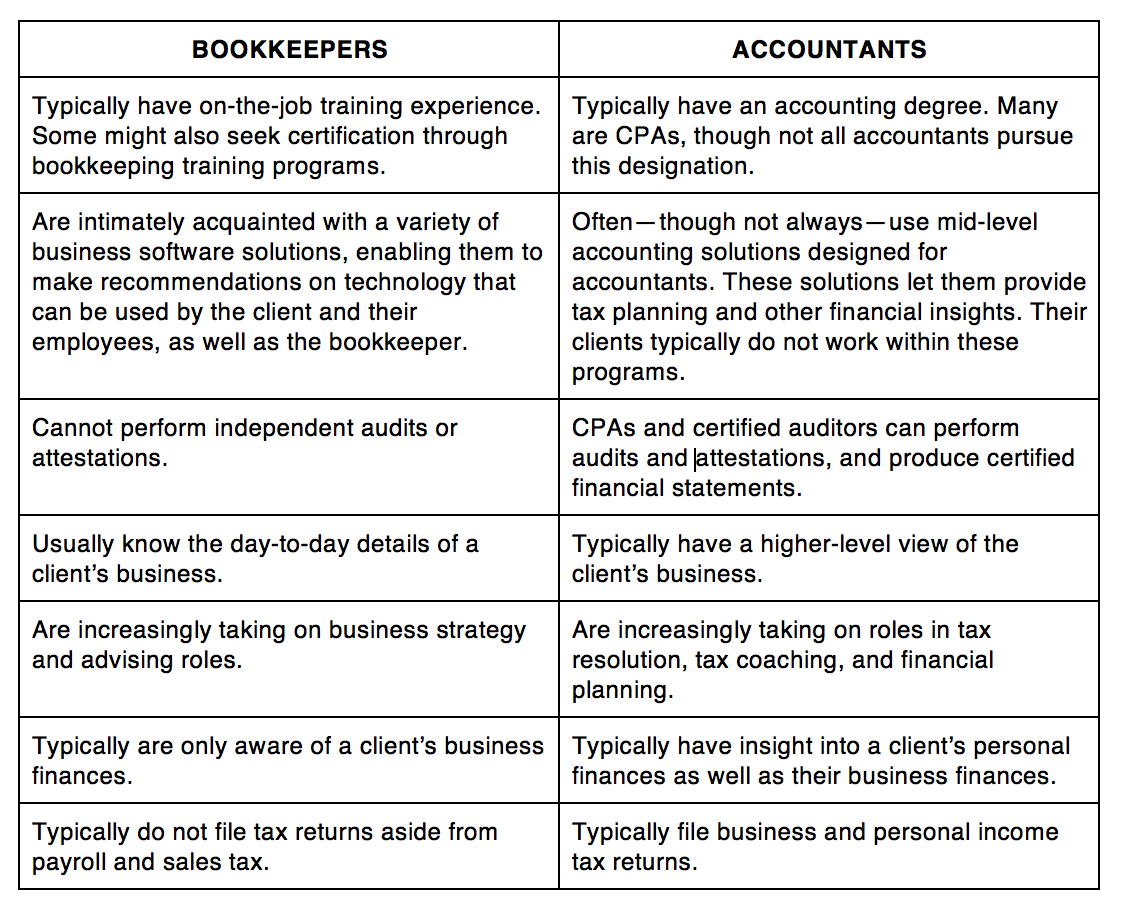

Since most people consider bookkeeping and accounting to be interchangeable, there is often a lot of misconception about what each professional can provide. Following are a few key differences between what bookkeepers do vs. what accountants do.

Which professional do you need for your business?

Businesses do better when they have a complete picture of their finances, and bookkeepers and accountants each look at a business’ numbers through different lenses. Engaging both a bookkeeper and an accountant ensures that you receive the best advice for your business. While it may seem daunting to have to find and engage two professionals, bookkeepers and accountants are usually happy to provide a list of professionals they enjoy working with and trust. This lets each professional work to their own strengths and provide the best value to you, rather than reviewing the other’s work and possibly giving you conflicting advice.

Bookkeeping vs. accounting does not have to be an either/or proposition. The two functions work hand in hand, helping business owners become more profitable. With the perspectives of both positions, you get a holistic view of your finances, setting your mind at ease and freeing your energy to do what you love—running your business.

The post What’s the Difference Between Bookkeeping Vs. Accounting? appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/bookkeeping-vs-accounting

No comments:

Post a Comment