As an accountant, I often see small business owners struggle to get a handle on their accounts payable. Even the term sounds a bit daunting, doesn’t it? But accounts payable is just a fancy accounting name for bill management. Accounts payable is the account on the balance sheet that reflects the amount of money you currently owe your vendors.

As your small business grows and you develop relationships with trading partners, it is important that you have a system in place to effectively and efficiently manage your bills. The consequences of poorly managed accounts payable can be expensive and, in some cases, catastrophic to your business.

Let’s explore what it takes to expertly manage your accounts payable!

Get Organized

The first step to effectively managing your accounts payable is to get organized. Develop a system to keep track of your vendor information, such as payment terms, credit limit, and contact information. When you first start out, you might decide to track this information in a spreadsheet or even a notebook. Information you need to track for each vendor includes:

- Business name

- Legal name (for IRS reporting purposes)

- Remittance address

- Terms of payment

- Contact phone number and email address

- Account number

Keep in mind that many vendors have separate physical and remittance addresses, so make sure you pay attention to the details!

Make it a standard practice to request a completed IRS Form W-9 from each vendor before you pay them for the first time (your accountant will thank me later). The Form W-9 is an information tax form that includes the business name (and legal name, if different), federal tax classification (individual, corporation, partnership, or trust/estate), address, and EIN or social security number.

Each W-9 must be signed by an authorized officer or owner of the vendor’s business. Not only will the W-9 provide you with much of the information you need from the vendor, but you are required to have a signed W-9 on file for each vendor that provides services (as opposed to tangible goods) to your business so that you can prepare and submit any required Forms 1099 to the IRS at the end of each calendar year.

Set Up a System

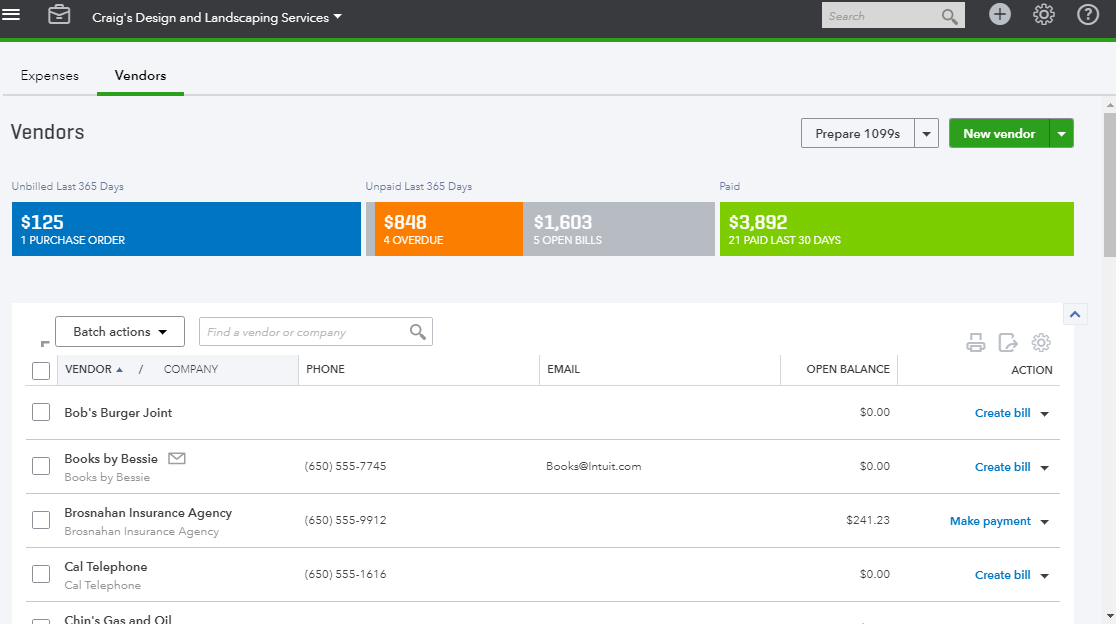

Your next step will be to set up a system to keep track of your open bills and payments. While using a spreadsheet or notebook to track amounts owed to vendors can work for some, most businesses use an online accounting system like QuickBooks to manage their bills and payments. The benefit of setting up and using an accounting system is that it provides a central place to store all your vendor information, including bills, payments, and type of expenditure.

As you record data into the system, you’re building a database of information that can provide key information to help you manage your spending and cash flow. The program uses the payment terms entered for each vendor to produce reports that can help you stay on top of when bills are due, whether they are eligible for an early payment discount, and how much you owe.

Understand Payment Terms

When you start doing business with a vendor, typically they will require payment at the time of service or upon delivery of goods unless you submit a credit application for deferred payment terms. Payment terms are the condition under which a seller agrees to complete the sale and common payment terms extended by businesses include net 10, 30, 60, or 90 days. The net amount is the total outstanding or due on the bill, and the number specifies the number of days from the issuance of the bill that the payment is due.

Many vendors offer a discount if you pay the bill early, with the stated terms specifying both the discount percentage and the number of days that the discount is valid. For example, if a vendor offers you the terms 2% 10, net 30, this indicates that you can deduct 2% from the amount due if you pay the bill within 10 days of the bill date. However, you will pay the full amount if you pay the bill 11 or more days after the bill date, and the bill will be considered late on day 31.

Taking advantage of early payment discounts is a great way to reduce your costs and can really add up to save you money. And don’t wait until day 30 to pay the bill—make sure you schedule the payment or mail the check a few days in advance to ensure timely delivery to your vendors.

Paying Bills

Make every effort to pay your bills within the payment terms. It is important to establish and maintain positive relationships with your trading partners, and paying on time goes a long way in cultivating these relationships. A vendor is more likely to offer you favorable credit terms and give you a good reference when applying for new credit with other vendors.

If you are in a cash-tight situation, make sure to communicate with your vendors before your payment is late. A vendor is more likely to work with a customer who is upfront about their situation and proactively communicates with them.

Set up a regular schedule for paying bills and stick to it! Most small businesses pay bills weekly or biweekly depending on the number and frequency of the bills. As your company grows, you might find that you need to add additional payment runs in order to keep up with the volume and various due dates.

Lots of vendors offer the option of automatically paying your bills via credit card or electronic check when they come due. While this is a convenient option, you need to set up a system of checks and balances to make sure that you monitor the accuracy of your transactions. Even recurring fixed fees occasionally change and inevitably mistakes do happen. Make sure that you have a review process in place to verify the accuracy of your bills in order to catch any mistakes or changes to your accounts.

Hiring Someone to Help You

In the early days of your business, you’ll wear most of the hats in your business and accounts payable clerk will likely be one of them. But as you grow, you might decide to hire someone else to handle accounts payable or to delegate the duties to someone else in your company. Handing over the responsibility of paying your bills and writing checks involves risk, but there are steps you can take and best practices to help mitigate these risks.

Take the time to find the right person. An accounts payable clerk doesn’t necessarily need to have a bachelor’s degree in accounting, but they must have a good understanding of bookkeeping and accounting and, most importantly, be trustworthy. Check the candidate’s references and consider running a credit check before hiring them (check the laws in your state regarding this).

Ideally, the person recording the bill should not be the person writing the check and should definitely not be the person signing the check. If you have one person entering the bill and writing the check or scheduling a payment, set up an approval process that requires someone else to sign off on the bill before it is scheduled for payment. There are many accounts payable apps and programs that include an approval process, like Bill.com, Plooto, and MineralTree.

Finally, consider hiring a qualified bookkeeper or accountant to help you manage your accounts payable. Many accounting professionals offer outsourced CFO services and can provide much more than paying your bills, including expert insight into your cash flow, financial analysis, and business coaching.

The post The Accountant’s Guide to Expertly Managing Your Accounts Payable appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/accounts-payable-2

No comments:

Post a Comment