If you are a sole proprietor, freelancer, or independent contractor, QuickBooks Self-Employed is a fantastic tool for organizing your finances and staying prepared for tax time throughout the year.

Quickbooks Self-Employed was made specifically for self-employed folks to easily track business expenses and help them save money by finding Schedule C deductions when tax time rolls around. Once you connect your bank and credit card accounts, expense tracking makes it easy to separate your personal and business spending with just a click of a button.

Who Should Look into QuickBooks Self-Employed?

Good candidates for Quickbooks Self-Employed include small business owners who are sole proprietors, LLC owners without partners, Uber drivers, Etsy sellers, realtors, freelancers, and anyone who runs some type of side business—assuming this individual or business does not need to produce actual transactions.

It’s important to note that Quickbooks Self-Employed is really a bank-feed and expense tracker—more akin to Mint than QuickBooks’ other flagship products. Intuit is making the bet that people who own these types of businesses often have difficulty sorting through business and personal expenses, and that’s where the simplicity of this product really shines.

It’s also important to point out that you cannot migrate Quickbooks Self-Employed to QuickBooks Online. So if you want to upgrade to Essentials from Quickbooks Self-Employed, you’ll have to start all over again.

But for a such an intuitive, easy-to-use product, the price simply can’t be beaten. Rather than spending hundreds or thousands of dollars a month on complicated accounting software, you can get Quickbooks Self-Employed for $5/month for the first six months, with a free 30-day trial—you don’t even have to put in your credit card information.

So how do you get started? We’ll go through the Quickbooks Self-Employed demo account below.

Connecting Your Accounts

The search function makes it easy to connect your bank and credit card accounts. While you can manually import your expenses or add receipts on the go (we go into that later) connecting your accounts off the bat is the simplest way to get started tracking expenses and setting up your account.

Exploring the Homepage

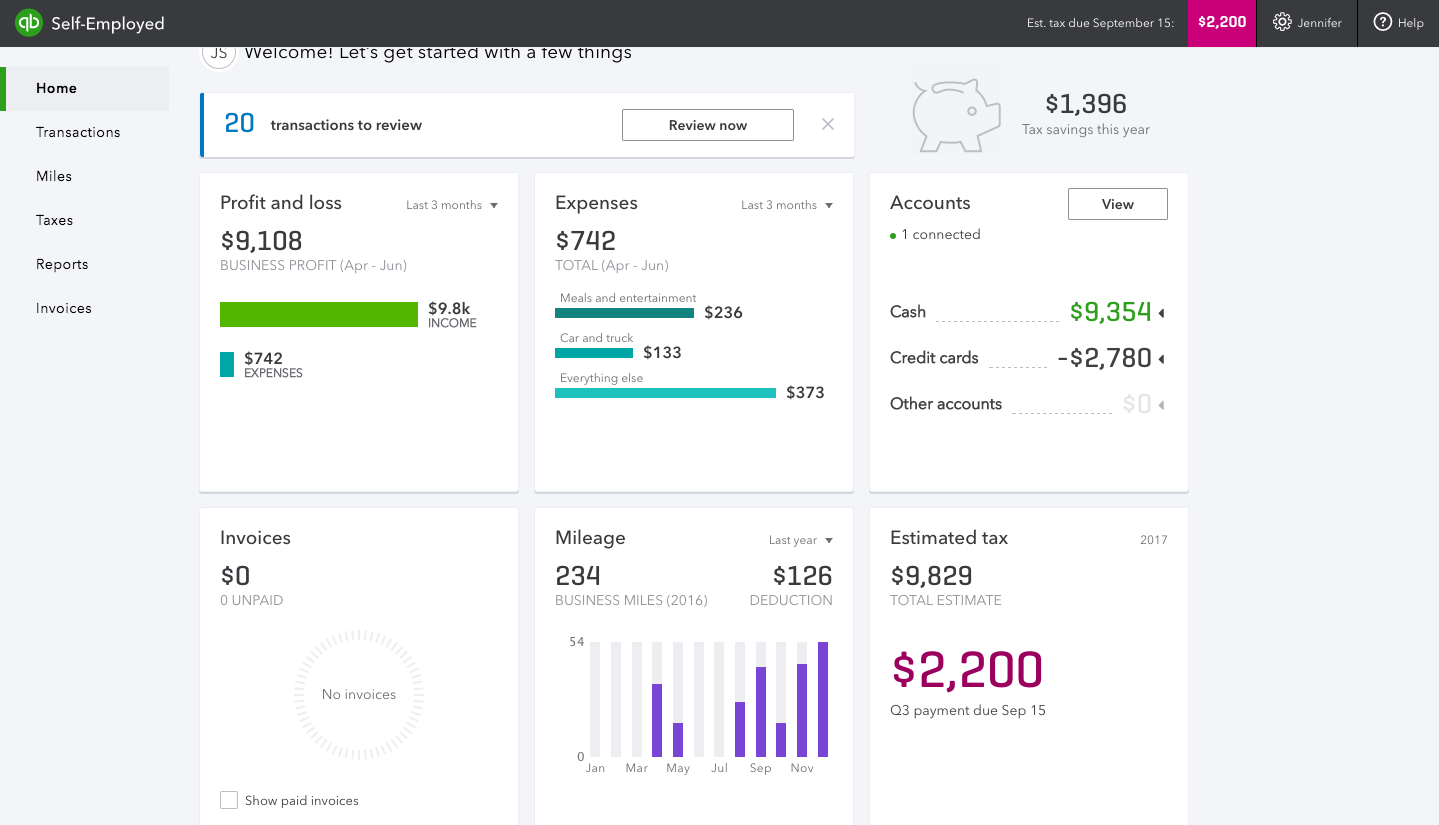

The homepage of Quickbooks Self-Employed is super user-friendly and intuitive. There are just five tabs on the left-hand side where you can explore your Transactions—credit card and bank activity, not business sales—Miles, Taxes, Reports, and Invoices (we dig into these in just a bit).

The mobile app is also easy to use and makes tracking expenses even easier.

Through the homepage, you can easily see the state of your credit and bank accounts, expenses, and profit and loss statement. You can click on any of these reports to get a deeper dive. The app sorts out any personal expenses, so here you just get your business view.

Reviewing Transactions

If you click Review Now at the top of the homepage, it will take you to your Transactions report.

Here, you can see your business profit, income, and spending, and categorize your spending as business or personal. You can even “split” transactions to keep track of purchases where business and personal supplies are mixed.

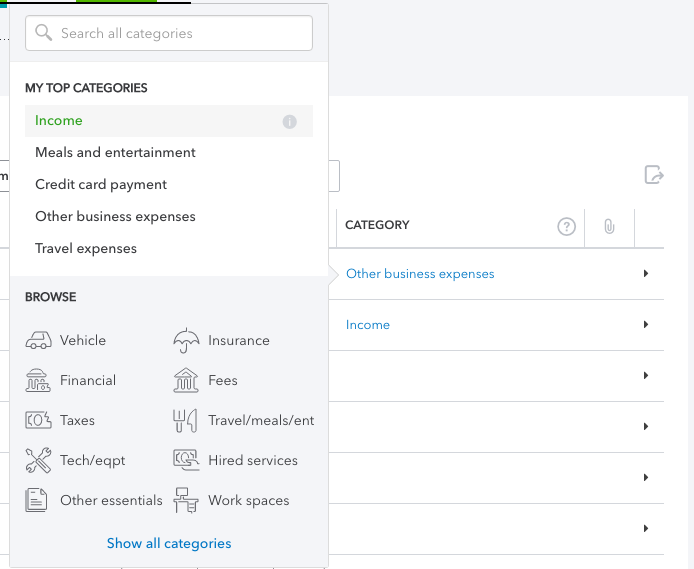

You can easily add categories to further organize your expenses and make it easy to find deductions at tax time.

Or create rules for trending, predictable expenses or payments to help you automate data entry. Unfortunately, you can’t add a journal entry or new category since they are strictly Schedule C categories.

You can also add new transactions and easily import receipts. The mobile app makes this even easier.

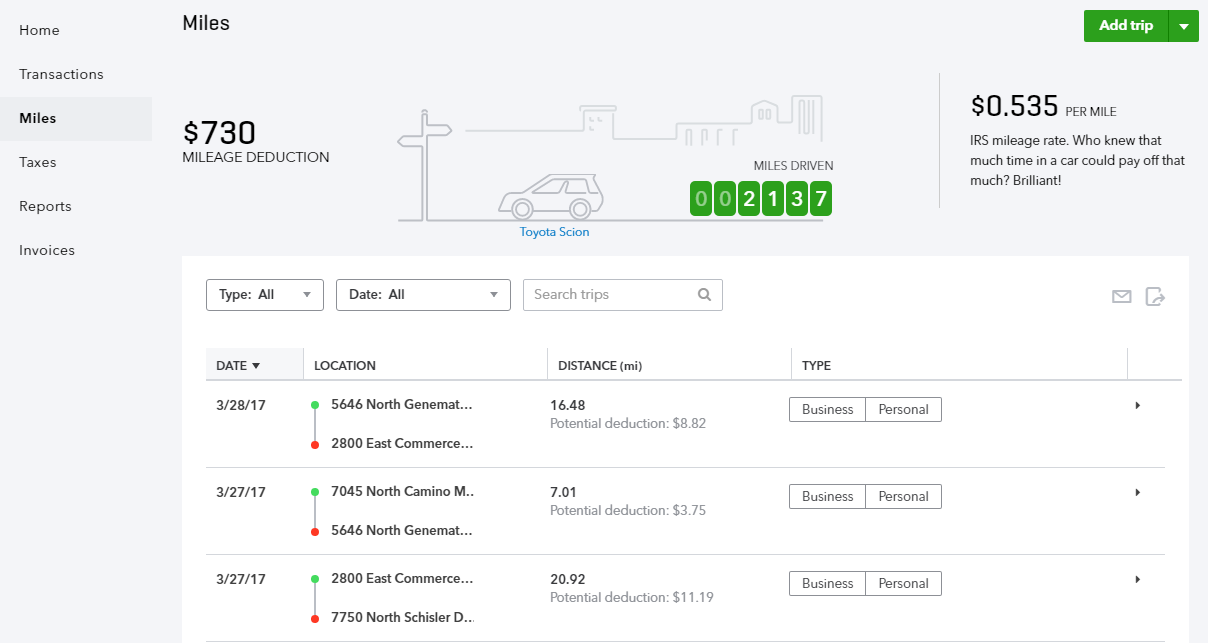

Tracking your Miles

In the Miles tab, you can easily and automatically track your miles. On the web, you can add individual trips, notes, and more so you don’t have to make year-end mileage guesstimates. If you download the app (with GPS), which I’d highly recommend, you can track trips automatically.

Sorting Through Taxes and Deductions

In the Taxes tab, you can set up your tax profile and estimate your quarterly and annual tax payments, so you’ll never be surprised when tax time comes around.

A Deeper Dive into Reports

In the Reports section, you can review your profit and loss statement, which summarizes your income and expense so that you can see how profitable you are. Your Tax summary shows your taxable business profit and totals for Schedule C deductions. And finally, your Tax details show transaction info by category. This is a downloadable Excel file.

Tracking and Sending Invoices

Last but not least, Quickbooks Self-Employed makes it easy for you to create and track invoices via the Invoices tab. Plus, clients can pay via Quickbooks Payments (online payment processing).

***

Quickbooks Self-Employed is a fantastic play by Intuit. The gig economy is growing more and more every day. And as millennials continue to start their own companies and work for themselves, this growth will only continue.

Unlike complicated accounting software or the more comprehensive QuickBooks products, Quickbooks Self-Employed is a super easy-to-use product that is perfect for solopreneurs, freelancers, or independent contractors.

If you want to make expense tracking easy and get the most deductions when it comes to tax time, you should absolutely give this product a try.

The post QuickBooks Self-Employed 2017 Review appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/quickbooks-self-employed

No comments:

Post a Comment