As a small business bookkeeper, I can’t think of an industry that would need to install QuickBooks Desktop anymore. In 2017, unless your small business resides in a part of the world without internet access, regardless of your niche, QuickBooks Online is the solution to go with out of the two choices.

The biggest plus is the QuickBooks Online ecosystem, with QuickBooks Online as the hub. So if you’re a manufacturer or general contractor, or if you require more advanced functionality, you can find what you need through the many third-party app solutions found at Apps.com.

So, where is QuickBooks Online in 2017?

Let’s dive into the key features you can leverage to track your business activity whether you connect to a third-party app or not. And I will even list some key apps that come up weekly for me when clients seek further automation and workflow efficiency.

QuickBooks Online Review: 2017

Bank Feeds

Let’s start with bank feeds, a great way to build some automation into your accounting entry flow. You can find QuickBooks Online’s Bank and Credit Card page either from the Transactions tab in the left-hand panel or from the Banking tab in the left-hand panel (if you signed up for QuickBooks Online any time after mid-December 2016).

Note the two feeds I have below, as well as the bank balance, vs. what is in QuickBooks Online register. There are three sub tabs too—For Review, In QuickBooks, and Excluded. For Review is the latest feed and not yet added to the register.

You can either drill into a downloaded transaction to choose the correct payee and account, or let QuickBooks Online do it, based on prior feed activity. I like starting with the Recognized section, as those are the transactions QuickBooks Online either remembers from last time, direct matches to the register or applied rules.

Recognized transactions can be batch accepted into the register. I use the term “accepted,” as you might be adding them or matching them to what is already there, so they are not duplicated. Green is good!

As my client’s advisor, when I’m in bank feeds, we create rules for the predictable expenses and payments. I don’t want to do any data entry if I can avoid it, and I don’t want my clients to have to do a lot of that either.

Automating the data entry is one of the most important parts of a 2017 QuickBooks Online review. It’s what make the software really stand out. But to get there, bank rules are the key. (Notice how I can even tell QuickBooks Online to automatically add to register once the rule has been applied.)

Bank and credit card feed is the core of QuickBooks Online, the backbone to creating that work/life balance you so crave. With the help of your ProAdvisor, setting up bank feeds and rules saves you time, and offers the opportunity that your reports will be current, as of yesterday or even today.

Recurring Transactions

Recurring transactions in QuickBooks Online also cultivate this environment of data entry automation we are all seeking. This is the ability to create expense or revenue templates that enter automatically at intervals of our choosing.

Again, why do the data entry at all? Entering a bill or credit card expense is not an appropriate relaxation technique.

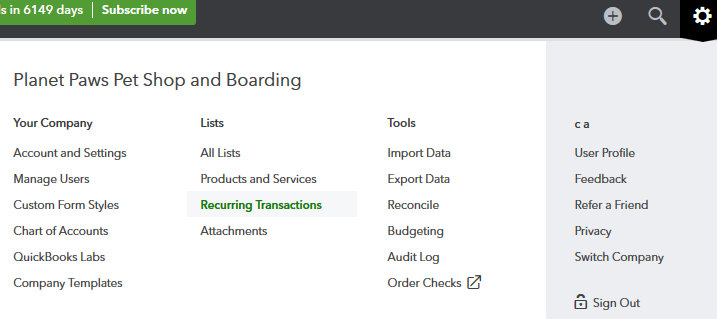

What is calming to the mind is telling QuickBooks Online to enter it for you. You will find the recurring transactions list from the gear icon at the top right of QuickBooks Online. (Of course you can make a transaction recurring when on any transaction, save for a bill payment, receive payment against invoice or paycheck. For customer payments, recurring sales receipts are a fantastic option to automate customer payments, though.)

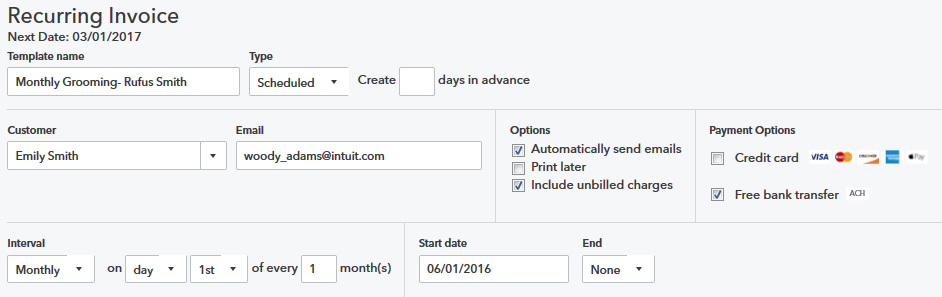

Above is a screenshot of recurring bill. Again, I can make nearly any form in QuickBooks Online recurring. The best story is recurring revenue when the customer payments are also automated.

QuickBooks Payments

Make sure to turn on QuickBooks Payments in Account and Settings. It’s free, and ACH payments from your customers are also now free. No monthly fee, no per transaction fee.

What? Yup! Just super fab.

Though my screenshot below is of a recurring invoice that goes out to a customer automatically, the free bank transfer option lets my client’s customer pay online, simply by entering their bank and routing numbers. My client is funded in 48 hours, and the invoice closes automatically. The only legwork is setting up the recurring invoice template and checking off a couple boxes.

I do this with my monthly service clients, setting up recurring sales receipts and entering in bank/routing info once. Every month I get paid, and every month the client gets an emailed receipt of payment. No more A/R! No more data entry. No more waiting for a check to arrive in the mail or hassle with a phone call. Set it and forget it, let it!

Again: The theme of our 2017 QuickBooks Online review is automation, automation, automation.

Did I forget to mention the invoice or sales receipt is auto sent out of QuickBooks Online?

Note the “Include the unbilled charges.” Any time this customer is tagged to expense, material, time, or a delayed charge, this monthly invoice picks up the unbilled activity so it is not left out.

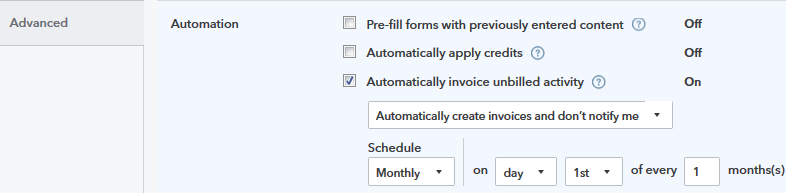

Bill your customers for all the work you are doing for them. There is also an advanced setting for this in QuickBooks Online, in case you have no use to set up recurring invoices but still don’t want effort being left unbilled.

Online Bill Pay

Right now, I’ve been part of the beta test of Online Bill Pay within QuickBooks Online, via a tight integration with Bill.com. You can see in the screenshot below that it adds a menu option under Vendors when I use the Quick Create button:

Here, you can see me selecting a bill to be paid:

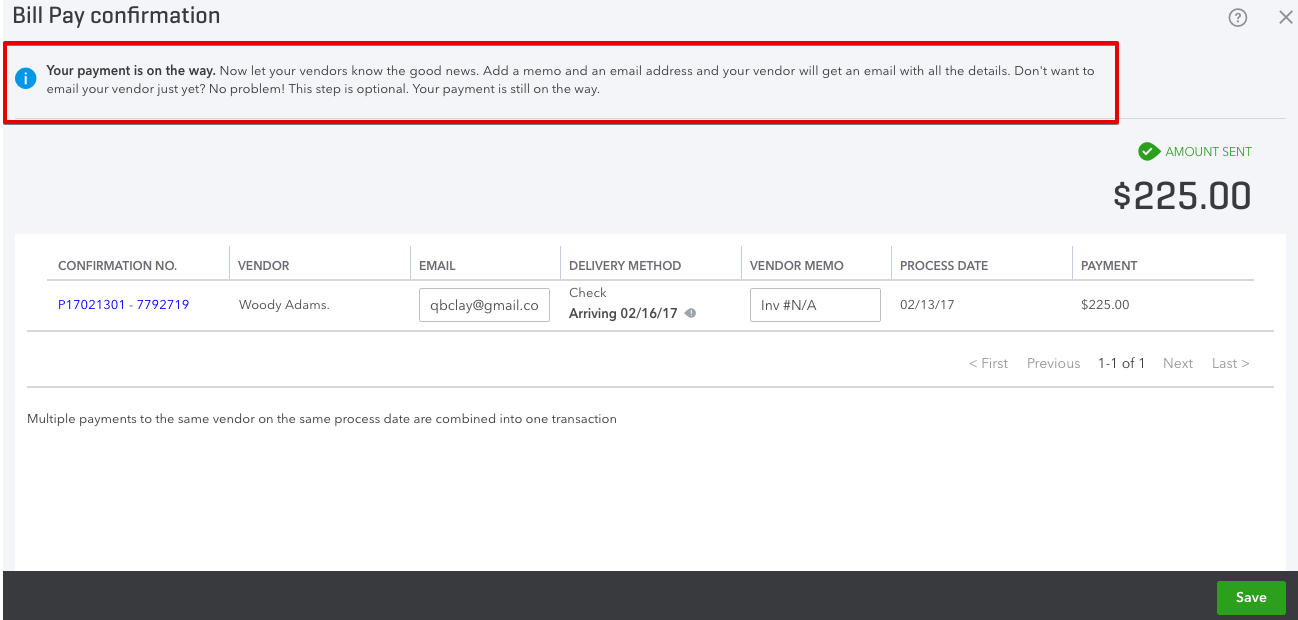

And here’s my confirmation of the bill payment having been scheduled:

I’m not sure when this will be out of beta, and right now, only master admin users can do the beta setup, and only they will have Online Bill Payments access rights. But I imagine that will change once in widespread release.

Changes to Invoicing

Let me leave you with one more QuickBooks Online feature that some small businesses are noting in their files. This would be most QuickBooks Online users who signed up for QuickBooks Online around mid-December 2016 but will be standard in all QuickBooks Online companies one day. (I have no idea what the ETA is at this point.)

There will now be better visibility for invoicing. Actually, it won’t be just invoices but also what payments paid what invoices, partial payment visibility, and—my favorite—enhanced clarity between what was paid and deposited, and what was paid but not yet deposited! This is a huge win for small businesses.

Apps.com

Don’t forget: There is an ecosystem of apps for QuickBooks Online that continues to grow and solve any niche requirement, from A1A billing, to tracking labor burden, to managing your trucking fleet, and even brewing beer!

Want to see for yourself? Check out Apps.com. You can search by niche even to find an app that will fit QuickBooks Online into any scenario you got. Check it out!

The QuickBooks Online review of changes coming in 2017 show QBO continues to get smarter and better for business owners every day. Apps.com makes the software work for anyone. If you want to automate your bookkeeping, there really is nothing better.

The post The 2017 QuickBooks Online Review for Small Business Owners appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/quickbooks-online-review

No comments:

Post a Comment