The IRS tax code is complicated—many small businesses struggle to understand how their tax liability is determined.

While understanding how the small business tax rate is calculated and applied can seem overwhelming to any business owner, getting some basics down can help you while making decisions and working with your tax professional.

This guide breaks down the types of federal taxes your business may be subject to, how these taxes are applied to different types of business types, and the different rates applied to your business earnings.

Types of Small Business Taxes

There are several types of federal taxes that a business must pay to the IRS. Your company might have to pay one or all of them, depending on your business structure, whether you have employees, or what products or services you provide to your customers or use to conduct business.

The five general types of taxes are:

Income tax: Everyone is familiar with income tax—individuals must pay income tax on their wages, income from investments, and gains from the sale of property they own. Generally, a business must also pay tax on the net income it earns each year.

Estimated tax: This is tax you pay throughout the year, based on what you think your taxable income at the end of the year is going to be. The amount of estimated tax payments you make throughout the year is deducted from your total liability when you file your tax return. The federal tax is a pay-as-you-go tax and you can incur penalties and interest if you fail to make the required estimated tax payments when they are due.

Employment taxes: If you have employees, you are responsible for paying employment taxes on their wages. Employment taxes include federal income tax withholding, Social Security and Medicare taxes, and federal unemployment tax. Check out this page to learn more about your responsibilities as an employer, along with where and when to pay and file employment taxes. Many businesses hire a payroll company to manage their payroll tax liabilities and file their tax forms on their behalf. Employment taxes can be complicated—failure to file and pay timely can result in stiff penalties and, in some cases, criminal prosecution.

Self-employment tax: Self-employed individuals are responsible for paying self-employment tax, which includes Social Security and Medicare. You must pay this tax if your net earnings from self-employment last year were at least $400. Most businesses pick up half of the tab for Social Security and Medicare taxes on their employees’ wages, while the other half is withheld from the employees’ paychecks and remitted by the business. But for self-employed individuals, they pay the entire amount for these taxes on their own. Special rules apply here, such as for self-employed individuals who work for a church or on a fishing crew.

Excise tax: If your business engages in certain types of industries or sells certain types of products or services, you might be responsible for excise taxes on these transactions and activities. An excise tax is an indirect tax, meaning it isn’t directly paid by the consumer of the product. The tax can is either calculated as a percentage of the price of the product or service (ad valorem) or as a fixed dollar amount. Different industries are subject to different excise taxes, and each is calculated and reported using its own tax form.

Tax Rates by Type of Tax

The federal income tax is a progressive tax, which means the more income you make, the higher the rate you will pay. Income tax rates also vary by the type of entity being taxed and the amount of taxable income. Individual tax rates are determined by your taxable income and your income bracket. Your bracket depends on your filing status and a number of exemptions.

Individual income tax rates for 2017 are 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Corporate income tax rates for 2017 are 15%, 25%, 34%, 35%, 38%, 39%. The rates vary based on your taxable income and are not necessary progressive depending on your level.

Employment taxes include:

- Social Security: 12.4% on wages paid up to $127,200 for 2017. Employers pay ½ of this amount (or 6.2%), while the other ½ is deducted from the employee’s wages.

- Medicare tax is 2.9% of all wages paid to an employee (no wage threshold) with the tax split between employer and employee. There are additional medicare withholding requirements for highly paid employees.

- Federal unemployment tax is generally 6% of the first $7,000 you pay to an employee. You can usually take a credit against this tax for amounts paid into your state unemployment funds. If you’re entitled to the maximum 5.4% credit, the federal unemployment tax rate is reduced to 0.6%.

- Excise taxes: These taxes vary greatly based on the type. You can read more about the different types of excise taxes and rates in Publication 510.

Who Pays the Tax?

In most cases, the business is responsible for paying the tax to government. But in certain cases, the business might not be the one writing the check. All companies pay employment and excise taxes directly, but not all companies pay estimated taxes or income taxes to the IRS.

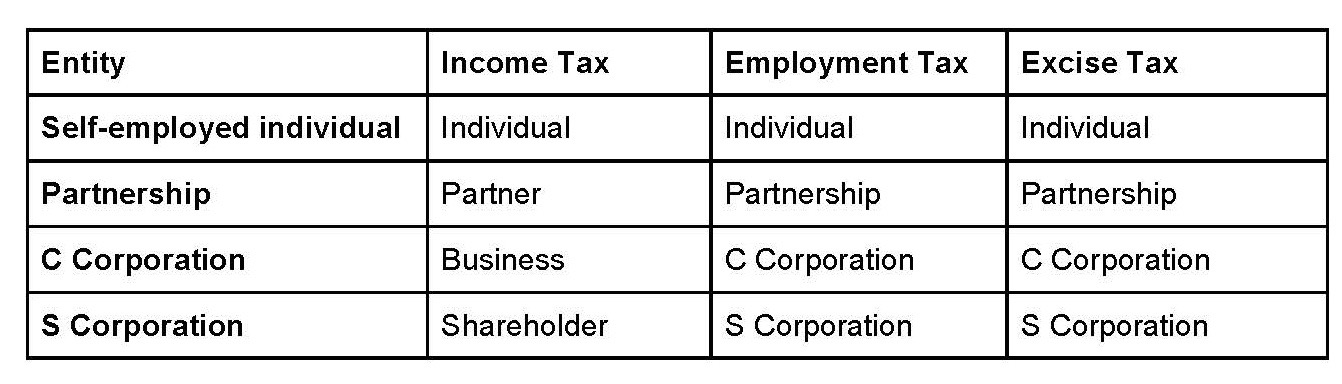

The legal structure of your business determines who pays. Partnerships and corporations that elect to be treated as S corporations pass their taxable income through to the partners or shareholders, who include their portion of the income on their own tax returns. A partner or shareholder can be either another business or an individual. The chart below summarizes who pays the tax for each type of entity.

Summary of Who Pays Which Taxes for a Business

Selecting an entity type for your business can affect the amount of tax you pay on your income. Corporate tax rates are higher than individual tax rates. In some cases, passing income from a Partnership or S Corporation through to your individual return will result in less tax paid on the income.

Selecting an entity type for your business can affect the amount of tax you pay on your income. Corporate tax rates are higher than individual tax rates. In some cases, passing income from a Partnership or S Corporation through to your individual return will result in less tax paid on the income.

Determining Your Small Business Tax Rate

Figuring out your small business tax rate isn’t as easy as multiplying your net income or the cost of machinery by your tax rate. For example, your taxable income might be different from the net income of the business for a variety of reasons. Some businesses take advantage of special deductions, such as the Sec 179 deduction, which lets businesses deduct the total cost of a major purchase, like a vehicle or machinery, in the year of purchase. Others may have NOL (net operating loss) deductions carried forward from a prior year that reduce the amount of the current year’s taxable income.

Your business could also be eligible for some of the many credits that can reduce the amount of tax you pay and your effective tax rate. While your marginal small business tax rate is based on your tax bracket and the rates set forth by the IRS, your effective small business tax rate is essentially the total tax paid divided by your taxable income. This is why two businesses with the same net income for a year could pay different amounts of federal income tax.

Because the tax code is so complicated, it is wise to work with a qualified tax professional, like a CPA, enrolled agent, or tax attorney. Their expertise can help you understand the types of taxes your business is responsible for and make sure you are paying the correct amount.

from Fundera Ledger https://www.fundera.com/blog/small-business-tax-rate

No comments:

Post a Comment