My friends at Fundera asked me to write an article comparing Freshbooks vs QuickBooks. I did indeed do that, but I have to say this before you read any further: I’ve owned a bookkeeping and consulting business, Kildal Services LLC, for the better part of 15 years. We only support QuickBooks products, and I’ve exclusively used some version of QuickBooks since 1998. In other words, my viewpoint started out pretty skewed.

I’m not doing a side-by-side feature comparison. You can find those on about a dozen different websites. Instead, I’m going to tell you about specific features that I like or dislike in both. So rather than a true Freshbooks vs QuickBooks piece, this is really a “which one does it better” article, and I’ve covered 3 categories: pricing, interface, and accounting functionality.

Freshbooks vs Quickbooks: Pricing

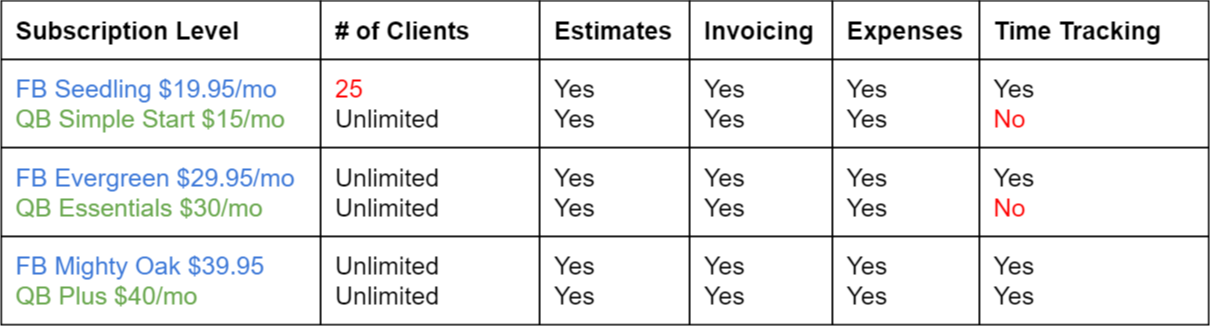

The pricing for Freshbooks vs QuickBooks is similar, but not identical. With Freshbooks, you pay for the number of clients you have plus features plus additional users. With QuickBooks Online, you pay for features plus users.

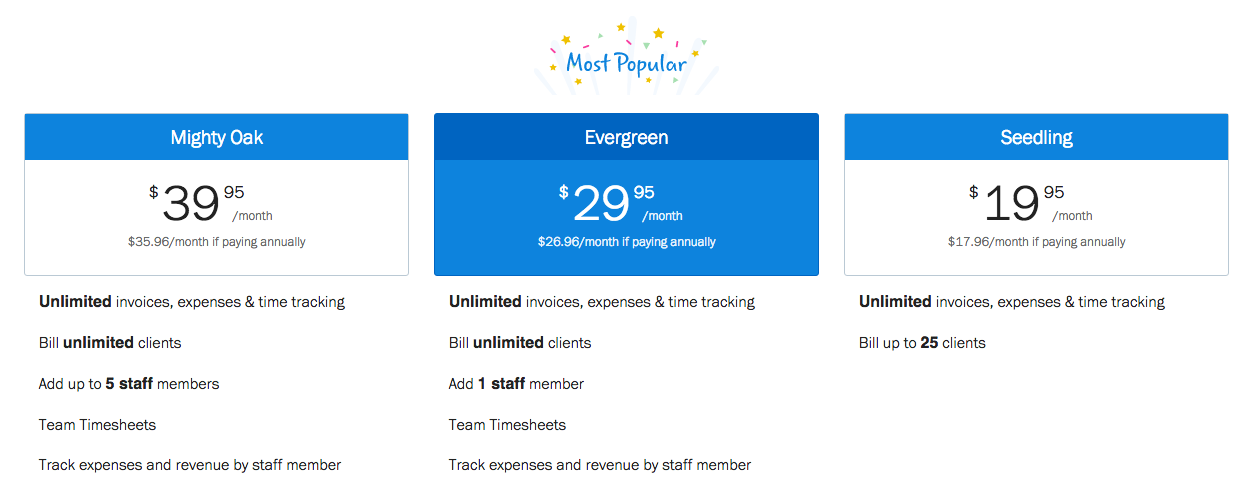

Freshbooks pricing:

With Freshbooks, for $19.95/month, you get estimates, invoicing, expense recording, time tracking and reporting, but only for 25 clients. This could be a problem. You might hit that that 25 client limit if you’re adding them to create estimates. As far as users go, I either get one with the Seedling level, two with the Evergreen level, or six with the Mighty Oak level. You can add one accountant user (in other words, a bookkeeper or tax preparer) with each level.

With Freshbooks, for $19.95/month, you get estimates, invoicing, expense recording, time tracking and reporting, but only for 25 clients. This could be a problem. You might hit that that 25 client limit if you’re adding them to create estimates. As far as users go, I either get one with the Seedling level, two with the Evergreen level, or six with the Mighty Oak level. You can add one accountant user (in other words, a bookkeeper or tax preparer) with each level.

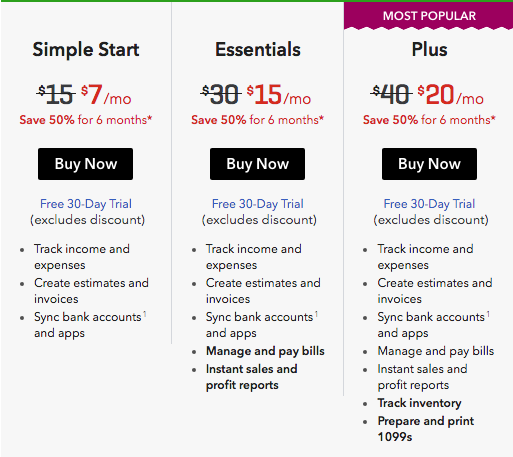

QuickBooks Online pricing:

With Quickbooks Online, you’re only paying for features and users. The number of clients you can have is unlimited. So regardless of how many users you need, if you want all the features, you’ll pay $40 retail. If you just need the basics—estimates, invoicing, and expenses—you’re still paying $15/month.

However, I do love that you can track time in Freshbooks for client projects at any subscription level. Plus, you have the ability to turn the hours into an invoice, you can visualize the time you have in for those projects, and you can mark hours as already billed without creating an invoice from them. With QuickBooks Online, you can only track time against clients/jobs with the Plus subscription.

So… It’s a tie?

Freshbooks vs QuickBooks Pricing Advantage: QuickBooks Online & Freshbooks

Freshbooks vs Quickbooks: Interface

When comparing Freshbooks vs QuickBooks on interface, obviously I’m used to QuickBooks because I’ve been using it for almost 11 years. I found Freshbooks easy to navigate as well, because it looked very similar to older versions of QuickBooks Online.

Freshbooks homepage:

QuickBooks Online circa 2012:

See?

The Freshbooks interface made me feel like I was using an old-timey website. (And for what it’s worth, I just cracked myself up typing that sentence. Because calling a site that looks like another one that’s only four years gone “old timey” is slightly ridiculous. True, but still a little silly.)

The QuickBooks Online homepage:

To me, this is a more modern look. There’s some white space, and for me, more relevant information.

One thing you can’t tell from these screenshots is that, with QuickBooks, the expenses that show on the homepage are actual expenses that have been assigned to the General Ledger. Meanwhile, the expense on the Freshbooks expenses are just everything that’s been downloaded via a bank feed.

Note the giant chunk of that pie chart that says “Uncategorized”: these are transactions that have been downloaded, but no one has assigned them to the correct expense categories. Not ideal, but it’s a good segue into the the next category.

Freshbooks vs QuickBooks Interface Advantage: QuickBooks Online

Freshbooks vs Quickbooks: Accounting Functionality

I’ve already mentioned a few Freshbooks vs QuickBooks accounting features, like time tracking (Freshbooks does this better) and bank feed management (QuickBooks does this better). I want to talk about some other stuff, just some basic functionality that I believe should be in any accounting application.

The biggest issue is that there’s no chart of accounts in Freshbooks. There is no way to see what a business’s cash position might be, no way to track balances of credit card accounts, no ability to add or manage a line of credit, sales tax payable, nothing. I attempted to edit the existing “Categories” expense accounts but was unable to do so. I could add or delete them, but was unable to add any income accounts. I can track my income, but only if it’s all one type of income.

This mean a Freshbooks user is unable to open a register to view the history of transactions and that they are unable to reconcile any bank and/or credit card accounts. How is a business supposed to make sure their books actually match what the bank is saying? With Freshbooks, they just can’t do it.

¹ Freshbooks offers recurring invoices, but QuickBooks online not only offers recurring invoices, it also lets users set it so that it will automatically create invoices on a predetermined interval if there are any time/expenses marked as billable. I didn’t see this option in Freshbooks. QuickBooks Online also offers delayed charges for things you want to track but not put on an invoice until a later date.

² While both offer expense tracking, only QuickBooks Online offers a distinction between what type of expense. This is important when searching for a specific transaction—if a user has multiple bank accounts and credit cards, it makes finding a transaction much more difficult if the user doesn’t have an exact amount and/or date. There’s no ability to enter a bill to be paid later in Freshbooks, which means any company that wants to keep track of things they need to pay later is out of luck. I know many Cash Basis companies that still choose to enter the bills so that they can manage cash flow. If you want to do this, you’ll need QuickBooks Online Essentials or Plus.

³ QuickBooks has the advantage here. I could only see the ability to track 2 different tax rates in Freshbooks, and then I could find no way to mark those as paid… Only a “Tax Summary” report. I attempted to add an expense that could track this, but it didn’t show up in the report. This means a user can always look to see what Sales Tax they’ve accrued, but without creating a new expense category and doing a search for them, they can’t see the payments. (This is where a chart of accounts could come in handy: to look at the register.)

⁴ I mentioned this in the interface section, but as soon as transactions are downloaded into Freshbooks, they’re assigned as expenses. If the application can’t figure out what the transaction is, it dumps it “Uncategorized.” In QuickBooks, the transactions are downloaded, but then a user has to add as a new transaction or match them to an existing transaction, and then they show up as expense or income. I also noticed that when I added my American Express card in Freshbooks, it only brought in charges. No payments to the account.

⁵ Reporting is abysmal in Freshbooks. The first one I looked at—a Balance Sheet—was slightly insane. Aside from automatically entering the total for any Accounts Receivable, all the other totals had to be manually entered:

Why?

Again: no chart of accounts. If you can’t track any assets (not even a bank account!) or liabilities, then there’s nothing for Freshbooks to pull from to get this report. Why even bother?

Since I’m assuming Freshbooks is designed for service providers and not business that sell things, I’m also assuming most of these businesses are Cash Basis for their returns. In which case, they shouldn’t show any Accounts Receivable on a Balance Sheet in the first place.

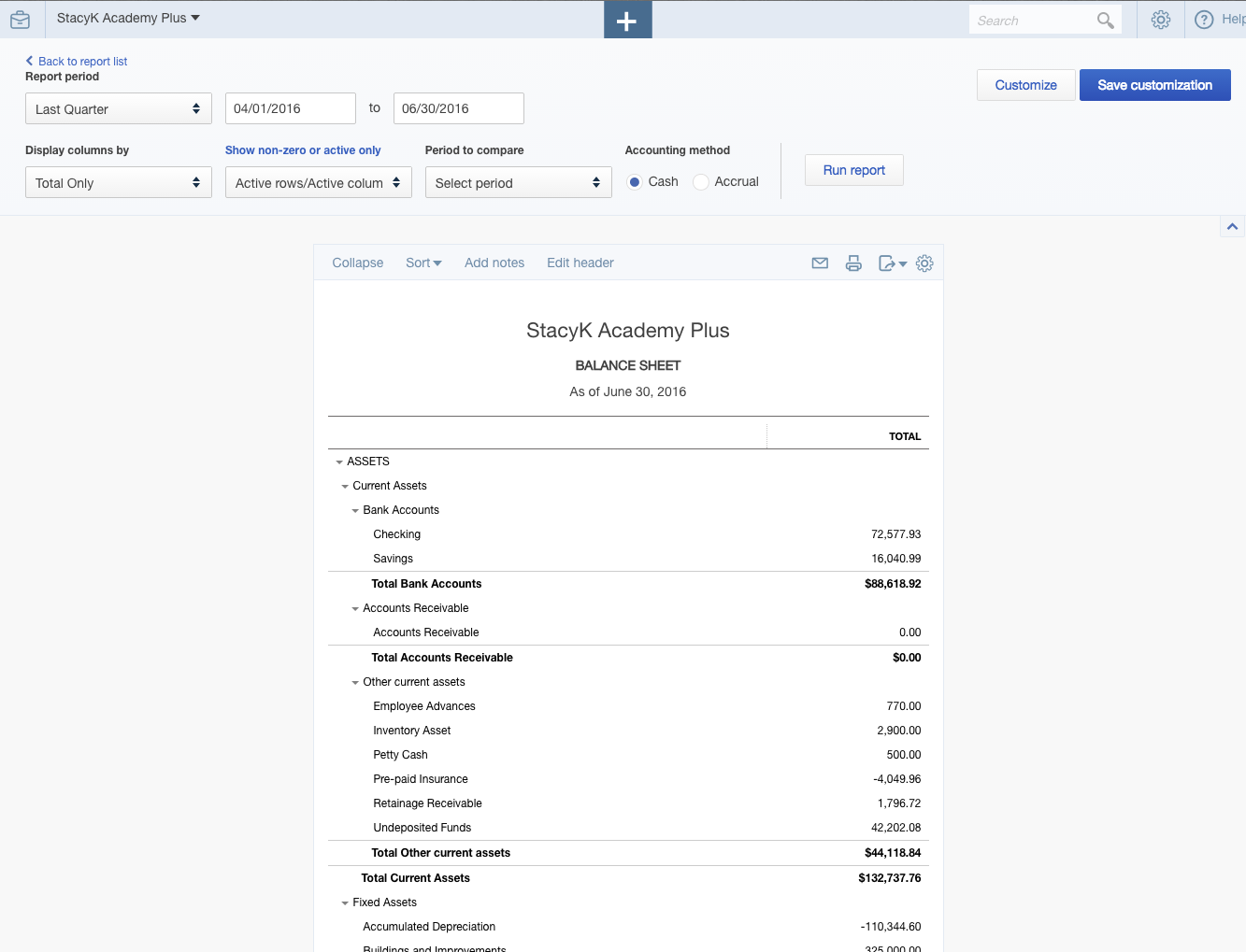

Here’s how a Cash Basis balance sheet looks in QuickBooks Online:

Note two things: $0 for Accounts Receivable (despite having open invoices) and no place to manually enter the other balances.

Freshbooks vs QuickBooks Accounting Functionality Advantage: QuickBooks Online

Here’s the final score for my Freshbooks vs QuickBooks comparison:

Your takeaway from this? The pricing is fair and reasonable for what you get with each program, and QuickBooks Online has a more modern, easier to navigate interface.

But most importantly, if you want true accounting functionality—and trust me, you do need this if you want to have a successful business—QuickBooks Online is the only one of the two that offers it.

The post Freshbooks vs Quickbooks: Which is Best for Your Business? appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/09/15/freshbooks-vs-quickbooks/

No comments:

Post a Comment