When I was asked to write about the general ledger, I groaned at the thought… What could I possibly write about it? But once I dug in, I found a few things that might be helpful to small business owners.

Before I tell you how the general ledger can help you, let’s do that thing where I explain what a few things happen to be.

General Ledger: Defined

A general ledger is a master of all the accounts your company has—it’s the complete record of financial transactions over the life of the company.

Let’s look at an example.

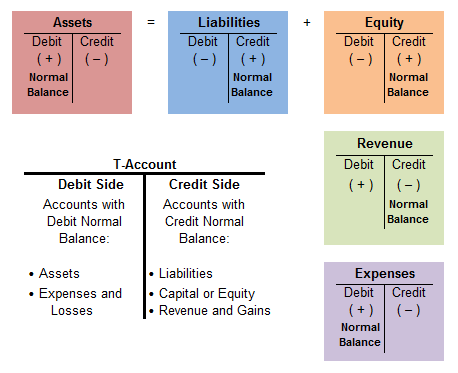

You should be making entries in your accounting system every day: checks, invoices, deposits. All of these hit your general ledger and are considering posting transactions. For instance, if you write a check to pay rent, that transaction will hit two accounts in your general ledger: it will credit (lower the balance of) your bank account and debit (increase the balance of) your rent expense account.

Each account has what’s considered a “normal balance.” Here’s a great tool to show you what these normal balances should be:

I got this here.

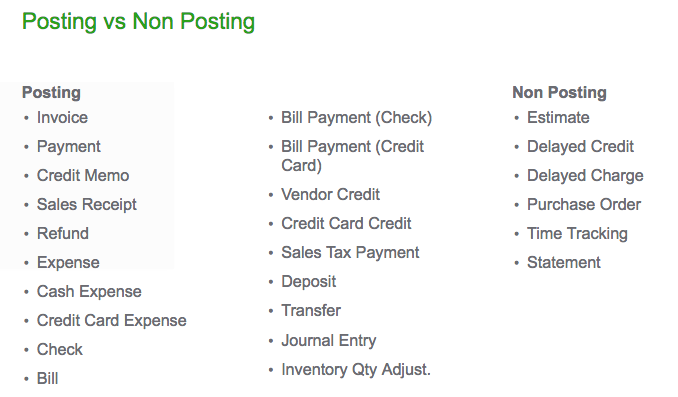

Not every transaction will hit your general ledger, though. There are a few transactions in QuickBooks Online that are considering “non-posting” and they never touch your general ledger. Here’s a list of posting versus non-posting in QBO:

(For the record, it drives me insane that Statement is listed here. Technically, a statement is not a transaction.)

Why are some transactions posting and non-posting? Let’s look at the non-posting transactions one by one: I’ll define them and explain why they don’t show up on general ledger reports.

- Estimates: This is when you tell your customer what you plan on selling them and what the price will be. No sale has been made yet.

- Delayed Credit/Charge: These transactions are ways for you to keep a tally of services or items for which you want to invoice a customer at a later date. Again, no sale has been made… Yet.

- Purchase Order: The flipside of an estimate, this is a transaction that you give a vendor to let them know what you plan on buying from them and at what cost. No purchase has been made.

- Time Tracking: Time transactions can be used to track time that will eventually show up on an employee paycheck, or time for which a client will be invoiced at a later date.

- Statement: This isn’t a transaction. It’s actually a list of transactions that have already posted to your general ledger.

How the General Ledger Can Help Small Business Owners

The general ledger can be the most useful tool in your business—it’s a simple way to view spending in order to keep you business on track. Specifically:

- To make sure your books are accurate. A quick glance through the general ledger can show where you might have made a mistake on data entry or where numbers aren’t adding up. You can review a general ledger report to make sure that everything posting to telephone is correct: if you see all AT&T and then one for Consumers Energy—you’ll know that one was mis-posted.

- To track financial expenditures. We all know that you can’t spend more than you earn without consequences. Reviewing the general ledger will keep you stay on top of spending and guarantee that vehicle payments aren’t allocated to an Auto Expense account. These should be split between Loan/Liability account and an expense account to track interest.

- Track the company’s transactions—have you deposited personal funds into the bank account to cover costs? Ever paid for business expenses with personal funds? A general ledger report will help make sure that those deposits aren’t recorded as income and those expenses are on the books.

Reading the General Ledger

You’re probably saying that it’s great to know what this thing is, but why do I need it? Whether you do your own bookkeeping or outsource to someone like me, you need to be familiar with the general ledger. Every financial transaction that impacts your business is in the general ledger, in the form of a posting transaction.

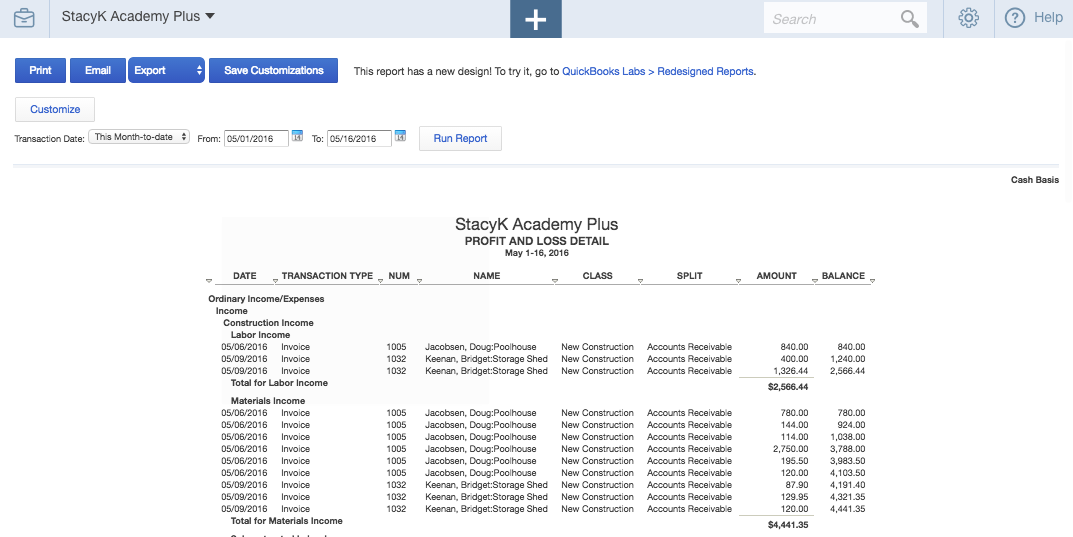

Odds are good that you won’t be reviewing a general ledger report very often. Most small business owners I know review their Profit & Loss and Balance Sheet reports monthly, if not weekly—or even more often. They’re familiar with drilling down into specific accounts to make sure that everything has been allocated correctly.

P&L Detail lists all income/expense transactions for specified period.

One of my favorite things about QBO is that users can customize reports and have them emailed to themselves or others on a recurring schedule:

Automatic emailing reports kicks so much ass.

I end with this recommendation for small business owners: if you’re reviewing your financial statement detail reports on a weekly basis, your books will be in near-perfect shape by the time your tax preparer asks for the general ledger at the end of the year. And don’t be surprised if they tell you that you’re one of their favorite clients!

The post Why We Need to Have a Serious Talk About Your General Ledger appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/05/17/general-ledger/

No comments:

Post a Comment