Here’s the deal. Every business needs an accounting system: we’ve been over that a few times. So we got that part, right?

I got this here.

Cool. Now, I want to talk about your Chart of Accounts. I promise—this won’t take long. I just want to point out a few things to keep in mind when creating (or editing) your Chart of Accounts.

What the heck is a Chart of Accounts?

AccountingCoach.com uses this definition: “A chart of accounts is a listing of the names of the accounts that a company has identified and made available for recording transactions in its general ledger.”

Which then leads to the question: what is a general ledger? And that leads to needing to find out about financial statements…

I got this here.

You know you were thinking it.

Here’s what I tell my clients: the chart of accounts is the backbone of your accounting system. Everything you do in bookkeeping/accounting starts and ends with that chart of accounts. You can enter transactions without a customer name, or a vendor name, but you always need accounts.

You don’t need account numbers…

…But they might come in handy. In QuickBooks Online, you can’t order your chart of accounts in any way other than alphabetical. If you want them to show up on your QBO reports in any other order, you’ll need to use account numbers—but keep in mind that there’s a certain way they need to be numbered.

I said this wouldn’t be boring, so I’m not going to list how account numbering works, but you can find the list here.

Keep it short

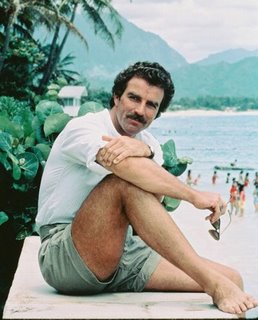

Like Magnum PI’s shorts: long enough to cover everything, but short enough to keep it interesting.

I got this here.

See? You get it.

Alright, back to work! I’m trying to tell you to create a chart of accounts that will give you important information, but that doesn’t mean every single detail about every single transaction.

You don’t need a separate account for every single product or service you sell: use items to track that.

You don’t need a separate account for each utility: expense by vendor reports can give you that data.

So put what you need in your chart of accounts. For many micro and small businesses, that means keeping it to one page. Sub-accounts are a great way to get more detail.

Don’t go crazy with editing

I understand that sometimes you need to add or edit the accounts, but I have to beg you to be mindful of this. Merging, deleting, or renaming accounts will drive your bookkeeper and tax preparer, um… Insane.

If you’re going to add an account, make sure you don’t already have one that you can use.

I used to have a client who would add a new account every week. Every. Single Week. There was one already in his Chart of Accounts called “Contracted Services” for any payments to independent contractors and he would add a new one—every week—that was some variation: “Contract Labor” or “Contract Service Labor” or “Contractor Service Payments” or “Contractor Service Labor Payments.” Please do not do this.

I got this here.

Just… Don’t.

Try out the default

Taking all of this into account (see what I did there?), the last thing I want to say is that the default chart of accounts that QuickBooks Online sets up is usually sufficient.

There might be accounts you need but don’t have, or accounts that are created that you don’t need. If you’re unsure, take the time to find a ProAdvisor to help you create chart of accounts that will give you the information you need to make decisions about your business and your future.

For instance, if you’re thinking about trying to get those Magnum PI shorts to make a comeback. Personally, I think it’s worth a shot, regardless of what the reports say…

I got this here.

You know I’m right.

The post Your Guide to a Chart of Accounts (That Won’t Bore You to Tears) appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/04/26/your-guide-to-a-chart-of-accounts/

No comments:

Post a Comment