For the past few years, the Federal Reserve Banks of New York, Atlanta, Boston, Cleveland, Philadelphia, Richmond, and St. Louis have joined together to release the Small Business Credit Survey in February. Nearly 3,500 businesses with fewer than 500 employees were surveyed!

There were a few interesting and informative trends from 2015 highlighted in this report, but the most compelling one we found was the success of small banks in the lending landscape.

Let’s take a look at the data.

A Reliable Credit Source

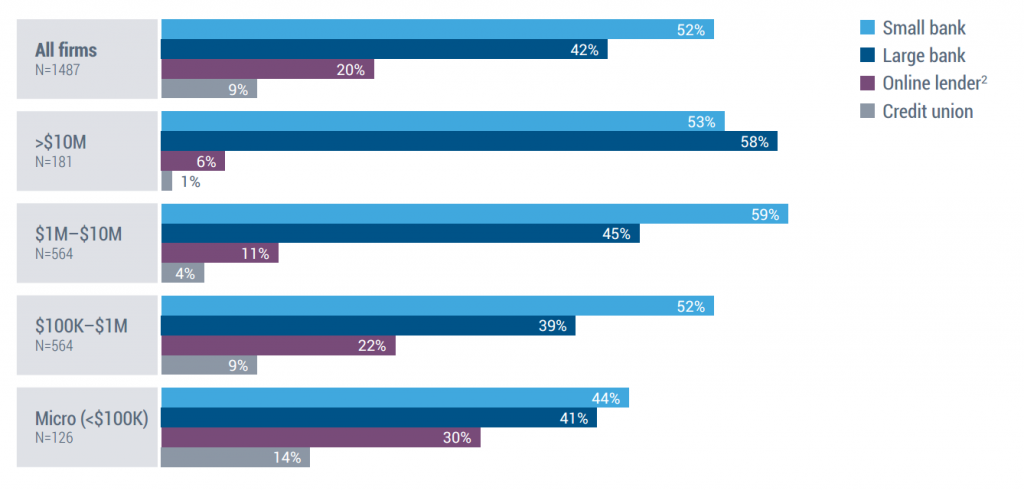

This graphic shows the credit sources applied to by the revenue sizes of applicants.

Small banks make up at least half of all credit sources applied to for nearly every category of company—except for microbusinesses, defined as businesses with less than $100,000 in yearly revenue. Younger, smaller businesses tend to have more trouble finding business loans from banks, which accounts for the accompanying increase in credit unions and especially online lenders.

While this doesn’t prove much by itself, it does show just how important the next few charts and graphs actually are. With over half of all credit applications heading towards small banks, they clearly have an immense influence on lending in the United States.

Small Banks, Big Wins

Next, let’s take a look at a table showing acceptance rates by credit source and loan type.

This charts the percentage of applicants who receive at least some funding. Overall, 76% of all applicants for credit from a small bank received some funding, while only 58% received funding when they applied to a big bank.

The chances of successful financing increased alongside the size of the business, which makes sense—the smaller and younger the business, the more precarious the investment, and banks tend to be risk-averse. That said, though, small banks still out-fund larger banks to a substantial degree at every tier of revenue.

Just playing the odds of 2015, you’re way more likely to secure funding from a small bank than from a big one—especially if you’re making less than $10 million a year in revenue.

Satisfied?

Small banks receive and fund more credit applications—but are small business owners happy with their deals?

This graph takes a look at the percentage of business owners who approved of their credit source.

Small banks won the popularity contest pretty handily—they were rated as 50% more satisfactory than the runners-up of credit unions and large banks. (Plus, note that only 46 businesses were surveyed here about credit unions, compared to 619 for small banks and 424 for large banks.)

And here’s a breakdown of the reasons that successfully funded applicants felt dissatisfied about their credit source. Surveyed small business owners could choose more than one response, and credit unions weren’t counted because of lower numbers.

The most apparent takeaway here is that small banks and large banks tended to have the same issues, except small banks still ranked better than big banks everywhere but in the “ease of application process” category and ranked significantly better in the “transparency” category. But again, overall, business owners preferred their small bank experiences much more than their large bank ones.

***

In 2015, on the whole, small banks received more applications, funded more small businesses, and were rated more highly per category and overall than their lending competition. If you’re a small business owner with more than $100,000 in annual revenue—since microbusinesses unfortunately still went underfunded in 2015—it seems as though a small bank is the way to go.

Finally, let’s just take a brief but heartening look at the success of small business credit in 2015:

Big banks or small, online lenders or credit unions—all lenders have stepped up and loosened their belts to give the small businesses of the United States more credit. Every category of financing has grown from 2014 to 2015. Whereas 1 in 3 small business owners would get rejected in 2014 from lending institutions surveyed by this report, only 1 in 5 met the same fate in 2015.

We’re excited to see how that trend keeps going strong in 2016 and beyond!

The post Small Businesses + Small Banks = Big Success appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/03/08/small-businesses-small-banks-big-success/

No comments:

Post a Comment