If you own a retail small business, you know that every product you stock and every square foot of your retail space matters to the bottom line of your business. At the end of every month, quarter, or fiscal year, the amount of profit or loss shown on your balance sheet reflects the products you chose to offer for sale, the value of those items over cost, and how quickly you were able to move those products through your store and into the hands of your customers.

Knowing that managing inventory has such a significant impact on any retailer’s long-term success, it’s surprising to note that very few retail small business owners have the right system in place to track the movement of their inventory—known in accounting as inventory turnover.

What is Inventory Turnover?

Very simply put, inventory turnover is the measure of how many times inventory is sold or used in a given time period—usually a year.

How to Calculate Inventory Turnover

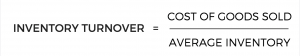

Accountants calculate inventory turnover using this formula:

Of course, this means that in order to calculate your inventory turnover, you’ll first need to determine your cost of goods sold and your average inventory…

What exactly are those, again?

Cost of Goods Sold (COGS)

These are the direct costs associated with producing or purchasing the products sold to a consumer. For manufacturers, this includes the costs of materials and labor time required. For a retailer who doesn’t make their own products, this’ll simply be the purchase price of products gotten from a wholesaler or manufacturer.

Let’s look at a few different examples of calculations for costs of goods sold:

- For a jewelry designer, the costs of goods sold would include the price of purchasing materials—like wire, beads or ornate jewels, precious metals, clasps, or any other materials that will be included in the final product. It will also include the cost of labor to make the individual jewelry pieces.

- For a retail electronics shop, which is presumably not manufacturing its own electronics, the cost of goods sold would simply be the wholesale purchase price of all inventory sold in a given time period.

Notice that the method of calculating cost of goods sold changes depending on whether your business buys products from a wholesaler or produces its own. For the purpose of calculating COGS, it doesn’t matter whether your products are sold to a retailer or directly to the consumer—the cost of goods sold is the same.

Remember that while your business will have many expenses, not all of those should be included in the cost of goods sold. Things like rent for your retail space, labor costs for your sales force, or tools and equipment shouldn’t get included.

Average Inventory

The good news about calculating your average inventory? Once you’ve determined your cost of goods sold, you’ve already done most of the work!

That’s because the only difference between these figures is that cost of goods sold reflects the acquisition or production cost of items that have already been purchased by a consumer, while the cost of inventory reflects the same value for items that you still have on hand (or haven’t yet been sold).

So, to calculate the value of your inventory, you’ll use those same calculations as above—either the purchase price from a wholesaler or materials plus labor if you’re making your own products—and apply them to the inventory that you’re holding in-house at a given point in time.

However, keep in mind that the amount of inventory you have on hand at a given time can fluctuate considerably.

For example, right before or after you receive a big shipment of new inventory, the total value of your inventory on hand will change a lot. That’s why accountants calculate the average inventory—to get a better idea of the median amount of inventory held by your business at a given time.

Use this formula to calculate your average inventory for a given time period:

The Importance of Time Period

Depending on why you’re calculating your inventory turnover, you can apply your inventory measurement to a few different spans of time. A year is standard, but in some cases you might want to calculate your inventory turnover for a given month—or even a particular week.

Regardless of what time period you’re using, what’s most important is that you’re applying the same dates to your cost of good sold as you do for your average inventory. Otherwise, you won’t be comparing apples to apples, and your inventory turnover calculations won’t accurately reflect what’s happening with your business.

Identify the time period you want to use, then calculate your cost of goods sold and your average inventory, using the same start and end dates for each’s time period.

The Ideal Inventory Turnover Ratio

In the broadest terms, accountants’ general rule of thumb for your inventory turnover ratio is the higher the better—within reason.

If your inventory turnover is very low, that means your inventory spends a whole lot of time sitting on your shelves, not being sold. That translates into a lot of money on space for that inventory to just sit around, plus a high risk that the inventory will become damaged or that its value will depreciate because consumers don’t want it.

Consider the Product Type

Beyond that broad-strokes recommendation, the range of what’s considered “normal” in inventory turnover can change vastly based on the nature of your business and the products you sell.

For example, grocery stores, bakeries, and other businesses that sell food and other perishable goods typically need to have the highest inventory turnover out there, because their products go bad and lose their value much faster than, say, a designer shoe store’s. A gallon of milk is saleable for about a week or even less, while a pair of shoes can sit on the display for weeks or even months and keep its value.

Too Much of a Good Thing

In fact, for non-perishable goods, there can be such a thing as an inventory turnover that’s too high.

On one hand, high inventory turnover can mean high sales volumes—but it can also mean that you’re not keeping enough inventory in stock to meet the demand. Back to the shoe store example—if new shipments of a certain brand of shoe are selling out the same day they arrive in store, that’s a definite sign that you need to be ordering larger shipments of each product. This is a good problem to have, but still something to keep an eye on!

5 Ways to Apply the Inventory Turnover Ratio

When we’re talking about a figure that can easily be calculated on the back of a cocktail napkin and doesn’t have an exact “ideal” to aspire towards, you might be wondering… Why is inventory turnover so important for my business again?

Let’s take a look at the different ways you can apply the inventory ratio to improving your business!

1. Total Inventory Turnover

The first number you’ll want to calculate is your total inventory turnover for your business. It’s usually best to start with a big picture view of your business for a full fiscal year, and then “zoom in” to particular products or time periods.

If you use accounting software like Quickbooks, Freshbooks, or Wave to track your business finances, there should be a section already included on your balance sheet for value of inventory and cost of goods sold. If you’ve maintained these sections accurately, it should be easy to calculate your total inventory turnover for the most recent year.

Keep in mind that while calculating your total inventory turnover is useful, it might not show a completely accurate portrayal of what inventory turnover looks like for your business within different product categories or in a given month or season. That’s why it’s important to dig further into particular sectors of your business to consider exactly how inventory moves through your business.

2. Inventory Turnover By Product or Category

Which products in your store sell out faster than you can get them in stock? What inventory sits on your shelves for months at a time, just taking up space? Should you order more green dresses next month or save space on the rack for blue skirts?

These are the questions you can answer by calculating inventory turnover for specific categories or items within the grand scheme of all the inventory you sell. By gathering data on the most and least popular products in your store, you can make smart decisions about items to select for a sale or markdown, as well as make better choices about what products to buy or make more of in the future.

3. Seasonal Inventory Turnover

If you own a ski and snowboarding equipment shop or a designers swimsuit boutique, you’re probably pretty familiar with the ups and downs of sales volumes during high and low seasons for your business. For these businesses, relying on an average inventory turnover ratio over the course of a year can be very deceiving, leading you to have too much inventory on hand during slower months, but then quickly sell out of stock during higher sales months.

Use shorter spans of time instead, like a fiscal quarter or even a month at a time, to calculate the amount of inventory you’ll need during your “high” season—and to make sure you don’t have too much excess product collecting dust during your “low” seasons. It helps to pay particular attention to the months at the beginning and end of your busiest season to make sure you have the right amount of inventory on hand when you need it.

4. Product Category and Season Together

Even if your business isn’t strictly seasonal, you can combine calculating inventory by product or category with seasonal inventory turnover calculations to figure out how much of a given product you should stock in a given time period. This will help you to match your ordering or manufacturing with the seasonal preferences of your customers

For example, if a clothing store gets a new shipment of sweaters in June, that inventory will probably take up space in the shop for quite a long time. Consumers won’t want to purchase the sweaters until cold weather comes around again. And even then, there’s some risk that trends will have changed and that the sweaters arriving in June won’t be in fashion by November.

5. Using Inventory Turnover to Analyze Marketing or Product Placement

Some of the options above might have seemed obvious. But did you know that you can even use the inventory turnover ratio to analyze how your marketing efforts are working—and even where to place items in your store?

For example, identify a product in your inventory that’s had low turnover for awhile, leading to a good amount of excess inventory being left in stock. Now try moving the placement of that product in your store to the endcap of an aisle, for example, or closer to the register. Or maybe you can move a particular necklace closer to a shirt that it would pair well with? Then wait a month and compare your inventory turnover for that product this month to the same number for last month. Did the move make a difference?

Similarly, consider running an online advertisement or a buy-one-get-one special for inventory that you have sitting around. By using the same methods above to run a before-and-after comparison of your inventory turnover ratio, you can determine which advertising channels or special promotions work best for your target audience.

How to Improve Inventory Turnover For Your Small Business

Now that you know what inventory turnover is, how to calculate it, what kinds of results you should be looking for, and how to apply this ratio to different areas of your business… Your next question will undoubtedly be how can you change it?

If you’ve calculated your inventory turnover and don’t love the numbers you’ve seen—either as a whole or within a different product or season—here are a few things you can do to try moving inventory through your business more efficiently.

Order Conservatively

It happens to every business owner from time to time. A vendor goes on and on about how this is the product of the year, or how there is no way prices will ever be this low again. If you don’t act now, you won’t have this opportunity later! How about increasing your order by just 5 or 10%?

Unfortunately, over-ordering or producing larger batches of product than you can sell is the first and most common culprit of a low inventory turnover ratio. While you never want to order so little product that your shelves are bare, it’s typically in your best interest to order conservatively, especially for a new product that you’ve never offered before. While it might occasionally be true that you miss the added value of a special discounted rate, that risk is much lower than the risk of overstocking and being forced to slash prices beyond profitability.

Move Things Around

As we mentioned above, you might be surprised how big of a factor location can play into how quickly consumers choose to purchase your products. Identify which products are likely to be “impulse buys” for your customers and move them to high traffic areas of your store. You can apply this same principle to your retail website by featuring a particular product on your front page, or even making a particular product image larger and more noticeable within a section.

As you move things around, be sure to pay attention to your inventory turnover ratio before and after the change to help you determine what’s working and what isn’t.

Consider Complementary Products

Along the same lines, pay attention to products that might naturally go together. Would your homemade jelly be more popular if you sold peanut butter as well? Could you display items that would make good gifts closer to your greeting cards or gift wrap?

Take a walk through your store or browse your website with fresh eyes, thinking about what’s missing. If you get the sense that “if only you had…” then your customers could be feeling the same.

You should even consider bringing in a focus group or objective third party to do this, as they might notice something that you missed!

Pay Attention to Seasons

For the purposes of inventory turnover, when you stock a certain product is just as—if not more—important than what you choose to stock! It doesn’t matter how awesome your new pool toys are—nobody is going to buy them in November, unless you live in Florida.

And while that example might seem a bit obvious, other products or specific months can be a bit more complicated. Should you order the last round of winter coats before Christmas, or after? Will customers start looking for spring dresses in March or in April? Making the wrong choices here can cause you to miss an opportunity with your target market, or even to have an excess of inventory lying around all the way until next winter! And with the drastic changes in weather patterns we’ve seen in recent years, even the largest of mega-retailers can find themselves missing the mark.

While you’ll never be able to perfectly predict the weather, using historical year-to-year comparisons of your inventory turnover for certain products during certain months can help you to get the right products in-house at the right time.

Give Marketing a Boost

Advertising and marketing efforts are another great way to boost your inventory turnover. By paying attention to products that need to be turned over and promoting those to consumers outside your store, you’ll gain more attention—and more purchases—for products that might otherwise just sit unsold.

Use email marketing campaigns to highlight specific products to existing customers, or include a low-turnover product in a direct mailer or online ad. Sometimes all it takes is a few new sets of eyes on an item that customers might not have realized that you have.

Know When to Discount

Of course, offering a discount is never any retailer’s first choice for moving inventory. After all, surely your inventory turnover ratio isn’t as important as your profit margin!

Well, let’s think about that for a minute. When inventory sits in your store for a long time, it’s taking up space. That space could be used for other, better inventory that’s more in line with what your customer wants—and will move much more quickly. By hanging onto that old inventory, you could be missing the opportunity to sell another product several times over! With that in mind, offering 25% off or a buy-one-get-one deal to move old inventory probably seems much more worthwhile.

The More You Know

As the saying goes, the first step is admitting that you have a problem—and that’s exactly what the inventory turnover ratio does. It helps you identify problem areas within your inventory so that you can take steps to improve your turnover as needed.

We hope these steps will help you to make better decisions with your business inventory in the future, leading to better sales volumes and more long-term business success!

The post Inventory Turnover: The What, Why, and How appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/03/15/inventory-turnover/

No comments:

Post a Comment