If you’re a small business owner on the quest for funding, there’s a heck of a lot to keep track of in order to apply to a lender. You’ve got your personal credit score, your balance sheet, your profit and loss statement, your FICO SBSS…

Wait, wait. Back it up. Your what?

Your FICO SBSS! You know, that small business credit score that’s all the rage these days? That part of your loan application that could make or break your chance at growing? That crazy long acronym that more and more lenders have been taking a closer look at?

No?

Well, let’s get educating. Your FICO SBSS isn’t something to disregard—so let’s talk about what it is, how it works, why it’s important, and how you can use it to your advantage. Welcome to the definitive guide to your FICO SBSS.

Credit Scores: A Refresher Course

Before we dive into the intricacies of the FICO SBSS, let’s take a breather—and review the credit scores you already know about.

Just speaking fundamentals: a credit score is essentially a measure of your quality as a borrower. Let’s put aside the different kinds of credit scores, the various companies that measure them, and the diverse ways lenders and banks weigh them for a moment. A credit score reflects how trustworthy you are with money you borrow.

Now consider how big of an impact your reputation has on your business. Bigger corporations can get away with PR flubs and messed-up products. The world isn’t going to suddenly stop drinking Coca-Cola, after all. But a small business relies on positive word-of-mouth to survive. It might get figured out mathematically instead of by a gut feeling, but your credit score is pretty analogous to your reputation—only as a borrower, not just a business owner.

When we put it that way, it sounds like a big deal.

And it is. Statistically speaking, higher credit scores strongly correlate with lower APRs and a broader availability of funding products—as our last quarterly report explains. In other words, the better your credit score, the more loan products you can get at better prices.

There are two kinds of credit scores we’ll look at before getting back to your FICO SBSS:

1. Personal Credit Score

When it comes to small business borrowing, your personal credit score reigns supreme. As a small business owner, your finances get lumped together with your business’s—whether that seems fair to you or not.

But really, it does make a sort of sense.

While the CEO of a multinational corporation might have a terrible personal credit score, that doesn’t mean his or her company is also seen as an unreliable borrower. There are too many moving parts in the mix for a lender to make that judgment.

On the other hand, if you’re running a small business, then chances are your personal financial habits affect or reflect your business financial tendencies. If you pay your personal loans late, then it’s not unfair to assume that you’ll deliver your business loans late, too. And even if that’s not the case, you can’t really fault your lender for making that logical leap—they just don’t have as much data to go off of with a small business.

Your payment history, the amount of money you owe, the types of credit you use, and how many new lines of credit you’ve opened are all factors in your personal credit score. Your age, race, marital status, occupation, religion, salary, family structure, superhero alter ego, and favorite color don’t matter—because they don’t have any bearing on what sort of borrower you are.

In terms of goals: you’ll want to aim for a personal credit score of at least 600 if you’re interested in taking out a decent loan. Any lower, and you’ll be dealing with expensive cash—which might be necessary, but it won’t be pleasant. And the higher the better, so if you can get to 700 or above, you’re in good standing for higher quality funding.

2. Business Credit Score

Your business credit score, on the other hand, naturally comes from your business instead of your personal finances.

It’s pretty important for small business owners to understand the difference between their personal and business credit scores—and to maintain them separately. Otherwise, if your business faces some financial turbulence, your personal finances can get affected in a bad way.

The simplest and most important way to separate your personal and business credit? A business credit card. This will help you begin, develop, and keep your business credit distinct from your personal credit. You’ll lessen your personal liability, disentangle your personal and business finances, and show to lenders that you understand what you’re doing.

On the flipside, business credit checks tend to be more rigorous. While an important step to growing and maturing your business, starting your business credit isn’t an easy one.

But who said running a business was supposed to be easy?

Your FICO SBSS and You

Alright, so we’ve got the idea of a credit score down-pat, and we’re comfortable with the two main types of credit scores. You’d think that’s all there is to it…

Except now everyone’s talking about this FICO SBSS. Oh, bother. Let’s start at the beginning—with what you’re probably already familiar with.

The Old

FICO, or the Fair Isaac Corporation, introduced the personal credit score we all know and love in 1989. Even if you’re not a small business owner, you’ve almost definitely heard of your FICO score—and you know, even if you skipped our review session above, how important that three-digit number is for your financial well-being.

Your FICO score isn’t just a measure for small business lenders, after all. Are you borrowing money for a car? For a house? For tuition? No matter the reason, this evaluation of your creditworthiness will come into play. And now you know exactly what “FICO” means.

The New

So we’ve got FICO—but what’s SBSS?

It stands for Small Business Scoring Service, and it does for small businesses what the FICO personal credit scoring service does for individual borrowers. It’s meant to reflect your small business’s creditworthiness—or how likely it is that your business will repay its loans on time and without issue.

As we’ve covered, a credit score is a measure of your reliability when it comes to borrowing money. But consider it this way: a credit score also tracks the risk factor of lending to you. If you have a bad credit score, lenders will see you as an unreliable borrower—and, therefore, a risky investment.

In other words, your FICO SBSS helps banks and lenders analyze the risk level of investing in your business by lending you money. It’s fast, easy, systematic, and designed specifically with small business funding in mind—so it helps your lenders process more applications faster and more accurately.

With all those benefits for the lender, you can bet the FICO SBSS is here to stay.

(Not that it’s particularly new, though—FICO released the FICO SBSS way back in 1993, actually. It didn’t have much of a following, though, until the Small Business Administration started using the score in its 7(a) loan application process in 2014, which was a pretty big deal. But we’re not quite there yet.)

So How Does the FICO SBSS Work?

Okay, okay. The FICO SBSS is a third type of credit score, different from FICO’s personal credit score as well as the business credit scores you see from credit reporting companies like Dun & Bradstreet, Equifax, and Experian.

But how is it actually different?

Sourcing Your Credit

In some ways, your FICO SBSS isn’t quite an entirely new kind of credit score. It’s actually more of a hybrid: FICO draws from your personal credit and your business credit in order to figure out your business’s FICO SBSS.

This makes a lot of sense when you think about it. By combining the two kinds of credit small business owners build up, your FICO SBSS covers more ground than either your personal credit score or your business credit score. A lender can get a more in-depth look into your borrowing habits and history—while any mistakes you might have made in your personal finances could get buffered by better business borrowing, as well.

As we discussed, lenders usually think of small business owners as their businesses. You’re inseparable. The FICO SBSS reinforces this line of thinking by combining your personal and business finances, but that’s not necessarily a bad thing. If your borrowing habits stand out across the board, from personal loans and mortgages to your small business funding—and they should!—then your FICO SBSS will portray you in an especially good light.

The Range

So, say you’ve got a credit score of 300… Terrible, right?

Nope—it’s actually fantastic. Depending on what kind of credit score, that is.

While your personal FICO credit score ranges from 300 to 850, your FICO SBSS starts at 0 and ends at 300. And the higher the better, as usual. We can’t say for sure why FICO changed the scale of its FICO SBSS, but what’s important is that you understand how your business’s score fits in—and that you don’t panic!

The Process

Alright—onto the good part. How exactly does FICO come up with your FICO SBSS?

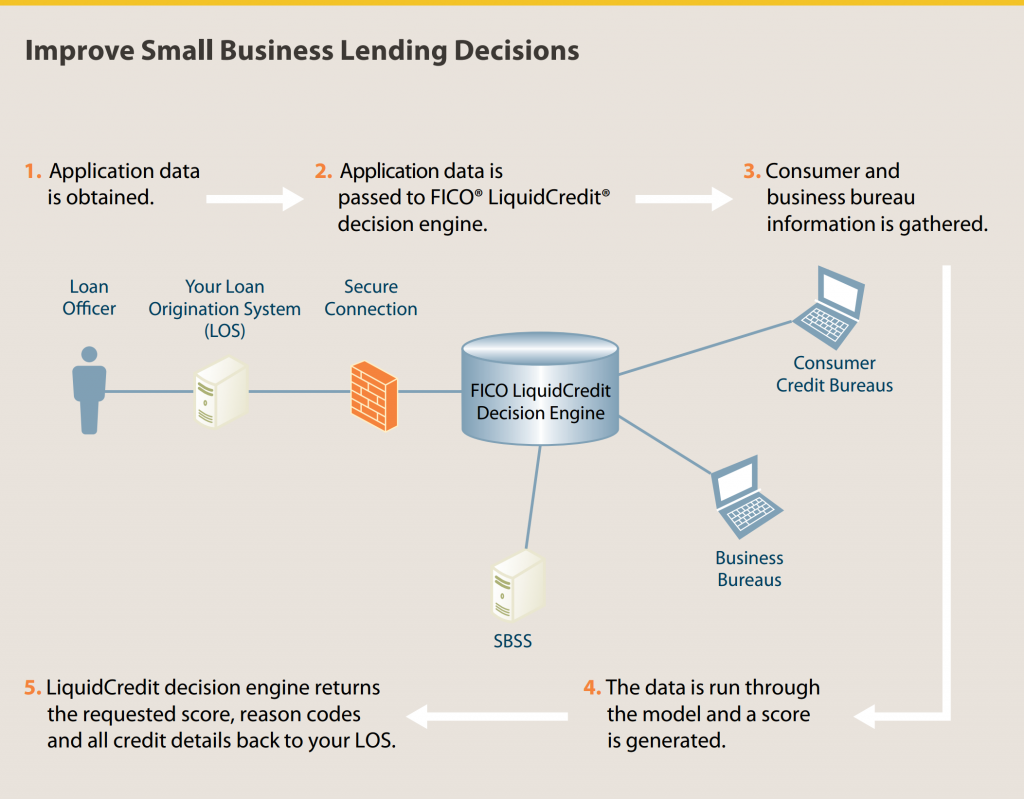

So FICO let us in on their secret formula… Well, sort of. Not really. Fine, we don’t have access to FICO’s models and rubrics that they use to grade your small business credit score—but we do have the 5 steps they take to get you the end result. Let’s take a look.

- You give your application documents, including your personal and business financial statements, to your lender.

- Your lender passes these documents onto FICO.

- FICO combines your application documentation with additional information it gets from consumer and business bureaus like Dun & Bradstreet, Equifax, and Experian.

- Then, FICO runs all that information through its modeling system, ending up with your bright and shiny FICO SBSS.

- Finally, your lender receives the FICO SBSS score, the reason codes behind your score, and your credit details.

After that, it’s up to your lender to decide whether your FICO SBSS meets their minimum requirements—and if it does, how to grade your FICO SBSS to figure out what terms to offer you for your funding.

FICO also provides an infographic explaining this process, if you’re more into that:

There’s just one thing missing from this graphic: how exactly FICO weighs the various parts of your financial information in order to figure out that pesky FICO SBSS score.

We know FICO peaks at your personal credit history, business credit history, business financial data, time in business, assets and liabilities, cash flow, revenue, liens, and judgments, but we’re not sure what else they look at—and more importantly, we’re not sure of the relative importance of all these factors. But that’s the mysterious formula we don’t have—and chances are, FICO won’t ever clue us in, because that would let small business owners game the system.

It’s like this: Bob and Sally are both taking a science test next week. Their teacher, Mr. Apple, happens to accidentally let it slip that the test will cover chemistry, but not physics, to Bob one day. As a result, Bob only studies chemistry, while Sally studies chemistry, physics, biology… You get the picture. So while Bob might do better on the test a week later, that doesn’t necessarily mean that he’s better at science than Sally is.

Okay—it’s a bit of an easy example. But we think it illustrates FICO’s reasoning: if they reveal their secret formula, then the FICO SBSS won’t necessarily reflect a small business’s actual creditworthiness. Instead, it’ll just show how well a small business owner can cozy up to the FICO SBSS grading rubric.

Flexibility is Key

The final difference between your FICO SBSS and your personal and business credit scores is, we have to admit, actually pretty cool.

You see, your FICO SBSS is especially flexible, as far as credit scores are concerned. In other words, FICO’s formula naturally adjusts for how much information you supply it—their process treats a small business like a small business, a medium business like a medium business, and a big business like a big business. (Of course, this is the small business scoring service, but you get the idea.)

What exactly does that mean for you, though?

Well, the point is that two small businesses of very different sizes—say, one is a single freelancer while the other has two dozen full-time employees—can actually have the exact same FICO SBSS. You’re neither punished nor rewarded for your size.

This might sound intuitive—and logically, it is—but you have to remember that FICO’s formula combines business finances with the individual owner’s. It’s no small feat to adjust all that information to scale, and it’s not easy to overlook FICO’s choice to give the same benefit of the doubt to a company of one as it does to a company of a hundred.

Why Does the FICO SBSS Matter?

We get how it works—but what’s the big deal?

Like any part of your loan application, your FICO SBSS score can have an impact on whether you get that funding—and if you do, it can influence the terms of that funding you receive.

Let’s take a look at who, exactly, cares about your FICO SBSS.

Alternative Lenders Care

Remember from way, way back, when we talked about how important credit scores are for your loan application? What was it that we said…?

Oh, that’s right. Your credit score is the number one driver of low APRs and greater product availability. Or in plain English: the better your credit score, the lower your APR, and the more types of loans you qualify for.

(Now, we’ve got to mention a caveat here. If you check out our quarterly report, you’ll see that all this is a matter of correlation, not causation. Higher credit scores go together with lower APRs, in other words, but we can’t say for certain that higher credit scores cause lower APRs. We might suspect that’s the case, but our data doesn’t prove it one way or another.)

There’s a whole important discussion to be had about the state of online and alternative lending, and how banks turn away four times as many small business owners looking for funding as they accept, and all that—but it’s a bigger conversation. For now, let’s focus on the fact that online and alternative lending has never been a more prominent industry than it is today—and so, if alternative lenders care about your FICO SBSS, then you should too.

The Small Business Administration Cares

As we mentioned earlier, the SBA started taking the FICO SBSS into account when considering applications for its 7(a) loan program in 2014.

That’s a lot of finance-speak, so let’s break it down.

You might already know that the Small Business Administration is an arm of the government that helps small business owners secure loans to grow their businesses. The SBA doesn’t lend money itself, though—instead, it guarantees portions of loans, reducing the risk for the actual lenders involved. It’s a great resource for small business in the United States: everyone wins.

On the other hand, though, SBA loans aren’t easy to get—and like most parts of the government, the SBA moves much more slowly than an alternative lender would on its own when it comes to providing funds. It takes time, effort, and a bit of luck to snag that SBA loan… But if you can, you’re looking at nearly bank-level interest rates and repayment terms.

So when we say that the SBA considers your FICO SBSS for the 7(a) loan program—which is, by the way, its most flexible and popular initiative—you should lean in and listen up.

Starting in 2014, the SBA pre-screened its 7(a) loan program applicants for their FICO SBSS scores if they applied for loans of up to and including $350,000. The minimum FICO SBSS is 140, but generally the SBA looks at small businesses with FICO SBSS scores of 160 or above.

This process lets the SBA save time, money, and energy by cutting out small businesses who don’t mean their minimum, which also saves lenders and banks on their underwriting costs.

Now, here’s an interesting fact: the maximum FICO SBSS you can snag with zero business credit history and almost no time in business? 140.

If that number strikes a chord, then you’ve been paying attention—it’s the minimum FICO SBSS required by the SBA for its 7(a) loan program. So, you technically can qualify for a 7(a) loan if you’re a brand-spankin’-new business… But it’s unlikely.

While a 140 is possible, it’s not easy. You’ll need an unblemished personal credit history, along with incredible personal and business financials, to get a 140 FICO SBSS without any time in business. And even then, you’re just hitting the SBA’s minimum—they’ll almost always be looking for more.

So while the SBA is giving young businesses a chance, it’s not a staggering one. Don’t put your chips into that basket just yet—but do keep the information in mind for the future. Your FICO SBSS never stops being relevant.

Banks Care

Last but certainly not least, some banks have started caring about your FICO SBSS.

It’s a useful score for them to consider, especially since small business lending tends to be relatively riskier than a bank’s normal slew of investments. Any additional piece of information you can use to show a bank that you’re good for the money, so to speak, will only help your case. And as banks offer the lowest interest rates and longest terms of any lenders out there, you’ll want to keep this option open—though of course, it’s rare to qualify, so don’t get your hopes up.

PNC, US Bank, and HSBC, alongside more regional and local banks, are some of the adopters of the FICO SBSS as a metric for small business creditworthiness.

Improving Your FICO SBSS

What’s the point in knowing everything there is to know about your FICO SBSS if there isn’t something you can do about it, right?

Luckily, your FICO SBSS is largely under your control. Improve your score, and you’ll better your chances at getting the funding you need for your small business. Let’s talk about how.

1. Maintain your personal credit

Step 1 is pretty obvious—we know that your FICO SBSS is made up of your personal credit, in part, so keeping your personal credit as golden as possible will help your FICO SBSS improve.

There are plenty of ways to do well by your personal credit score, but at the foundation of all these plans is one simple truth: the better borrower you are, the better your credit score will be.

So while you should pay attention to the nitty-gritty—disputing incorrect charges, negotiating collected debt records, diversifying your credit portfolio—you’ll want to keep in mind that these are cleanup strategies, meant to keep your credit report spick and span.

Never lose sight of the big picture: Pay your debts in full and on time, if not early. Borrow and spend responsibly, with foresight and flexibility. See your credit card payments as temporary loans, and treat them as such. Don’t take risks you can’t recover from. Act like someone you yourself would have no problems lending money to, and you should be fine.

2. Build your business credit

Step 2? Also pretty obvious, we’ll admit! Your FICO SBSS also has bits of your business credit score, so having one is fairly important.

Don’t get sucked into the trap of thinking you can manage your small business with your personal credit alone. There are loads of advantages to separating out your credit scores—some of which we discussed in the first section of this article—and another is optimizing for your FICO SBSS. A good business credit score will reinforce your good personal credit score, but if you’re only relying on your personal credit, your FICO SBSS will suffer.

Sign up for a business credit card and spend diligently, using the right card for the right purchases so there’s no possibility of confusion in the future. Your lender will want to know that your business credit score accurately reflects your business spending habits—so don’t mix in any personal transactions!

3. FICO SBSS Investigation

That might be a bit overdramatic, but there are some things you can look into for your FICO SBSS score on FICO’s website and literature.

For example, FICO breaks down some specific credit risk models that you might want to scan, as they could affect how your particular business gets analyzed by the FICO SBSS formula. FICO has additional FICO SBSS systems for companies that deal in leasing and agriculture, for example, and for businesses located in Canada.

This is the definitive guide to your FICO SBSS score, but stay on top of the news—and do your research, if you feel like your specific business might get processed uniquely.

4. Relax!

Finally, don’t stress out! Yes, your FICO SBSS might feel like a new and frustrating element to deal with when thinking about funding for your business—but really, it doesn’t add anything you haven’t seen before. It’s only one part of your loan application, and a relatively untested one at that.

So understand what it is, how it works, and how it could affect you, but don’t overestimate the importance of your FICO SBSS—or underestimate your own control over it. Be the best small business owner you can be, and you’ve got nothing to worry about.

The post The Definitive Guide to your FICO SBSS Score appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2016/01/21/fico-sbss/

No comments:

Post a Comment