It’s that time of year again: tax season is upon us. Close your books and get ready to file!

It sounds so simple, doesn’t it? Just get your accounting cleaned up and organized. But I know it isn’t easy for many small business owners—like I always say, you didn’t start your business to do bank reconciliations (but I did!).

Got this one here.

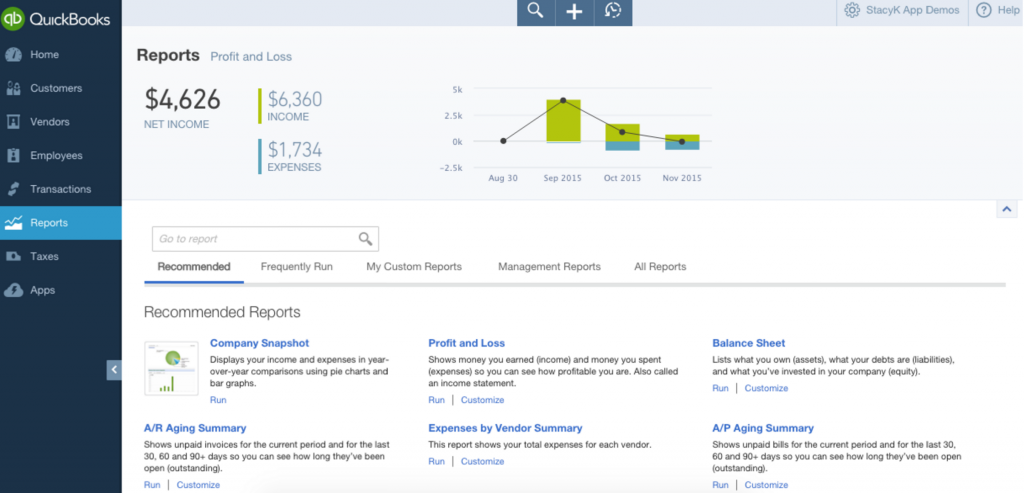

Every year we get clients who come to us in a panic, because they can’t quite figure out how to make something work in QuickBooks, or what basic reports they should be looking at. So today, let me head you off at the pass and tell you how to get a Balance Sheet and Profit & Loss Statement from QuickBooks.

Profit & Loss Statement

Your Profit & Loss Statement, also called an Income Statement, is a pretty darn important document. You’ll want to review this more than once a year when you send documents to get your taxes prepared. Personally, I like to review the P&L for Kildal Services about once a week—sometimes more. Essentially, your P&L summarizes your business’s financial performance over a period of time—daily, weekly, monthly, quarterly or annually.

- In the left nav bar, select Reports:

- From the Report Center, you can either go to the Recommended tab or to All Reports > Business Overview, then choose Profit and Loss. (The Recommended tab is faster, but you’ll need to go to All Reports to get the Profit and Loss Detail). Just click on the report name or the link that says “Run” to open it.

- Once it’s open, you can edit the date range, or click “Customize” to make other changes to the report. If you just change the date directly without clicking the customize button, make sure you click the “Run Report” button to view it with the new dates.

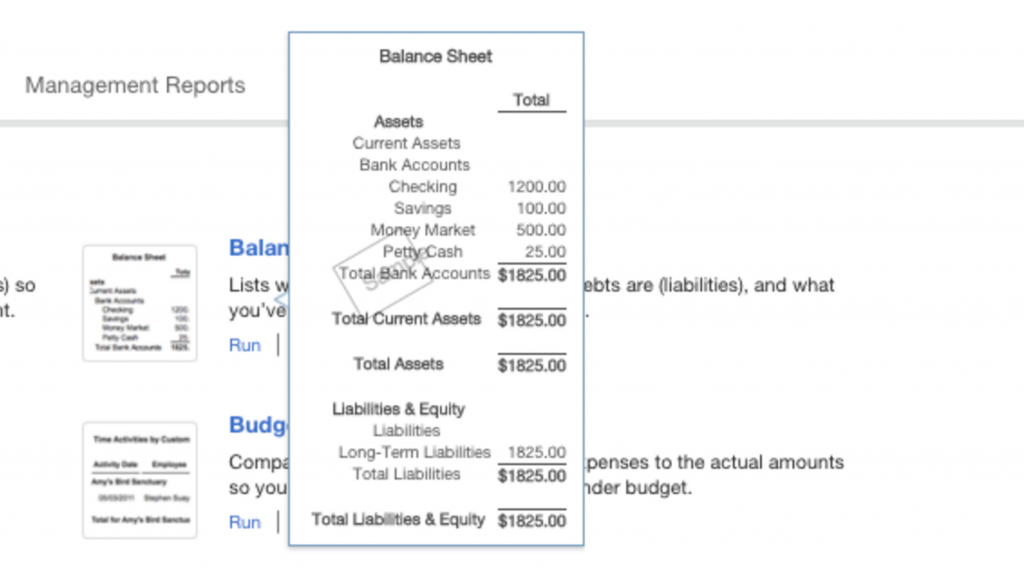

Balance Sheet

A balance sheet is a statement of the assets, liabilities, and equity of a business—essentially a “snapshot” of your business value. This is done by subtracting your liabilities, or what you owe, from your assets, or cash, property, and what you’re owed. What you get is the equity, or what your company is worth. It’s useful for accountants to see your financial health and for banks when you are applying for loans. It’s also essential for the small business owner to get a true sense of how the business is doing.

Just as with a P&L, the standard balance sheet is fine, but I recommend pulling the balance sheet detail to send to your tax preparer. As you can guess, it’s a more detailed version of the standard balance sheet, showing the starting balance at the beginning of last month, transactions entered in for the month, and ending balances.

To view the Balance Sheet, we’ll start the same way we did with the P&L.

- In the left navigation bar, click Reports:

- From the Report Center, you can either go to the Recommended tab or to All Reports > Business Overview, then choose Balance Sheet. Recommended is faster for a standard Balance Sheet, but you’ll need to to All Reports to get the Balance Sheet Detail. Just click on the report name or the link that says “Run” to open it. If you hover over it, you’ll get a preview—this works for the P&L and other reports, too:

- You can customize it before you view it, too. When you click the Customize button, QuickBooks Online will take you directly to the customization screen. This lets you choose your date range, along with some other options, like adding a column to compare to a prior period:

Now that you know what each of these reports are, and how to get to them, let’s recap what you’re looking at with each report:

| Profit and Loss Statement

Summary of revenue, expenses, and profit or loss during a specific time period |

Balance Sheet

“Snapshot” of your company’s value, as of a specific date |

|

|

See how easy that is?

Got this one here.

The only trick is to make sure you have your books up to date.

Remember: Each report serves a different purpose. The P&L statement answers an important question: Is your company profitable? The balance sheet shows the company’s value more broadly, revealing what the company owns and what is owed to vendors or creditors.

The post A Step-By-Step Guide to Getting Important Financials From QuickBooks appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2015/12/22/a-step-by-step-guide-to-getting-important-financials-from-quickbooks/

We are offer Quickbooks online support number +1-888-817-0312 for users who encounter Quickbooks errors, find problems with setup, installation, Quickbooks updates, and much more. We are provide best possible Quickbooks services with a cost effective online solution. Along with our quality support services, we guarantee secure data and files.

ReplyDeleteWe are a prime leader as a third party tech support service provider offering world class technical support services for Brother printer issues. We offer live technical support services like live phone, email and chat support services as per your needs in very affordable prices. Our printer experts are highly experienced for resolving any type of technical issues easily. Our Brother Printer Help is open for you anytime to get instant help for any issue.

ReplyDeleteWe offer instant Epson Printer Offline errors to fix printer device issues like driver installation, printer installation, printer offline issue and much more.

ReplyDeletecanon printer

ReplyDeletecanon scanner is not working

canon printer error code b300

how to connect canon printer to wi fi

The technicians are extremely helpful and work with great dedication and enthusiasm. Avail 24/7 instant resolutions from the support team. Some common issues fixed by Lexmark printer support number.

ReplyDeletehp printer support | Lexmark Printer Support | Brother printer support

Web designers may choose to limit the variety of website typefaces to only a few which are of a similar style, instead of using a wide range of typefaces or type styles. Most browsers recognize a specific number of safe fonts, which designers mainly use in order to avoid complications.

ReplyDeleteweb design

website design

website builder

web designer

ecommerce webs

web design company

The Canon printers are prominent for its amazing performance, still individuals may experience issues while utilizing it. All things considered, you can legitimately approach the specialists for Canon Printer Customer Service. There are numerous mistakes that you may face during printing time.But you need only to contact us for technical support.

ReplyDeleteCanon Printer Support Toll-Free Number

Canon Printer Tech Support Number

Canon Printer Helpline Number

fitness club

ReplyDeletefitness club around me

fitness club near me

fitness club in delhi

best fitness club in delhi

fight club

fight club around me

fight club near me

best fight club in delhi

mma

mma around me

mma near me

mma in delhi

best mma in delhi

knock out

knock out around me

knock out near me

knock out in delhi

best knock out in delhi