When we started Fundera, we wanted to bring more transparency and accountability to the small business lending industry. Our unbiased marketplace was the first step. Our “Know Before You Owe” campaign was the second.

We’ve taken even bigger strides since, like leading an industry-wide coalition to launch a Small Business Borrower’s Bill of Rights. But there’s still so much more to be done.

We’re taking our next step with the launch of the State of Online Small Business Lending, a quarterly report aimed to bring more transparency to the space. It covers all the trends we’ve seen in eligibility requirements, loan product offerings, and rate expectations. This report is for small business owners, by small business owners.

We’re upfront about where we got our numbers, how we crunched them, and what it all means for you. You can use the index to see where you and your business stand, and to better understand what you should expect.

The path to a fair lending industry begins with access to data. Let’s get started.

Executive Summary

Takeaways

- The first step in empowering small business owners to make the best financing decisions is giving them access to information. This report utilizes anonymous customer loan data to shed light on eligibility trends in online small business lending.

- The Fundera marketplace model enables the collection of data on a wide range of lenders and products, and an even wider range of small business owners, based on 1,300 loans totaling $63 million in customer financing from February 2014 through the end of Q3 2015.

Data Findings

- Basic eligibility for online lending is largely dependent on creditworthiness and annual revenue.

- There is strong inverse correlation between credit score and APR.

- There is a strong direct correlation between time to funding and funded loan amounts.

- Even in online lending, the business owner’s personal credit score continues to have the largest impact on their loan’s APR.

- Small business owners who obtained short-term financing through Fundera’s lending marketplace report annual percentage rates 15% below available industry averages.

- SBA loans, while having the most stringent credit score requirements, have surprisingly low revenue requirements — even lower than other more expensive products.

- Medium-term loans and lines of credit have the highest revenue requirements of any online small business loan.

Shedding Light on the Online Lending Industry

Fundera was built with one goal in mind: to help small business owners better understand their credit options by helping them navigate the complex world of online lending. Fundera wants them to make smart financing decisions and, in the end, find the best loan available to their business. But this can only happen if they have access to information on what options are truly available to them. In other words, they need total transparency.

Small business owners want to know where they fit into this new world of online lending. Their five main concerns are:

- Where to find loans: With hundreds of new online lenders competing for their business, it is becoming increasingly difficult to figure out which lender is best to work with.

- Understanding the available loan products: Different loan types have different purposes, so how is a business owner to know which is right for them?

- Knowing the eligibility requirements for these loans: Some loan products connect to specific situations, and similarly, some lenders focus on select types of businesses. How does a business owner avoid wasting time with lenders that aren’t a right “fit”?

- What rates to expect: Every loan product offers different rates. Based on a business owner’s financial makeup, what rates should they be looking for?

- How to choose between the final offers they’ve received: Comparing offers from different loan products and lenders can be near impossible. How does a business owner decide, in the end, which is best for them?

There are dozens of small business reports produced monthly, but none of them answer these critical questions. By releasing anonymous customer loan data, Fundera is making an effort to address these questions. This initial report, which will be updated quarterly, is focused on trends in online lending eligibility. The transparent data in this report complements advances made through creation of the Small Business Borrowers’ Bill of Rights.

Two specific qualifiers enable Fundera’s marketplace data to provide a uniquely comprehensive look into the state of online small business lending. They include:

- Vetted lender network. In order to give borrowers the fairest financing deals possible, Fundera only collaborates with the industry’s top lenders, who together offer a wide range of small business credit products. The table below shows Fundera’s lender network by product type. Additional information about Fundera’s lenders is available on the lender review site.

- Wide range of small business owner customers. Fundera’s data reflects its wide range of customers, which includes all kinds of small business owners. The company has funded loan amounts as low as $1K and as high as $2M, and seen APRs ranging from 6% to beyond 50%. Fundera does not limit by credit score minimums, industry requirements, or loan amount requests.

Methodology

- All-inclusive data. The data in this report includes all loans funded through Fundera’s platform between launch in February 2014 and the end of Q3 2015 (September 30, 2015), with no exclusions.

- Statistical significance. The data set for this release consists of about 1,300 funded loans, which is a large enough number to confidently draw conclusions without worrying about sample size.

- All data is normalized to APR. Loan terms get expressed in a variety of rates: daily, weekly, interest, effective interest, factor, etc. This makes it nearly impossible to compare one loan to another, so the data is figured to effective APRs for each funded loan. (Fundera’s APR calculators for each different product type can be found here.) However, APR is not always the best metric for comparing the terms of loan products. Duration, use case, total payback and cost, repayment frequency, and prepayment conditions can all be equally important, too. Generally speaking, however, APR is a standard and effective method of calculating a loan’s costs.

- Data margin of error. Fundera’s data does not perfectly represent the entire online lending industry. However, Fundera’s ability to aggregate data across a large variety of lenders and credit products, and across an even larger variety of small business owners, allows for one of the most reliable sources of information in the industry. It’s particularly important to note that differences amongst Fundera’s lenders can substantially impact the product-specific data. For example, there are big differences in the median APRs offered by Fundera’s medium-term lenders and line of credit lenders, because they each focus on distinct sets of customers. Throughout the report, distributions are provided when possible, and presented in the data from multiple perspectives.

Q3 2015: What key factors drive loan eligibility?

For an overview of the loan products offered on Fundera, visit the Business Loans page. This page includes a visualization of the general qualifications required to be eligible for various types of loans, as follows:

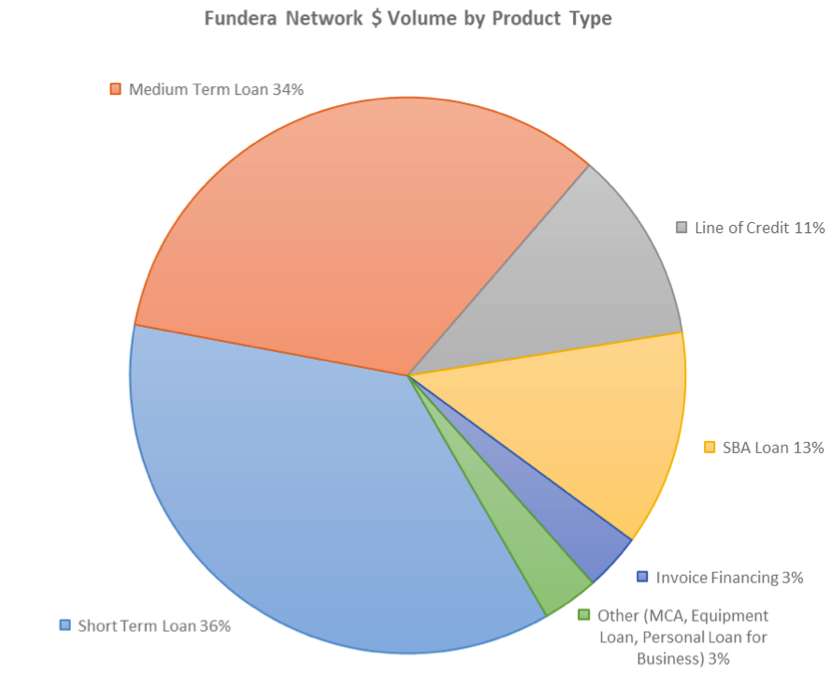

To better understand the dataset, below is Fundera’s credit product distribution by dollar volume funded.

This report contains additional information on four types of loan products: short-term loans (with a duration of 3-18 months), medium-term loans (1-5 years), lines of credit, and SBA loans. These loan types, in keeping with general activity in the online lending market, make up most of the loans funded through the Fundera platform. Future Fundera reports will include other loan products, such as invoice financing and equipment loans.

There are three key eligibility-related findings that Fundera has observed:

1. Basic eligibility for a loan product varies with creditworthiness and annual revenue.

The chart below provides the interquartile ranges for credit score, annual revenue, and APR for each loan product. To clarify, an interquartile range is the range of values between the 25th and 75th percentiles. It’s a reasonable “average” range (middle 50% of values) that deletes the extreme values on either end. This means that business owners with lower or higher credit scores or annual revenues may still be eligible for a funding option, but being in the target range increases the probability of getting a loan. The chart below reveals, based on credit score revenue, what loan products a small business owner is most likely to be eligible for, as well as the approximate APR they should expect to pay.

Important Findings on a Product by Product Basis

SBA Loans

SBA loans offer the lowest APRs but require the highest credit scores. Interestingly, the revenue range required for an SBA loan is significantly lower than those required for medium-term loans or lines of credit.

Medium-Term Loans

Medium-term loans offer a meaningful alternative to SBA loans. In return for APRs that are higher than those for SBA loans but significantly lower than those for short-term loans, medium-term loans have a faster application process and lower credit score requirements. However, medium-term loans currently have the highest revenue requirements.

Short-Term Loans

Short-term loans bear high APRs, but for borrowers with lower credit scores and revenues, they may be the only option. However, due to Fundera’s marketplace approach, borrowers report effective APRs that are 15% below available industry averages. In fact, the median factor rate for short-term loans funded on Fundera’s platform was 1.18. (Business owners multiply their cash advance amount by a factor rate to determine their payback.)

Lines of Credit

Lines of credit have very similar requirements to medium-term loans, except for lower credit score thresholds. However, the median APR for lines of credit is almost twice the median APR for medium-term loans. This is where the aforementioned lender-by-lender differences come into play. Two of Fundera’s four lenders in this category have a median APR of around 20%, which is very similar to that of medium-term loans. The other two lenders in this category have a median APR of around 38%, increasing the overall median for the product category. The affordability of the line of credit product varies, and Fundera’s offerings will continue to vary, considerably by lender.

2. Credit score is the key driver of APR and product eligibility.

As mentioned, APR is the best way to compare the costs of different loan products. However, every lender has their own underwriting processes, so it is difficult to identify all of the factors—and how they’re weighted—when determining the APR for a loan. That said, Fundera’s data clearly shows that a borrower’s personal credit score will be the single most influential part of their business loan application. It singlehandedly affects eligibility and APR more than anything else. And, unsurprisingly, the higher the credit score, the lower the APR.

Again, this is not to say that a small business with strong revenue and profitability would not be able to find relatively low APR just because of a below average credit score. The correlation is not predictive but does confirm that credit score remains an important part of how online lenders underwrite.

Statistical Note: The R2 value suggests that 97.1% of the variation in the median APR can be explained by the average credit score. This does not imply causation, but confirms that there is a very strong correlation between the two variables.

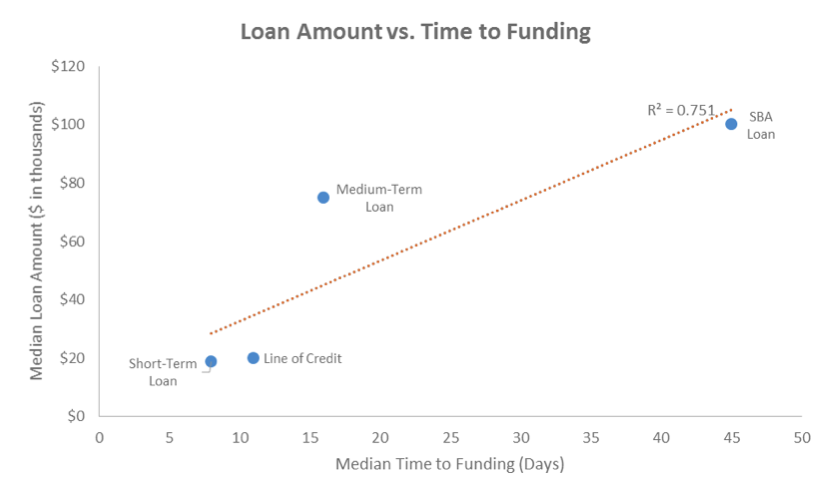

3. There is a strong correlation between time to funding and funded loan amount.

There’s a clear relationship between loan amount and time to funding: the longer the time to funding, the higher the loan amount. This means that if a small business owner can spend extra time to provide additional information and documentation and wait longer for approval, they’re more likely to qualify for larger loan amounts. Of course, many other factors come into play here, but it’s a useful point to consider: attempting to find capital within a short time period will often limit the loan amount a small business can qualify for.

Statistical Note: The R2 value suggests that 75.1% of the variation in the median loan amount funded can be explained by the median time to funding. This does not imply causation, but confirms that there is a very strong correlation between the two variables.

Looking Ahead

For Fundera’s future quarterly reports, small business owners can expect:

- Focus on historical comparisons. Fundera’s first report focused on giving insight into the eligibility trends seen since Fundera’s public launch. Moving forward, the report will analyze how eligibility requirements, loan volumes, APRs, etc. continue to fluctuate on a quarterly basis.

- Deeper dive into product eligibility trends. Fundera’s look into eligibility by product zoomed in on the key factors identified so far—credit score, annual revenue, and time in business. This will expand to include other variables, like industry, profitability, and loan use, in the next quarterly reports. Fundera will also expand this analysis beyond the highest volume loan products.

- Exploration of changes in Fundera’s platform, and the broader industry. As online small business lending grows, Fundera’s platform will change. New lenders, new product types, and more will enter the arena. Fundera intends to provide commentary on shifts in both its platform and the broader industry, and how these transformations will impact access to credit for all small businesses.

If you have questions or feedback about The State of Online Small Business Lending, please email transparency@fundera.com.

Access the PDF version of this report here.

The post The State of Online Small Business Lending — Q3 2015 appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2015/11/23/the-state-of-online-small-business-lending-q3-2015/

No comments:

Post a Comment