In recent years, the lending marketplace has turned upside-down. As always, banks hold the greatest share of the small business lending landscape: they currently make up 75% of the $800 billion in outstanding small business loans in the United States, according to a recent report co-authored by QED Investors and Oliver Wyman. But alternative lenders—and other innovators—have popped up to fill in the gaps. New lenders, new loan products, new procedures.

But with all this newness in the industry, how can small business owners keep track of what they need before applying for a loan? We’ve written up a list of 25 conventional loan requirements that a borrower will probably have to think about, whether faced with a bank or an alternative lender. There may be times when a strict bank will ask you for more obscure documentation, but in our experience, having these forms prepared and questions answered will get you ready for nearly any loan application.

Enjoy—and good luck!

The Basics

These are the documents you can confidently assume a lender will ask for. Simple, straightforward, and self-explanatory, these conventional loan requirements cover the fundamental questions a lender will have: Why do you need a loan? Can you afford one? And most importantly, will you repay it?

1. Bank Statements

Generally speaking, the more financials you can present, the better. Lenders will typically ask for at least two years of business bank statements, but younger companies naturally won’t have such a long history available. Give what you have, and supplement any shortcomings with other financials if possible.

The idea with most of these documents, and the bank statements are no exception, is to show the lenders that you’re a good investment—and a responsible borrower.

2. Average Bank Balance

Maybe you’re a rockstar at raking in the dough… But can you manage it as well? Lenders will want to feel confident that you’re able to maintain a cash cushion in case things go south, in order to ensure you can pay back the loan even if you’re not hitting all your sales goals for the pay period. Using your bank statements to calculate your average bank balance is the way they can confirm you’re able to stay afloat whether a payday is imminent or not.

Remember: the higher the loan amount, the higher the average bank balance you’ll want to show!

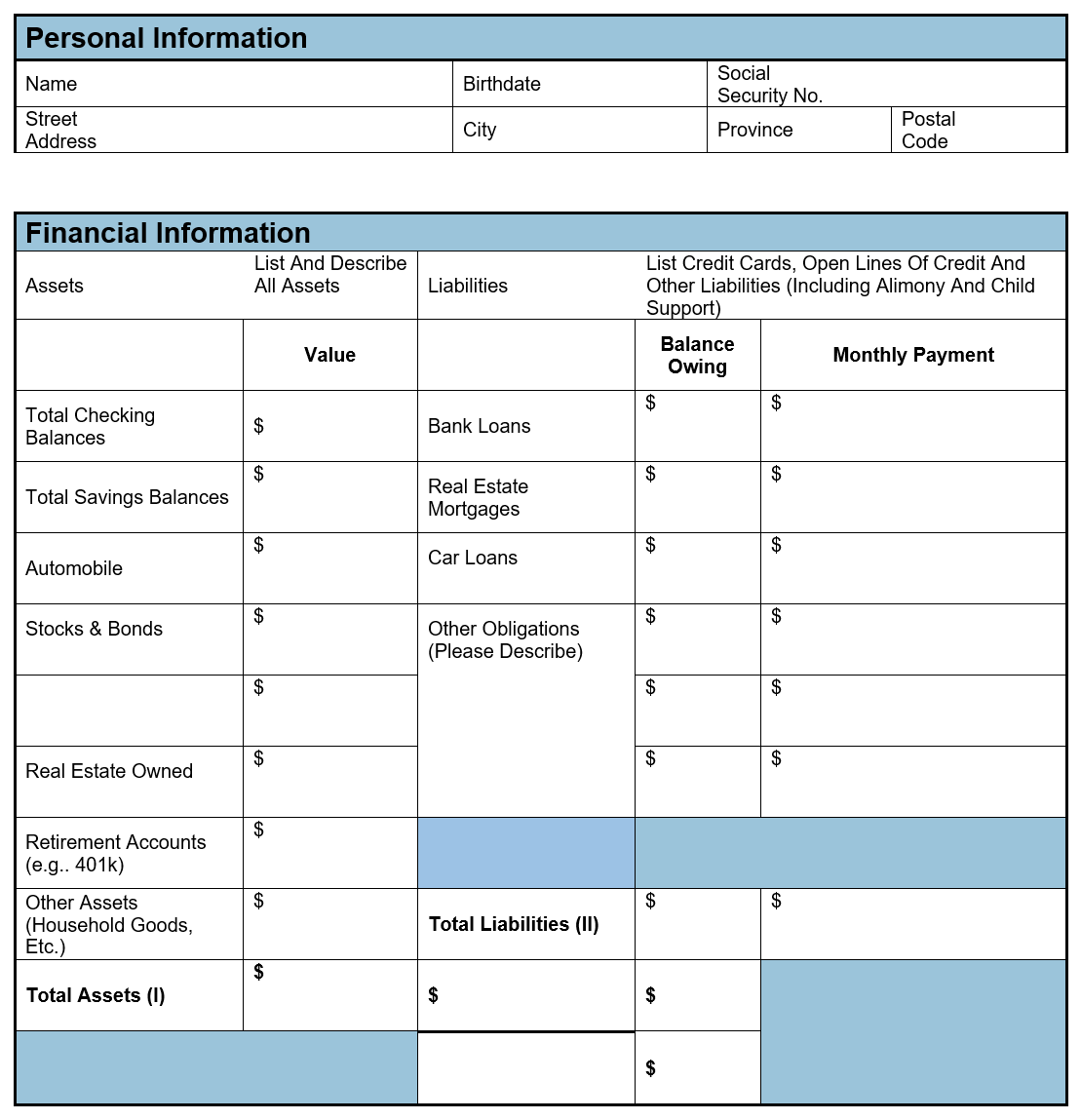

3. Balance Sheet

A snapshot of your business’s financial health, your balance sheet will say a lot about how your business functions. Marking the specifics of what you have and what you owe can offer a lot of insight into how well you manage your assets and liabilities, and that’s definitely something a lender is interested in understanding.

This conventional loan requirement, along with many others on this list and particularly in this section, are useful and important documents for every small business owner to consider often and analyze deeply.

4. Profit & Loss Statements (Income Statements)

Show (off) your small business’s revenue and expenses with both a year-to-date P&L, updated within the last 60 days, and statements from the 2 previous years. This will assure lenders of where your money is coming from and going to, and can help inform them—and you!—of any danger zones in your business’s inner workings. You’ll want evidence of a steady and sensible cash flow that can weather tough times as well as grow.

Like with the balance sheet, you should work on having this on-hand and up-to-date all the time, so you’re never in the dark about your profits and losses.

5. Personal Credit Score

It might seem weird that an application for a business loan would take your personal credit score into account, but if you think about it, it makes a lot of sense. After all, if you’re a responsible borrower as an individual, then chances are you’re a responsible borrower as a business owner. On the flipside, a less-than-stellar credit score reflects late payments, and lenders definitely don’t want to deal with an untimely borrower.

You’ll want to aim for a credit score above 600—and even higher, ideally. Above 700 and you’re good to go; lower than 600 and you may have some trouble getting affordable deals.

6. Personal Tax Returns

Like with the personal credit score, your personal tax returns may play a bigger role than you anticipated in getting a loan for your small business. It’s the same deal with a different document: lenders scrutinize the lives of small business owners more because their businesses are smaller, younger, and harder to prove the long-term success for. Its main purpose is to verify your income. This is bread and butter for conventional loan requirements, so don’t delay on organizing your tax returns before applying.

This form isn’t a tax return, but it’s the same idea—your personal finances affect your business lending options.

7. Time in Business

This one is self-explanatory: how long have you been in business? As you might expect, the longer the better. A business that’s lasted for 5 years can obviously weather seasonal ups and downs, economic downturns, and unexpected shortfalls much more apparently than a 6-month old business can. In fact, only 50% of small businesses last their first 5 years, according to this Small Business Administration study.

That’s not to say newer businesses can’t handle the same challenges—they just haven’t been tested as much, in the lenders’ eyes.

8. Use of Loan

A lender will definitely want to know what you plan to use the cash influx for. Are you planning to open another location? Buyout a partner? Make repairs to vital equipment? Cover a seasonal downturn? The list goes on and on—but what’s important is that you know what you’re taking on debt for.

Beyond the lender’s peace of mind, figuring this out will also help you decide what type of loan to aim for. If you’re only interested in upgrading your gym machines or kitchen appliances, then maybe an equipment loan is the way to go. Or maybe some customers haven’t paid you on time, and you need to gather funds to make payroll next month—invoice financing could be for you.

Business History

You’ll find that most of these documents are still pretty standard fare for loan applications, too. This category is geared more towards the specifics of your business rather than your general financial situation—but you might notice some overlap in what these conventional loan requirements ask for. Remember, you want to make the lenders feel as confident in you and your small business as possible. In this case, too much of a good thing is the goal!

9. Business Plan

The heart and soul of your company (at least as far as documents are concerned!), your business plan should combine financial projections—future sales, profits, cash flow, income, and so on—with qualitative assessments of your goals. What makes your small business unique and important? Where do you see it growing? As a small business owner, your business is front-and-center for you. Convince the lenders of that, and they’ll know you’re worth the investment.

Note that banks especially will ask to see your business plan—and that means SBA loans, too, since they often go through commercial banks.

10. Business Tax Returns

Business tax returns are how a lender will verify your business’s revenue. Keep in mind if you haven’t filed your taxes for the year, that could hold up your loan application.

11. Profitability

“Is your business profitable?” When applying for a loan, there’s no doubt that you’ll be asked that question. Some loan products and lenders require profitability, like business lines of credit and invoice financing, while others don’t. So no need to panic if you need a short term loan but haven’t turned a profit in your first year—and at any rate, a lender will be able to see the answer to this question once you submit your financial documents, too.

12. FICO SBSS

A credit score for your business, FICO’s Small Business Scoring Service works just like it sounds. It’s relatively new and unknown to many, yet the SBSS score plays a part in the Small Business Administration’s loan program, for example. It ranges from zero to 300, and builds differently than personal credit, though personal credit is actually a factor in the FICO SBSS score. At the very least, it’s a good conventional loan requirement to be aware of, even if it’s not the most prevalent metric for borrower trust.

13. Cash Flow Forecast

Whereas your P&L charts your revenue and expenses in the past, your cash flow forecast predicts those values for the future. You should chart your normal cash input and output, of course, but make sure to think ahead about growth and new opportunities as well. Just make sure that your forecast is realistic! (Tip: here’s a neat template to do it yourself.)

A well-organized cash flow forecast needn’t only show that your small business will succeed next quarter—it can also display your business savvy, financial acumen, dedication, and planning. An owner who thinks and cares about the future of his or her business is exactly who lenders are looking to work with.

14. Business Debt Schedule

As the name implies, a business debt schedule showcases your business’s outstanding loan and credit amounts, as well as its monthly payments, alongside interest and payment dates. (We have a handy template to build one, if you haven’t already!) This is just another conventional loan requirement that would give a lender some insight into both your business’s financials and your organizational practices in one go.

15. Accounts Receivable Aging

An accounts receivable aging reports your outstanding invoices by date, and helps you understand which invoices are overdue. Track your accounts receivable aging over time to tell how efficient (or inefficient) your invoice collection system is. By turning the spotlight onto your customers and payment methods, a lender will better appreciate your small business’s financial heartiness.

This document would also give you some insight into invoice financing, discussed more in number 23 of this list.

16. Industry Type

Just scanning the Small Business Administration’s eligibility standards for their 7(a) Loan Program—their broadest product—you can see how your small business’s industry might affect your loan options. Private clubs, religious institutions, agricultural businesses, fishing vessels, private clinics, and more have special conditions they need to meet in order to qualify. Many of these conditions are rather straightforward: a membership-based gym can’t discriminate against groups of people if it wants an SBA loan, for example. Regardless, it’s still something to keep in mind.

Beyond the SBA, other lenders will take their own approaches to your business’s industry. Some industries are inherently riskier than others, and if you’re aware of the data there, you can deftly compensate in the rest of your loan application.

As far as conventional loan requirements go, knowing your industry type isn’t something you’ll have to gather up—naturally you’ll know it off the bat. And in your mind, your business is totally unique! But it’s important to consider how a lender will look at your business, and that’ll be partially through the lens of its industry.

17. # of Employees

Naturally, only small businesses can apply for loan backing from the Small Business Administration. But what makes a small business small?

According to the SBA, business size can be measured in millions of dollars or number of employees. The average varies by industry: the typical small logging company has 500 employees, while most small courier and express delivery services clock in at 1,500.

But why would an alternative lender want the same information? Basically, the number of full- and part-time employees your business has can act as a shorthand for its size—and can be analyzed together with your financials and predictions to check your potential for growth or overexpansion. It’s an easy conventional loan requirement to have on-hand, but a critical one to think deeply about as you lead your small business.

18. Entity Type

Your business structure—sole proprietorship, limited liability company, corporation, and so on—will determine some legal and tax aspects of your small business. As with your number of employees, this information could simply be a matter of filing the correct paperwork for your lender…

…But it could also lead to some deeper insights about how you organize and operate your small business, how financially and managerially aware you are, and where you see your business going. Whether or not your lender dives deep into this conventional loan requirement, make sure you know your entity type and the reasons behind it for your business’s sake!

19. States of Incorporation

You’re probably registered in the same state as most of your business—but as different states have different understandings of what constitutes “business activity,” it makes sense for a lender to want this information. Once you add in the common growth spurt of doing business in or across multiple states, the complexity piles up.

Check out the SBA’s list of states’ filing requirements for business registration for more!

20. Proof of Ownership, Business Licences and Permits, Franchise Agreement

Depending on your industry, state, and type of company, you may have all or some of these documents. Regardless, you’ll at least have proof of ownership and a business license, so make sure you have those available to reference for your lender.

You’ll also want to confirm well in advance that any permits you might need are up-to-date. Few lenders would be encouraged by the possibility of your business shutting down for a month because you forgot to renew a permit—and fewer would offer a loan to a lax small business owner.

21. Work History / Resume

While not the most conventional loan requirement, a lender asking for a resume or work history certainly isn’t unheard of. Maybe they want to see that you’re familiar with your industry, or have experience managing and growing another company. Or maybe a lender just wants that extra bit of trust. No matter the reason, keep your resume prepared, so you don’t waste time later if you’re asked to submit your past work experience alongside your application.

22. Landlord Subordination Form

Another rarer but still conventional loan requirement, a landlord subordination form is an assurance on behalf of a landlord that a tenant will be able to remain on his or her property for the duration of a lease—even if that landlord no longer owns that property.

In less legal speak, it ensures that a tenant will get his or her property for an entire lease, no matter what happens to the landlord. While an online store might not need a landlord subordination form, it could be incredibly important for a brick-and-mortar shop. The last thing a small business owner wants is to get kicked off their own premises—and a lender definitely doesn’t want that, either. You might need to ask your landlord about securing a landlord subordination form even if you’re not planning on getting a loan, in fact!

Specific Loan Products

Phew! We’ve covered most of the conventional loan requirements you’ll be asked when applying to a lender… But you might come across a few more that focus on specific aspects of your small business.

23. Do you invoice customers?

If yes, then you might be eligible for invoice financing—a type of loan that advances you 85% of your outstanding invoices right away, generally, with the other 15% coming later. Also called accounts receivable financing, this loan product guarantees you see cash on your invoices, and lets you prevent any issues that might arise from late-paying or unreliable customers.

Speaking of invoice financing, do you use accounting software to keep track of your accounts receivable (and all your other financials)? It might be a good time to start if not. Not only would your loan applications be easier, but some lenders and loan products actually require it.

24. Do you process credit cards?

If you do, then you might be interested in pursuing a merchant cash advance. Though they have a quick turnaround and require little paperwork, merchant cash advances tend to be expensive. In return for fast cash, you pay back the advance (plus a fee) with a portion of your daily credit card transactions. This can cut into your daily cash flow and may not be worth the speed and ease—but that’s a decision you’ll have to make for your business!

25. Do you have equipment?

Okay, okay… We admit this doesn’t fit the pattern as well. Most businesses have equipment, and qualify for equipment financing—though the amount of financing rate, and the interest rate for repayment, still fluctuate depending on the rest of your loan application. Equipment financing can help spread the cost of updating your facilities over time, though you’ll want to be careful about that equipment becoming outdated while you’re still paying off your loan, and be aware that you’ll still require insurance and maintenance.

If this is a path that interests you, then try getting a quote for new equipment you’d want to spend the financing on, and have prepared some explanations of why you need what you need.

Learn By Doing

You probably noticed that preparing these conventional loan requirements will give you a greater understanding of what lenders are looking for—alongside the inner financial workings of your own small business.

The more you understand your own business’s financial health, the better you can manage its success, and maneuver towards more palatable loans. We strongly believe that the best time to get a loan is well before you need it, and that looking for financing is an important step every small business takes when it wants to grow. Happy borrowing!

The post 25 Conventional Loan Requirements Your Business Should Know Before Applying appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2015/11/05/25-conventional-loan-requirements/

No comments:

Post a Comment