Reading the word ratio might be giving you horrific flashbacks to 8th grade math class. Especially when it comes to a term like fixed charge coverage ratio or FCCR. What on earth is it? Why does it matter? Why do most scary terms have even scarier acronyms?

Let’s start at the beginning. As you started building you business, you set out to be as successful as possible and realize profit as soon as possible. Creating it meant studiously assessing what it would take to achieve your dreams. Of course, you had grand plans, but you tempered them with doses of reality so that your dreams became realistic. Now the time has come to grow your business and you need funding. This is also the time to put those skills at assessment to work.

Why Should I Care About Ratios?

When you apply for a small business loan with a bank, there are a number of factors that the bank will use in order to determine your credit worthiness. This includes things like your FICO SBSS score, your personal FICO score, your business’s financial standing including current and previous annual statements, and your available collateral. They also will ask for management guarantees and will look at the overall relationship that your business has with them. In addition to all of these factors, the bank loan officer will calculate your fixed charge coverage ratio, also known as the FCCR. The fixed charge coverage ratio may be called times interest earned; however, it is calculated the same way. There are several different ratios that lenders compute and analyze for your loan application and they all look very similar, like the debt service coverage ratio and the debt ratio. In this guide, we will be focusing on the fixed charge coverage ratio, but it is worth being familiar with all of them. This way they won’t confuse you.

The reason that lenders take the time to work out these calculations is because they don’t want to make a bad investment. It is imperative that they know whether or not you will be able to pay back the loan. The ratios help them to understand just how much revenue your business has produced. The ratios will also give them an idea of how much revenue your business will produce in the future.

If your business is barely scraping by, it is reflected in the ratios. The standard healthy ratio for the FCCR is 1.25:1, however, that will change depending on the economic climate. If the economy is on a downturn, the lender might require you to have a higher ratio of 1.5. If the state of the economy is good, then the lender might accept a lower ratio of 1.15.

When you submit your application, go ahead and determine your FCCR. You can also ask your lender what other ratios they use and calculate those as well. Some lenders recommend doing projections for three years and submitting those along with your application. If you have been in business for awhile, consider submitting the previous three years figures as well.

What is the FCCR?

The FCCR is a broader measure of the times interest coverage ratio, which calculates how easily a company can pay the interest on their debt. As stated above, the FCCR is important to know when you are applying for a loan. It is also critical information to have when you are considering the overall health of your business. The FCCR includes the interest on the debt and may also include other annual fixed costs like leases and insurance. The advantage of the broader scope of the FCCR over the times interest coverage ratio includes giving the lender a good assessment as to your company’s ability to handle your finances. A major drawback to the FCCR is that it doesn’t take into account rapid capital increases or decreases of a new and growing company. The original calculation also doesn’t take into account owner draws or dividends. This is something we will take a look at later in this guide.

It is important to understand why banks utilize these credit-worthiness tests in determining loans. Learning about the FCCR, other ratios, and factors means that when the time comes to apply for a loan, your business will be in the best shape it can possibly be. The lender will see that you are not simply getting by, but that you have a “long term cushion” in case of a downturn in business. It also means that you have a stronger leg to stand on when it comes to negotiations.

The FCCR

How about some math? (And you thought I’d never ask.)

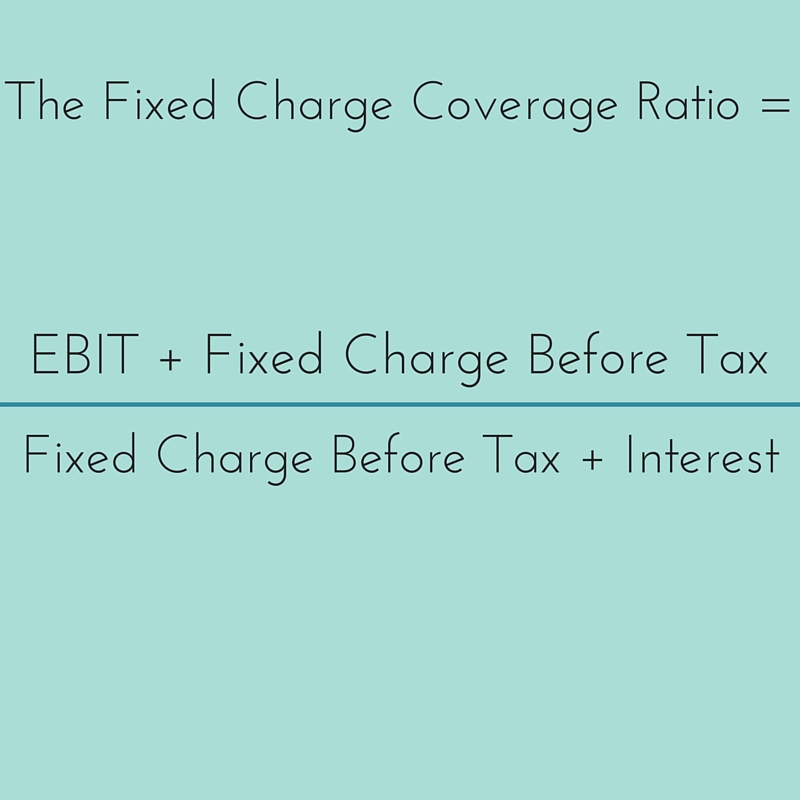

The FCCR is explained as the Earnings Before Interest and Taxes plus the Fixed Charge Before Tax divided by the Fixed Charge Before Tax plus Interest. The EBIT is also calculated as the EBITDA or even the EBITDAR. The EBITDA will add depreciation and amortization back in, while the EBITDAR adds depreciation, amortization and rent in the formula. Depreciation and amortization are both ways to prorate the cost of an asset to the lifespan of that asset. You would calculate the prorated cost by deducting the salvage value of the asset from the original cost. Amortization deals with intangible assets like patents and depreciation deals with tangible assets like cars. Some companies argue that the use of EBITDA in calculating their FCCR is better because it gives a more accurate picture of their cash flow (and it makes their financial status look better.) The reason being is that depreciation and amortization are accrual charges and are not paid during the reporting period. The problem is that the amount really shouldn’t cover interest payments (except in the short term) as the company will eventually need money to cover their capital goods. The use of EBIT, EBITDA, or EBITDAR is really a matter of bank or lender preference; however, it is wise to be aware of all three in your calculations. In these examples, we will work with the standard EBIT.

Your EBIT

A company’s EBIT is also known as the operating income, operating earnings, or operating property. It is calculated by taking the total annual revenue and subtracting the cost of goods sold (COGS) and the operating expenses. The operating expenses include things like wages and benefits for employees, plus the cost of research and development. Investopedia has several short videos on different calculations and ratios, including one on how to calculate EBIT. That website also has numerous definitions and explanations for almost every business finance question.

Your Fixed Charge

The fixed charge is calculated annually and can include any number of regular charges like leases or insurance. However, if you deduct rent as part of the operating expenses for your EBIT figure, you will not need to include it as part of the fixed charge. Most of what a business will account in a fixed charge can be deducted as business expenses. Lastly, the interest payments that a business makes are calculated annually. Next, let’s go over a couple of examples to show how to calculate this ratio for your business.

Example 1

For example, Lisa runs a spa and salon in a small historic town in Georgia. Because her business location is in a more exclusive area of her town, her monthly rent is higher than if she were further out. Her monthly expenses include her rent, her insurance both on the salon and also on its vehicle, and her regular interest payments. Her total fixed charge before interest calculated annually is $30,000. Her annual interest payments are $10,000. On average, the spa’s earnings before interest and taxes are $84,000.

To find Lisa’s FCCR, we would then add her earnings before interest and taxes and the total fixed charge before taxes and then divide by the total fixed charge plus interest. You can see in the image above that it equals 114,000 divided by 40,000.

Lisa’s fixed charge coverage ratio is 2.8:1. This means that there should be $2.80 of operating cash flow produced for every $1 of debt incurred. Lisa’s ratio is healthy, as the baseline for a good ratio is 1.25:1 or a ratio of $1.25 to every $1 of debt incurred.

Owner Draws or Dividends

Some financial experts contend that the FCCR does not take into account significant decreases in cash flow for corporations like S-corps and LLCs. This significant decrease in cash flow can take the form of owner draws or dividends, which is not counted in the standard EBIT or even the EBITDA. There are several reasons why owners often obtain a large part of their income through distributions, the biggest being, of course, taxes. Owners will often take draws or dividends to avoid paying payroll taxes. The fact that the standard FCCR calculation does not take draws into account is an issue for banks because they might be ranking a potential borrower too highly. They do not know how much the owner or owners are receiving in compensation.

However, there is a formula, based on the FCCR, which can help to calculate the ratio correctly for LLCs and S-corps. It is calculated as the EBIT + Fixed Charge Before Tax + Owner Draws divided by Fixed Charge Before Tax + Interest + Owner Draws. As an example, let’s turn our attention to Michael and his home theater business.

Example 2

Michael’s home theater business, located in Orlando, Florida, has annual earnings before taxes of $250,000. He has a fixed lease of $48,000 annually, plus he makes annual interest payments of $26,000. His dividend from the company every year is $70,000. To calculate Michael’s FCCR with the additional owner dividend, we would add $250,000 plus $48,000 plus $70,000 and divide by $48,000 plus $26,000 plus $70,000.

As you can see in the image above, the calculation we must complete is 368,000 divided by 144,000 with a final ratio of 2.5:1 or $2.50 for every $1 of debt incurred. This is another good ratio for a company, especially when the owner dividend taken into consideration. It is interesting to note that if the FCCR was calculated and the loan officer had omitted or had been unaware of the owner draw, the ratio would have been much higher at 4:1. Usually, if a FCCR is over 3, it’s assumed that the company is not using leverage to its maximum potential.

What if I Have a Low FCCR Ratio?

The question next becomes what if you have a 1:1 ratio or even slightly above it? Are you doomed to never get a loan? Not quite, but it does pay to calculate all the different ratios so you understand the financial shape that your business is in. In the next examples, we will examine a business with a low FCCR and the steps taken to remedy that situation. Despite the warnings of having a low ratio, it IS possible to fix it.

Example 3

Beth is a florist living and working in an expensive neighborhood in East Hampton, NY. Her flower shop is located on Main Street in a coveted commercial space. Right now, Beth does not focus her business towards weddings; however, it is her goal to expand in the near future. Her annual rent is $135,000 for a 2,000 square foot retail space. She also takes an annual dividend of $50,000 and she makes regular interest payments that total $55,000. Beth’s earnings before interest and taxes is $85,000.

Beth’s ratio is 1.13, which means she has a $1.13 for every $1 of debt incurred. While Beth is able to cover every debt, she does not have a large cushion to fall back on. If her business went through a downturn, she might have to dip into her cash reserves. As her ratio stands now, it would not be considered good enough to warrant her being considered for a loan. While a lender will also take into account other ratios and factors, her fixed charge coverage ratio might be enough reason to not grant Beth a loan.

Beth’s next step would be to improve her FCCR and there are a few ways to go about this. First, Beth could work to improve her marketing to increase her sales. Partnering with a wedding caterer or bakery means that Beth could expand her florist business by doing weddings without a significant increase in her marketing budget. Beth could also negotiate for a lower rental rate after proving her stability as a renter. This would drop her fixed charge significantly and increase her current ratio. Another step that Beth could take would be to consolidate her high interest payments and perhaps pay them off with a loan with a lower interest rate.

Summing it All Up

As we can see, knowing your fixed charge coverage ratio is essential for the small business owner. Hopefully, through these examples we have made it easy for you to see how to calculate your own FCCR. Remember to calculate your earnings before taxes and interest by subtracting your cost of goods sold and your operating expenses. Your fixed charge can be any number of things that you regularly pay. Add these payments up to find your approximate annual fixed charge. It is totally customizable to your business and can include insurance, utilities, or rent. After you have added those two together, you will then focus on your interest payments. Find the total annual amount of your interest payments and then add them to fixed charge. Now divide your EBIT and fixed charge by the fixed charge and the interest payments. This gives you an idea as to what your ratio is for your loan application. As we stated earlier, a lender’s preference on how a ratio is calculated might be different than the standard calculation. Although there are many online calculators to help you figure out your ratios, if they don’t match the lender’s standards, they won’t be any help.

For the beginner or the new business owner, Investopedia offers easy to understand definitions and explanations on accounting and finance terms. For added insight, plus a fun video, check out their page on the fixed charge coverage ratio. AccountingExplained also has some great information on all things accounting and finance.

Taking your business to the next level means being aware of all aspects of your business. Not just marketing and not just product, but the finance end of it. Business owners have a responsibility to themselves to understand the ins and outs of the banking and lending world. Your business is your baby and your nest egg, we know you want to protect it. Keeping in mind all of the above advice is the best way to do that.

Have additional questions on the FCCR or any other ratio that lenders use? Talk to us in the comments.

The post How to Calculate Your Fixed Charge Coverage Ratio (and Why It’s Important) appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/2015/10/19/fixed-charge-coverage-ratio/

No comments:

Post a Comment