Summit Bank is an Oregon-based independent community bank with locations in Eugene, Bend, and Portland. Founded in 2004, Summit Bank’s stated mission is “to be the best community bank for businesses and professionals,” a mission they pursue in part through their business lending and business banking products.

For qualified business owners, a Summit Bank business loan may well be the best and most affordable loan option available. Unfortunately, however, Summit Bank offers very little transparency about their business loans, so you’ll need to visit a branch to learn more about their loan programs—and with only three physical locations, that obviously disqualifies the vast majority of American business owners from securing a Summit Bank business loan.

Here, we’ll tell you what we do know about Summit Bank business loans, but we’ll also tell you about three more accessible loan options if you find that you’re not a fit for a loan from this Northwestern bank.

An Overview of Summit Bank Business Loans

As we mentioned, other than listing the types of loans they offer, Summit Bank doesn’t provide any details about their loans, like their rates, terms, amounts, or eligibility requirements. This isn’t uncommon for banks—especially very small institutions, like Summit Bank—which often encourage interested parties to visit a branch to discuss the application process in person. Also, Summit Bank says they design custom banking solutions tailored to the needs and financial capacity of individual business owners (as is also the case with many bank lenders) so there’s really no one-size-fits-all Summit Bank business loan that they can advertise on their website.

With that disclaimer in mind, we can tell you a little more about how each type of Summit Bank business loan works, and which projects each is best suited for. That way, if you do decide to visit your local Summit Bank branch, you’ll better understand which of their loan products would work best for your needs.

Equipment Loans

Equipment financing programs lend business owners the cash they need to purchase the expensive tools of their trade, both big (like heavy machinery) and small (like office furniture).

Along with other application materials, you’ll submit a quote for your equipment to your lender. If they approve your loan application, your lender will front you up to 100% of the equipment’s cost, at a term that generally lasts as long as the expected life of the equipment.

Because the equipment itself acts as the loan collateral, lenders are mainly concerned about the equipment’s value and relatively less concerned about traditional qualification standards, like your credit score and time in business—which makes equipment loans among the most accessible types of small business loans.

Commercial Lines of Credit

Along with business credit cards, lines of credit are probably the most flexible form of business financing available.

Much like a credit card without the plastic and perks, a business line of credit is a revolving, renewable pool of funds from which you can draw whatever amount you need (up to your credit limit), at any time you need it. Unlike a term loan, you’ll only need to pay interest on the funds you actually pull from your line of credit. That makes lines of credit excellent reserve funds to keep in case of unforeseen emergencies or opportunities, or to smooth out gaps in your cash flow.

Lines of credit from banks typically range anywhere from $5,000 to $1 million or more. Generally, banks most heavily weigh an applicant’s credit score, revenue, collateral, and projected financials when considering an applicant’s qualification for a line of credit.

Commercial Real Estate and Construction Loans

Summit Bank also offers business loans for financing commercial real estate-related projects, like constructing a new facility, purchasing a building or land, or developing a property for business purposes. Once again, Summit Bank doesn’t provide information about their commercial real estate or construction loans’ rates, terms, or eligibility requirements, so you’ll need to contact the bank directly to learn more. Typically, though, commercial real estate loans carry long repayment periods—think anywhere between five and 25 years, depending on the size of the loan—and interest rates may be fixed or variable.

Standby Letters of Credit

Finally, Summit Bank can provide business owners with standby letters of credit, which are documents guaranteeing that the bank will deliver payment to the appropriate party in case their client fails to do so. SLOCs are typically used in international trade transactions, which present several potential risks and complications that may result in either the exporter or the importer failing to hold up their end of the bargain—which an SLOC protects against.

3 Alternatives to a Summit Bank Business Loan

Although Summit Bank doesn’t specify their eligibility requirements, as a brick-and-mortar institution it’s likely that they’ll only approve the applicants that pose the least-possible risk: Typically, that means businesses that have good credit, experience in their industry, sufficient collateral (if necessary for the particular loan they’re applying for), a demonstrated ability to repay additional debt, and that are cash-flow positive.

If your business can’t yet qualify for a Summit Bank business loan, consider working with an online lender, which typically requires much less stringent qualification standards than traditional lending institutions do. As these lenders leverage the power of technology, their application processes and time-to-funding windows tend to be streamlined, easy, and incredibly fast, too.

Here are just three of your best options:

Equipment Loan From Balboa Capital

If you’re seeking an even more accessible equipment loan, consider applying for the equipment leasing program through Balboa Capital.

Keep in mind that Balboa Capital offers an equipment lease, rather than a loan, which means that the lender will retain the title to your equipment. You’ll pay for the use of that equipment for as long as your remittance schedule lasts, and at the end of your lease, you’ll have the option to buy the equipment for a low price.

In order to be considered for a Balboa Capital equipment lease, this online lender doesn’t require additional collateral or hefty financial documentation. And although they will consider your credit score during the underwriting process, they don’t set a required minimum credit score for eligibility. Like most online platforms, Balboa Capital boasts an incredibly fast turnaround time—if you qualify, you may receive a credit decision and access to your loan funds in as little as a single day.

Balboa Capital can provide qualified business owners with up to $500,000, and you’ll repay your equipment lease in monthly installments at a term lasting between 24 and 72 months.

Business Line of Credit From Kabbage

Business owners seeking lines of credit with quick turnaround times should look into Kabbage, one of the most trusted and transparent lenders in the online business lending marketplace. Kabbage can provide business owners with lines of credit between $1,000 and $250,000, with repayment terms lasting six, 12, or 18 months, and fees range between 1.25% and 10%. Kabbage’s fee schedules are somewhat unusual, but you can find a detailed explanation right on their website.

To qualify for a Kabbage line of credit of less than $100,000, at a minimum you’ll need $50,000 in annual revenue (or $4,200 per month), a 550 credit score, and a year in business. As you’d expect, qualifying for a larger line of credit requires more demanding minimum qualifications: $1 million in annual revenue (or $125,000 per month), a 680 personal credit score, and three years in business.

If you do qualify for a Kabbage loan, your loan may be funded in a single day. Drawing down on your loan is simple, too—you can either use the Kabbage dashboard, app, or Kabbage Card, which is essentially a credit card tied directly to your Kabbage line of credit funds.

Term Loan From Fundation

If you need lump-sum financing to fund larger projects—but you’re not yet qualified for a commercial real estate or construction loan from Summit Bank, or another traditional lending institution—look into a medium-term loan from an online lender, like Fundation. This premium online lender can provide qualified business owners with loans between $20,000 and $300,000, at terms lasting between one and four years. Those are among the highest loan amounts and longest repayment periods you’ll find from a trustworthy online lender, which can give you the funds and time you need to finance expensive projects like expansion and capital improvements.

If you’re interested in a Fundation loan under $200,000, at a minimum you’ll need $100,000 in annual revenue, a 660 credit score, and a year in business. Those seeking Fundation loans greater than $200,000 will need at least $750,000 in annual revenue, a 720 credit score, and five years in business.

While Fundation may take as long as 30 days to review your application and deliver your loan funds, on average it takes this online lender three days to fund approved applicants—which is likely a much faster funding window than you’d experience with a brick-and-mortar bank.

Is a Summit Bank Business Loan Right for You?

A Summit Bank business loan may be an excellent, low-cost financing option if your business is based near one of Summit Bank’s three locations, though you’ll need to visit your local branch to understand their business financing eligibility requirements.

If you don’t yet qualify for a Summit Bank business loan, or if you don’t live near one of their branches, then you’re certainly not out of options. Consider working with a loan specialist who can help you evaluate your needs and financials, pinpoint your financing options—both from online lenders and brick-and-mortar institutions—and then help you package and submit your loan application.

The post Summit Bank Business Loan Review, Plus Top Alternatives appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/summit-bank-business-loan

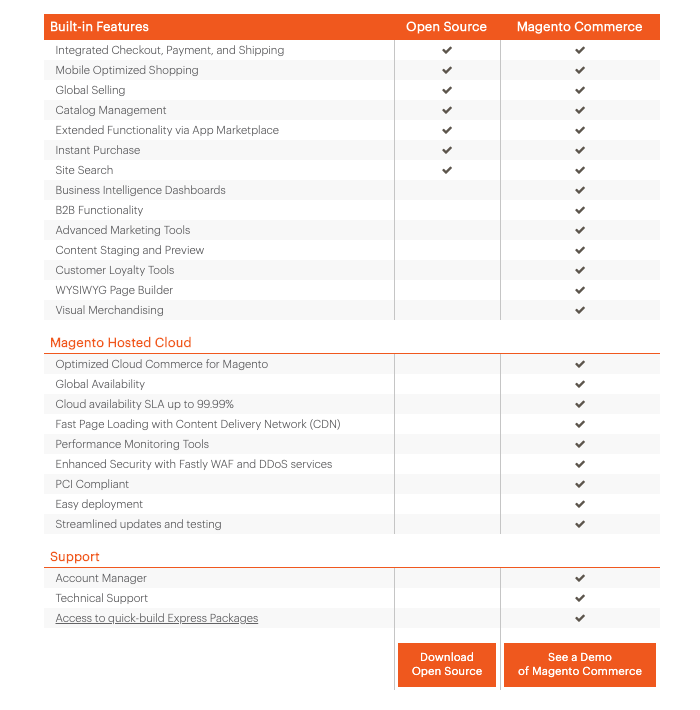

Photo credit: Magento

Photo credit: Magento

Photo credit: Heartland Payment Systems

Photo credit: Heartland Payment Systems